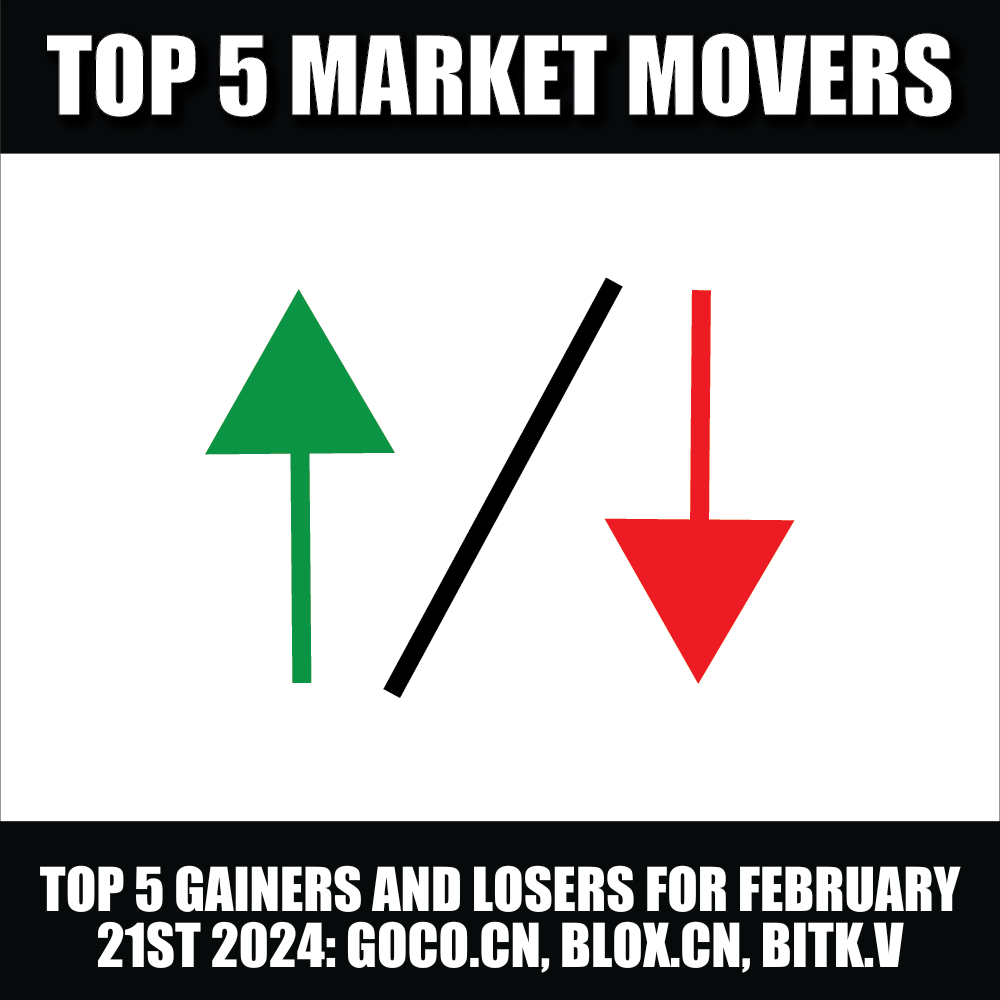

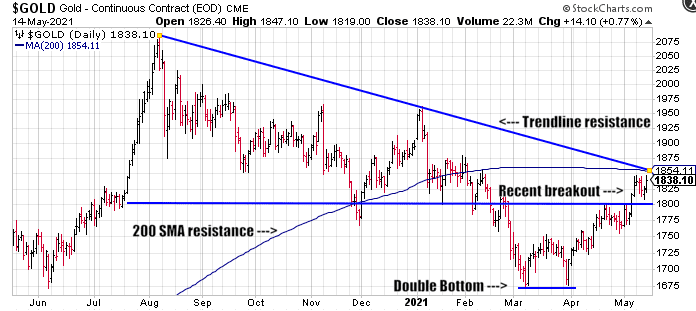

After crossing the $1800 line in recent sessions, Gold’s next hurdle is the $1850 level, and then $1854 (ish), where the 200 SMA and a downtrend line currently reside. This makes for an interesting confluence of resistance…

We took a detailed look at the ‘Gold Friendly’ inflationary pressures building under the precious metal in a recent Guru offering titled Gold Mountain (GMTN.V) updates Elk Gold Project resource estimate near mining-friendly Merritt B.C.

We took a detailed look at the ‘Gold Friendly’ inflationary pressures building under the precious metal in a recent Guru offering titled Gold Mountain (GMTN.V) updates Elk Gold Project resource estimate near mining-friendly Merritt B.C.

This past Wednesday (May 12th), the U.S. Labor Department reported Consumer Prices rising 4.2% over the 12 months ending in April, its most dramatic increase in 13 years.

On Thursday (May 13th), U.S. Producer Prices rose 6.2% for the year, the largest increase on record.

Inflation is on a tear. The Fed suspects these price pressures are transitory—we stand to watch.

Quoting yours truly from a recent Guru offering…

It would appear that the Fed is in the mother of all binds here. It can’t pull the trigger on higher rates (its only real defense against raging inflation). To do so would kill whatever momentum the U.S. economy can muster.

Rising inflation and low interest rates almost guarantee real rates will remain deep in negative territory for the foreseeable future.

It would appear that no matter what the Fed does, it’ll be behind the (inflation) curve.

Gold is a no-brainer in this environment.

