It’s that time again! Earnings season is upon us! And we kick off with the Big Banks releasing numbers this week. Add earnings to a week with Interest Rate Decisions (New Zealand, Canada, and Japan), Powell Testifying (Wednesday and Thursday), China Q2 GDP and Retail Sales (Wednesday) , US Retail Sales (Friday), and US CPI for June on Tuesday (will stir the inflation debate and whether the Fed tapers sooner rather than later), we are bound for volatility and action in the markets.

JP Morgan and Goldman Sachs kick off earnings starting Tuesday July 13th. But Bank of America, BNY Mellon, BlackRock, Citigroup, Morgan Stanley, US Bancorp, Wells Fargo, First Republic, PNC, and State Street will also release numbers this week.

Banks are always seen as that safe bet in long term value portfolio’s. Even though the US Federal Reserve imposed restrictions on buying back shares and increasing dividends, bank stocks continued following the stock markets: all the way up.

These restrictions have now dropped. They dropped back on June 30th. Banks are now allowed to start share buybacks and increase dividends. All positive for shareholders. Some analysts even expect dividends to double in aggregate. A senior analyst at Wells Fargo projected that large-cap banks could pay out $127 billion in capital this year (compared to $63 billion in 2020).

Strong capital levels to be able to withstand a recession is key here. If any of the big banks fall below minimums that are set by the stress capital framework, the Fed automatically reimposes restrictions on that bank.

The big debate is whether banks are healthy. According to the stress tests, they are. But many contrarians await a bank failure. Maybe more so in Europe (Deutsche Bank) rather than the US. Lower rates, negative in Europe, has been a challenge for the banks. But rather than loaning which you know is the traditional business of banks, they have traded the markets for profits. The last time we saw big bank earnings, we saw RECORD earnings. All because of the investment banking portion of their business. I suspect things will be the same. We should expect to see the investment side continue to carry on with gains, but commercial side will see a bump up due to re-openings and mortgages.

