Gold. Sometimes you love it, sometimes you hate it. Being someone who has been following the Gold markets since 2014, and has read up on Classical economics and Austrian economics…I am a fan of the precious metal. I don’t necessarily like to call it a commodity as many people do. I see Gold as a currency. But that is for my older posts which you can read here on Equity Guru.

I am bullish Gold going forward on the confidence crisis. If people start losing trust in the government, the central banks, and the fiat currency, Gold will shine. Many Billionaires such as Paul Tudor Jones, Ray Dalio, and Stanley Druckenmiller are also encouraging investors to load up on the precious metal. Bullish right? Yes, but recently I posted a piece on deflation. I recommend precious metal bulls to read this. Eyes are on the US Dollar and Bonds going forward.

In a moment, we will take a look at the charts of Gold, and the GDXJ. These will be important in answering whether one should load up on Gold Mountain Mining (GMTN.V).

Gold Mountain Mining is a BC based exploration and development company focused on the 100% owned Elk Gold project. This project was once owned by Equinox, and Gold Mountain acquired it back in 2019 when Gold prices were down. The asset was a past producer with 97 g/t average.

When one invests in junior miners, you need to do some analysis since most of these are speculation. But Gold Mountain Mining is quite derisked. The project itself is in a good jurisdiction with infrastructure around it. Management has years of mining experience. The project already has a PEA established NI 43-101 Mineral Resource with 454,000 measured and indicated Gold equivalent ounce grading 5 g/t. Drilling is on going to expand the resource. The company has just recently raised $12,000,000 so is cashed up and investors will be hoping the cash can trigger a catalyst. Oh and the best part? Gold Mountain is ready to begin commercial production at 19,000 oz per year for 3 years with fixed mining costs ($554 AISC) by Q4 of 2021! The next catalyst is an important derisking element: a permit from the Ministry of Energy, Mines & Low Carbon Innovation (EMLI). All documents are with the provincial regulators, and Gold Mountain expects delivery of the permit in the upcoming weeks. This will be a huge catalyst for the stock price if granted!

Technical Tactics

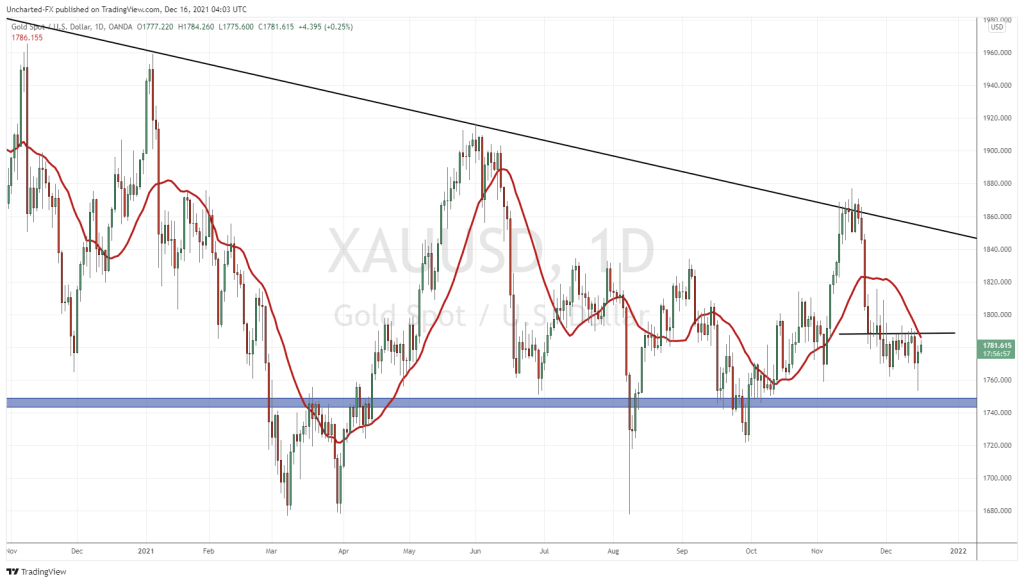

A catalyst like the permit will be bullish for the stock, but what Gold does will also determine whether the momentum continues on the charts. Gold got smashed at the beginning of last week. We saw a $4 Billion Sell order trigger on Sunday evening when the Gold markets opened, smashing Gold prices down to $1680. It sucked for us Gold bulls. But on a positive note, Gold prices are recovering and we are back over $1700.

But we aren’t in the safety zone just yet. $1680 is the big support to the downside. Above we have the major $1900 resistance zone. But before we even talk about that price, we have a price zone coming up much earlier. You can see my horizontal black line at $1830. This is important because it is the lower high we are working with.

What the heck does that mean I hear you say? It means as long as Gold prices remain below $1830 on the daily timeframe, we still remain in a downtrend and can roll back to test $1680. If we break above $1830, I will start to breathe a bit easier and will load up on more Gold contracts. A lot of this depends on the US Dollar, and if you read the story I posted above, you understand why I am worried that a new US Dollar bull run could hammer down Gold prices.

Above is the WEEKLY timeframe chart of the junior Gold miners ETF, known as the GDXJ. This is giving us some hope of a potential bottoming in the juniors…which will be buoyed if Gold takes out $1830.

The hope comes from the fact we are about to test a flip zone. An area that has been both price floor and ceiling in the past. In technical terms we call this support and resistance. These are great areas to see reversals of trends. In this case, a trend shift from a downtrend to an uptrend is what we want to see. If the weekly candle closes below this, we will have to assess the following week to determine whether the breakdown was a fake out, or if things are looking dire for Gold and the miners going forward. Friday’s close is setting up to be a big one as currently, prices are below the weekly flip zone.

Now that we have these two charts out of the way, let’s take a look at Gold Mountain (GMTN.V).

Funnily enough, Gold Mountain will also be testing a major support zone just like the GDXJ. This is just how things turn out with the juniors and the GDXJ. The market structure tends to look the same.

The support zone for Gold Mountain comes in at $1.35. We could test this zone very soon, and hopefully for the bulls, we remain above it. From that point on, a double bottom reversal pattern could be in the cards, but I am getting ahead of myself. Let’s see what happens on that retest first.

Alternatively, Gold Mountain could just take off on a Gold and GDXJ pop. I would like to see the recent highs at $1.80 be taken out. It would be a powerful bullish signal. Be careful of the resistance at the $2.00 zone. As you can see, $2.00 was a price floor area for a good three months.

Gold Mountain stock was a big winner this year hitting highs of $3.00 while trading below $1.00 at the beginning of 2021.

Going forward, Gold Mountain has the catalysts to get the stock moving. They are drilling, and have the cash to drill more. They have a big catalyst in terms of the mining permit. Once the permit is achieved, commercial production and cash flows beginning in Q4 of this year! Junior miners are speculations. I personally like to buy the physical metal and Gold royalty and streamers, but the big gains come in the junior miners. If you are bullish Gold, the juniors will provide you with some amazing returns that warrant the risk.