Over the past seven months, we’ve seen a dramatic shift in sentiment in the uranium arena. The market now has an appetite for high-quality companies along all stages of the food chain—production, resource delineation-development, and exploration.

Sprott Asset Management’s move to take over Uranium Participation Corporation (UPC.T), the world’s largest publicly traded buyer of physical U308, is a powerful signal that it’s Game On for uranium.

Sprott Acquires Physical Uranium Fund as Uranium Bear Market Ends

With Developers, Producers, and physical holding companies already on a buying binge, this move by Sprott is bound to firm-up an increasingly tight market.

Why uranium? It’s all about the clean/green, renewable energy advantages this energy-dense metal—symbol U and atomic number 92—can offer a planet where breathable air is becoming an increasingly rare commodity.

The current supply-demand dynamics underpinning uranium are compelling. Global demand for electricity is set to grow 76% by 2030.

There are currently 444 reactors in operation. As I type this piece, 52 reactors are under construction, an additional 400-plus are on the drawing board.

The world is going to need a lot more uranium to keep up with this increasing demand. Industry experts and analysts are pointing to a looming supply shortfall.

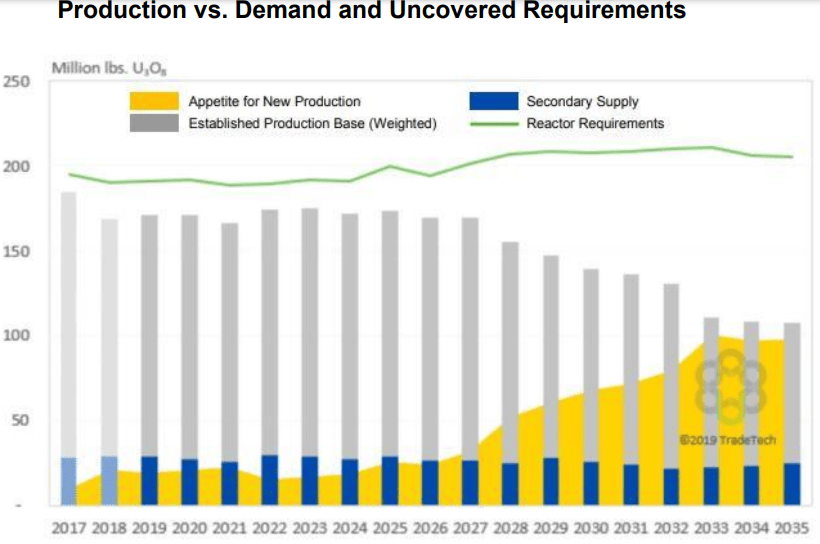

A couple of important stats pulled from Skyharbour’s pitch deck (slide #10)…

- 2016 mine supply of approx 163 million lbs; fell

to approx 154 million lbs in 2017 and to approx

120 million lbs with pandemic supply disruptions; - UxC estimates annual deficit forming over next

decade of approx 100 million lbs; - Uncovered demand rises rapidly over the coming

years increasing to approx 40% of demand in 2025

and 65% of demand in 2030; - Utilities will have to return to the market and

enter into long-term contracts; return to

normalized pricing.

In addition to providing base-load, CO2 emissions-free, low-cost energy, nuclear provides unmatched electricity generation in terms of Megawatts per square kilometer.

In addition to providing base-load, CO2 emissions-free, low-cost energy, nuclear provides unmatched electricity generation in terms of Megawatts per square kilometer.

Concerning uranium as an investment, the food chain is similar to that of every other sector in the mining arena—you have your mining behemoths, like Cameco (CCO.T), all the way down to your micro-cap grassroots exploreco hoping to tag a significant new discovery. As a potential investor in this arena, it’s important to know that uranium is gaining increasing acceptance as a desireable ESG (Environmental, Social, and Governance) investment.

Skyharbour Resources (SYH.V)

If you’re looking for exposure to uranium via a high-risk/high-reward vehicle, cash-rich Skyharbour represents a compelling option, one with significant high-grade discovery potential, as well as good leverage to firmer U3O8 prices and the positive sentiment sweeping across the sector.

Skyharbour’s project pipeline is located in Saskatchewan. Two points regarding this Canadian province:

1) Saskatchewan is ranked #3 according to the Fraser Institute’s Annual Survey of Mining Companies (Saskatchewan climbed eight spots from 11th in 2019 to 3rd in 2020).

