Researching Filament Health (FH.NE) taught me a lot about the psychedelic space and shroom stocks. As someone who is big on eating clean and organic food, it came to a surprise to me that there is such thing as a natural psychedelic stock. With the organic trend strong already, and only getting stronger, plus a shroom boom to occur just as we saw with the Canadian Cannabis stock rip a few years back, Filament Health is a very intriguing long term proposition.

Filament states its mission is to “get safe, natural psychedelics into the hands of everyone who needs them, as soon as possible, by using hard extraction and drug discovery science to unlock their healing potential.”

I highly recommend Piers’ article here on Equity Guru explaining why Filament Health (FH.NE) is a company flying under the radar. He is also bullish on this organic trend. In that piece he explains the move to synthetic psilocybin:

The nature of psychedelics and the way people interact with them changed drastically in the 20th century. On November 16, 1938, Albert Hoffman first synthesized lysergic acid diethylamide (LSD), and 5 years later discovered its psychoactive nature. From then on, psychedelics no longer came exclusively from nature, and so some of the mystery behind their power slipped away.

As psychedelic therapy companies have become the talk of the town, most have gone with a hybrid of the natural and artificial approach by using synthetic psilocybin. There are a few reasons for this – better control of dosage and psychedelic duration – but the main reason most psychedelic companies are choosing synthetic psilocybin over its natural counterpart is the same reason so many of these companies are based in Canada: patents. In Canada, you can’t patent a natural compound, but you can patent a slight variation on psilocybin that you produce synthetically.

Reading that last sentence, I hear you asking ‘but how can you patent something natural then?’. Filament has done this through patenting the extraction process.

On August 3rd 2021, Filament Health received the first ever psilocybin extraction and standardized patent for a public company by the Canadian Intellectual Property Office.

In terms of synthetic being cheaper? Well as our very own Joseph Morton stated:

“They’ve developed a technology to extract and standardize a stable dose of psilocybin, thus avoiding unstable variability in crop harvests. The idea here is to find a reliable, repeatable formula to produce the best yield all the time, every time. Filament has managed to do this and at a lower cost.”

Going forward, Filament Health plans to create the first ever pharma grade extracts and get them into clinical trials in Q3 2021.

