Skyharbour, an Athabasca Basin land baron, is currently drilling its flagship 35,705 hectare Moore Uranium Project located 15 kilometers to the east of Denison’s uber high-grade Wheeler River Project in the prolific Athabasca Basin of Saskatchewan.

The Athabasca Basin is to uranium what the Carlin Trend is to gold (have a look at slides 13 thru 16 on Skyharbour’s pitch deck).

Ringed by regional infrastructure, Moore Lake is an advanced stage project boasting significant (high-grade) resource and discovery potential.

Unconformity style uranium mineralization was discovered on the Moore Project at the Maverick Zone in May 2000. Historical drill results include 4.03% U3O8 over 10.0 metres including 20% U3O8 over 1.4 metres. In 2017, Skyharbour announced drill results of 6.0% U3O8 over 5.9 metres including 20.8% U3O8 over 1.5 metres at a vertical depth of 265.0 metres at the Maverick Zone. In addition to the Maverick Zone, the project hosts other mineralized targets with strong discovery potential which the Company plans to test with future drill programs.

Equity Guru’s June 9th piece on the subject—Skyharbour Resources (SYH.V) an Athabasca Basin Uranium gem in the midst of an aggressive drill campaign—examines the latent subsurface potential as the Company pushes its flagship project aggressively along the development curve.

Having recently announced an acceleration in drilling—from 3,500 meters to 5,000 meters in up to 14 holes—assay-related news should begin flowing out of Moore Lake in the not-too-distant future (Skyharbour (SYH.V) accelerates Moore Lake drill campaign in the prolific Athabasca Basin).

All told, this cash-rich, expertly helmed Company is looking to drill roughly 10,000 meters on its own dime this year—8,000 meters at Moore Lake and 2,000 meters at its wholly-owned South Falcon Point property. South Falcon, the 2nd most advanced project in Skyharbour’s portfolio, could attract a JV partner in the coming weeks/months.

Holding an extensive pipeline of highly prospective properties, Skyharbour employs the prospect generator business model to push these drill-ready projects further along the curve.

In wrapping up our June 9th piece, we told readers to expect multiple drill programs over the next seven to eight months as the Company’s JV partners continue working their ground.

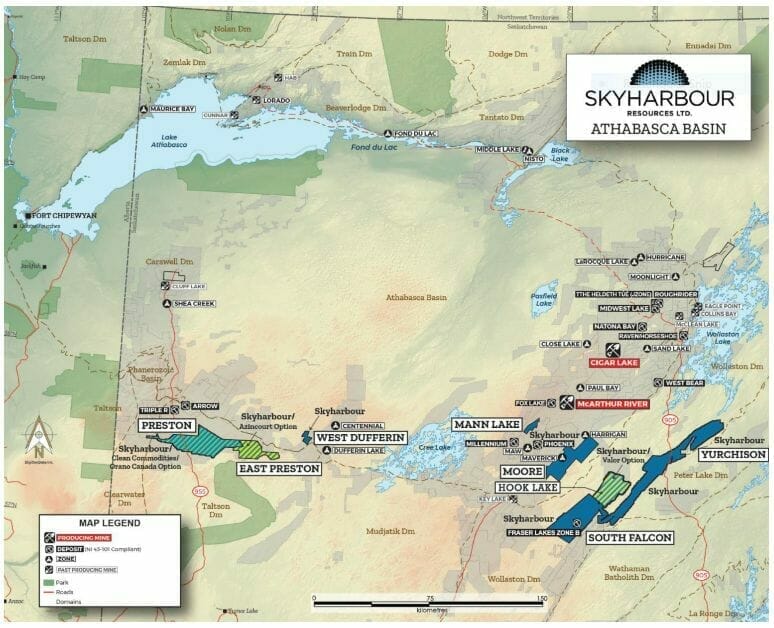

One such project is East Preston—note its location on the above map.