This annual survey offers one of the better shortcuts to getting a handle on the ‘Investment Attractiveness’ of a region. It also serves as a “report card” to governments regarding the efficacy and sanity of their mining policies.

According to Elmira Aliakbari, director of the Institute’s Centre for Natural Resource Studies…

“The Fraser Institute’s mining survey is the most comprehensive report on government policies that either attract or discourage mining investors.”

Why all the fuss about jurisdictions? A project’s zip code is an essential consideration when shortlisting investment candidates.

A twitchy landlord, one without a clear and fair set of values where mining interests are concerned, can wreak all kinds of havoc on a company’s trek along the exploration, development, and permitting curve.

A territory without an established and trusted track record of permitting mines to production may all-of-a-sudden pull a Fast. Out-of-the-blue it might decide to revise its mining codes. It might lead your company down the garden path—allowing millions to be poured into the project—and then suddenly raise taxes during the final phase of development. Some might try bullying their way in for a (larger) piece of the action or even expropriate the project outright… it’s been known to happen. Venezuela comes to mind.

Moving along…

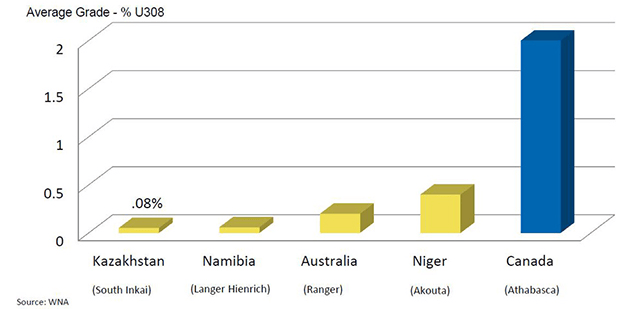

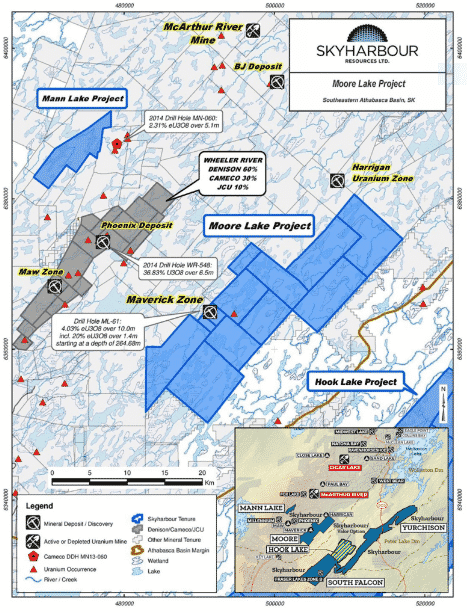

2) Regarding the region Skyharbour is operating in—the Athabasca Basin (“the Basin” from hereon)—the Basin is to uranium what the Carlin Trend is to gold.

The Basin, a 100,000 square kilometer setting straddling the Saskatchewan-Alberta border, is an ancient sedimentary basin hosting the world’s largest and highest-grade uranium mines and deposits.

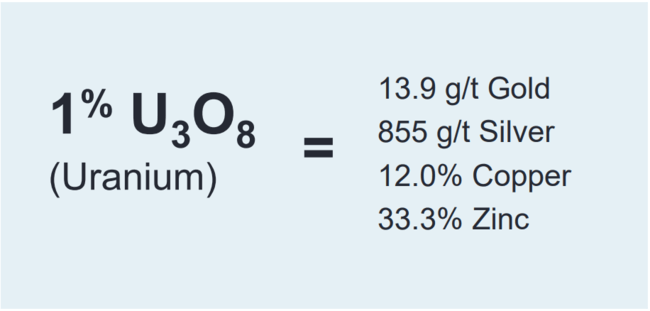

Grade is king—you hear that phrase a lot in the junior exploration arena. This next chart demonstrates comparative values most investors fail to appreciate where (uranium) grades are concerned…

And when it comes to high-grade rock, the Basin clearly stands out…

Mining operations in the Basin include the world-class McArthur River and Cigar Lake mines, as well as the Key Lake and McClean Lake mills.