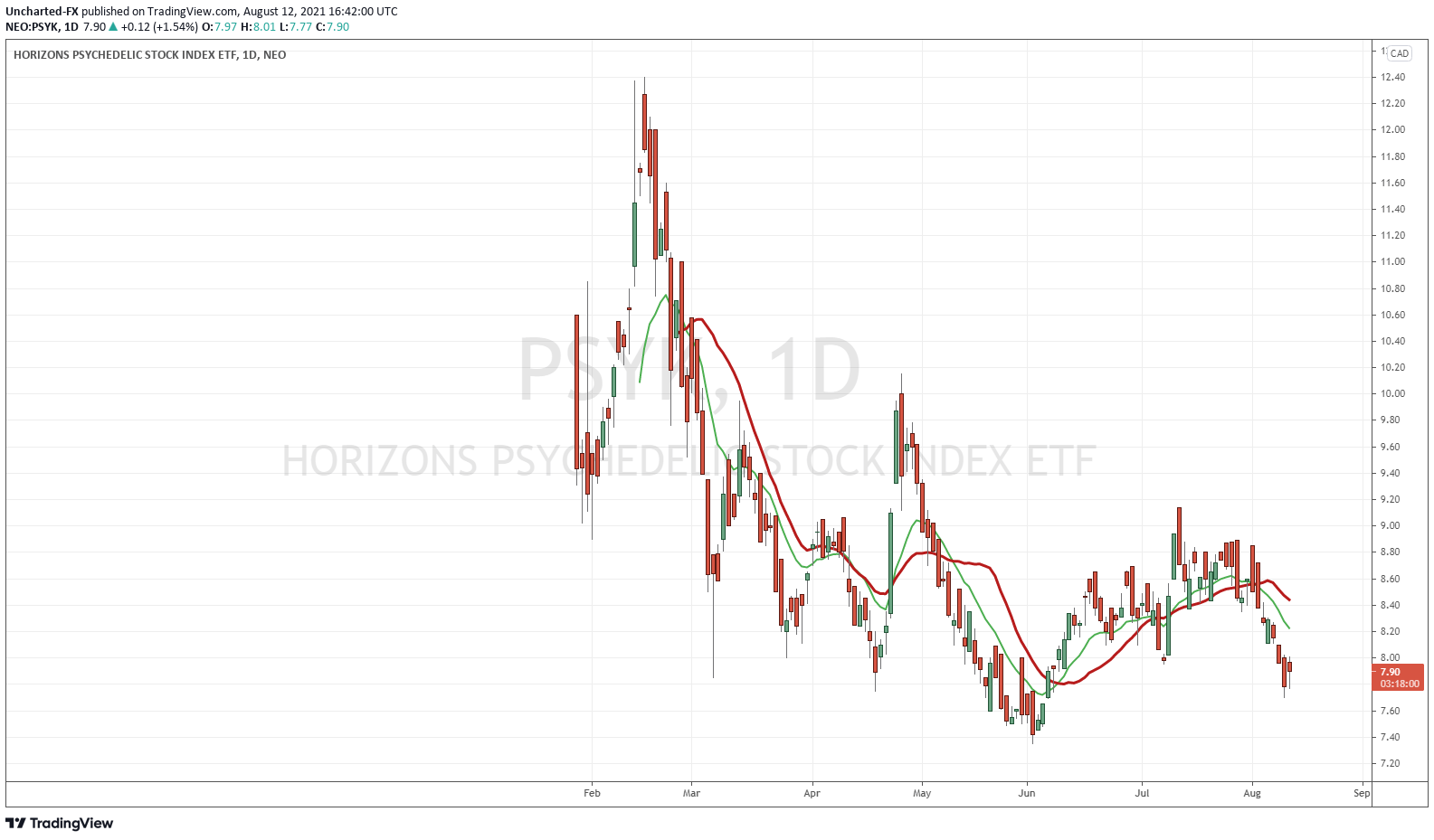

I must say, this is a very exciting story. I alluded to it earlier, but as someone who believes that shroom stocks will boom like Cannabis, and fundamentally, WILL be what Cannabis was promising to be in terms of health benefits, this is a sector with high growth potential. Even here in Canada a psychedelic ETF (PSYK) came out this year. We are still in the early stages. What Filament Health has going with the organic shrooms has great marketing potential. As someone who started microdosing recently, I didn’t if they were synthetic nor organic. My generation tends to spend money preferably on the organic alternative. If I had the choice, I would have gone the organic way. But maybe I am just too picky, and other microdosers won’t care.

