On May 27, 2021 Gold Mountain Mining (GMTN.V) announced an updated Preliminary Economic Analysis (PEA) of the Elk Gold Project, located 57 kilometers from Merritt in South Central British Columbia.

“If you are looking for exposure to the precious metal and can appreciate the risk/reward dynamics of the junior exploration arena, Gold Mountain is a compelling speculation—a near-term production scenario boasting a (growing) high-grade resource and significant exploration upside,” wrote Equity Guru’s Greg Nolan on May 14, 2021.

A PEA answers the question, “How best can this deposit be exploited to maximize its profits for investors?”

Unlike more advanced studies, a PEA can use inferred resources for its operational and financial modeling.

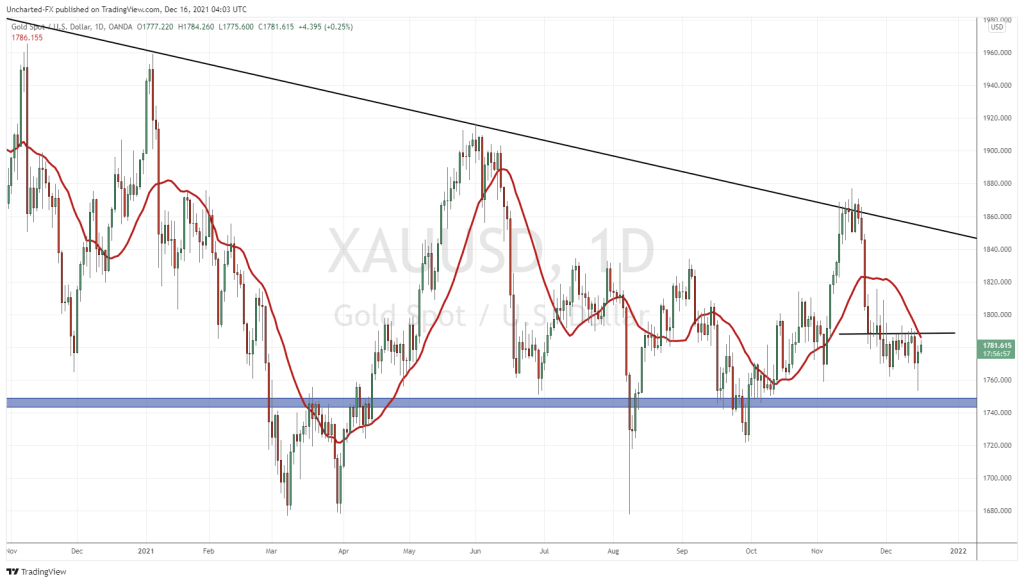

A positive PEA will typically create an upward re-valuation of the company, unless the spot price of the targeted mineral is falling – which isn’t happening now, and is unlikely in the near future given rising inflation and exploding global debt.

The updated PEA assumes a conservative long term gold price of USD $1,600 – about $300/ounce lower than it is today.

GMTN’s update comes on the heels of three recent developments:

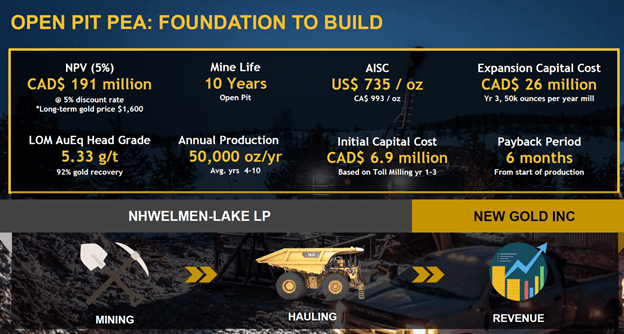

January 19, 2021 – Mining Contract with Nhwelmen-Lake LP

January 26, 2021 – Ore Purchase Agreement with New Gold

May 14, 2021 – Increased Mineral Resource Estimate.

Highlights:

- Updated PEA with an After-tax NPV5% of C$231M

- 19,000oz annual production (Years 1-3) expanding to 65,000oz annual production (Years 4-11)

- Increased cost certainty over September 2020 PEA through executed:

- Construction and Mining Contract with Nhwelmen-Lake LP

- Ore Purchase Agreement with New Gold Inc.

