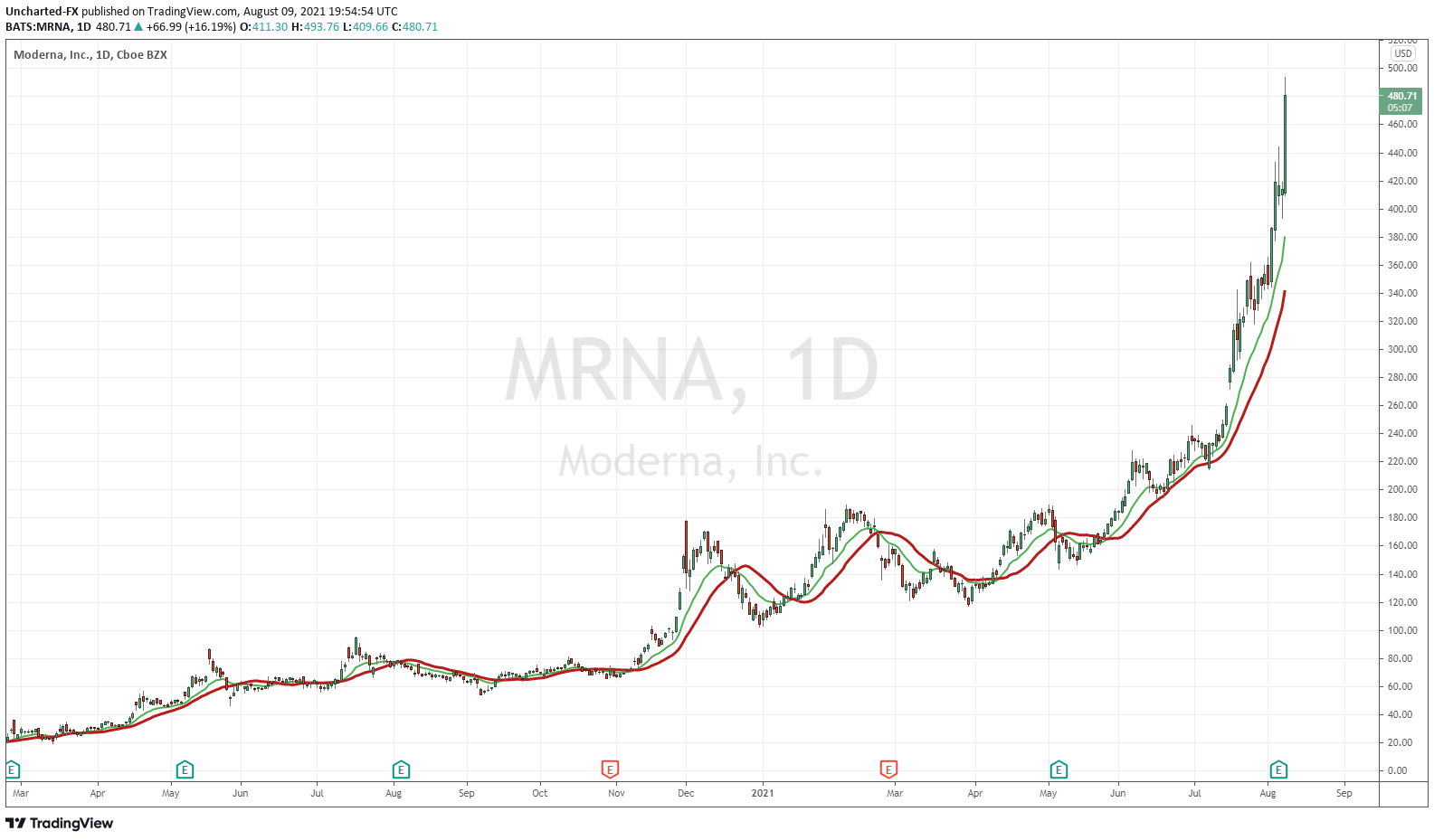

I am writing about Valeo Pharma Inc. at a very fascinating time for biotech/health stocks. Recently, Biotech has been hot! Led by the vaccine companies which are soaring. Just today, Moderna (MRNA) eclipsed all the price targets that 17 analysts had! Pfizer is going, Astrazeneca…not so much. The popular one with the daytraders has been Novavax (NVAX).

