Pubco failure

Microdosing was the biggest buzzword in the psychedelics sector only 2 years ago, but nowadays it’s rarely discussed, at least in terms of publicly traded companies. HAVN Life Sciences (HAVN.C), the ex-Aphria shop spent nearly $300,000 CAD developing ‘mushroom formulas’ that aren’t any different from what dudes like Paul Stamets have been selling for over a decade. The opportunities and breakthroughs haven’t really come yet, whereas in macrodosing they seem to be dropping weekly.

In 2019 I was in a position where it looked like I was going to be running one of these deals. I had a couple of funds lined up, some well-branded products with cool artwork, a sexy website, and friends who have prestigious digital marketing roles who would have been on my board. We were also looking to break into China’s market as an organic Canadian company specializing in high-quality mushroom supplements. The deal never got done, but in the process, I learned everything I possibly could about these powders, and microdosing, which was going to be phase 2 of the company’s business plan, along with retreat partnerships in jurisdictions like Jamaica where mushrooms are legal and used by well off Westerners looking to find themselves amongst the backdrop of a 5-star beach resort.

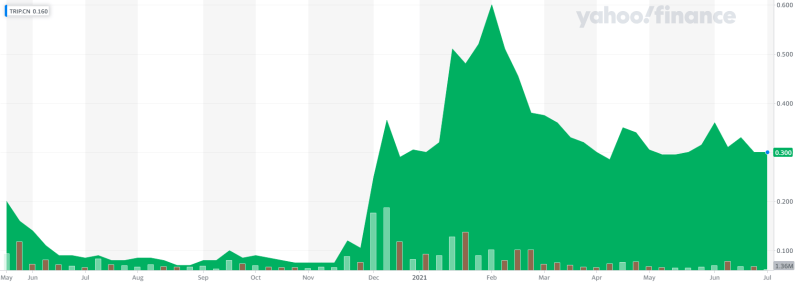

Now a couple of years later I am glad the deal didn’t go through as really no other microdosing or supplement pubco has been all that successful, and I think my investors would have been disappointed. Red Light Holland (TRIP.C) has done OK, their stock is down 50% from its peak in February. They entered the market in May 2020 at $0.25 CAD and are now at $0.30. Nothing to really write home about as of yet when you compare it to the legitimate biotechs and clinic-based companies.

‘Cannabis 2.0’ was a bad take

The Silicon Valley microdose scene looked like the coolest and sexiest trend to put big dollars behind around 2017. There was this image of armies of highly intelligent coders in the Bay Area dropping fractions of acid tabs into their morning coffee that gave them this undetectable beneath the surface superpower to code all day and not get stressed out. The problem is, clinical trials on microdosing have been spotty at best, as have mushroom supplements. Guys like Joe Rogan who have been shills for the mushroom powder industry for years now still can only cite either their own biased studies or ones of similar stature.

It’s not that there’s anything wrong with powders or microdosing. I still liberally pour my powders into my blender each morning when I make my smoothies, but something like trauma healing through MDMA-assisted psychotherapy is just a better story, especially now that there is respectable scientific evidence to back it. The problem 2 years ago was people weren’t thinking big enough, myself included. Back in the day, I saw this industry as cannabis 2.0, and I am kind of embarrassed to say that as someone who has currently taken up trauma healing and therapy with quick and profound results. If the mushroom powders add 3% more happiness to my life, the therapy is probably more like 30% and I’m not even doing psychedelics.

Champignon Brands switches to Braxia Scientific (BRAX.C), picks up 4th ketamine clinic

Highly profitable ketamine clinics and clinical trials are really what’s dominating the space now. I think there is still room for lifestyle brands downstream to be bought out by some of the bigger fish. Joe Rogan’s Onnit for example could be of extreme value to a big biotech company that has shit tons of cash, new exciting NCE’s and clinical trials all lined up, but who no one outside of r/shroomstocks has ever heard of. But unlike cannabis, the rec market isn’t likely coming anytime soon, and cannabis is a much more widely used substance than all psychedelics combined, so the likelihood of the DOJA/Tokyo Smoke of mushrooms being bought out by a big biotech for $600 million dollars doesn’t look probable at this point. And that’s probably a good thing because psychedelics and cannabis are very different. There are a lot more risks involved in psychedelics, namely DIY usage and misunderstanding of dosage, which maybe didn’t really contribute to Nixon fucking up the 1960’s afterparty, but more so the public perception around said psychedelics.

I wrote earlier this week about Ketamine One (MEDI.NE) buying 16 ex-cannabis clinics turned ketamine clinics. Genius in my opinion. And earlier today Cybin (CYBN.NE) announced an R&D partnership that gives them access to 129 research locations across the USA. Now while some folks on Reddit erroneously thought this meant Cybin will have 129 clinics, planting a flag of that size this early in the game is significant. This is excellent ground game from Cybin.

Branding?

So how can brands fit into all of this, or is branding a moot point when discussing psychedelics?

The clinics themselves are being branded which makes sense, attracting new customers is key for revenue growth. From what I have seen most of the clinics have chic and sexy branding down to the furniture, signage, websites, social media strategy – all of it looks very high class. This is important in attracting higher net individuals that are likely to become repeat customers who can afford this type of therapy, and not those who are maybe just looking to try something like ketamine infusion therapy once or twice just for the kick of it. Attracting and retaining a database of repeat clientele will require these companies to put a better product out than the next operation down the road, and a big part of that in today’s retail market comes down to branding.

So 2 years ago when everyone was talking about cannabis 2.0, lifestyle brands, and microdosing they weren’t wrong, there still is a market for that. I will continue to be a customer. Things just happened a lot quicker than initially expected, psilocybin was granted breakthrough status by the FDA in 2019, the same year the FDA approved the ketamine derivative Sparvato for use in treating depression. These outcomes were almost impossible to predict when this sector first got going. The unexciting nature of the microdose market has nothing to do with microdosing being useless, but rather, something much bigger and better has come. This could all change is legalization starts to move forward. But as of now, it feels like we are so far out from that that speculating around it is a waste of time. There are other business models generating significant revenue now, ie ketamine clinics.

Unfortunately for newer startups breaking into the clinic game or conducting clinical trials is going to be cash-intensive and time-consuming, causing a pretty sturdy barrier to entry. This means companies like Cybin (CYBN.NE), Mindmed (MNMD.Q), Compass Pathways (CMPS.Q), Field Trip (FTRP.T), Novamind (NM.C) who already have an established ground game, and the funds necessary to scale their operations in the near future might be more valuable than we are giving them credit for.

Full disclosure: Cybin is an Equity Guru marketing client.