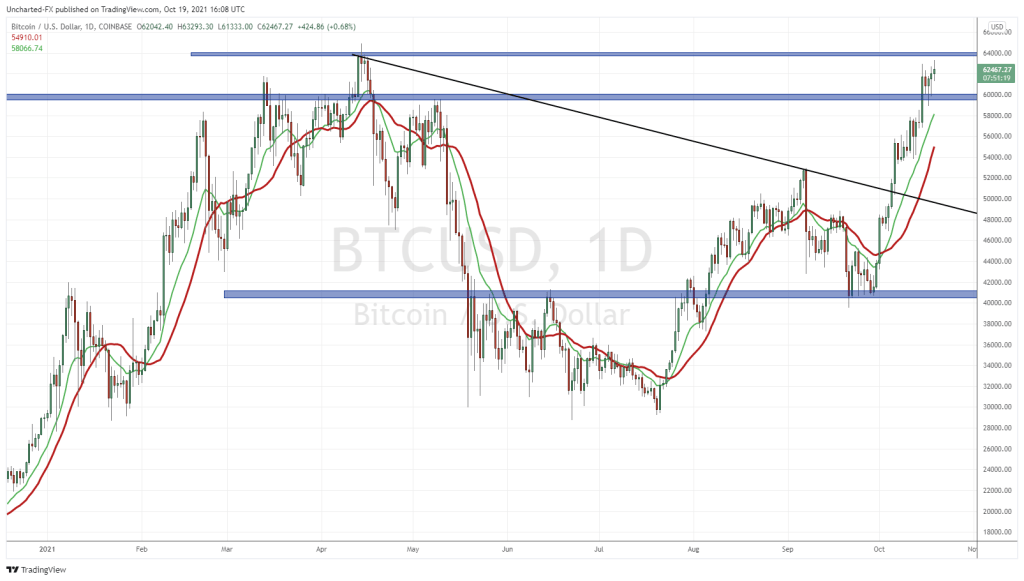

Ever since the IPO of Coinbase (COIN), the stock has become the proxy to play the crypto market. If Bitcoin dumps, Coinbase will dump. Bitcoin had a wild trading day yesterday. At one point, Bitcoin was below our $30,000 support zone. However, the daily candle did not close below the big support level. Instead, the price of Bitcoin was bid up over 30k and the crypto is now trading close to 34k. Nice recovery.

The price action on Bitcoin was covered in yesterday’s Market Moment. You can read that here. Our key was the daily candle close. Which did NOT close below our major support. The death cross remains in play, and probably will weigh in on the minds of the new retail crowd.

I just mentioned that Coinbase will be a proxy for Bitcoin. What do I mean by that? It provides a cleaner way for institutions to play crypto’s, other than buying the individual coins and tokens themselves. When Coinbase IPO’d, I called it a watershed moment for the cryptocurrency market. In that Market Moment article, I explained that institutional money could now buy Coinbase rather than stocks such as Tesla, Microstrategy, Riot Blockchain, Square, and the Grayscale Bitcoin Trust. All of which have Bitcoin on their balance sheets. Coinbase just offers a broader exposure, and a better correlation to the crypto market.

As long as crypto’s remain popular with the retail crowd for years to come, Coinbase will see growth and transactions (81% of its transaction fees come from the retail crowd, and 5% from institutions). The things which can hamper this is a crypto winter (or a crypto bear market), or if the retail crowd begins to leave crypto’s and head back to the stock market. With short squeezes in stocks such as AMC and CLOV just to name a few, this could be the case, especially as Bitcoin ranges. Watch the Russell 2000, or the US Small Cap Index, to determine whether the retail crowd is coming back.

But if institutions are involved, you have to put yourselves in their shoes. If Coinbase is the best play for crypto’s, do you add now as a way to play Bitcoin and crypto strength for the future? Do you believe in Bitcoin and cryptocurrency for the long term?

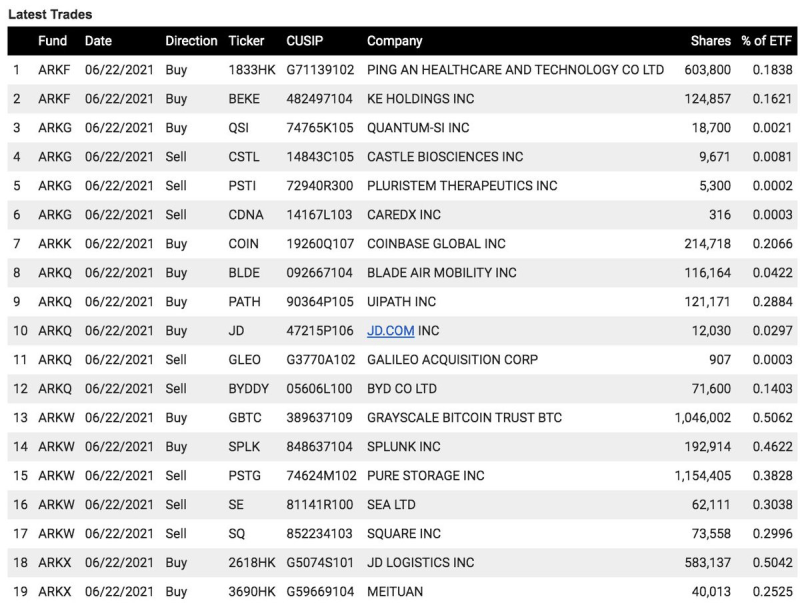

People like Cathie Wood think so. She recently picked up 214,718 shares of Coinbase, pushing the total holdings to 4.7 million shares. That’s a $1 Billion position.

