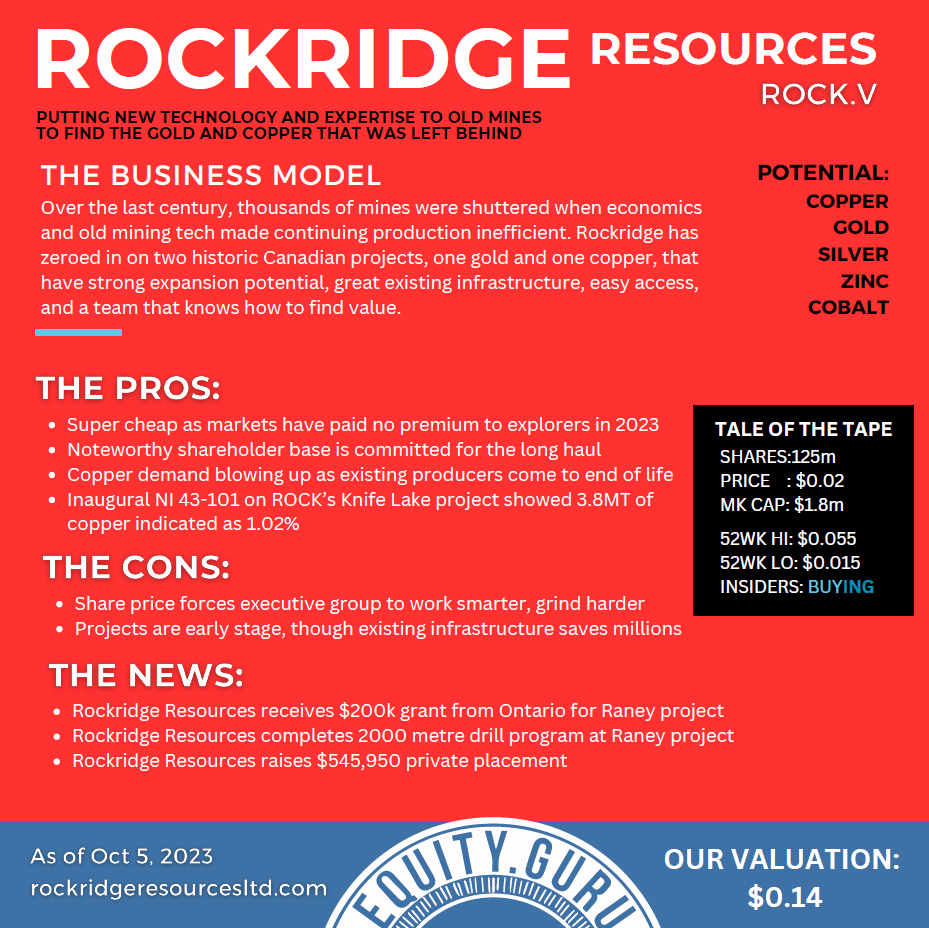

Rockridge Resources (TSXV:ROCK) is a Canadian mining company located in Vancouver with 73 million shares outstanding and a market cap of $6.93M.

https://www.rockridgeresourcesltd.com/

Millions of mining companies share the same story, a Canadian gold company with hopes of one day becoming a large producer. As a mining investor, is it essential to look for projects where you can ignore the hype and find value. Companies that have actual hopes of production and one day becoming an economically viable business. Where the information and historical background points to a business that is more than a cheap story.

In a slow mining market, multiple companies have yet to have the time of day. Investors have shied away from mining stocks but with the current factors driving the gold rally including inflation levels, low-interest rates, and global economic and political uncertainties, the future outlook for gold and other precious metals is bright.

Rockridge Resources is a fundamental mining company from head to toe with quality leadership, two outstanding assets with lots of potential, current drill programs in place, diversification across multiple metals, and a world-class jurisdiction.

A Diamond In The Rough

The junior mining space is constantly underappreciated, companies without a world-class story or famous founders are often overlooked. Even with strong assets, well-polished leaders, and proven grades. There are so many mining companies being created every year, it’s easy to look at these companies without a second glance.

The investment community and the current investor’s outlook is impatient and without worry. People are ignoring the value that lies within the mining sector and in particular, the juniors. Although these stocks don’t share the same excitement as investing in tech or bitcoin, the assets they hold have the potential to create serious income for their shareholders.

From a macro perspective, mining companies are in the perfect place to benefit right now. After a slow summer for the industry, it seems interest rates won’t be going up soon and inflation is to continually increase. On a long-term basis, a modest 10% allocation in gold makes a “world of sense,” says Psarras, head of market research for GoldCore USA.

Rockridge is one of those companies you find after ignoring the hype and clearing the dust, a company that’s solid and without a crazy pump story on why it’s the next largest gold producer. It has credible assets, strong leadership and in this current market, investors have undervalued their stock.

Looking At A Company

When I look at juniors, there’s a checklist I like to follow when determining whether this project has value and the potential to become a large metals producer.

- Leadership: Does the company have multiple leadership positions filled with individuals who have had previous success in the industry? I would like to know if the CEO has already proven he can lead a company or if the geologist has had a track record of discovering high-class ore bodies. Knowing that the company has these leaders with them makes me confident they can handle themselves and create value in the mining sector. In some ways, this could be the most important thing.