If the Biotech remains hot, largely due to the market pricing in the ability of booster shots and the vaccines to manage rising Delta Variant cases (while Oil prices are pricing in the opposite…), money will trickle down to the small cap plays that have Covid links. While many people are focused on the vaccines, I think we should remain open to alternate methods to tackle the virus.

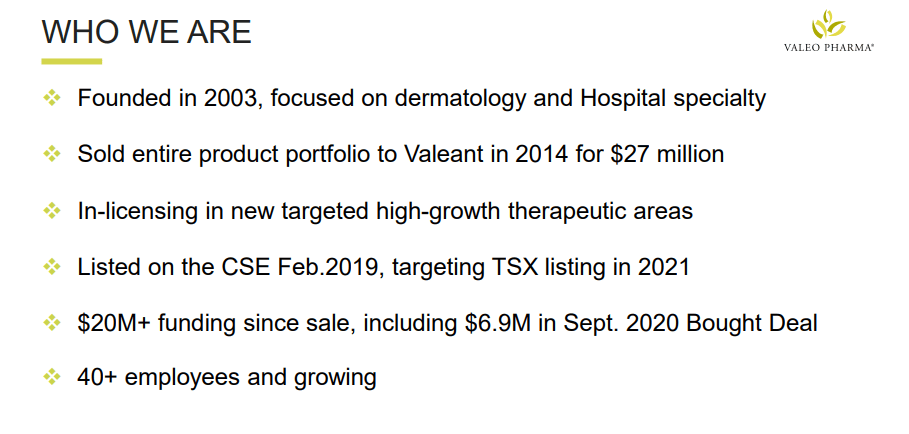

Valeo Pharma is a Canadian company which provides innovative therapeutic solutions to improve quality of life. The value this company has is that it is fully integrated. Valeo has all the resources and expertise required to register and market a product in Canada, which includes the regulatory affairs, quality assurance, warehousing, marketing, sales, and all financial activities. Great when it comes to surfing through the regulatory framework in Canada. These guys can get a product out into the market, which means revenue.

Furthermore, Valeo Pharma states:

Our strategy does not include Manufacturing or R&D and we work hard to find the best international partners to manage these capabilities. This allows Valeo Pharma to concentrate on what we do best, bringing high quality, novel therapeutic solutions to Canadian Healthcare professionals and patients to improve quality of life.

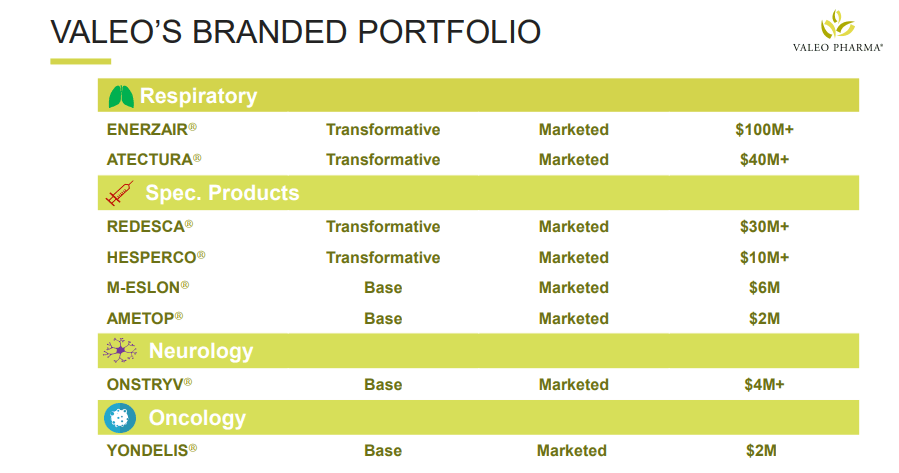

The company began focusing on dermatology products. Management sold the the entire portfolio to Valeant (yes, the infamous Bill Ackman trade) in 2014 for $27 million. A shift then began to target high growth therapeutic areas including oncology, respiratory, neurology and other specialty products.

To learn more about their products, I leave a link to their great investor presentation slide here.