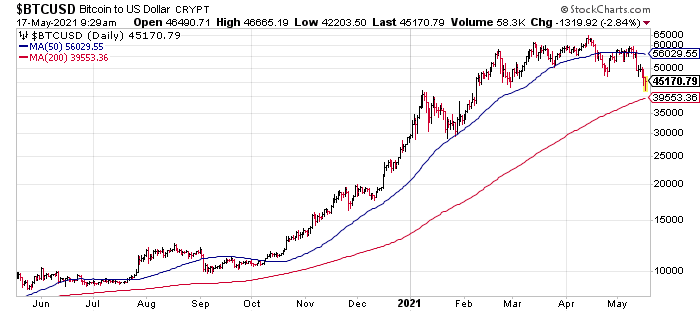

Looking at Bitcoin and the broad weakness across the crypto space…

… if this move spells exhaustion and develops into a serious rout, Gold could reclaim its role as the ultimate safe-haven asset—we stand to watch.

… if this move spells exhaustion and develops into a serious rout, Gold could reclaim its role as the ultimate safe-haven asset—we stand to watch.

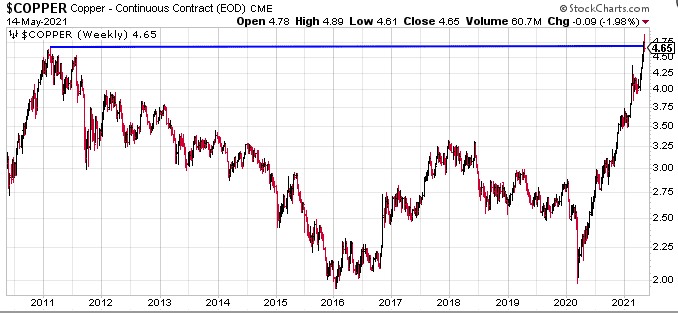

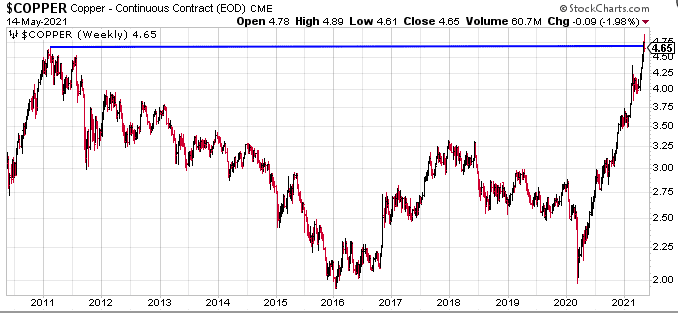

Looking at copper—if you believe we’re in a structural bull market that will rage on indefinitely as the global economy accelerates its push to electrify—its recent price action, taking out all-time historic highs, should have come as no surprise.

There will be no global decarbonization without this malleable, red-orange metal—a malleable, red-orange metal with superior thermal and electrical conductivity properties.

There will be no global decarbonization without this malleable, red-orange metal—a malleable, red-orange metal with superior thermal and electrical conductivity properties.

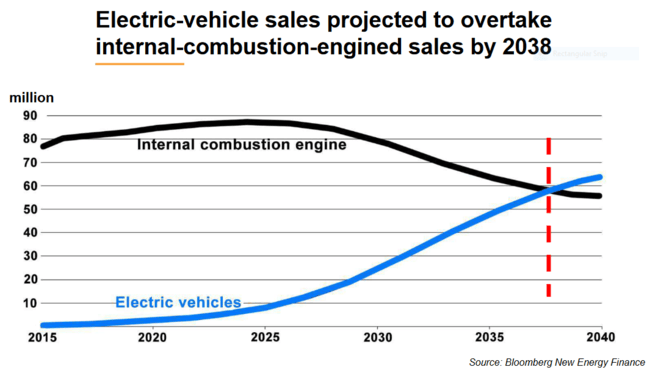

Electric vehicles (EVs) require roughly 183 lbs of Cu (electric buses need between 500 and 800 lbs).

Even the charging stations that keep these vehicles in motion require copper—heaps of it:

EV sector will need 250% more copper by 2030 just for charging stations

The pace at which EVs are rolling off the assembly line is best characterized visually…

More examples of the role copper will play in a greener, electrified world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW).

- Wind turbines will require 3.6 tonnes per MW.

- Solar panels will require 4 to 5 tonnes per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years (global warming n all):

- 52 lbs of Cu will go into each cool air unit.

- 8 billion cool air units are expected to be in use worldwide by 2050.

- China, India, and Indonesia will account for roughly half of this global increase in electric power demand.

19% of today’s energy is electricity. Over the next 30 years, that number will rise to 50%.

Looking at supply, my research a few months back unveiled the following stats:

- The lion’s share of the world’s primary Cu supply comes from only 20 mines.

- The world has less than 20 years’ worth of (economic) copper reserves remaining.

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare).

- Future copper projects – the 19 largest development projects on deck – run grades averaging roughly 0.5%.

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average.

- The Cu sector is suffering from years of underinvestment – massive sums will be required to bring these lower-grade deposits online.

Where could Cu prices ultimately peak over the next decade? Some respected analysts see $15 per pound by the latter part of this decade.

Got Cu?

Rounding up some of the Gold-Copper ExploreCo’s on our list

Delta Resources (DLTA.V)

- 36.62 million shares outstanding

- $13.92M market cap based on its recent $0.38 close

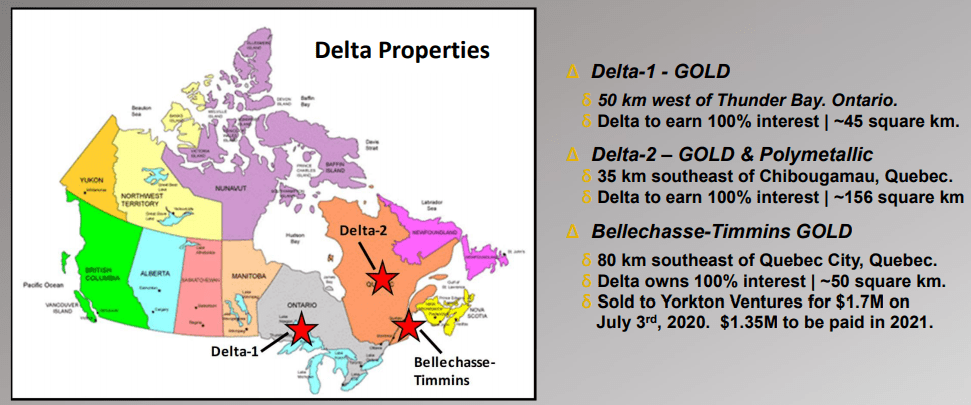

We’ve been following developments at Delta closely since they began reporting high gold grain counts at Delta-1 and an acceleration in activity at Delta-2.

