Cybin (CYBN.NE) announced that their wholly-owned subsidiary, Adelia Therapeutics, has achieved certain earn-out milestones for the period commencing January 1, 2021.

The terms of the milestone earnings were agreed upon back on December 14, 2020, when Cybin acquired Adelia. Cybin is sending Adelia shareholders $457,537.54 in Class B shares, which can be exchanged for 10 CYBN shares each. However, exchanges cannot take place until the one year anniversary of the deal in December, and even then, only 1/3 of shares can be exchanged before the second anniversary, with the next 1/3 being exchangeable after the third anniversary, before all shares can be exchanged by the fourth anniversary.

Cybin is sending Adelia shareholders $457,537.54 in Class B shares, which can be exchanged for 10 CYBN shares each.

Adelia is an innovative biopharmaceutical company committed to addressing unmet mental health needs through developing proprietary psychedelic therapeutics with improved dosing efficacy and therapeutic indices. When Cybin acquired them, they brought in a range of technologies related to novel therapeutics, delivery methods, and therapeutic regimens, as well as six patent applications and an operating development facility in the epicenter of the Boston biotechnology center.

This milestone was met because Adelia achieved positive pre-clinical results, which determined that their proprietary deuteration modifications (which can lower rates of metabolism and lengthen the half-life of a chemical) in multiple lead new chemical entity candidates did not alter pharmacodynamic properties and did not alter safety as assessed in in-vitro toxicity tests as compared to non-deuterated analogs.

Adelia achieved positive pre-clinical results, which determined that their proprietary deuteration modifications in multiple lead new chemical entity candidates did not alter pharmacodynamic properties and did not alter safety as assessed in in-vitro toxicity tests as compared to non-deuterated analogs.

Being able to make these kinds of changes to compounds without affecting their pharmacodynamic properties is a big part of Cybin’s business model, as their psychedelic molecules perform similar to naturally occurring psychedelic compounds, but by synthesizing their psychedelics, they have more control of its pharmacokinetic profile.

Through multiple pre-clinical studies, Adelia has observed s consistent positive results in various proprietary deuterated psychedelic tryptamine molecules when compared to the parent molecule.

The studies showed similar potency at the targeted serotonin 2 receptors and monoamine transporters, which are responsible for the reuptake of their associated amine neurotransmitters, such as serotonin, dopamine, or norepinephrine (which is related to adrenaline). They also demonstrated analogous binding to off-targets and no difference in an in-vivo assay of serotonin 2 receptor activation. In-vitro research tested the toxicity associated with the drugs on other tissues or cells, including kidney and liver cell viability, proarrhythmia core panel, Ames fluctuation test, bacterial cytotoxicity, a micronucleus panel, and cell viability.

“These positive catalysts continue to provide the necessary data required to demonstrate that Cybin’s proprietary deuterated psychedelic molecules potentially carry the same pharmacodynamic properties, safety profiles, potency and receptor targeting as their parent molecules. While the profiles are similar to parent molecules, early research has shown that these proprietary molecules also carry certain characteristics that may lead them to potentially become commercially viable because of their improved stability, bioavailability, controlled psychedelic duration and overall enhanced chemical make-up,” said Doug Drysdale, Cybin’s CEO.

According to the acquisition deal between Cybin and Adelia, Adelia can earn up to $9,388,045.50 worth of Class B shares from milestone achievements.

In other Cybin news, the company released financial and business highlights for its financial year ended March 31, 2021.

On March 31, 2021, Cybin had $64,026,000 in cash and cash equivalents. Like most biotech companies in the development stage, they ran a net loss, which totaled $32,220,000, of which non-cash expenses were $13,100,000 and cash-based operating expenses totaled $19,120,000.

On March 31, 2021, Cybin had $64,026,000 in cash and cash equivalents.

Cybin also took the opportunity to draw attention to some of their most notable recent business highlights, including multiple partnerships they have entered into, such as their partnership with Kernel, Catalent, Covance and the University of Washington.

On top of their new partnerships, they also noted that Cybin has raised ~$90 million since 2019 through private and public financings.

“It has been an incredibly busy and successful year for the Cybin team, expanding both our product development capabilities and our drug development programs,” stated Drysdale. “The enormous progress that we have made serves to strengthen the foundation of our organization, upon which we plan to build further in the coming 12 months as we continue our clinical research activities. I want to thank the entire Cybin team, our Board of Directors and our investors for supporting the important work we are doing to revolutionize the future of mental healthcare.”

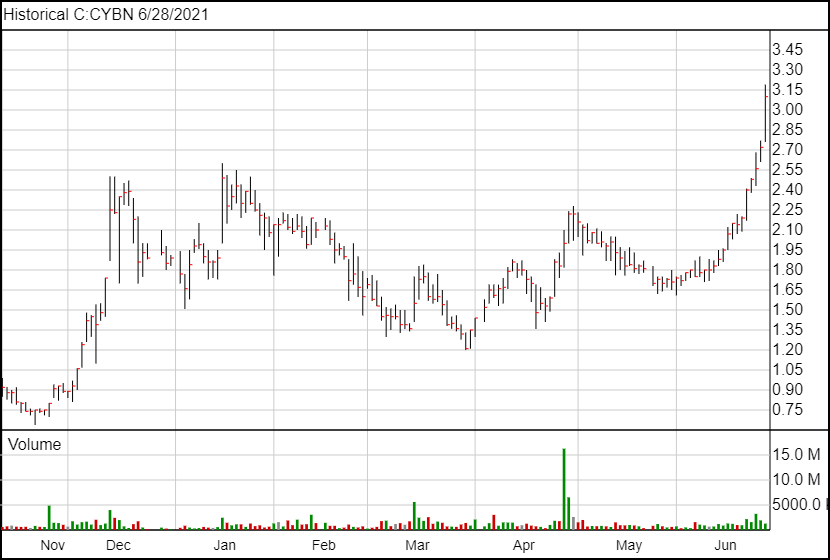

Following today’s news, Cybin shares are up 38 cents and are currently trading at $3.10. The 38 cent jump represents a 14% increase of Cybin’s share price.

Full disclosure: Cybin is an Equity Guru marketing client.