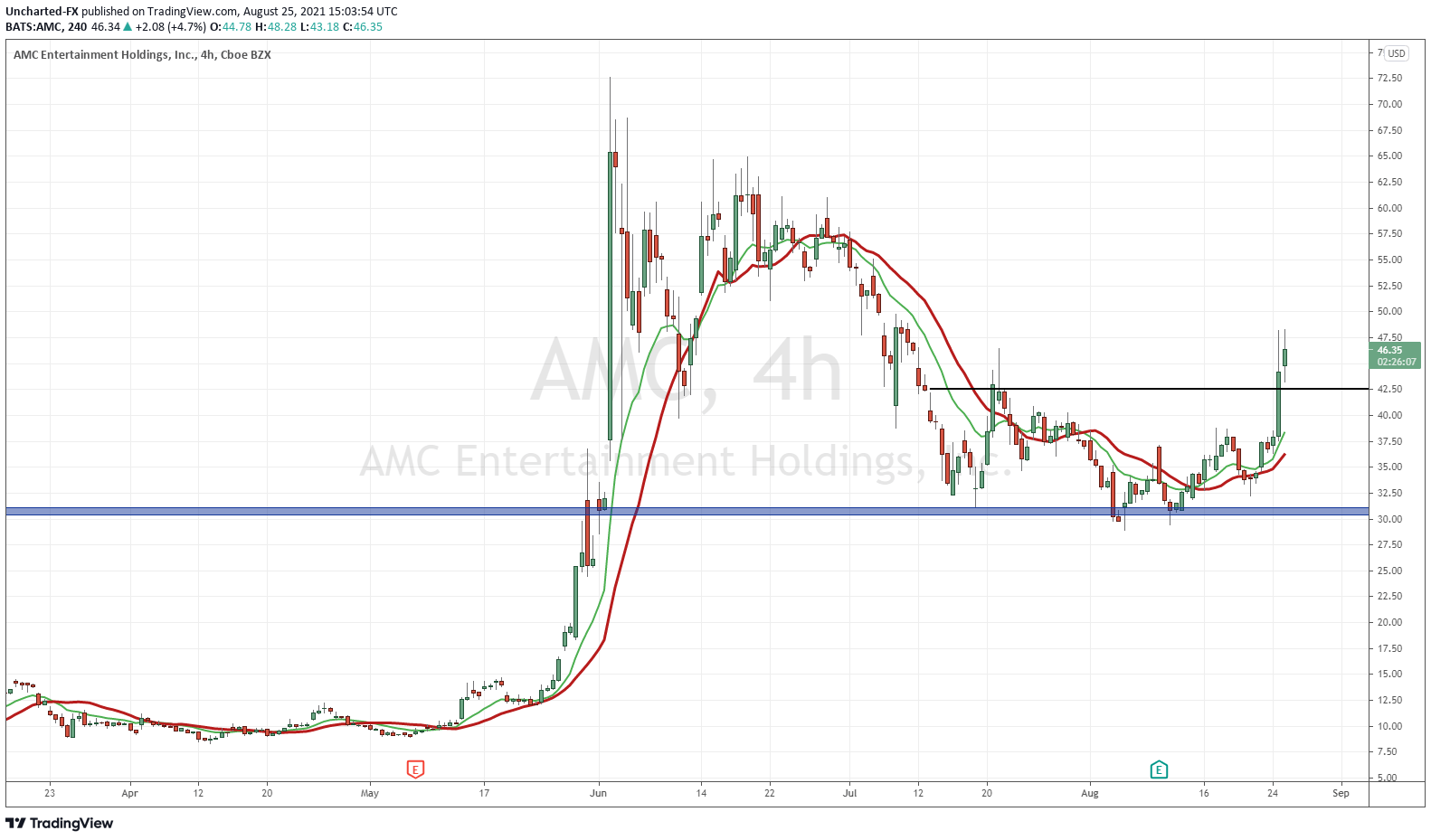

Meme stocks are running wild. Yesterday, I informed readers that AMC was setting up a reversal pattern. The apes piled in. And they piled in hard! You can read my pre ape mode AMC set up. Study it, as the technical criteria is what I look for in all my trades regardless of the type of market.

If you prefer video format, we got you covered! Here are my thoughts on AMC and further price action:

But the meme stocks are going wild today! It seems to be just focused on the short squeeze stocks such as AMC and GME. You go on WSB and you see headlines such as “GME gang is back”, “GME Calls go Brrrr”, and “GME gang to the moon!”.