We’ve been following developments at Delta closely since they began reporting high gold grain counts at Delta-1 and an acceleration in activity at Delta-2.

Delta checks all of my boxes: jurisdiction, geological setting(s), high-grade prospects, cap structure, valuation, management, cash in the coffers, newsflow…

I suspect current prices represent an attractive entry point for those seeking exposure to gold (and base metals) and can tolerate the underlying risk/reward dynamics of the junior arena (I’m biased—do your own due diligence).

A May 13th headline – Delta Announces Option Agreement to Acquire the Dollier Property from Cartier Resources to Add to Its VMS Property Package in Chibougamau, Quebec

Here, the Company announced having optioned the Dollier Property in Chibougamau, Quebec from Cartier Resources (ECR.V). Dollier is immediately adjacent to the Company’s Delta-2 VMS ground that will see multiple probes with the drill bit in the coming weeks.

The price of admission looks like a good deal for Delta.

Delta shall have the sole and exclusive right to earn a 100% Interest (the “Option”) by paying Cartier a non-refundable amount of $10,000 in cash (the “Cash Payment”) at signing; by completing the issuance in favour of Cartier of an aggregate of 600,000 Delta shares including 100,000 shares at signing, 100,000 shares at the one year anniversary, 200,000 shares at the two year anniversary and 200,000 shares at three year anniversary; and by incurring $1,000,000 in exploration expenditures over the four year Option period.

Upon earning a 100% interest in the Dollier Property, Cartier will be granted a 2% NSR production royalty. Delta will have the exclusive right to purchase the first 1% NSR for $2,000,000 and the second 1% NSR for $15,000,000.

The 2,228-hectare Dollier property is host to the Delinel Gold-Pyrite VMS prospect where best results include 25.1 g/t gold over 1.0 meter, 13.3 g/t gold over 1.2 meters, and 11.9 g/t gold over 1.0 meter.

André Tessier, President and CEO:

“As we plan our next phase of exploration drilling to test our highly prospective VMS drill targets, it was imperative that we consolidate the property package in Chibougamau, Quebec. We look forward to beginning the drill campaign on a number of our high priority VMS targets in the coming weeks.”

Tying up additional ground in the region is a solid move as VMS deposits, as you may already know, are unique. They occur in clusters. Where there’s one, there are often others.

Though sometimes modest in scale, these polymetallic deposits can hold huge concentrations of metals due to their rich nature.

The Company’s 12,650 hectare Delta-2 project is largely unexplored and as you can see via the following map, management has a great many targets in its crosshairs…

Just out of view along the project’s upper north boundary is the past-producing Lemoine Mine. This mine goes down as one of the richest mines in Canadian history (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag).

Lemoine is likely NOT a one-off. Surrounded by vast stretches of unexplored terrain, it’s possible that an entire VMS camp remains to be discovered in D-2’s subsurface stratum.

As per this May 13th press release, the Company neatly summarizes its two main assets accordingly…

DELTA-1, 45 km2 located 50km west of Thunder Bay, Ontario where an extremely high gold-in-till anomaly and kilometre-scale gold-bearing alteration halo point to a never-tested regional structure.

DELTA-2 GOLD and DELTA-2 VMS, 170 km2 in the prolific Chibougamau District of Quebec, with a potential for hydrothermal-gold and gold-rich VMS deposits.

It’s a toss-up as to which project deserves flagship status—both are unique and highly prospective for their discovery potential.

We’re currently waiting on drill results from both Delta-1 and Delta-2 (Delta-2 also has a hydrothermal-gold component)—see my April 24th piece titled Delta (DLTA.V) tags 27.93 g/t over 3.3 meters (including 106 g/t over 0.8 meters) at Delta-2 Project in mining-friendly Quebec

Newsflow should be steady over the balance of 2021. We stand to watch (a recurring theme, apparently).

Freeport Resources (FRI.V)

- 75.59 million shares outstanding

- $13.23M market cap based on its recent $0.175 close

Freeport is a company we first covered late last year in a piece titled Freeport (FRI.V) targets porphyry-style gold and copper along the prolific PNG Orogenic Belt, Papua New Guinea

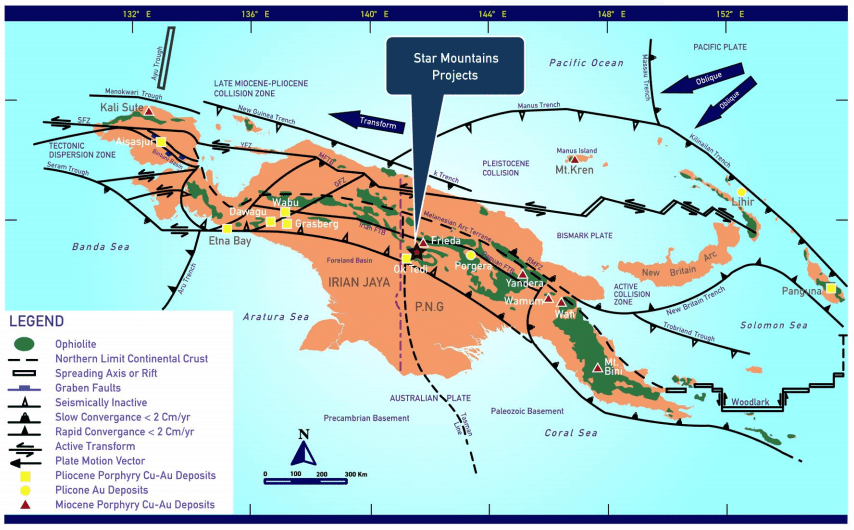

Freeport management has set its sights on a potentially massive copper/gold porphyry target(s)—the 501 square kilometer Star Mountains Project—in one of the final frontiers for mineral exploration, Papua New Guinea.