According to the Alberta Energy Regulator…

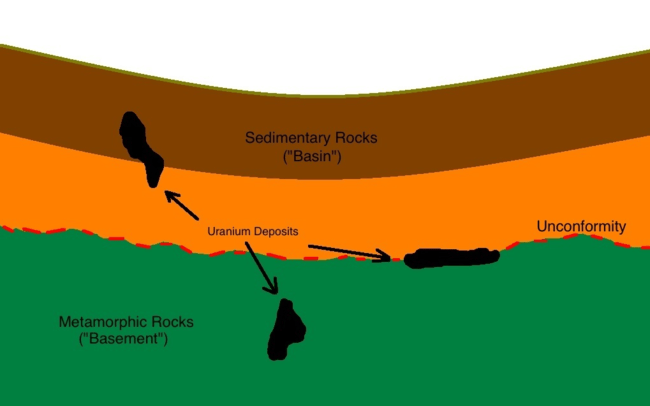

“Athabasca-type, unconformity-related uranium deposits are unique in size and grade compared to similar deposits elsewhere. These deposits have uranium oxide pods, veins, and disseminations at or close to the unconformity at the base of the Athabasca Group.

The flat-lying Athabasca strata are mainly fluvial, pervasively altered, red to pale-tan quartz conglomerate, sandstone, siltstone, and mudstone and are about 1.7 to 1.8 billion years old. The underlying crystalline basement is made of reworked Archean and Early Proterozoic crust. The mines in the eastern part of the basin in Saskatchewan contain the richest uranium deposits in the world. The potential exists for similar unconformity-associated uranium deposits in the western part of the Athabasca Basin.”

These unconformity-type deposits occur in sedimentary basins on top of ancient metamorphic basement rocks. Groundwater acts to concentrate and deposit the mineralization.

The deposits in the Basin are spatially related to the unconformities that separate the basement rocks from the clastic sedimentary rocks.

Skyharbour has a distinct advantage over the majority of junior exploration companies operating in the Basin.

Vectoring in on a potential uranium deposit is no easy task. Uranium deposits are often needles in a haystack, even in a prolific setting like the Basin.

It can take dozens, sometimes hundreds of holes to home-in on a new discovery. McArthur River, a Basin standout, ultimately required 210 pokes with the drill bit to tag.

Skyharbour’s advantage is that it’s testing ground that has already demonstrated significant (high-grade) resource and discovery potential—zones with known mineralization offering increased odds of success with the drill bit.

According to the Company’s website, Skyharbour is “well-positioned to benefit from improving uranium market fundamentals with six drill-ready projects.”

The Company’s wholly-owned flagship property—the Moore Lake Uranium Project—boasts the following highlights (verbatim as per the Company’s project page)…

- Skyharbour has acquired a 100% interest in the 35,705 hectare (88,191 acres) Moore Uranium Project from Denison Mines, a mature uranium exploration property in the eastern Athabasca Basin near existing infrastructure with known high grade uranium mineralization and significant discovery potential;

- Denison Mines (TSX: DML) (NYSE MKT: DNN) is a large, strategic shareholder of Skyharbour and David Cates, President and CEO on Denison, is on Skyharbour’s Board of Directors;

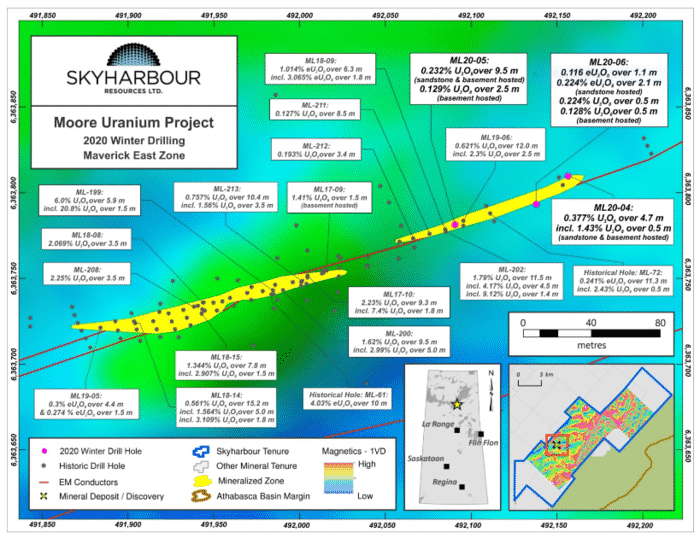

- Moore hosts high grade uranium mineralization at the Main Maverick Zone, which was discovered by JNR Resources in the early 2000’s; historical drill results include 4.03% eU3O8 over 10m, including 20% eU3O8 over 1.4m at a depth of 265m in hole ML-61;

