Who are they?

EarthRenew (ERTH.C) is a sustainable agriculture tech company that’s focused on creating innovative organic fertilizer formulations. The business generates most of its revenue from its electricity-generating sector which helps fund its fertilizer manufacturing. Both industries are highly competitive.

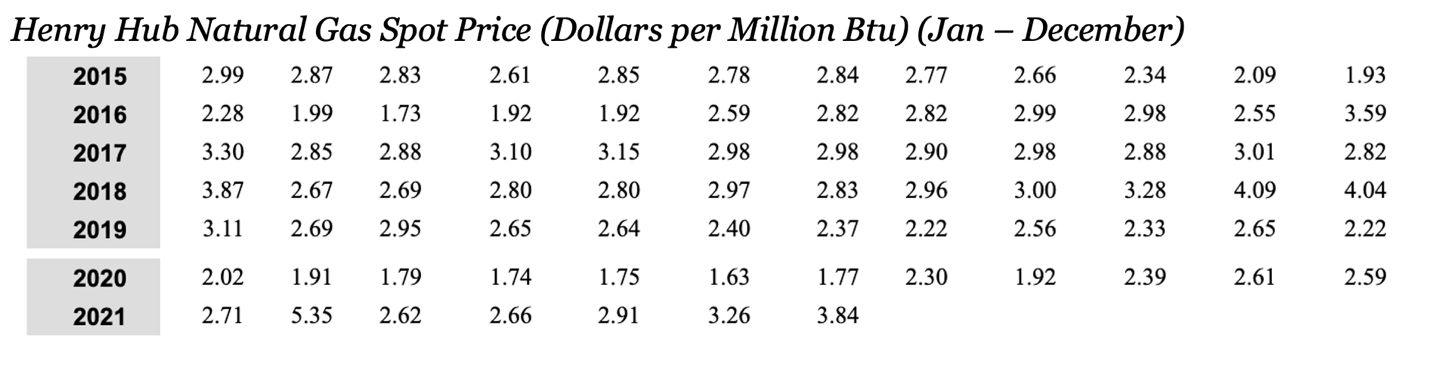

Although they do not produce the same product as traditional fertilizer producers the management team feels that future sales and margins will be affected by the price and availability of traditional soil products such as nitrogen-based fertilizers, the price of which is highly dependent on inputs such as natural gas.

As the business refocuses on its fertilizer manufacturing segment, its future revenue will be dependent on the market prices of electricity and natural gas.

The market prices and rates of electricity and natural gas can be affected by many factors, for example:

- By changes in regulations and government policy

- demand and capacity supply, including cyclical changes

- as well as the overall economy

For the business’s run smoothly and profitably, they will need electricity prices to increase in tandem with any future increases in natural gas prices. If this is not the case the company will not be able to sell the electricity produced by these plants at a level sufficient to offset most of the cost of the natural gas it needs to purchase.

The management team has highlighted six main things that they feel will push the business forward in the future.

The key highlights are:

- The company continued to generate strong revenues from power generation in 2021. The revenue generated from electricity sales offsets costs as the company moves toward restarting fertilizer production.

- On February 3, 2021, the company started trading on the OTCQB venture market under the symbol “VVIVF”.

- The company entered into an agreement of intent with Diamond Feeders LLC for the potential development of EarthRenews’ first facility in the United States.

- The company also entered into an agreement with the North American division of Enel-X a well-established player in the electricity industry, to participate in an operating reserve program in Alberta. Due to this program, they will be compensated for its ability to provide a short-term power supply to the Alberta power grid to support grid stability.

- In April the company entered into a power sales agreement with the cryptocurrency mining company to provide off-peak power over a five-year turn for the purposes of cryptocurrency mining.

- And in May the company closed the acquisition of Replenish Nutrients Ltd a privately-held regenerative fertilizer and nutrient company located in Alberta. The company paid $1.4 million in cash and a total of 21 million shares at a deemed price of 0.248 dollars per share.

- During the completion of their acquisition, Mr. Neil Weins was appointed to the company’s board of directors and will serve as the company’s chief technical officer and head of sales. Mr. Weins will also continue to serve as the president of Replenish Nutrients Ltd

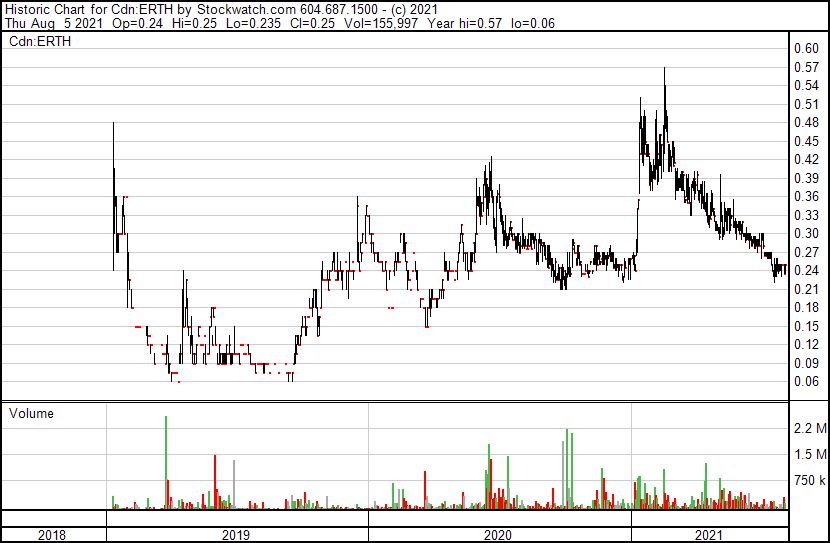

Even with all these progressive developments, the stock seems to be on a different path. At the start of 2021, the stock was trading at $0.27 per share, and in February it peaked at $0.54 per share. But since then, the stock lost about 50% of its value plummeting from its peak of $0.54 per share to $0.25 per share, leaving shareholders 2 cents poorer than when we opened 2021.