PNG is host to some of the world’s largest gold and copper deposits—Grasberg, Porgera, Frieda River, Ok Tedi, Ramu, Lihir… just to name a few.

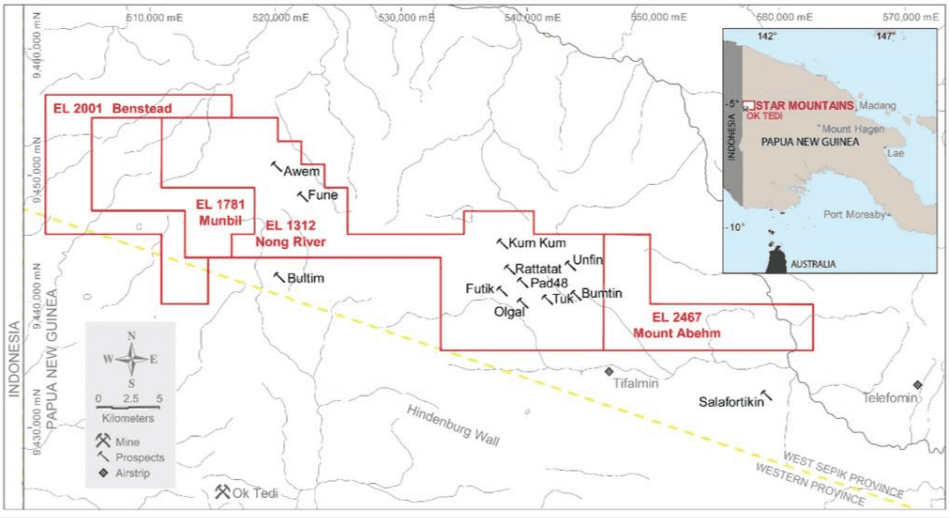

Star Mountains is located in the highly prospective PNG Orogenic Belt, only 25 kilometers from the world-class Ok Tedi Mine, and in the same geological arc as Grasberg, Frieda River, Porgera & Ramu.

More than $50 million has been spent on the project since the first discovery hole back in the early 1970s.

To date, five prospects have been tested with the drill bit. All delivered significant intervals of mineralization, but the Olgal Target is the standout having generated some truly outstanding values:

• 596 meters @ 0.61% Cu & 0.85 g/t Au from 24 meters downhole (Hole 14, 2012);

• 435 meters @ 0.52% Cu & 0.72 g/t Au from 76 meters downhole, including 100 meters @ 0.82% Cu & 1.39 g/t Au (Hole 17, 2016)

• 183 meters @ 0.53% Cu & 0.58 g/t Au from 168 meters downhole (Hole 19, 2016)

• 430 meters @ 0.39% Cu & 0.24 g/t Au from 168 meters downhole (Hole 20, 2016)

Success from these past drilling campaigns helped lay the foundation for a 43-101 compliant (Inferred) resource.

Using a 0.3% copper cut-off, Olgal contains 210 million tonnes grading 0.4% copper and 0.4 g/t gold. This works out to 2.9 million ounces of contained gold and 1.9 billion pounds (840,000 tonnes) of contained copper.

The last time we checked in with Freeport, copper was trading in the $3.20 per lb range. Today we’re trading closer to $5.00 per lb (this decade-plus copper chart is worth another peek).

This dramatically higher metal price warrants entertaining a lower cutoff grade, to let’s say… 0.2%.

At a 0.20 Cu-cutoff, Olgal’s Inferred tonnage would rise to ~450 million tonnes—the corresponding grades would run roughly 0.32% Cu and 0.31g/t Au, still respectable for a porphyry of this scale. This works out to 4.5 million ounces of gold and 1.2 million tonnes of copper.

This higher-copper-price regime could have game-changing economic consequences for the Star Mountains project.

A May 3rd headline – Freeport Resources Announces Star Mountains AI Evaluation and K-means Analysis Results Produced by Minerva Intelligence

Here, the Company shared results from an evaluation of its flagship project via data collected by Minerva Intelligence (MVAI.V), an artificial intelligence company focused on “knowledge engineering.”

Previously announced on November 23, 2020, Minerva utilized DRIVER, its cutting-edge AI software, to perform an evaluation of multi-element drilling data. In addition, Minerva reinterpreted existing geophysical information on the project and completed traditional K-Means Cluster analysis on the multi-element data.

Freeport engaged Minerva to apply its cognitive AI-powered DRIVER technology to sub-surface geochemical data available for the Star Mountains project to enhance its next phases of surface and sub-surface evaluation of the extensive property, located 25 kilometres from the Ok Tedi mine in Papua New Guinea.

The DRIVER and K-Means Cluster technology was aimed at the Olgal deposit area using geochemical analyses from the 23 drill holes (8,949 meters) that served as the foundation for the current Inferred resource base.

Evaluation identified multiple mineralized subgroups of dioritic rocks and skarn as potentially significant for copper, as well as a significant overlap of copper and gold-bearing volumes. These sub-groups are located at the core of the deposit area and well distributed from near surface to the basal thrust fault at depth. Two mineralized dioritic sub-groups for gold were identified.