Cathie Wood also doubled down on her cryptocurrency bet by purchasing more shares of the Grayscale Bitcoin Trust. 1 million shares to be exact. ARK now holds 8.5 million shares of the trust, and making it the ETF (ARKW) with the largest holding of GBTC.

Technical Tactics

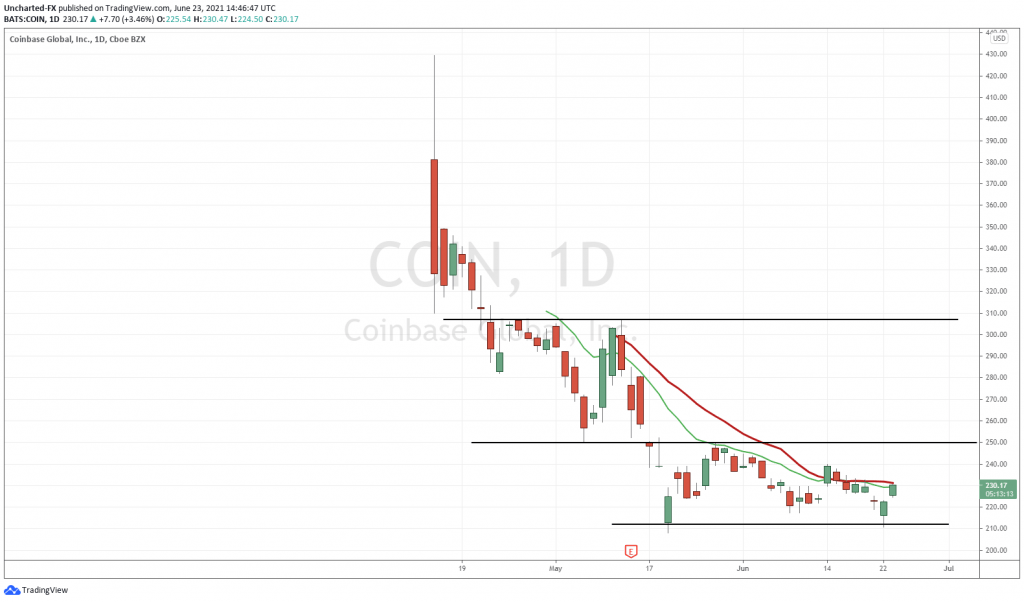

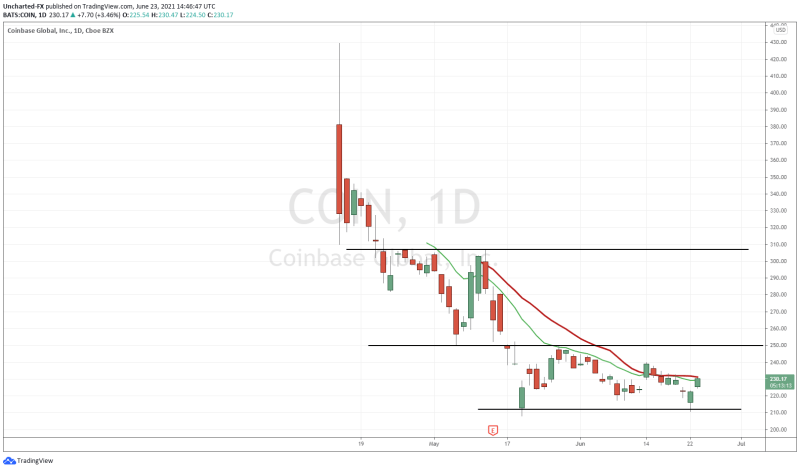

Coinbase is now nearly down 35% from its top. It looked like $250 was going to be a support, but that did not hold. We created new record lows at $208. This price zone was retested yesterday, and acted as support (a price floor).

Because Coinbase is a recent stock that has IPO’d, we do not have much price action to work with. It has been a few months since COIN began trading, but we have some levels we can now work with.

Right off the bat, the $208-$210 zone becomes support. We held on yesterday’s retest. Some might even say a double bottom pattern is forming here. One of the quintessential reversal patterns. However, for this reversal to trigger, we need a break and close above the resistance above at $250. If not, the downtrend is still in play, and you can see this with your naked eyes with no need to draw a downtrend sloping trendline.

Of course what Bitcoin does next will impact Coinbase. Personally, I want to see BTC break above $40,500 before I begin to entertain the idea of an uptrend. If it does not, we can still range or perhaps break below $30,000 on another retest. If this happens, Coinbase will make new record lows.

If we do get the break above $250, then the $300 zone would be our target, as it provides resistance. Remember: I am approaching this through the lens of trading, particularly swing trading. For trading, we want to align as many confluences as possible to increase our probability for success. Someone who is approaching Coinbase as an investment has a much longer time horizon. Investors are likely adding shares to their position here, and will continue to add even if new lows are created.