Cybin (CYBN.NE) announced today that it has closed its previously announced overnight marketed offering including the exercise in full of the over-allotment option granted to the Underwriters.

“Investor demand for this financing was very strong and we are thankful for the outstanding work of our banking syndicate partners and advisors and we welcome all new Cybin investors that share our vision. Cybin was well funded before this financing, and this new funding now further extends the runway for our drug programs, discovery pipeline and IP portfolio, and provides additional flexibility to support potential M&A opportunities,” said Doug Drysdale, Chief Executive Officer of Cybin.

In consideration for their services, the Company paid to the Underwriters a cash commission equal to $2,240,129 and issued 658,860 compensations options of the Company. Each compensation option is exercisable to acquire one share at the issue price for a period of 24 months from the closing date of the offering.

As for the details of Cybin’s offering, the Company issued an aggregate of 10,147,600 common shares in the capital of the Company at a price of $3.40 per share for total gross proceeds of $34,501,840. The shares were offered in each of the provinces of Canada, excluding Quebec, pursuant to a prospectus supplement to the Company’s short form base shelf prospectus dated July 5, 2021. With this in mind, Cybin intends to use the net proceeds from the offering for general corporate and working capital purposes.

“…Cybin has now raised over $120 million and sits on a very healthy cash balance. We remain dedicated to our mission to revolutionize the way mental health disorders are treated and the continued support of investors enables us to continue to work diligently towards that mission,” commented Doug Drysdale, Chief Executive Officer of Cybin.

Having secured a strong financial position, Cybin is well positioned to capitalize on the psychedelics sector, which is expected to reach approximately USD$10.75 billion by 2027. Between 2021 and 2027, this market is expected to grow at an impressive CAGR of 12.36%, demonstrating significant growth in the psychedelics sector.

With this in mind, Cybin has an extensive pipeline of psychedelic products, including CYB001, which received approval for a Phase II trial on May 18, 2021. This trial is intended to assess the Company’s sublingual psilocybin formulation versus a 25mg psilocybin capsule. Furthermore, Cybin also announced on July 28, 2021, that it had received approval for the listing of its common shares on the NYSE American LLC stock exchange, the world’s largest stock exchange by market capitalization.

Cybin has now raised more than $120 million, further strengthening the Company’s cash balance. Looking forward, investors should be keeping an eye out for any news related to Cybin’s preclinical advancements and trials, notably the Company’s CYB001 trial.

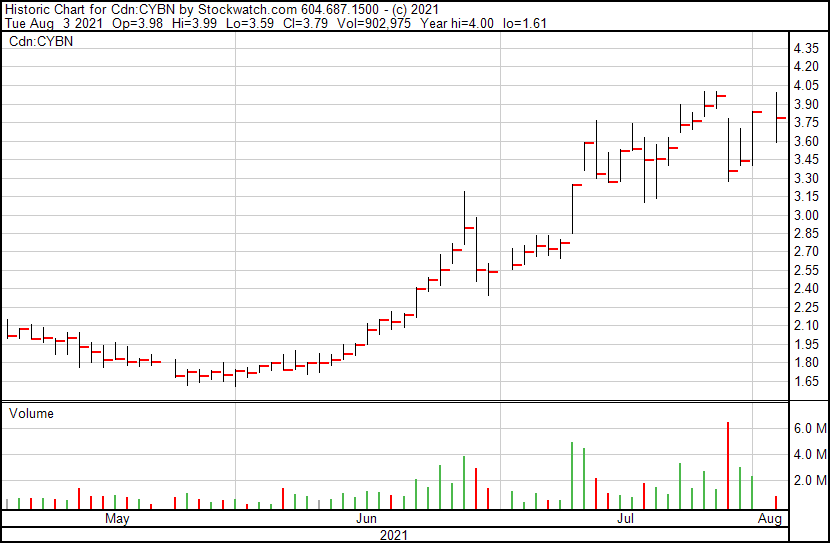

Cybin’s share price opened at $3.45, down from a previous close of $3.84. the Company’s shares are down -1.3% and are currently trading at $3.79 as of 10:41AM ET.

Full Disclosure: Cybin is a marketing client of Equity Guru.