Nathan Chutas, the Company’s Sr. VP of Operations, highlighted some key points/outcomes of Minerva’s work via a recent exchange of emails:

The K-Means Cluster and DRIVER data indicate strong resource expansion potential as well as the possibility of higher-grade zones within the porphyry envelope.

“Their examination of the geophysical magnetics data identified a previously unknown geophysical target that may represent porphyry mineralization below the thrust fault at the Olgal prospect that appears to be at a similar depth as the Olgal resource.”

Their review of the magnetics data suggests that previous drilling along the other prospects on the property—Futik, Ratatat, Pad48, and Tuk—may have tagged (only) the margins of the porphyry target.

Minerva’s work also indicates that Olgal’s mineralization may extend further to the northwest, toward the Futik prospect (map below).

The regional potential at Star Mountains appears wide open. Additional geochem, geophysics, and drilling could unearth additional discoveries across this vast, largely unexplored property.

Significant conclusions, with a little more technical detail (verbatim as stated in the May 3rd press release):

- Based on K-Means Cluster, DRIVER and 3D inversion results, potential to expand both grade and volume of copper ± gold porphyry-style mineralization is interpreted to exist at the core of the Olgal Deposit area, extending to the northwest. Infill drilling is recommended.

- Extending drill holes 003OLG10 and 004OLG10 below the basal thrust fault is expected to return mineralized intercepts associated with an anomaly identified through 3D inversion of magnetic data, based on magnetic susceptibility results.

- Mapped exposures of epidote alteration, marble, skarn, and diorite, supported by trends interpreted from the results of both K-Means Cluster and DRIVER analysis and a large sub-surface volume delineated by magnetic inversion, are interpreted to indicate strong potential for identification of additional porphyry-style mineralization extending from the Olgal Deposit northwest to Futik and beyond.

- Limited drilling at Futik, Ratatat, Pad 48 and Tuk is interpreted to have tested the margins of their respective target anomalies, particularly those defined by 3D inversion of magnetic data, with holes either collared too far laterally and/or not drilled deep enough. Further evaluation is strongly recommended.

Gord Friesen, Freeport CEO:

“We found Minerva’s analysis and the DRIVER system to be very useful to our understanding of the project. DRIVER validated our geologists’ interpretation of the deposit zonation and gave indication of mineral potential beyond known resources on our properties and confirmed it in a fraction of the time. The synthesis of independent methodologies was a valuable contribution to the project and gave us confidence about the results.”

Hit hard by the C-19 pandemic, the government of PNG restricted access to its borders preventing the Company from putting boots to the ground.

The Company’s exploration license (tenement EL 1312) was originally granted on Sep 20th, 2002. This license-to-explore has been successfully renewed eight times since then and the 9th renewal application is currently under review.

There’s no reason to expect problems here, but until that permit is in hand, there’ll be a modicum of uncertainty—Freeport’s share price could remain stuck in its current (narrow) trading range.

I view this license renewal outcome/event as a potential catalyst for the stock.

With the permit in hand, and once the travel restrictions are lifted, the Company’s common shares could see a significant re-rating.

With a substantial Inferred resource base (4.5 million ounces of Au and 1.2 million tonnes of Cu at a 0.2% Cu cutoff) and historic intercepts like 596 meters @ 0.61% Cu & 0.85 g/t Au, Freeport strikes me as a compelling speculation. But bring on that exploration license.

Nomad Royalty (NSR.T)

- 566.39M shares outstanding

- $611.7M market cap based on its recent $1.08 close

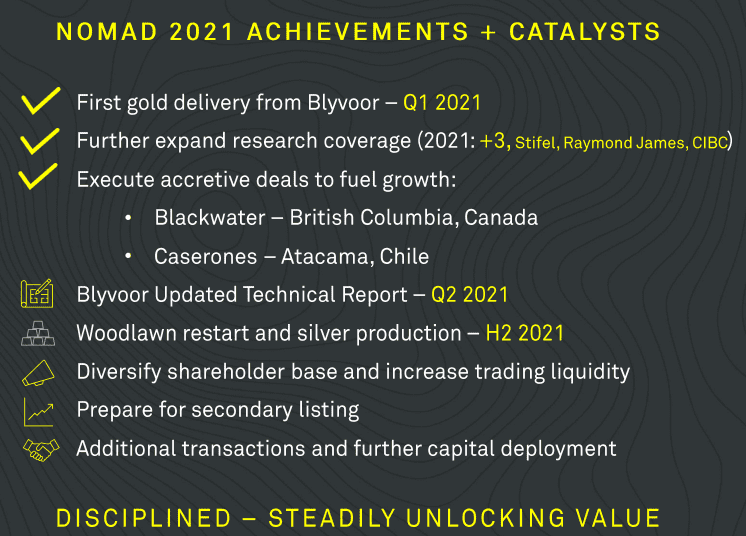

Since its debut on the TSX just under a year ago, Nomad management has been executing on multiple fronts.

The following slide from the Company’s pitch deck keeps score.

From the get, the Company set out to ink high-quality deals, adding to an already robust project portfolio of producing and advanced-stage assets. Yet the market is still not rewarding management’s successes.

From the get, the Company set out to ink high-quality deals, adding to an already robust project portfolio of producing and advanced-stage assets. Yet the market is still not rewarding management’s successes.

That’ll change, I suspect.

Price targets for Nomad common, always a moving target (especially when the metals are on the move), average $1.82 from the nine research firms polled.

A May 10th headline – Nomad Royalty Company Reports Q1 Results and Declares Second Quarter 2021 Dividend

Vincent Metcalfe, Nomad’s CEO:

“Our portfolio delivered a strong first quarter of gold and silver production and represents a great start to the year. Our focus ahead is on maintaining this positive momentum by delivering on our stated goal of delivering value through further deployment of capital in new opportunities across the globe, which coupled with the strong organic growth of our current portfolio will allow Nomad to continue to generate strong free cash flow and support further growth and returns to shareholders.”