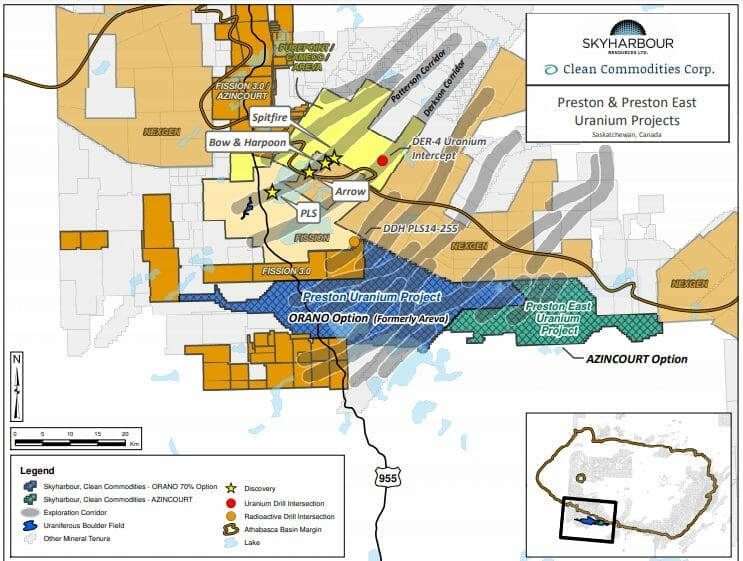

Located on the west side of the Basin, East Preston is a JV with Azincourt Uranium (AAZ.V).

Azincourt launched a drill campaign back in late February, but the program was cut short by unseasonably warm weather that compromised access into the region.

East Preston’s 20,647 hectares are also strategically located near Fission’s Triple R deposit and NexGen’s Arrow deposit.

East Preston is in the pre-discovery phase, having undergone several rounds of exploratory drilling.

Vectoring in on a uranium deposit can be challenging, even in a prolific setting like the Basin.

A new discovery often requires dozens, sometimes hundreds of probes with the drill bit. McArthur River, a Basin standout, ultimately required 210 holes before the geological sleuths at Cameco homed in on the orebody.

After its abbreviated winter campaign, Azincourt put out the following update…

June 8th news – Azincourt Energy Drilling Returns Elevated Uranium at the East Preston Uranium Project

Yesterday (July 6th) this JV partner dropped the following update concerning an upcoming summer drill campaign at East Preston…

Meriting consideration: the Azincourt technical team includes one Ted O’Connor, P.Geo., M.Sc., B.Sc., and an ex-Cameco man with over 25 years of experience in the uranium exploration arena. A couple of years back I heard Azincourt’s CEO, Alex Klenman, characterize O’Connor as the company’s “secret weapon”. If there is a major discovery to be had in East Preston’s subsurface stratum, O’Connor is bound to zero in on it.

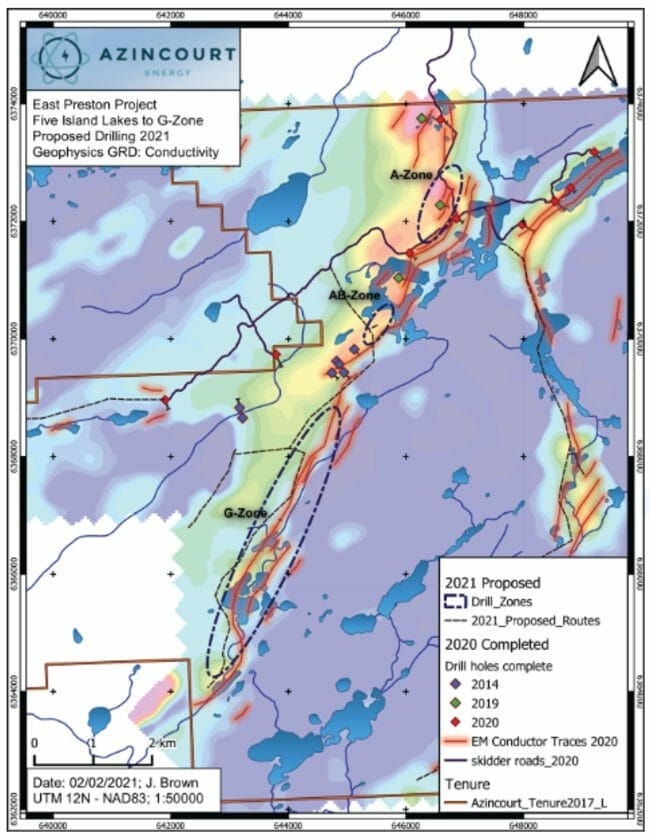

According to this July 6th update, the primary target area for the 2021 summer campaign continues to be a conductive corridor—from the A-Zone through to the G-Zone.