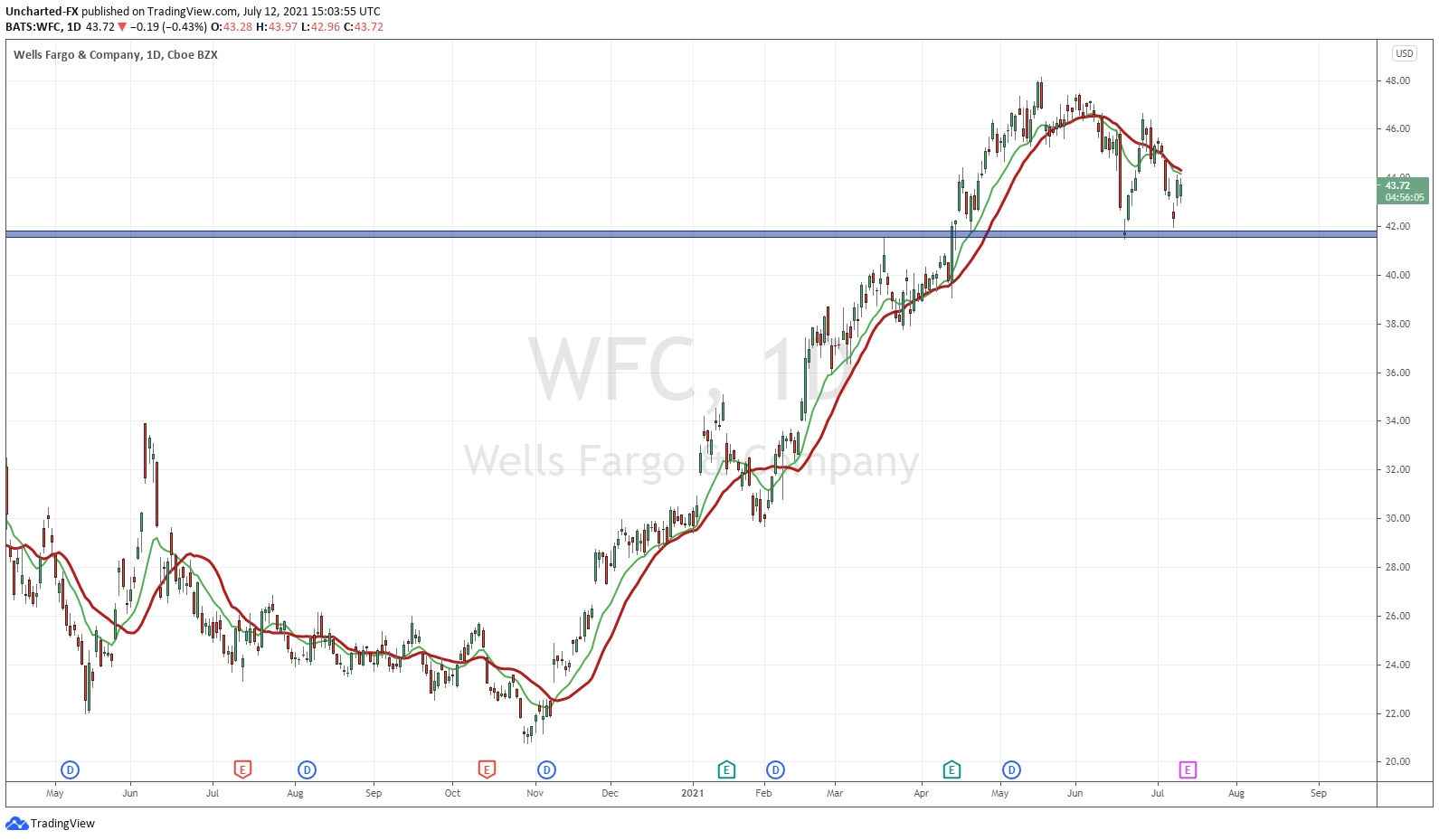

The biggest news from the banks, Wells Fargo in particular, came out last week. Wells Fargo is shutting down all personal lines of credit.

The revolving credit lines, which typically let users borrow $3,000 to $100,000, were pitched as a way to consolidate higher-interest credit card debt, pay for home renovations or avoid overdraft fees on linked checking accounts.

Wells Fargo CEO Charles Scharf has been forced to make difficult decisions during the coronavirus pandemic, offloading assets and deposits and stepping back from some products because of limitations imposed by the Federal Reserve. In 2018, the Fed barred Wells Fargo from growing its balance sheet until it fixes compliance shortcomings revealed by the bank’s fake accounts scandal.

The asset cap has ultimately cost the bank billions of dollars in lost earnings, based on the balance sheet growth of rivals including JPMorgan Chase and Bank of America over the past three years, analysts have said.

It has also affected Wells Fargo’s customers: Last year, the lender told staff it was halting all new home equity lines of credit, CNBC reported. Months later, the bank also withdrew from a segment of the auto lending business.

So not all is well with every bank, but the big boys still remain too big to fail. I would put Wells on that list since they are the third largest bank in the US.