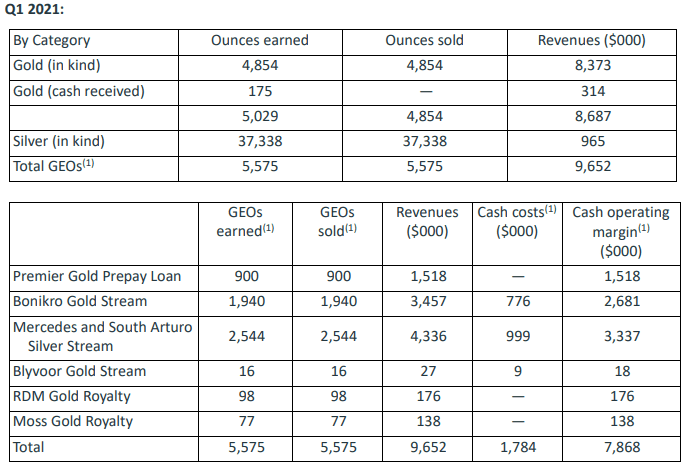

First Quarter Highlights:

- Record quarterly deliveries of 5,575 gold equivalent ounces (“GEOs”);

- Gold ounces earned of 5,029 (2,450 for Q1 2020);

- Silver ounces earned of 37,338 (43,963 for Q1 2020);

- GEOs(1) sold of 5,575 (3,817 for Q1 2020);

- Record revenues of $9.7 million ($6.4 million for Q1 2020);

- Net loss of $0.3 million (net income of $1.1 million for Q1 2020);

- Adjusted net income(1) of $1.9 million ($4.1 million for Q1 2020);

- Gross profit of $2.9 million ($0.7 million for Q1 2020);

- Cash operating margin(1) of $7.9 million ($5.9 million for Q1 2020);

- Cash operating margin(1) of 82% (93% for Q1 2020);

- $25.3 million of cash as at March 31, 2021;

- Completed the acquisition of the second tranche of the Blackwater Gold Royalty;

- Declared a quarterly dividend of CAD $0.005 per common share for a total amount of $2.3 million paid on April 15, 2021.

(1) Refer to the Non-IFRS measures section of this press release.

Results like these are only possible with a project portfolio packed with cash-flowing assets.

Nomad’s current portfolio stands at 15 royalty and streaming assets, EIGHT of which are producing.

Nomad is also pleased to announce a quarterly dividend of CAD $0.005 per common share, payable on July 15, 2021 to Nomad’s shareholders of record as of the close of business on June 30, 2021.

For shareholders residing in the United States, the dividend will be paid in U.S. dollars based on the daily exchange rate published by the Bank of Canada on June 30, 2021. The dividend has been designated by Nomad as an “eligible dividend” under the Income Tax Act (Canada).

For the first quarter of 2021, revenue was sourced 100% from gold and silver. Management’s objective for the portfolio is to maintain a focus on precious metals (primarily gold and silver) with a target of no more than 10% in revenue from other commodities. Geographically, revenue was sourced 64% (94% for Q1 2020) from the Americas, 36% (0% for Q1 2020) from Africa and 0% (6% for Q1 2020) from Australia.

This May 10th earnings report also provided an update on a number of its underlying assets.

MINING OPERATIONS RESUME AT BLYVOOR

Since April 12, 2021, after mining activities were temporarily suspended as the result of an unlawful blockade, Blyvoor has re-commenced operations—production ramp-up activities are back on track. Blyvoor will be fully operational with deliveries expected at regular intervals as the mine ramps up to full production capacity by year-end 2021.

EQUINOX GOLD ACQUIRES MERCEDES MINE

The Company amended its Mercedes and South Arturo stream in connection with the closing of the acquisition of Premier Gold by Equinox Gold, and the spinout of a new entity called i-80 Gold Corp.

The Company entered into a second amended and restated purchase and sale agreement (gold and silver) with certain subsidiaries of Equinox in respect of the Mercedes Mine in Mexico. Earlier in 2021, Premier Gold announced that there is expansion potential to increase production to 80,000 to 90,000 ounces of gold annually at the Mercedes Mine.

Starting April 7, 2021, the new Mercedes Gold and Silver Stream Agreement provides for, in addition to silver deliveries described in the Company’s audited consolidated financial statements, fixed quarterly gold deliveries of 1,000 ounces of refined gold from the Mercedes Mine (subject to upward and downward adjustments in certain circumstances), plus an additional 6.5% of such adjusted amount payable in refined gold. Fixed quarterly gold deliveries shall terminate once an aggregate of 9,000 ounces of gold have been delivered (not including any refined gold received pursuant to the additional 6.5% of the adjusted amount).

Similarly to the previous stream agreement, the Mercedes Gold and Silver Stream Agreement will continue to provide for a 100% silver stream on the Mercedes Mine until 3.75 million ounces (2.73 million ounces as of March 31, 2021) of silver have been delivered to the Company, as well as minimum annual deliveries of 300,000 ounces of silver until 2.1 million ounces (1.5 million ounces as of March 31, 2021) of silver have been delivered to the Company.

I-80 GOLD ACQUIRES SOUTH ARTURO MINE

The Company and i-80 Gold entered into a new streaming agreement that captures 100% of the silver mined from the existing mineralized areas, and 50% of the silver ounces produced from the exploration ground. South Arturo Mine is 40% owned by i-80 Gold—Nevada Gold Mines (a joint venture between Barrick Gold and Newmont Corp) owns the other 60%.