Let’s first take a look at some charts, before delving into the small caps correlation we’ve been following to track retail money flows.

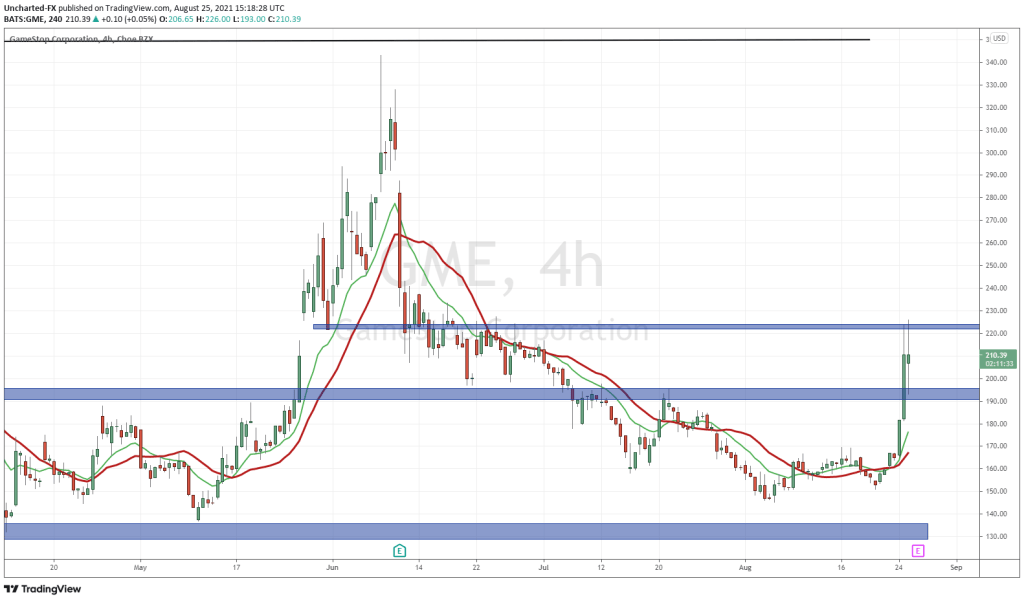

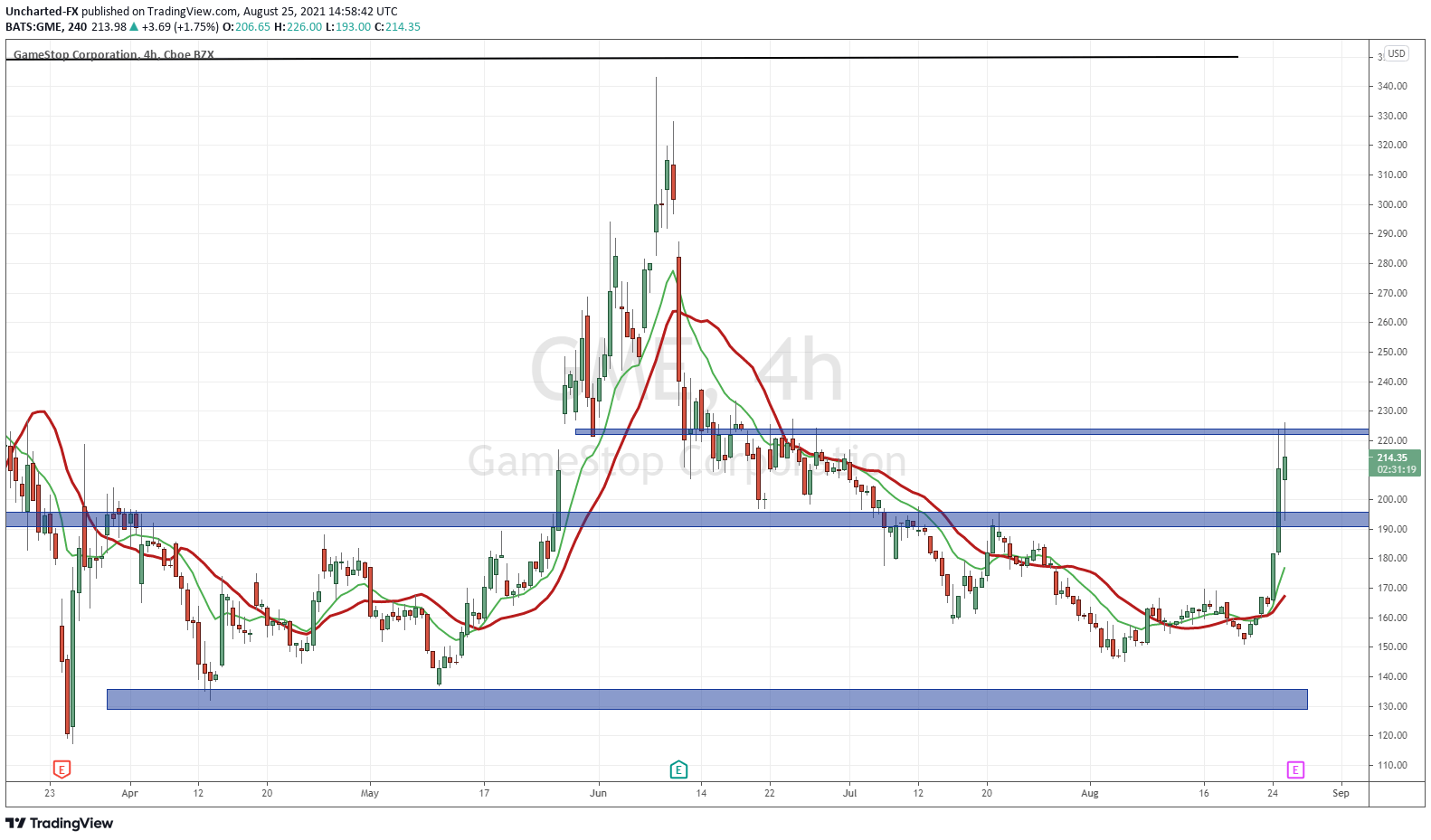

The GME gang is definitely back. So far the stock is up 2% on the day, but we have plenty of time left. GME is back above $200, but I must warn that we did hit a resistance zone today. Profits were taken, and you can see selling from that wick. In fact, we saw selling yesterday at the same resistance zone. $223 is resistance going forward. GME will need a break above to sustain any momentum.

To the downside, the $190-$200 zone is our price floor or support. The market structure is looking wonderful. It all began with the breakout above $160. That confirmed a new uptrend. We now wait for our first pullback, and then higher low swing. It is very likely this occurs around our support zone as it is a great area for new buyers to step in. This is what I will be watching this week and the next on GME.

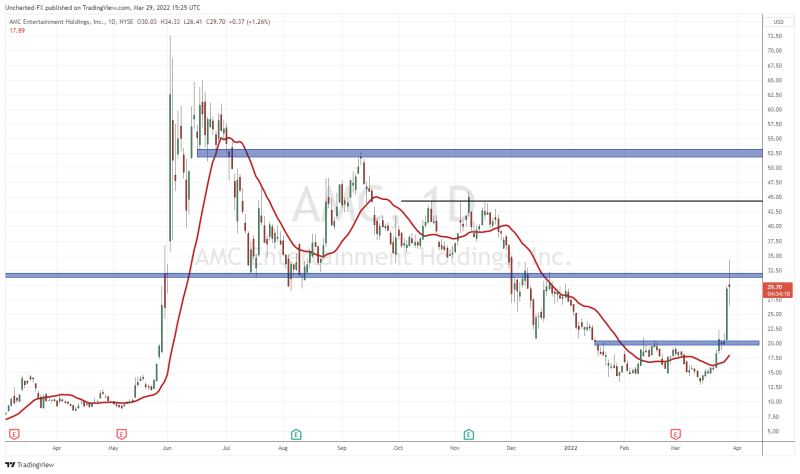

I won’t spend too long on AMC since what I wrote yesterday still stands. We had the breakout confirmed with our daily close, and now it is all about momentum. So far so good. The stock price briefly pulled back to $42.50 and saw buyers step in today. You can see that zone is an important support zone going forward. I would drop the zone briefly lower to $40.00. Our resistance target remain the same: $55.00 zone, and then previous body highs around $65.00.