- Revised mine plan eliminates construction of an onsite mill and incorporates underground mining

Elk Gold Project PEA Summary

The PEA contemplates an initial 19,000 ounce per year mine that ramps up to 65,000 ounces of annual production by Year 4.

The pre and post-tax NPV (5% discount) are $395M and $231M, respectively.

The mineralized material will be mined by GMTN’s mining partner, Nwhelmen-Lake then delivered to New Gold’s New Afton Mine located approximately 130km from the Elk Gold Project..

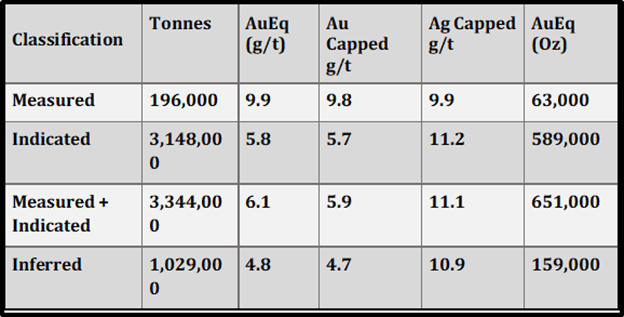

Elk Gold Resource Update – Summary

On May 14, 2021 the Company announced the following updated resource estimate at the Elk Gold Project:

Elk Gold Project Preliminary Economic Assessment`

The PEA envisages a conventional open pit mining operation for the life of mine with underground mining commissioned in Year 4.

The first three years of operation are planned at 200 tonnes/day.

Starting in Year 4 of the mine plan, the mine expands to a 900 tonnes/day operation.

Here is a 77-second video summarizing GMTN’s updated PEA:

“Since completing our PEA in August, a lot has happened on the project,” stated Kevin Smith, GMTN CEO and Director, “We’ve increased the resource to over 810,000 ounces. In light of all the recent progress on the project, we wanted to update our PEA which resulted in a 20% bump in our economics”.

“This PEA increased our NPV to over $230 million and achieved an all in sustaining cost of less than $560 an ounce,” confirmed Grant Carlson, GMTN COO, “By incorporating underground mining in this PEA, we were able to eliminate 50 million tons of waste rock mining which reduces our strip ratio or environmental footprint and also our operating costs.”

Existing Infrastructure

The Elk Gold Project is a past-producing mine with much of the required surface infrastructure still in place that is required to re-start operations.

The site is serviced by the all-season, four-lane Highway 97C connecting Kelowna and Merritt. An existing forest service road provides access to proposed open pits.

Surface water management infrastructure around the proposed open pit is already in place including collection ditches and sumps.

The stockpile pad where material will be placed prior to being shipped off-site for processing is in place, as well as the sample preparation plant which is required for sampling material from the mine for assay.

A laydown area is already in place for mobile equipment maintenance, fuel storage and office facilities.

Read the full May 27, 2021 PR for details on Pit Optimization, Open Pit Mine Design and Pit Phasing, Underground Stope Design, Rock Storage Facility Design, Mine Schedule and Mine Development Schedule

Year 1

- Two months of site preparation

- New water settling pond below the Rock Storage

- Stripping organic material, topsoil, and till from the initial footprint of the RSF and open pit Phase 1

- Mobilizing the initial fleet of mobile equipment, modular office facilities, and explosives storage.

- Mining production, including 70,000 tonnes of mineralized material shipped to the New Afton Mine

Years 2 and 3

- Mine and transport 70,000 tpa of mineralized material to the New Afton Mine.

- Initiate an Environmental Assessment process required for mine expansion

- Apply for a mine permit amendment for the expanded mining rate.

- Existing underground decline will be rehabilitated and extended in preparation for underground mining activities.

Years 4 to 10

Note: The increase in production in Year 4 assumes all permits are in hand

- Upon receipt of an Environmental Assessment Certificate, the mining rate will increase deliveries to the New Afton Mine to 324,000 tpa.

- The open pit mining rate will increase to an average rate of 150,000 tonnes of mineralized material per year.

- Underground mining activities will begin on the 1300 vein system to supplement the open pit plant feed, followed by the 2500, 2600 and 2800 veins later in the mine life.

- The combined open pit and underground plant feed will total 324,000 tonnes per year sold to the New Afton Mine.