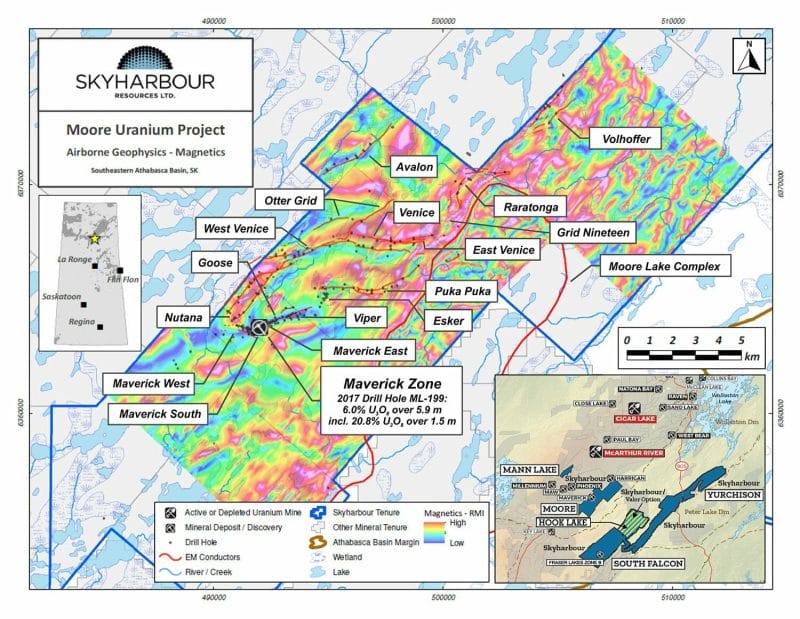

- Skyharbour has carried out diamond drill programs over the last few years with several drill holes intersecting high grade uranium mineralization along the 4.7 kilometre long Maverick structural corridor;

- Drill intercepts of high grade, shallow uranium include 20.8% U3O8 over 1.5m at 264m, 9.12% U3O8 over 1.4m at 278m and 5.29% over 2.5m U3O8 at 279m;

- Skyharbour’s drill hole ML-199 tested the Main Maverick Zone lens and intersected high grade uranium mineralization containing 6.0% U3O8 over 5.9m at 265 metres depth including 20.8% U3O8 over 1.5m;

- Hole ML-202 from the Maverick East Zone intersected high grade uranium of 1.79% U3O8 over 11.5m at 270m including 4.17% U3O8 over 4.5m and 9.12% U3O8 over 1.4m;

- This is a newly discovered high grade mineralized lens at Maverick East on the Maverick corridor 100 metres from the Main Maverick Zone, and illustrates the strong discovery potential of additional high grade lenses along strike.

More recently…

- Skyharbour has identified and refined new targets in the underlying basement rocks using modern exploration and methodologies;

- Drill hole ML19-06 intersected a broad zone of uranium mineralization from 273.0 metres to 285.0 metres downhole within the growing Maverick East Zone. The interval returned 0.62% U3O8 over 12.0 metres with a basal high grade basement-hosted intercept returning 2.5 metres of 2.31% U3O8;

- A drill program in the Fall of 2020 tested both unconformity and basement targets along the high grade Maverick structural corridor;

- Drill hole ML20-09 which returned 0.72% U3O8 over 17.5 metres from 271.5 metres to 289.0 metres, including 1.00% U3O8 over 10.0 metres hosted in the basement, represents the longest continuous drill intercept of uranium mineralization discovered to date at the project.

The Company believes they’ve barely scratched the surface at East Maverick and are intent on testing that hypothesis.

Robust assay-related newsflow on deck

Skyharbour is on the verge of a robust newsflow cycle as an aggressive drill campaign—one of the largest undertaken by the Company—is currently underway.

Skyharbours timing couldn’t be better. The market now has an appetite for new U3O8 discoveries. Positive results will undoubtedly generate positive trajectory on the price chart, especially in a top-shelf jurisdiction like the Basin.