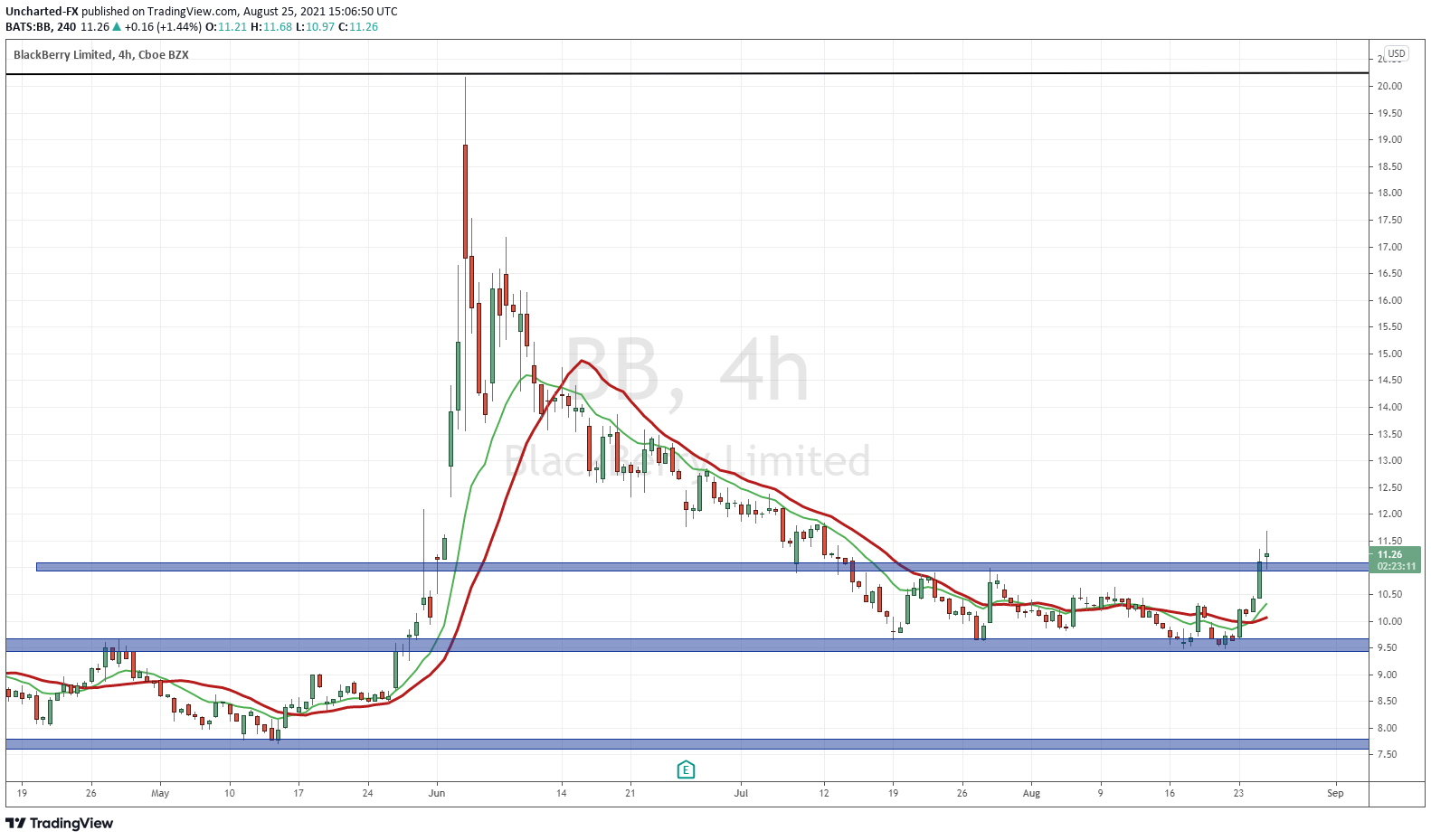

I don’t like calling BlackBerry a meme stock as it has some real solid fundamentals going forward. But nonetheless, it is a stock that saw a huge short squeeze, and these type of meme stocks are in play.

A very beautiful set up. We have a downtrend, then a range, and we should expect an uptrend according to market structure principles. The close above $11 was the trigger. I’ll be honest, even though we did get a candle close above $11, I would have liked to see a much stronger close, especially on the daily chart. We just barely closed above $11. It still is technically a breakout, but the stronger the break, the more likely the momentum will continue.

In typical breakout fashion, $11 now becomes support. Price has pulled back to retest the $11 zone today. Buyers did step in as evident from the wick. If BlackBerry can remain above $11 by the end of today, this one will move more. But hopefully we get a bit of a stronger close with a nice green body.