Technical Tactics

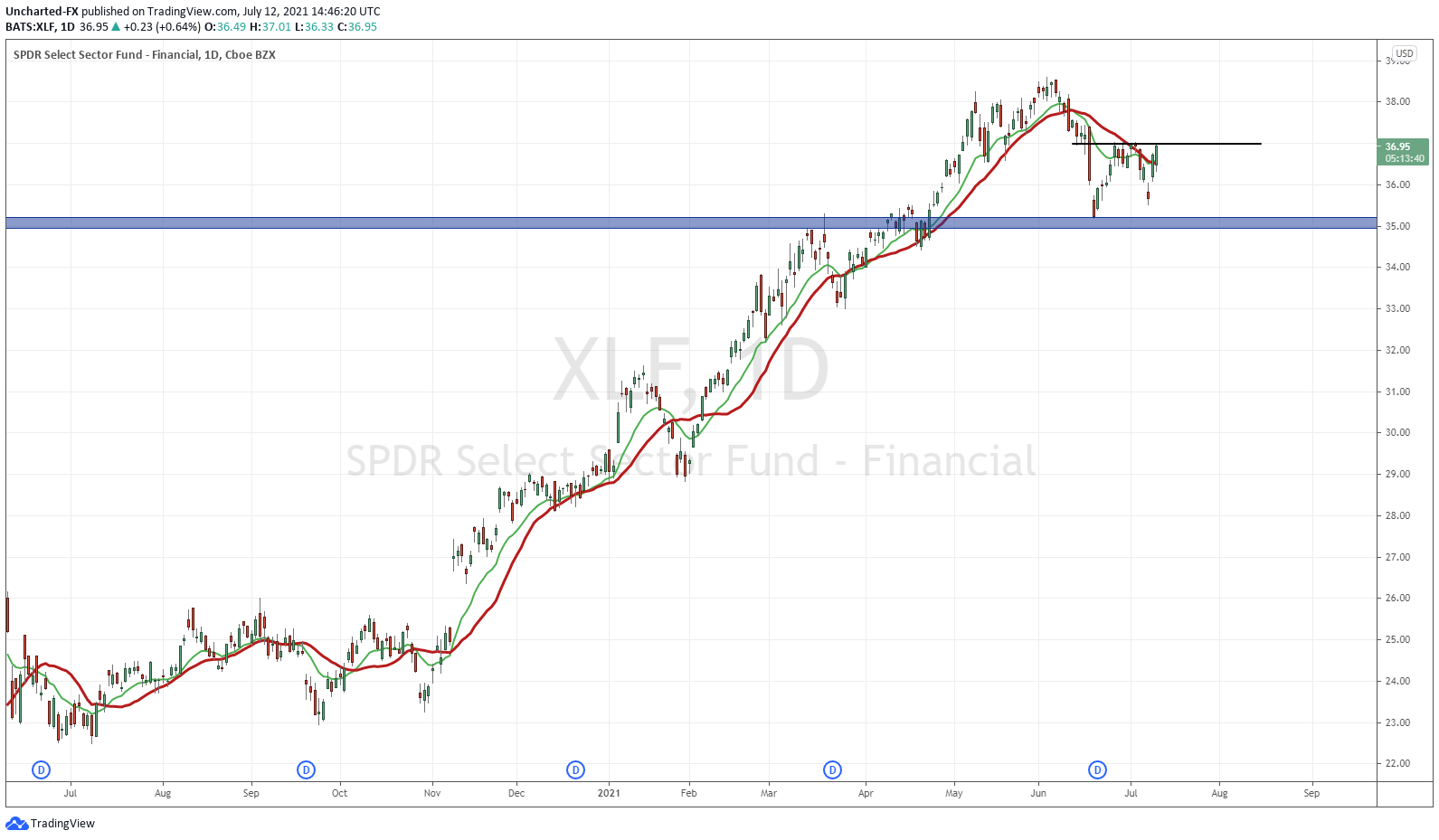

Let’s take a look at some charts! Beginning with the financial ETF XLF.

You will see a few charts looking similar to this. As you can see, I was a bit worried that banks were going to begin a reversal. $25.00 is the key support I was watching for a break and a trigger to go short. We held. Buyers stepped in and have driven prices higher. We are not out of the danger zone just yet. To do so, I would like to see a daily candle close above $37 (the line I have drawn). We are practically there now, so this daily close might occur today. This would be very bullish, and would be a sign that the market is pricing in solid and better than expected bank earnings.