“The selection of this trend is based on a compilation of results from the 2018 through 2020 ground-based EM and gravity surveys, property wide VTEM and magnetic surveys, and the 2019 through 2021 drill programs. The 2020 HLEM survey completed in December indicates multiple prospective conductors and structural complexity along the eastern edge of this corridor.”

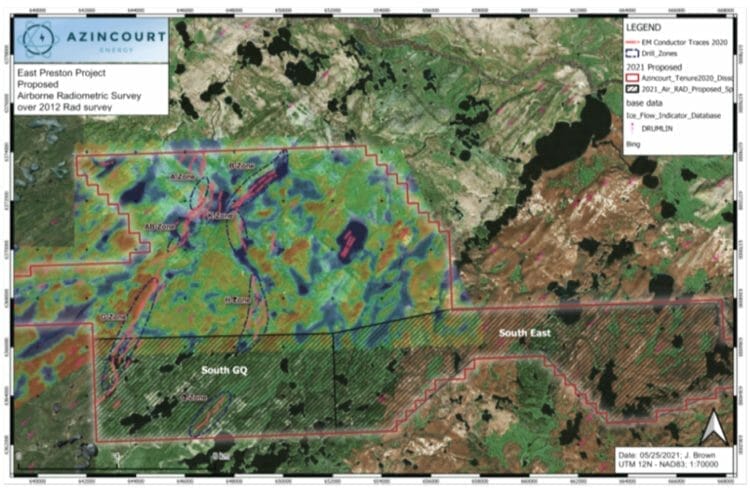

Azincourt has contracted Terralogic Exploration to facilitate an airborne radiometric survey—roughly 1,700 kilometers of survey lines flown at a low minimum altitude and 50-meter line spacings—over the previously unsurveyed southern portion of the property (image below). The Company will then put boots on the ground to follow up on the resulting anomalies.

An airborne radiometric survey uses a gamma ray scintillometer mounted on an airborne platform to measure and map the natural radiation emitted by the rocks and soil the aircraft is flying over. Gamma radiation occurs from the natural decay of elements such as uranium, thorium, and potassium. Locations that have a higher radiation signature (anomalies) than the normal values for the surrounding area (background) would then be examined by crews on the ground for the potential presence of radioactive bedrock if there is not much glacial till cover, or boulders in the till that could be traced back to a source. Many uranium deposits in the Athabasca Basin, including the nearby Triple-R deposit, have been found by following trails of radioactive boulders in the glacial till back to their source.

Trevor Perkins, Azincourt’s exploration manager:

“The additional radiometric survey coverage will help us ensure that we are focusing on the best sections of the conductive trends we have identified. We are eager to add these results to our data package to make sure that the highest quality targets are tested first.”

Planning is currently underway for a late summer/early fall diamond drill campaign of roughly 1,000 meters—meters that were originally scheduled for the 2021 winter program.

This July 6th press release goes on to state that an extensive 6,000-meter campaign consisting of 25-30 drill holes is on deck for the winter of 2022. Drill targets will be further prioritized with the data assembled this summer.

Permits and funding are in place to complete all the planned work through the winter of 2022, and consultations and information sessions with local communities are continuing throughout.

Final thoughts

Skyharbour has roughly C$9 million in cash and equity holdings in its coffers—approx $6.5M in cash and $2.5 in stock.

The Company’s current market cap of $43.67M, based on its 118.03 million shares outstanding and recent $0.37 close, strikes me as a modest valuation for a Basin-based land baron with multiple prospective irons in the fire.

Expect robust newsflow over the balance of 2021.

We stand to watch.

END

—Greg Nolan

Full disclosure: Skyharbour is an Equity Guru marketing client.