“Regarding the South Arturo Mine operations, NGM had another exceptional year with production exceeding budget by over 30%. The strong performance was driven by higher production rates that averaged 694 tonnes per day processed. On January 19, 2021, i-80 Gold’s predecessor, Premier Gold, published a preliminary feasibility study on South Arturo which outlined an 8-year mine life and was based on a mineral resource estimate as at December 1, 2020 which included Nomad attributable reserves of 1.9 million ounces of silver (3.8Mt at 15.23g/t), measured and indicated resources of 4.0 million ounces of silver (20.0Mt at 6.19g/t) and an inferred mineral resource of 1.8 million ounces of silver (10.1Mt at 5.47g/t). In 2020, drill programs were completed at El Nino, with initial results suggesting the potential to expand underground resources and extend the mine life. A new mineral resource estimate will be completed in 2021 following receipt of all 2020 drilling results.”

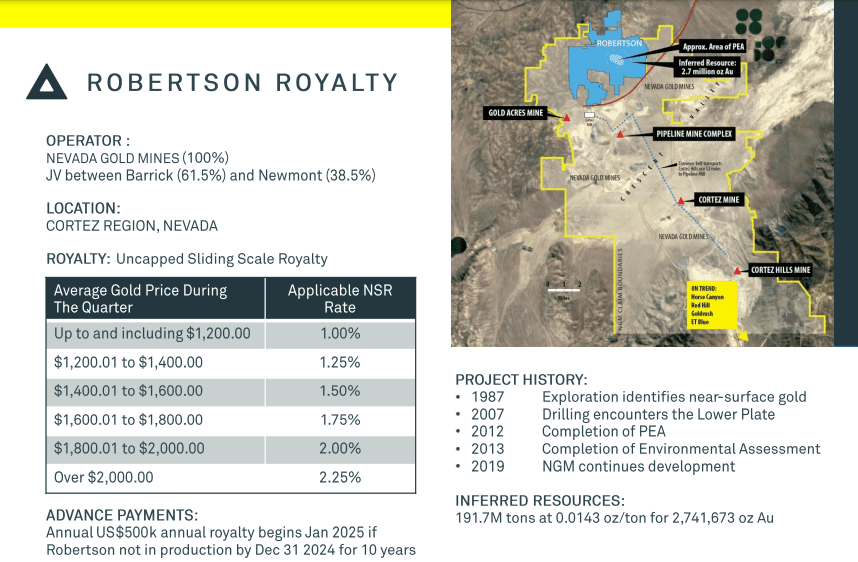

ROBERTSON—considerable near-surface exploration upside potential

Following a strategic review by the talent at Nevada Gold Mines, significant geological prospectivity of the area in and around the Robertson (royalty) asset was highlighted. The area between Pipeline and Robertson, included within the Cortez complex, was mentioned as an area holding exceptional opportunities for major new discoveries.

“On May 5, 2021, Barrick mentioned that, at Robertson, they were converting improved geological knowledge of the area into growth opportunities. Step-out drilling, 300 meters beyond the existing resource blocks suggest there is considerable near-surface upside that could lead to additional discoveries and validate the potential of this area. Barrick are also looking at Pipeline, an old tier 1 asset, immediately adjacent to Robertson which could provide a significant addition to Cortez life of mine. At Robertson, on the western side of the district, drilling results were received from the Distal target, to the west of current resources, testing a structure which is potentially analogous to the controls of mineralization at the Gold Pan/39A zone. These results yielded multiple significant intercepts confirming the nature of the hypothesized mineralization control and an up-dip extension to surface. Follow-up drilling commencing in the second quarter of 2021 will target the extent of the mineralization up-dip and to the north. Metallurgical test work for processing at the Pipeline oxide mill and the heap leach is in progress. Continuing on the western side of the district, sectional interpretation is ongoing between the Carlin-type Pipeline and Crossroads deposits, as well as intrusive related mineralization at Robertson five kilometers to the north. Surface mapping and sampling has identified a favorable structural setting between the Pipeline/Crossroads and Robertson deposits with folds and thrust faulting, as well as high angle faults carrying anomalous gold indicative of leakage from a target at depth. The area has no historic deep drilling and will be tested by framework drilling in the second quarter of 2021.”

A major discovery at depth could push the Robertson sliding scale NSR (currently residing at 2%) to the top of the Nomad’s royalty list.

The above updates represent only four of the ten projects highlighted in this May 10th earnings report. Additional updates covering Woodlawn, Blackwater, Moss, RDM, Suruca, and Troilus, are highlighted in the guts of this press release.

A new royalty — A May 13th headline…

Nomad Royalty Company Acquires Cash Flowing Royalty on the Caserones Mine in Chile

Though management’s focus is primarily on precious metals, they obviously couldn’t ignore the compelling supply/demand dynamics underpinning copper.

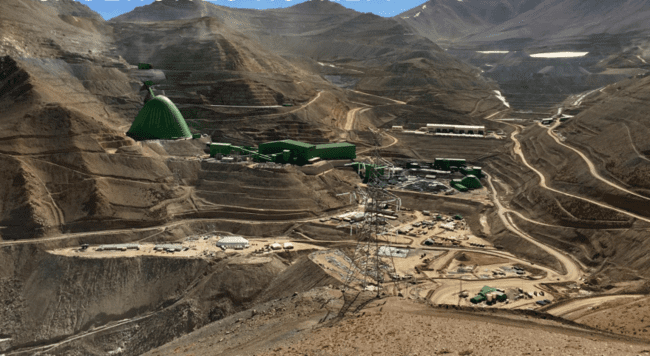

Here, the Company announced an agreement with Appian Capital Chile SpA—a subsidiary of the Appian Natural Resources Funds—to acquire a 0.28% net smelter return royalty on the producing Caserones Mine located in the Atacama region of Chile.

The price of admission: US$23 million in cash plus two million Nomad share purchase warrants.