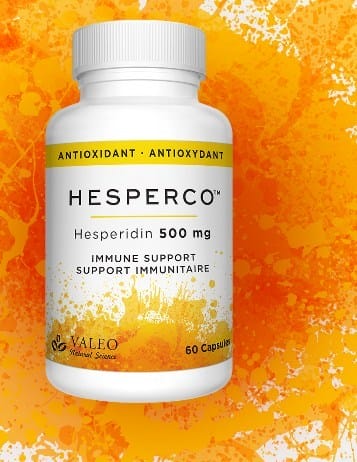

The supplement that has my interest is displayed on the front of their homepage. The Hesperco capsules which include Valeo’s unique flavonoid formula of Hesperidin. Read up on flavonoids and their powerful anti-oxidant capabilities. I am big on supplements. In fact, I have taken flavonoids and citrus bioflavonoids. I use them (Quercetin mostly, but also Hesperidin products) for general health, for anti-aging properties, immunity, AND anything to do with the respiratory tract. I find they do the best to deal with hay fever. Now, Valeo is doing trials to see if their Hesperidin can reduce the symptoms of Covid. Decreasing the severity of symptoms and the needs for hospitalization are being tested by the Montreal Heart Institute.

For those of you who read my macro work, you know I big I am in food and health. I think the supplements industry will see high growth going forward. With the more debt government is piling up, it means my generation and future generations will have to pay more taxes to receive the same amount of healthcare. Young people are already taking care of themselves, and supplements are playing a role. Things like anti-oxidants are taking off. Super foods like acai, maca, cocao, matcha and citrus foods to name just a few (oh and we cannot forget wine!).

I am really excited to see what these trials for Hesperco show.

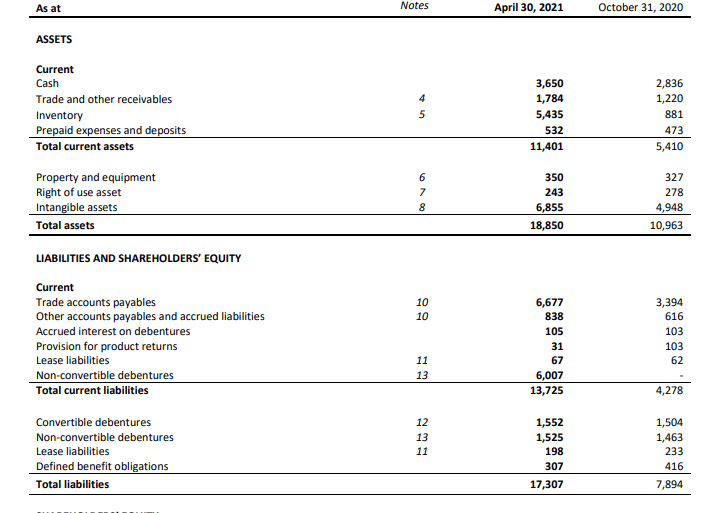

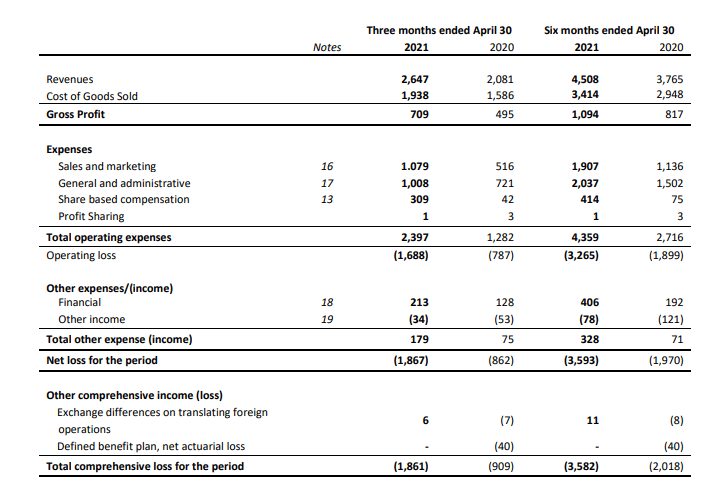

I will do a brief overview of their financial statements, although I recommend reading TK’s work on the numbers.

The latest balance sheet shows a cash position of $3.6 million, and the company did a $11.5 Million Bought Deal Public Offering near the end of June 2021. The one thing I look for when investing for the long term is the companies working capital. Current Assets- Current Liabilities. I want this number to be positive. Unfortunately for Valeo, we have a negative working capital.