A May 10th headline:

This drill campaign will follow up on existing unconformity and basement-hosted targets along the high-grade Maverick structural corridor where 2.2 kilometers of prospective ground remains to be tested with the drill bit.

After recently completing a 9 kilometer ‘Small Moving Loop EM’ (SML-EM) program of geophysics, the Company has additional high priority targets in its crosshairs outside of the main Maverick corridor.

The Maverick East target:

Probing the down-plunge extension of the new high-grade East Maverick zone—the 17.5 meter hit grading .72% (inc 10 meters of 1%)—will be a priority in this (minimum) 7-hole 3,500-meter diamond drilling campaign.

“The high grade Maverick East Zone has been identified over a minimum of 170 metres strike length. It is currently a minimum of 10 metres wide, open down dip and is up to 17.9 metres thick with grades of up to 9.12% U3O8 (with a minimum grade of 0.1% U3O8).”

Maverick Structural Corridor – Northeast Extension and Esker Targets:

As noted above, the 2.2 kilometers of virgin ground along the northeast Maverick Structural Corridor will receive a proper probe with the drill bit during this campaign.

“A large portion of this trend has been tested by a series of broadly spaced drill holes and fences with significant untested gaps. Virtually all the holes exhibited extensive sandstone and basement alteration and geochemical enrichment similar to that within the Main Maverick and Maverick East Zones. As well, narrow intercepts of uranium mineralization have been found in numerous locations along this portion of the Maverick corridor. Many of these mineralized intercepts occur at the unconformity, but in a few key areas significant strongly altered basement structures within prospective graphitic and metasedimentary units are the host for this mineralization, with only limited drilling of the basement rocks at depth.”

The Esker target—approx 4.7 kilometers length—is located at the northeast end of the conductive corridor. Just over half of Esker has been systematically explored, but there hasn’t been much in the way of follow-up work. Esker will receive a few probes with the drill bit during this campaign to follow up on positive (historic) drill results.

There’s a lot of potential along strike and at depth along these underlying basement rocks.

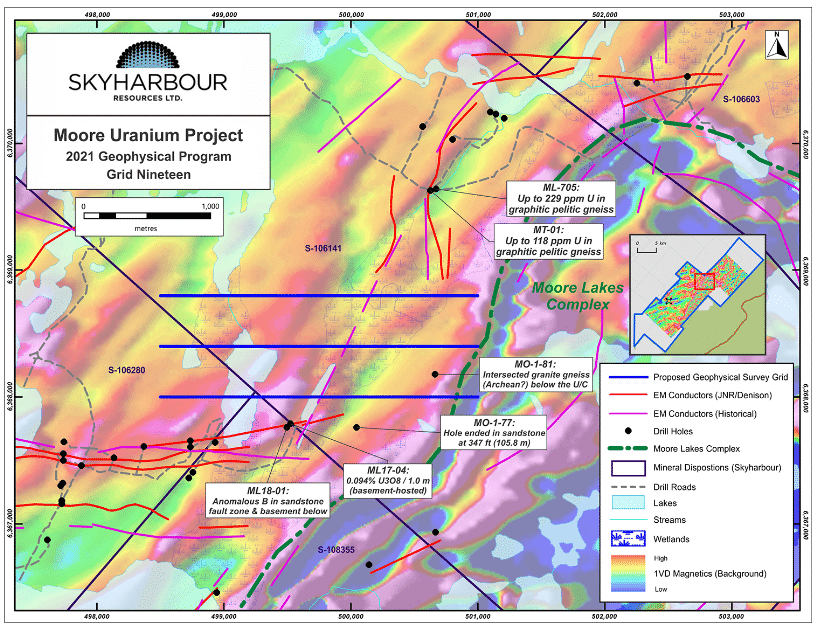

Grid 19 – a new target:

Grid 19 is located on a separate conductive corridor from the main Maverick corridor.

A limited number of historical drill holes tagged uranium mineralization, but there was no follow-up.

Grid 19 was the focus of the geophysical campaign highlighted in the May 10th headline. Several high-priority targets were generated and will be drill tested this summer.