After seeing such a poor performance from the stock one can’t help but wonder if the underlying business is performing just as badly.

Business Performance

Peeking under the hood tells a story of its own. This story is that operations might not be as bad as the stock performance has show

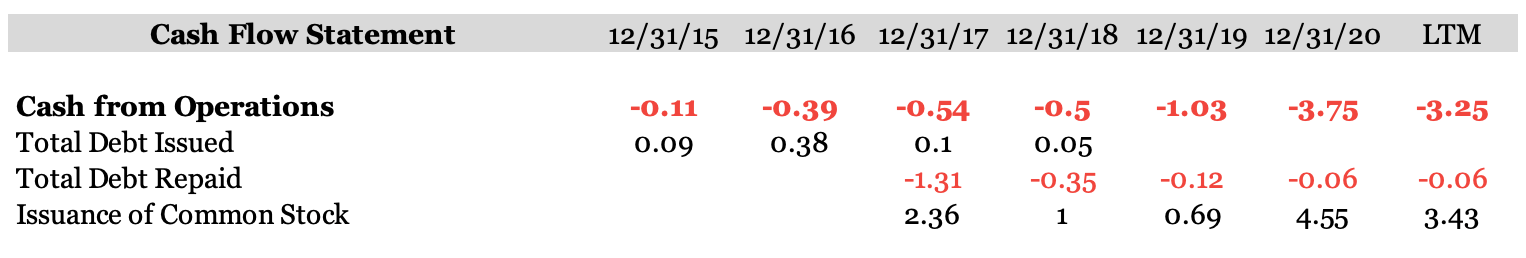

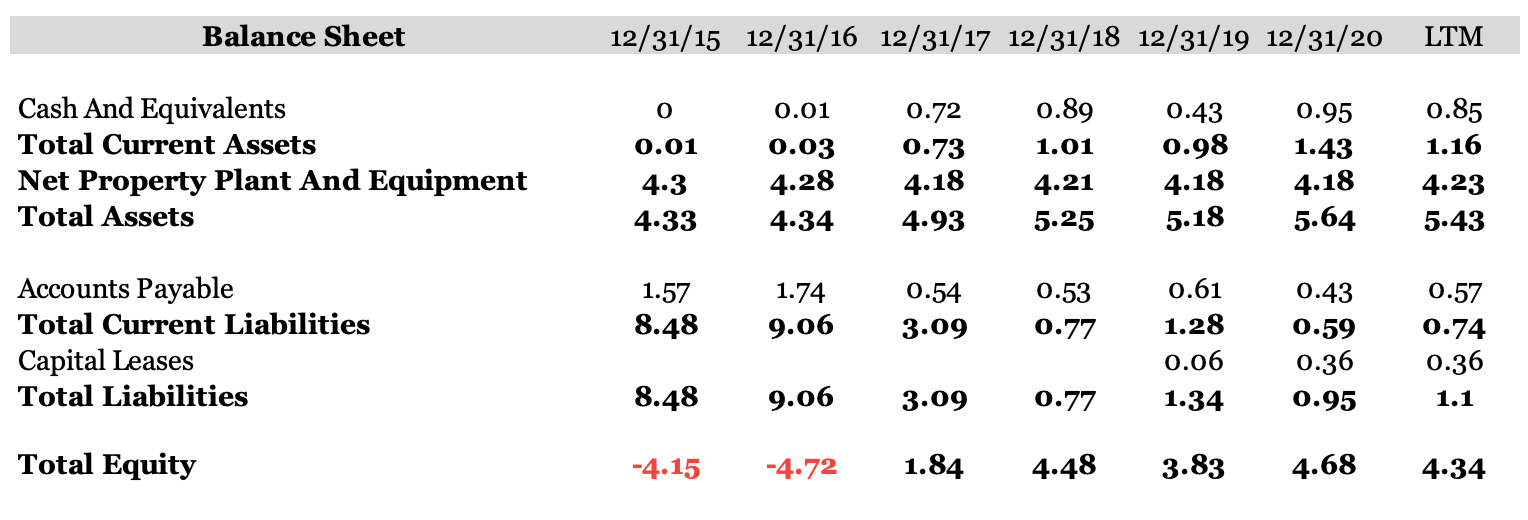

From the table above it’s obvious that the cash flow from operations has been deteriorating over time. The business is still aggressively investing in consulting and other professional services that are needed for its operations to run smoothly so this is expected.

When you factor in this seasonality of the industry and its exposure to the commodity prices the deteriorating cash flow from operations shows a business that uses more cash than it brings in.

To fund most of their operations the firm has relied on the issuance of common stock as you can see from the table in 2017, they issued $2.3 million in stock, and then as of the last 12 months, they’ve issued $3.43 million in stock.

On top of this, they have an equity financing facility with a New York-based private equity firm that allows them to draw a total of $10 million. This agreement provides the company with an at-will financing facility over a period of 24 months during which the company can draw down at its discretion up to $50,000 in private equity placement tranches.

These equity tranches are composed of units with each unit consisting of one share of the company and one common share purchase warrant at discounts between 15 and 25% of the closing price of the common shares of the day prior to the company’s drawdown. No drawdowns under the facility have been taken meaning these funds are still fully available for the firm including a cash buffer of $800,000 in the bank.

Although the company might be facing some headwinds it has enough of a cache buffer from its cash in the bank and its equity financing deal to facilitate future projects in the hopes that the electricity generating business will continue to produce revenues covering the majority of the cost whilst they plan and implement their new fertilizer manufacturing facilities.