The company is bringing revenues, but the cost and expenses are high, which is normal for biotech. I would note the 50% drop in General and Administrative Expenses, but the near 50% increase in Sales and Marketing.

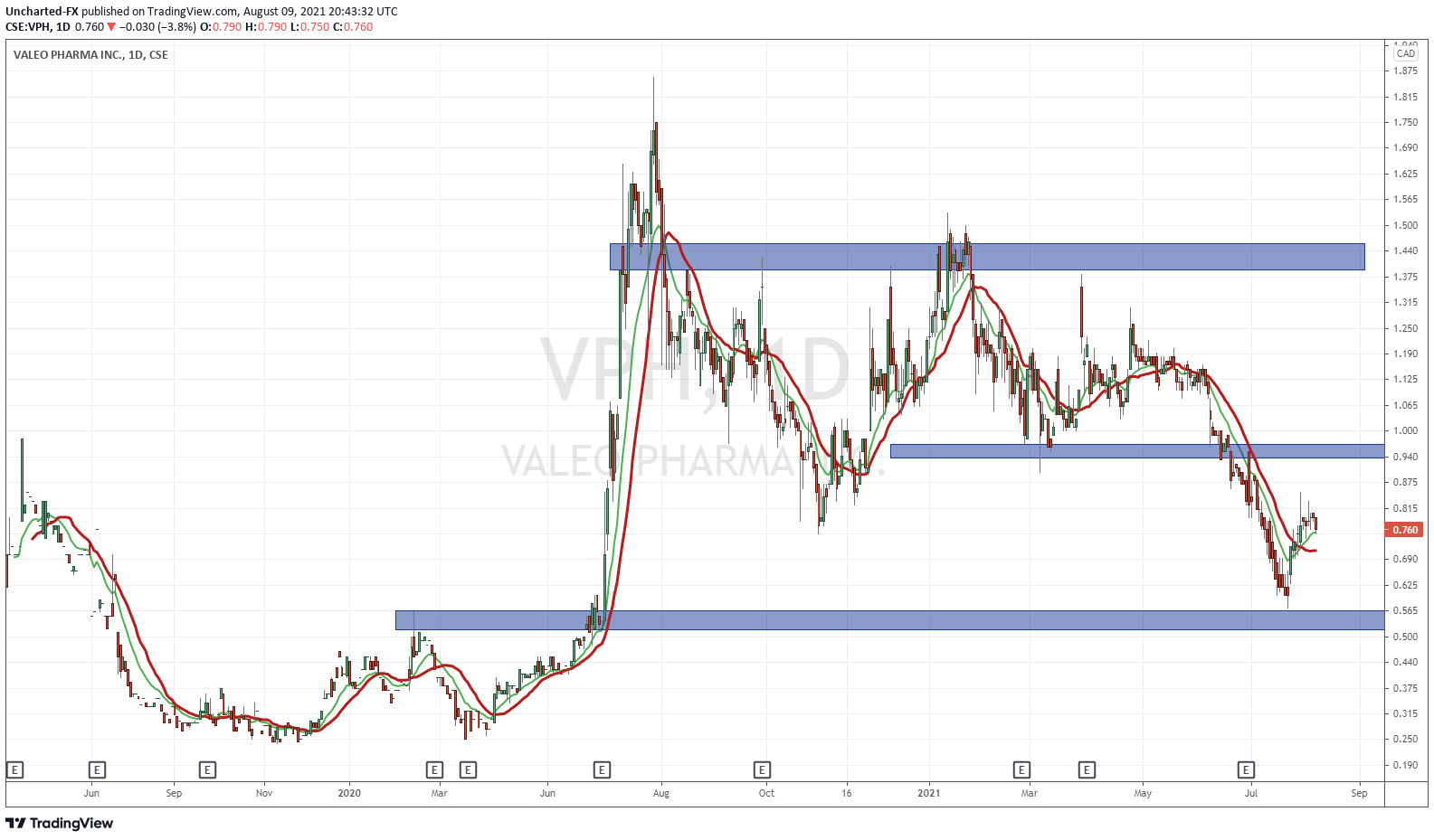

Technical Tactics

Looking at the stats on Marketwatch, Valeo Pharma has a market cap of $50.55 Million and the stock is down -37.70% year to date. However, for 1 month, the stock is up 4.11%.