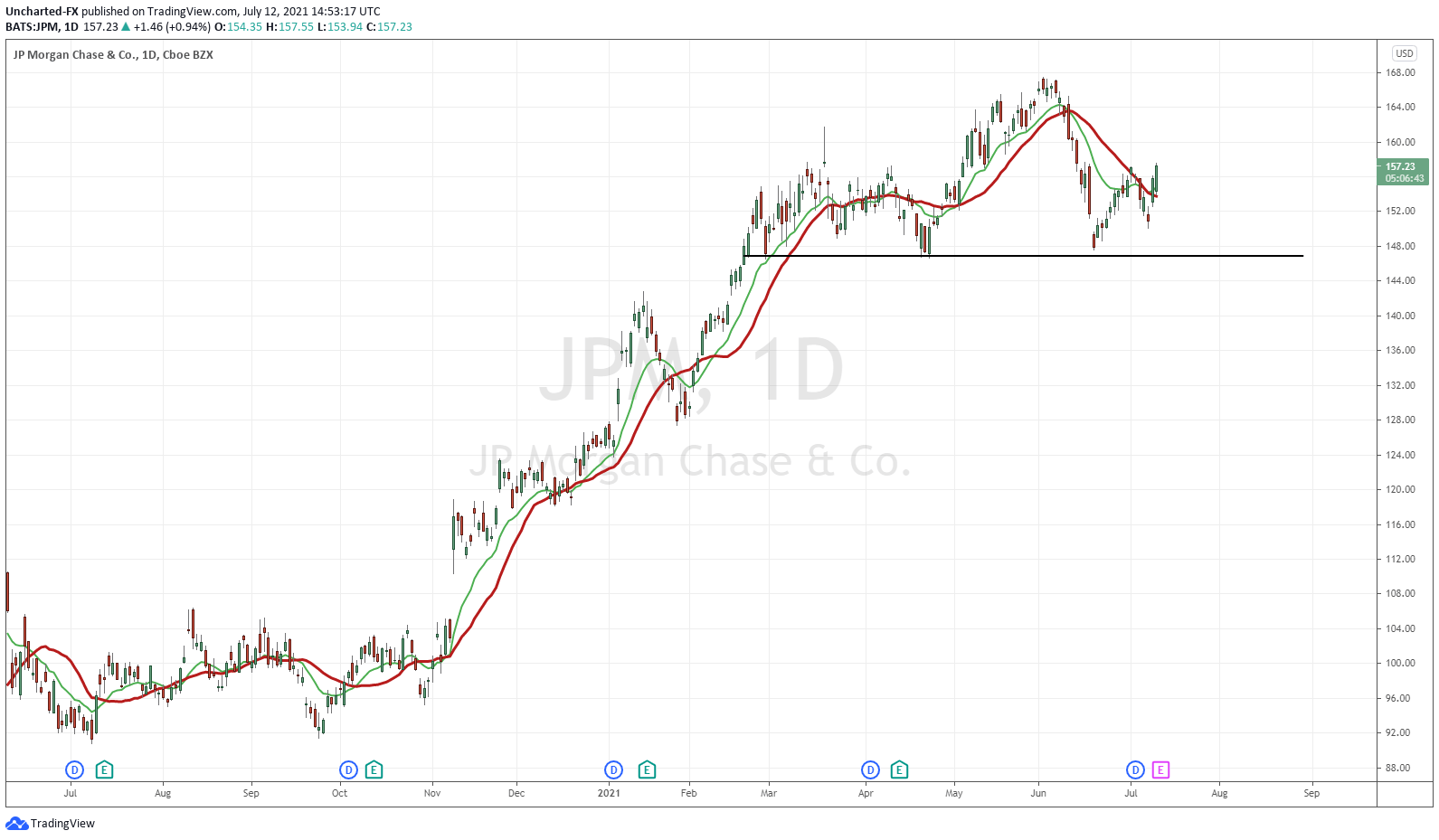

When you think of large banks, JP Morgan comes to mind. They are the biggest bank in the US under the leadership of CEO Jamie Dimon. The technicals were looking worrying earlier. Can you see it? Yes, I am talking about the infamous head and shoulders pattern. The Trigger though is the break below the support/neckline at $147.25. Didn’t happen. The question going forward is are we forming the right shoulder of this pattern right now? A close above $157.25 by the end of the day would nullify the right shoulder. So far it is looking good. JPM is trading at $157.41 at time of writing.

