Vox Royalty (VOX.V) reports record revenue in the first quarter of 2021, bringing in $668,600 from January 1, 2021 to March 31, 2021.

All their revenue for the quarter came from royalties, not streams, meaning the $668,600 is all profit. During the quarter, Vox received their first royalty payment from the Koolyanobbing royalty, which is an uncapped 2% Free on Board sales value royalty.

Vox said their revenue stream benefited from increases from production by Mineral Resources and Karora Resources, as well as record iron ore prices at Koolyanobbing and rebounding diamond prices.

“Record quarterly revenue for Q1 represents the start of Vox’s anticipated revenue growth through 2023 as numerous royalty assets are expected to commence production. The Company’s preliminary quarterly revenue is in line with previously announced 2021 full-year revenue guidance of C$1.7M to C$2.5M. Vox’s organic revenue growth is a product of the Company’s stated strategy of acquiring high quality, attractively priced royalties many of which are near term production opportunities. Vox held one producing royalty in May 2020 and anticipates finishing 2021 with seven producing assets based on its current portfolio of 50 royalties,” stated Kyle Floyd, Chief Executive Officer of Vox.

This quarter also saw Vox raise $16.85 million from a private offering, which they put to use buying more royalties. At the end of March, they purchased royalties on three mines in Western Australia for a total of $9.2 million AUD. Western Australia is famous for mining and was ranked the fourth-best mining jurisdiction in the world by the Fraser Institute, and had the highest percentage of respondents in their surveys from people indication they had received their permits in 6 months or less.

Vox has been busy since the beginning of 2019, acquiring 40 of their 50 royalties in that time frame. With revenue picking up, they can either start to cash in or – perhaps more likely – they can go out and acquire more royalties.

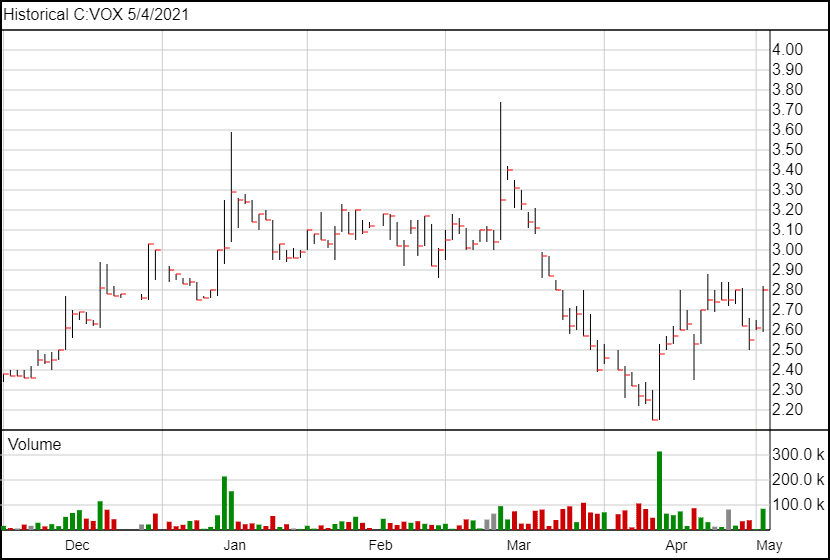

Following the news, Vox’s share price is up 20 cents to $2.82.