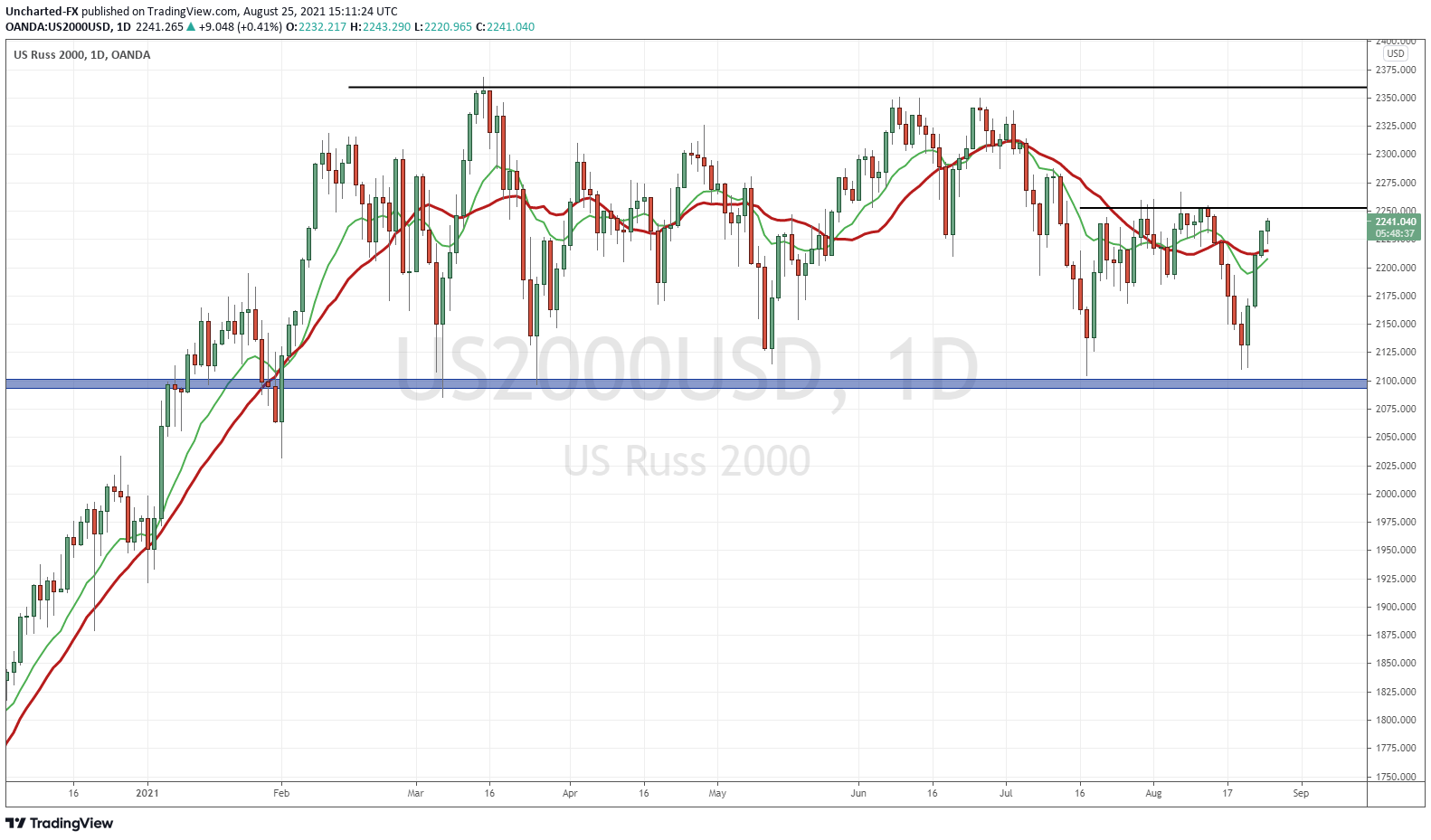

I have to mention the Russell 2000. Long time readers know how I have used this. The small cap index pops when the retail crowd plays small caps and the meme stocks. If the Russell takes out this 2255 zone (my black line), it is a significant technical breakout. And the Russell then pops to previous record highs. Small caps will follow. This can add some more oomph to the meme stocks.

But the most important correlation with the Russell 2000 is with cryptocurrency. In previous Market Moment articles, I have discussed the correlation I have been seeing between this index and crypto’s. When the Russell pops, we see crypto’s drop, and vice versa. Almost indicating retail/meme money flows from small caps to crypto’s.

I think it is a pretty strong correlation so keep this in your tool box. At time of writing, crypto’s are getting a nice pop, while the Russell is now selling off. One of them will give, and the other will rip.