Year 11

Initiation of major reclamation activities. The mine will prepare ahead of time for the ultimate reclamation and closure of the facility.

Year 12

Major mine site reclamation activities will be completed.

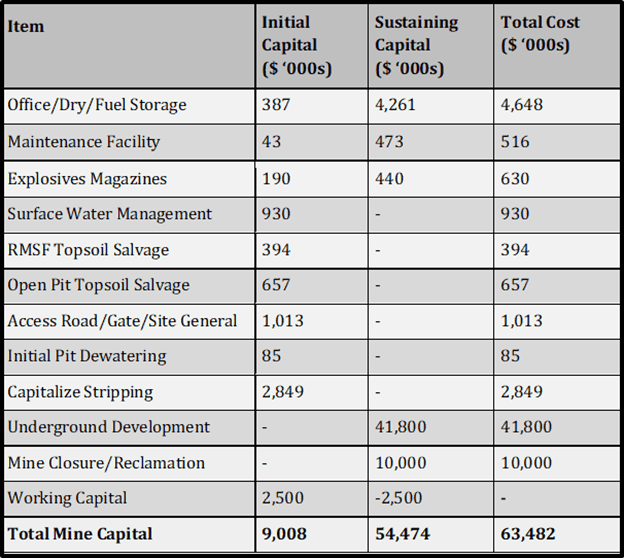

The May 27, 2021 PR also contains details about Open Pit Mine Operating Costs, Underground Mine Operating Costs, Highway Haulage Costs, Mineral Process Operating Costs, General and Administrative Costs, Mine Capital Costs.

The mine capital costs for initial operations (Year 1) and the sustaining capital are included in the table below.

“Unlike a lot of mining explorers, that take a decade-plus of drilling and photo taking and rock kicking and sampling and golfing to get to a place where they have a whole area mapped out and can start thinking about gold production,” wrote Equity Guru’s Chris Parry on May 6, 2021, “Gold Mountain is just going in”.

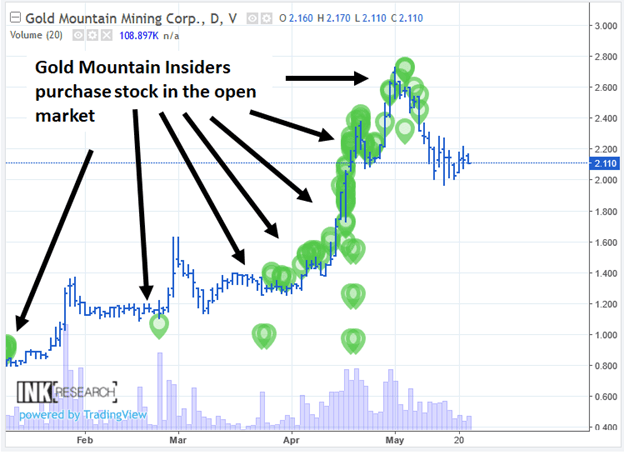

According to data on Canadian Insider, GMTN insiders have been buying stock during the recent sustained share-price appreciation.

The updated PEA does not contemplate construction of a processing facility on site at any stage of the mine life given that it will be delivering all mineralized material to New Gold’s New Afton Mine pursuant to the terms of the Ore Purchase Agreement.

The pre and post-tax NPV (5% discount) are $395M and $231M, respectively.

These figures are based on long term USD $1,600 gold price.

Tyler Winklevoss says, “gold is to #bitcoin like the horse and buggy is to the automobile.”

“I’ve been in numerous meetings with enthusiasts for cryptocurrency,” reported Nobel Prize-winning economist Paul Krugman, “In such meetings I and others always ask, as politely as we can: ‘What problem does this technology solve?’ I still haven’t heard a clear answer”.

Some pundits predict the gold price is headed for $5,000-$10,000.

At the current gold price of $1,900, Gold Mountain’s pre-tax NPV rises to $519 million.

If gold rises to $2,100, the pre-tax NPV is projected to be $600 million.

GMTN has a current market cap of $129 million.

The updated PEA will be filed on the Gold Mountain’s website by July 2, 2021.

–Lukas Kane

Full Disclosure: Gold Mountain is an Equity Guru marketing client, and we own stock in the company.