Technical Tactics

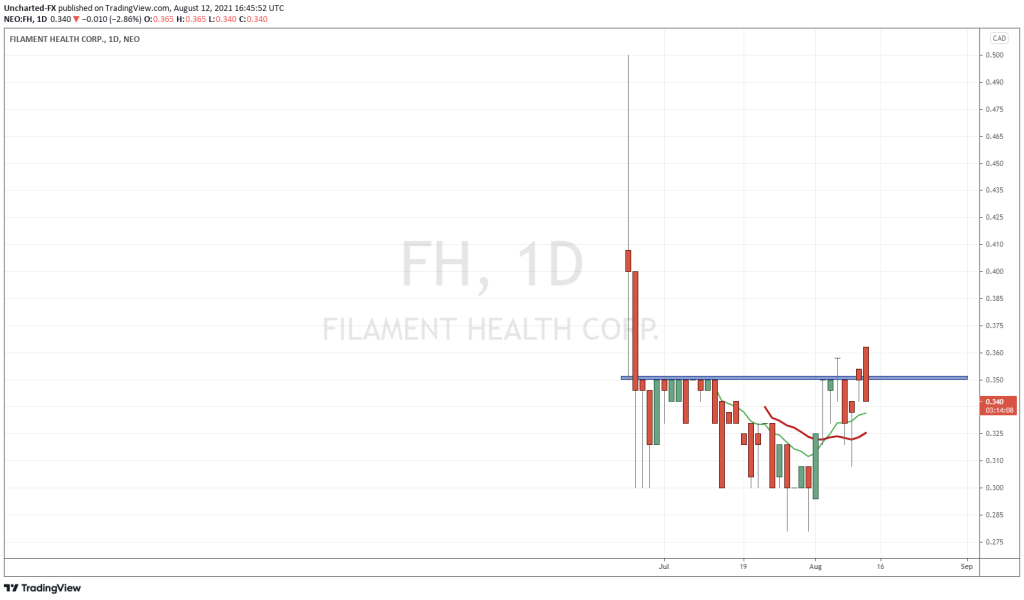

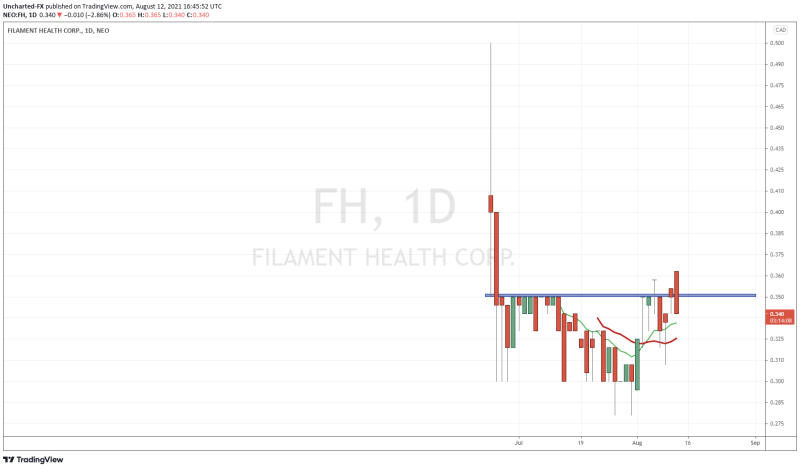

Filament Health is a stock that just recently IPO’d. The stock IPO’d at $0.41, hit highs of $0.50 (an important psychological level and a resistance area going forward), and then hit lows of $0.35.

As a trader, I tend to wait a few weeks before playing IPO’s. That’s because I want support and resistance levels to form so I can use them for take profit and stop loss levels. For investing, things are different. I must like the sector, the future growth and trends, and see that the company is providing value. In that case, I look for areas to pick up shares, and continue to add as long as my analysis remains unchanged.

Filament Health is providing one such opportunity to add before a pop. As you can see from the daily chart, the stock has been ranging between $0.275-$0.35. If we can get a daily candle CLOSE above this $0.35 zone, we then have a breakout trigger. A move to $0.50 and then higher would be next on the cards. Keep in mind that this stock trades thinly, so if we get that close above $0.35, higher volume would be a concrete sign that the stock is going to pop on the technical break.

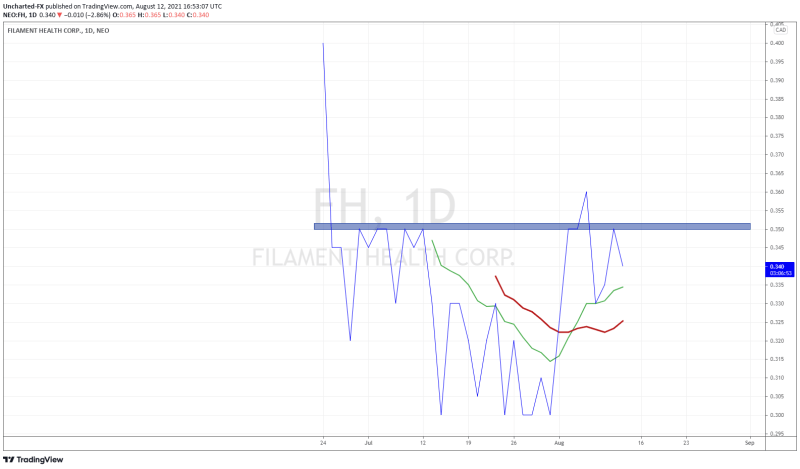

Some of you may be saying but we have had pops above $0.35? Yes, but we have not closed strongly above it. Also, let me share this little secret in spotting important support and resistance zones. Change your chart to a line chart. This is what we get for Filament Health:

As you can see, there actually was a breakout just a few days ago. The volume was not enough to sustain momentum. Looking at the historical data on Yahoo Finance, the breakout on the 6th of August had a volume of 45,431. The following sell off days had volume above the 51k average volume. We had volume of 70,384 and 63,205 the following days which took us back under our breakout zone. People were taking profits.

In summary, I like the sector and the organic story here. The real catalysts will come in Q3 with the clinical trials. As an investor, one can enter an initial position here, but keep in mind it is a longer term play. Others may wait for the close above $0.35 with strong volume. If this does not happen, then we can be patient as the stock either ranges or drifts lower.

Full disclosure: Filament Health is an Equity Guru marketing client.