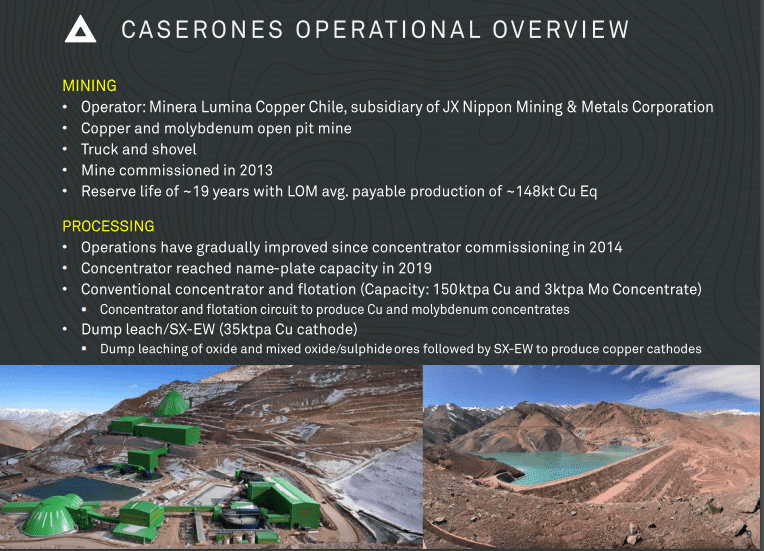

- Acquisition of a royalty on a major mine operated by Minera Lumina Copper Chile, which is indirectly owned by JX Nippon Mining & Metals Corporation;

- Addition of a new revenue stream from Chile, a tier 1 mining jurisdiction, to Nomad’s portfolio;

- New mine with long reserve life and significant exploration potential, located on a large land package of ~17,000 hectares with potential for future expansions;

- Provides Nomad with measured exposure to copper, a key metal in supporting the world’s green transition away from fossil fuels and towards electrification.

The Caserones mine is owned and operated by Minera Lumina Copper Chile (indirectly owned by JX Nippon Mining & Metals Corp). The mine consists of an open pit mining operation, with a plant to produce copper and molybdenum concentrates from primary sulfides, and a solvent extraction and electro winning plant (SX-EW) to produce copper cathodes with oxide ore processing, mixed and secondary sulfides. The mine is located in the Atacama region of Chile and has over 5 years of operational history with a current estimated mine life of 19 years. The mine is located 15 km west of the international border with Argentina and 162 km southeast of the city of Copiapó (the capital of the Atacama region) at an elevation of approximately 4,000m above sea level.

At first glance, a 0.28% NSR may appear modest, but Caserones is a robust producer—a long-life asset with considerable resource expansion and exploration upside.

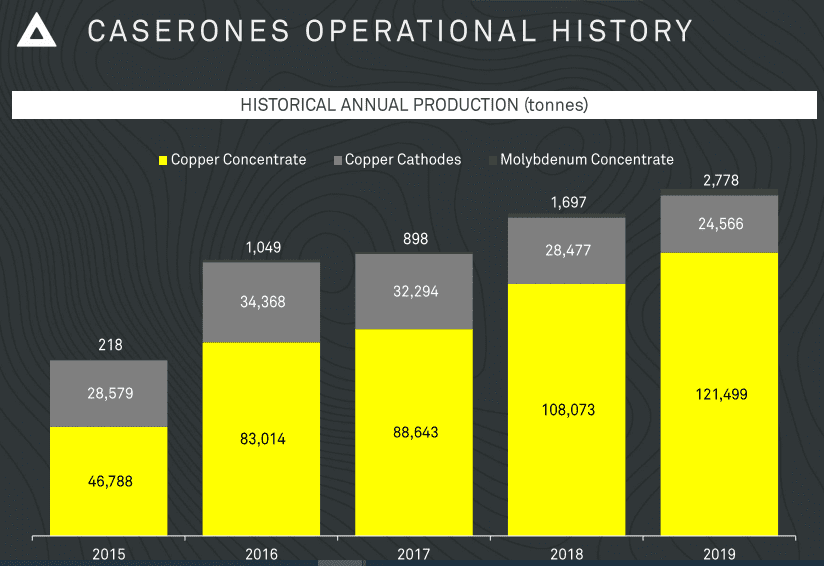

In 2019, Caserones produced 146,000 tonnes of Cu and 2,778 tonnes of Mo.

Expected (life of mine average) annual payable production = ~148,000 tonnes of CuEq.

The setting here is infrastructure-rich—the project has seen a total investment of US$4.2B over the years.

Caserones’ production profile shows a very positive trajectory (production began in 2014)…

Nomad expects to receive its first Caserones royalty cheque this August.

PDF Presentation – Acquisition of Cash Flowing Royalty On The Caserones Mine In Chile

Vincent Metcalfe, Nomad’s CEO:

“The Caserones Royalty provides Nomad with immediate cash flow over a very long mine life from Chile, a tier 1 mining jurisdiction. This transaction highlights Nomad’s unique positioning within the royalty space in terms of its financial capacity to acquire high quality royalties and is consistent with Nomad’s strategy of building a diversified portfolio of high quality cash flowing royalties and streams.”

Joseph de la Plante, Nomad’s Chief Investment Officer:

“We are very pleased to announce this transaction with Appian. The acquisition of the Caserones Royalty provides Nomad with exposure to copper at a time when the demand for green and electrification linked commodities, in particular copper, is set to surge to record highs as the global economy transitions to zero-emission technologies.”

2021 Catalysts:

- A Blyvoor updated technical report is due in Q2.

- Silver is expected to flow out of Woodlawn in H2.

- The likelihood of additional capital deployed resulting in additional accretive acquisitions.

- A buoyant Gold price that could see multiple breakouts in the coming days/weeks/months.

Once again, price targets for Nomad common average out to $1.82 from the nine analysts polled.

That’s it for this roundup.

END

—Greg Nolan

Full disclosure: Delta, Freeport, and Nomad are Equity Guru marketing clients.