“The preliminary results from the ground geophysical survey further refined the historical airborne conductors in the Grid Nineteen area and confirmed the extension of the Raratonga conductive system to the south. The survey further defined the abrupt change in the strike of the conductive systems at the southern end of the Grid Nineteen area, from an almost north-south orientation of the Raratonga conductors to the east-west orientation of the East Venice conductors. Weak basement-hosted mineralization was intersected in hole ML17-04 (1.0 m of 0.094% U3O8 at 235.0 metres depth) just to the west of this strike change, along with strong structural disruption and local pathfinder element enrichment in the sandstone of both ML17-04 and follow-up hole ML18-01. The intersection of these conductive systems forms one of several newly developed targets in the Grid Nineteen area.”

Jordan Trimble, President and CEO:

“With the geophysical results now in hand and final drill targets picked, we are excited to embark on another aggressive drill program at Moore. We have been very pleased with the results to date at the Maverick East Zone and believe we have just scratched the surface in our endeavour to delineate high grade zones of mineralization at depth in the underlying basement rocks. The uranium mineralization identified during previous drill programs illustrates the strong discovery potential at Moore and recent geophysical programs and geological modeling have enabled the Company to develop new regional drill targets in areas such as Grid Nineteen. Skyharbour is well funded with over CAD $9 million in cash and stock to continue advancing its flagship Moore Project. The uranium market has shown notable signs of recovery with increasing equity valuations and improving sentiment, and this recovery appears to be accelerating.”

The Joint ventured projects – Multiple irons in the fire = multiple shots at a major discovery

Skyharbour is perhaps best characterized as an Athabasca Basin land baron. It holds a number of large, strategic land positions in the Basin outside of the Moore Lake project area.

For these projects, in order to push them further along the exploration and development curve, management deploys the prospect generator business model with strategic partners who fund exploration and make cash and share payments to Skyharbour in return for a majority stake.

A small sample of this project pipeline:

Preston Uranium Project

Preston is a JV with industry-leader and strategic partner Orano Resources Canada where Skyharbour maintains a 24.5% stake.

Strategically located near Fission Uranium’s (FCU.T) Triple R deposit and NexGen Energy’s (NXE.T) Arrow deposit, this 49,635-hectare project represents one of the largest land positions in the highly prospective Patterson Lake area.

The project boasts numerous drill-ready targets offering strong discovery potential.

A recent headline…

East Preston Uranium Project

Located on the west side of the Basin, East Preston is a JV with Azincourt Uranium (AAZ.V) who launched a drill campaign back in late February, a program that was cut short by unseasonably warm weather that compromised access into the project area.

East Preston’s 20,647 hectares are also strategically located near Fission’s Triple R deposit and NexGen’s Arrow deposit.

A very recent headline emanating from the East Preston camp…

Azincourt Energy Drilling Returns Elevated Uranium at the East Preston Uranium Project

South Falcon Point Uranium Project

Skyharbour maintains a 100% interest in South Falcon Point’s 44,470 hectares. The project is located 55 kilometers east of the Key Lake mine.

South Falcon is the 2nd most advanced project in Skyharbour’s portfolio based on money spent and its current stage of development.

In March of 2015, Skyharbour released an updated resource estimate for the Fraser Lakes (Zone B) deposit at the south end of the property:

- 6,960,681 pounds U3O8 at average grade of 0.03% U3O8 Inferred

- 5,339,219 pounds ThO2 at average grade of 0.023% ThO2 Inferred

- All within 10,354,926 tonnes (cutoff grade of 0.01% U3O8)

The Company notes that the character of South Falcon’s mineralization changes at depth, with increasing grades, illustrating strong discovery potential going forward.

Important to note: if South Falcon is not JV’d out to another company, Skyharbour will drill the project on its own—a 2,000-meter campaign is envisioned.

Hook Lake Uranium Project

Hook Lake is a deal recently inked with Australian-registered Pitchblende Energy Pty Ltd and Valor Resources (VAL.AX).

The Dec. 9, 2020 headline…

“Valor will contribute cash and exploration expenditures consideration totaling CAD $3,975,000 over a three-year period ($475,000 will be in cash payments to Skyharbour as well as $3,500,000 in exploration expenditures)

Valor has issued a total of 233,333,333 shares to Skyharbour.”

Interestingly, the north end of the property recently yielded high-grade uranium grab samples of up to 68% U3O8 in a massive pitchblende vein at surface. Previous operators of the project were unable to definitively explain and locate the source.