- Assets: A company with drilling already in place, shown positive grades, and more room to operate puts them in a well-off place to turn into a profitable producer. It is rare to find a company with a strong grade and scale that would support a long-lasting mine.

- Market: What is the current market position? How are metals doing and what is the future outlook? These are the questions I like to ask before investing in a certain industry/market.

In our current market, you must find mining companies that match the entire criteria. It happens too often that companies die off because the news flow comes to a halt.

At first glance, Rockridge Resources didn’t catch my attention. However, after stumbling upon it again, the company’s structure, strong management and current valuation sparked my interest.

Rockridge Resources

Jordan Trimble, Director and President of Rockridge Resources was previously the Corporate Development Manager for Bayfield Ventures which was successfully acquired by New Gold (TSX: NGD) in 2014. He is also the current president and CEO of Skyharbour Resources (TSX.V: SYH) which has a market cap of $90M. Grant Ewing, the geologist was President and CEO of Kiska Metals (2014 to 2017) until it was acquired by AuRico Metals, where he continued as Vice President Exploration of AuRico Metals until it was acquired by Centerra Gold for ~$300 million. Before that, he was President and CEO of Acadian Mining (2010 to 2014) until its sale to an international mining company. Atlantic Gold later acquired and further developed the assets that Acadian advanced through the discovery and resource development stages, and was acquired by St. Barbara in 2019 for ~$700 million.

With these experienced leaders, Rockridge looks to turn a profit with the Knife Lake deposit located in the Flin Flon camp jurisdiction which has had over 50% of their deposits advanced to production, leading to 86 consecutive years of mining. A previously reported infill drilling at the Knife Lake deposit returned 1.95% Cu, 0.11 g/t Au, 7.41 g/t Ag, 0.53% Zn, and 0.02% Co (2.34% CuEq) over 14.02m beginning at 24.62m in hole KF21021. Another one of their promising assets is the Raney Gold Project located in Timmins, Ontario. Their 2020 spring exploration drilling program intercepted 28.0 g/t Au over 6 meters. In total, they drilled 9 holes over 2,070m.

From start to finish, the entire winter and spring exploration program including an airborne VTEM Plus survey and a 2,043m diamond drilling program at the Knife Lake Project was a great success overall. There are a number of exciting regional targets in close proximity to the Knife Lake deposit including the Gilbert Lake target area which was explored using modern-day techniques for the very first time. The results thus far have further supported our working thesis that Knife Lake is not a one-off VMS deposit and that the prospects to add to the project’s global resource remain high. Our priority for the balance of 2021 is to return to Knife Lake and to continue to advance the project and the deposit in a rising copper price environment.

Rockridge’s geological team is planning to return to Knife Lake later this summer to carry out an exploration program in preparation for another drill program later in the year. News flow will be forthcoming on these exploration programs.

Jonathan Wiesblatt, Rockridge’s CEO

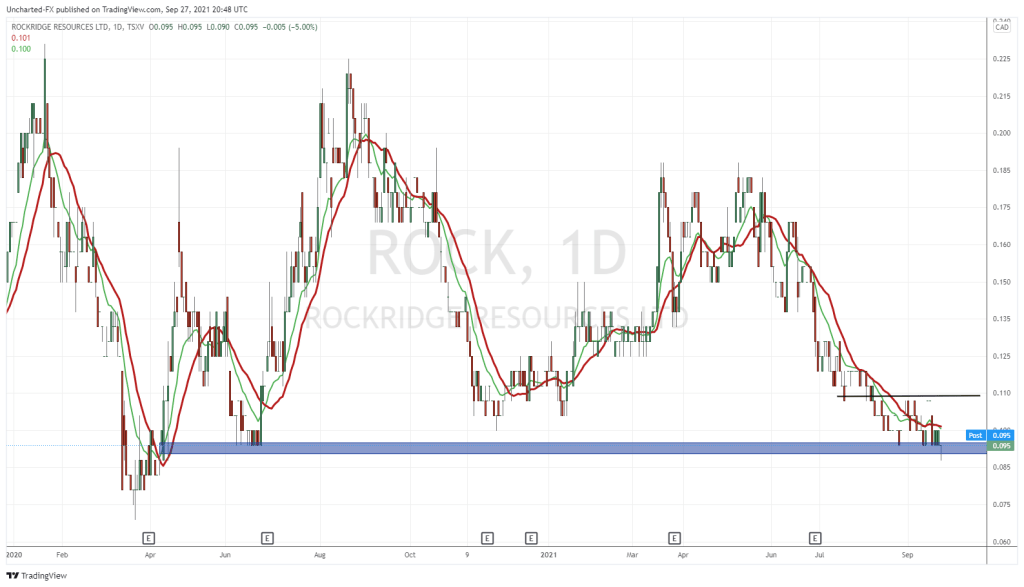

If you’re looking for a solid company with continued drilling success and further plans to drill, Rockridge Resources is worth a look. When looking for a junior mining stock, it is essential to me that the team has gathered successful drill results already, it shows that the asset has the potential to be profitable. Along with its leadership of excellent experience, at $0.10 Rockridge Resources is likely to see some more investors once the mining market sees an upward trend.

By Matthew Nelson