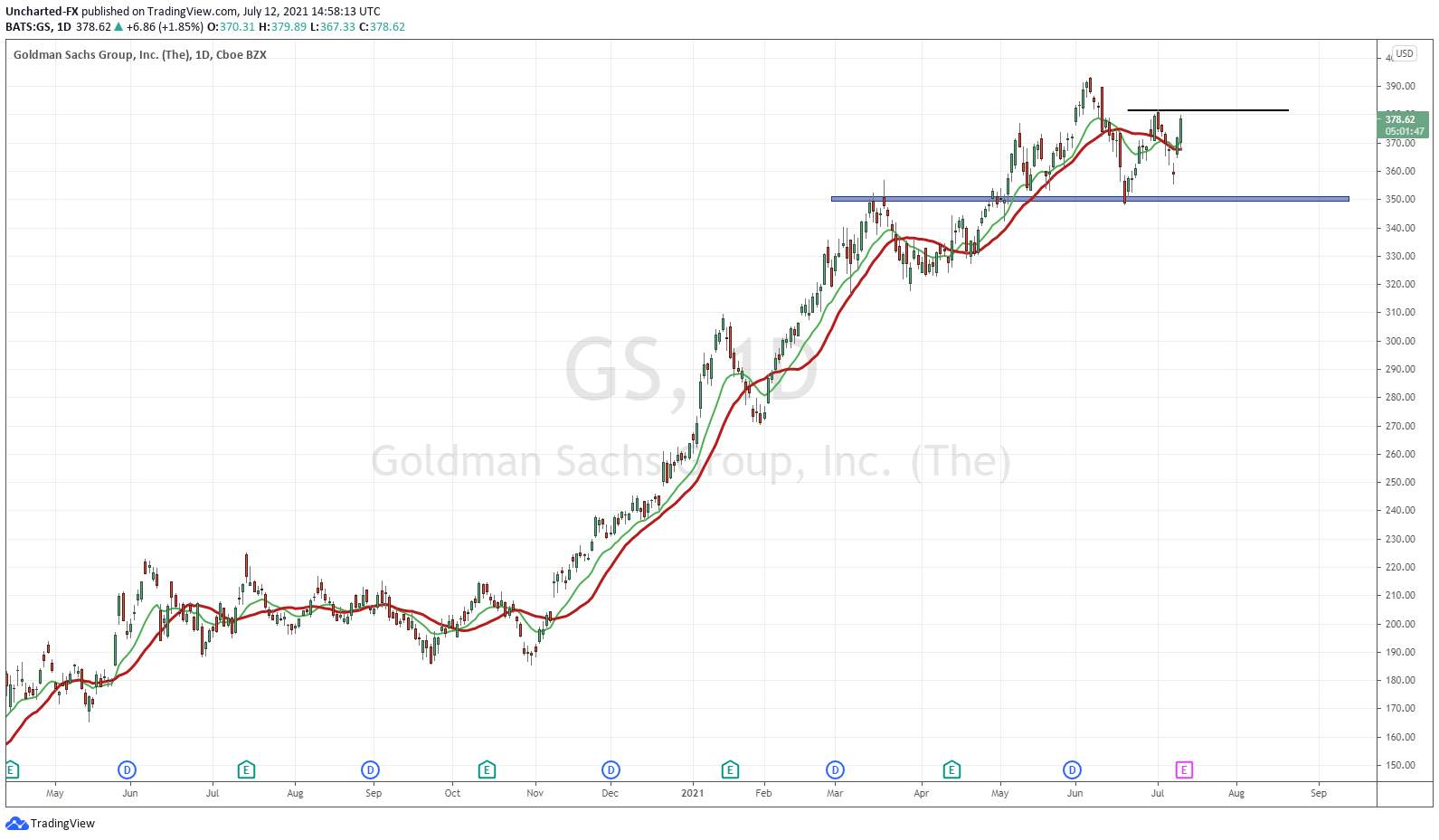

Goldman Sachs technically in the same boat. A possibility of a reversal pattern triggering with a close below $250. But now we are long ways above that zone. The right shoulder of a head and shoulders pattern can be nullified with a daily close above $381.75.