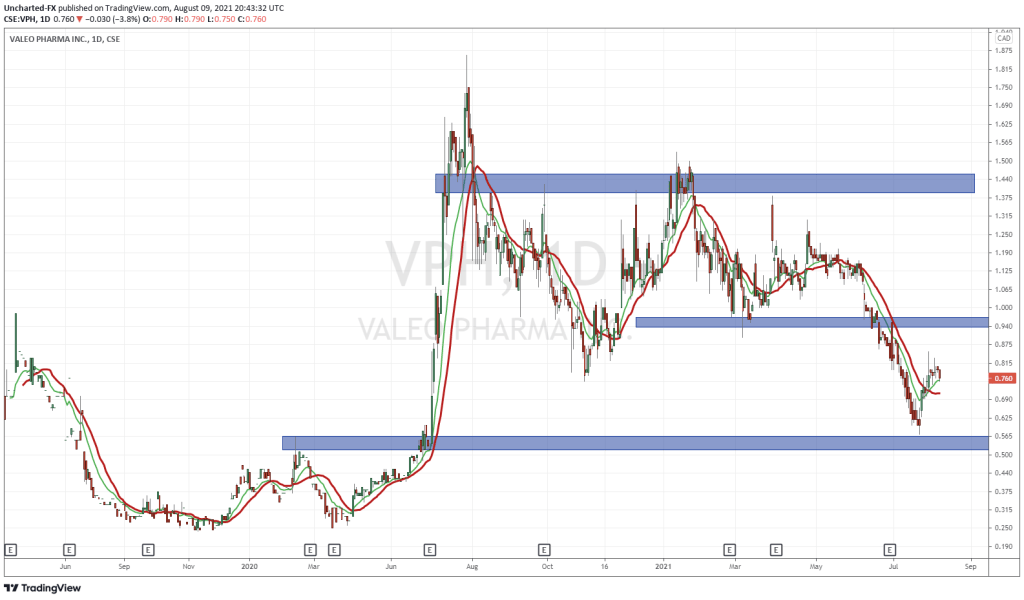

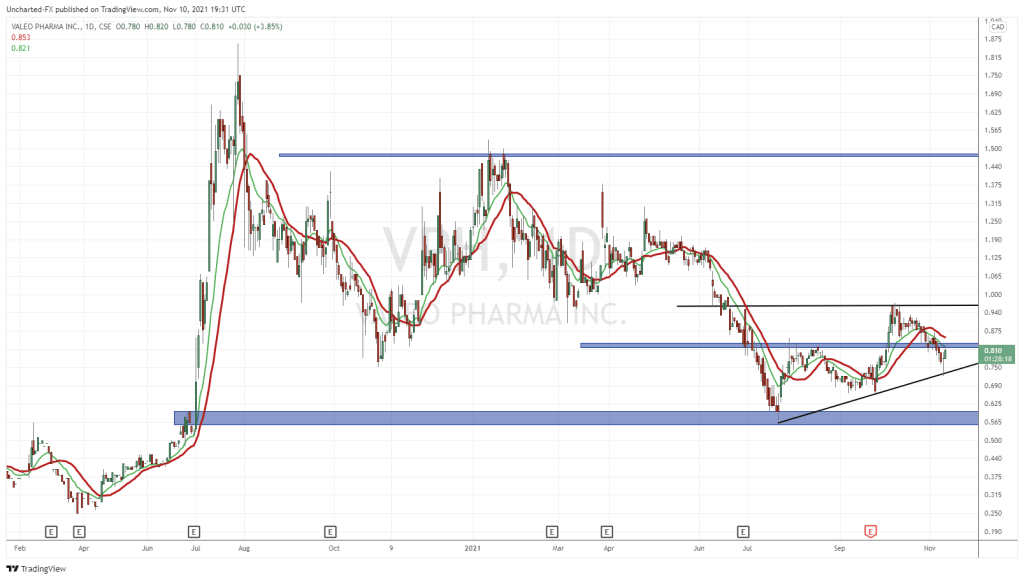

In terms of the technicals, Valeo is in no man’s land. Between a resistance zone and a support zone. I really like the tag of support at around the $0.55 zone. That would have been a great pick up zone. Resistance above is the $0.97 zone, but let’s round it up to $1.00. A very important psychological number and zone for small caps. If we see a close above $1.00, I would say that would be a super bullish sign.