Once again, the above projects represent only a small sample of what this Athabasca Basin land baron carries in its project pipeline—all are strategically located, all hold significant discovery potential in their subsurface layers.

In speaking with CEO Trimble recently, I learned that Skyharbour is in talks with interested parties concerning one or more of these projects—a development that could offer positive price catalysts going forward. Again, multiple irons in the fire = multiple shots at a discovery.

Management

The Skyharbour crew is stacked with talent. If you peruse slides 4 thru 6 on the Company’s pitch deck, you’ll see what I mean. Note the depth of geological and capital markets experience.

This team also boasts multiple past exits where significant shareholder value was created. This is something I look for when poring over resumes as it demonstrates an alignment of values (between management and shareholders).

In a recent Guru offering—Rockridge Resources (ROCK.V) offers re-rating potential, district-scale (VMS) exploration upside – Knife Lake assays are pending—I opined… management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and competent capital market types—things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises.

Skyharbour has the technical side and the capital markets side covered.

Final thoughts

The Company has applied good science to the foundation underpinning this aggressive Moore Lake drilling campaign.

Results should begin to flow in mid-July.

With over C$9 million in cash and equity holdings in its coffers—approx $6.5M in cash and $2.5 in stock—this 3,500-meter campaign is fully funded. If the Company likes what it sees coming out of the ground—if the onsite geos like the core—the program will be accelerated without hesitation. A late summer/fall program would extend newsflow right on through to the end of 2021.

All told, the Company is looking to drill roughly 10,000 meters on its own dime this year—8,000 meters at Moore Lake and 2,000 meters at South Falcon Point (in the event they don’t ink a deal before now and November).

Regarding OPM: Expect multiple drill programs over the next seven to eight months as Skyharbour’s JV partners further advance additional properties in the project portfolio.

As noted further up the page, the Company isn’t probing untested ground here. They’re probing areas with known mineralization. This offers increased odds of drill hole success, which increases the odds of defining meaningful U3O8 resources. And in this buoyant market, significant Basin-based-pounds-in-the-ground will stand out.

There could be an endgame here—a fat takeover offer via a resource-hungry predator (producer/developer).

An additional potential catalyst for the Company going forward is a maiden Moore Lake resource estimate, expected later this year or early next.

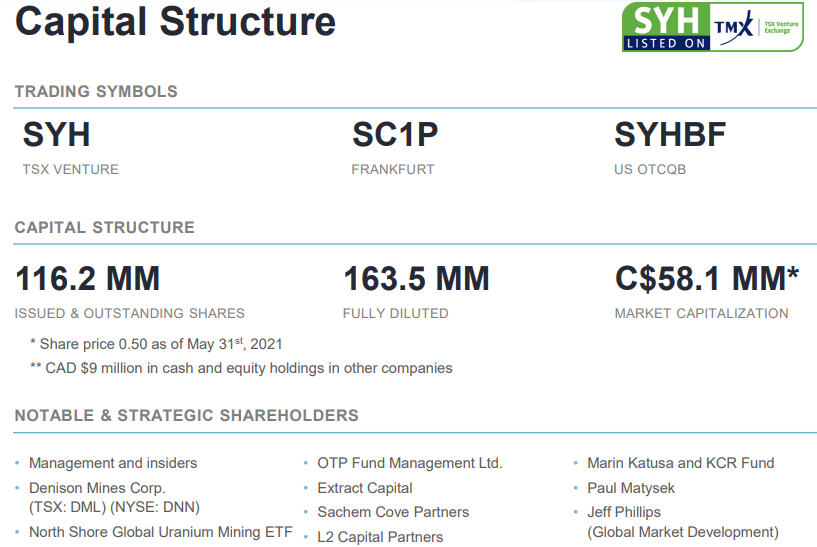

A quick look under the hood (slide #7 from the Company pitch deck)…

In a world that is growing increasingly desperate to clean up its act, nuclear will play a key role. It might be fair to state that there can be no green revolution—no global decarbonization—without nuclear energy.

With multiple high-grade U3O8 targets in its crosshairs, Skyharbour strikes me as a compelling speculation.

END

—Greg Nolan

Full disclosure: Skyharbour Resources is an Equity Guru marketing client.