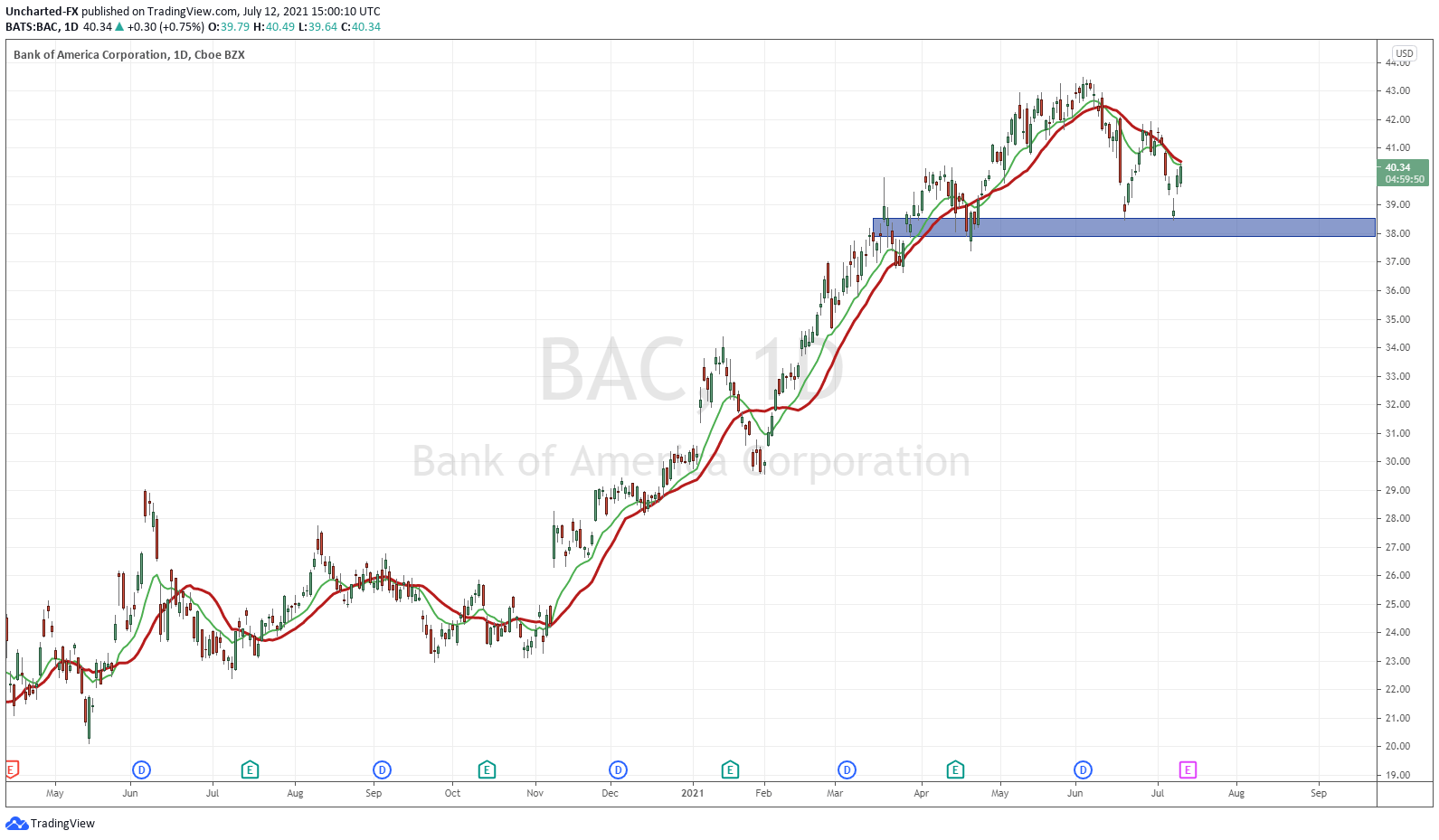

The second largest bank in the US, Bank of America, is looking slightly different. I say this because price is nowhere near the upper portion of the right shoulder. To nullify the chance of a reversal pattern triggering, I would want to see a close above $42.

This one gets the attention as Warren Buffett is a shareholder, and the CEO, Brian Moynihan, continues to receive praise for turning things around.

Let’s end off with Wells Fargo. Even with that bad news regarding the shutting of credit lines, the stock remains above its major support above $42. Just as Bank of America, it still has some room to make before nullifying the reversal pattern. Above the $46 zone in this case.

So in summary, a few of the big boys like JP Morgan and Goldman Sachs are looking great. It seems with current price action, that the market is pricing in better earnings for them. Morgan Stanley is also ripping today, so I would add that to my list. If earnings come out better than expected, the XLF would rip, but personally, I am looking forward to see the Dow Jones finally breakout into new record highs, as Goldman Sachs and JP Morgan are components.