As you all know I like to look for patterns and confluences. What this does is increase the probability for success. Some of the buyers might hate me, but I would not hate it if Valeo falls lower to test the $0.55 zone once more. I suspect buyers would be there, and then we would print a double bottom pattern.

But for the current bulls, there is a positive sign. Prices have climbed back above my 13 and 20 day moving averages, pictured in green and red. We can use the moving average as a support, since technically, if price crosses and remains above the moving average, it is a sign to buy. Therefore we can keep a bullish stance of VPH as long as price remains above $0.70.

In summary the technicals are showing signs of a potential reversal, and we just need some catalysts to take us higher. Of course specialty products have a lot of competition. As I said, I have taken flavonoids before, but what would make me buy Valeo’s ones? If the test comes back positive, what would be the difference between their Hesperidin versus the one I take?

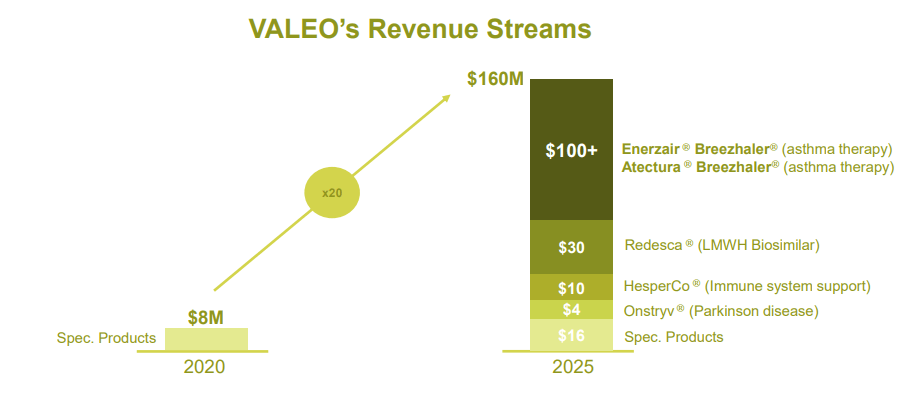

Perhaps this is why money went into sales and marketing. Most of their revenues is estimated to come from their asthma line of products in the future.

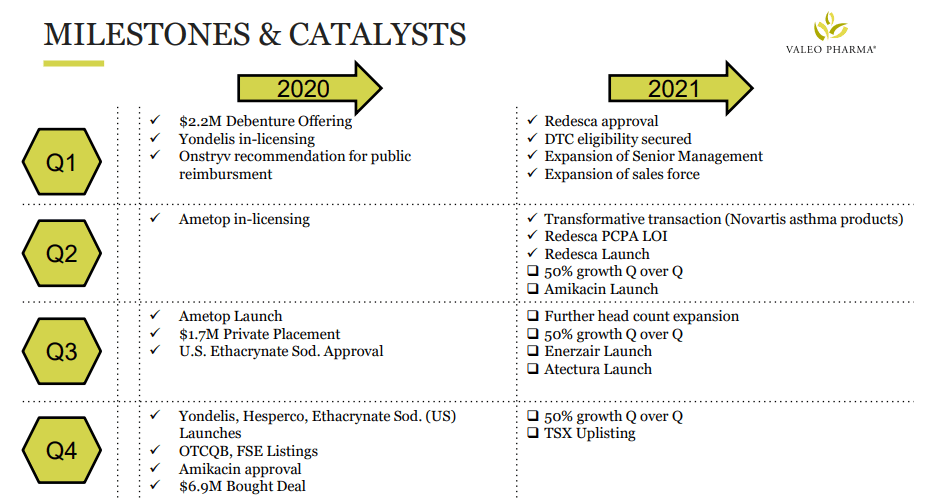

In terms of catalyst’s, there are PLENTY. A TSX listing is the big one, but for the company to also meet the management’s goals for 50% growth year over year. Don’t get me wrong, I like the specialty products, but it is about choosing their products over others.