Valeo Pharma (VPH.C) announced they have entered into a Product Listing Agreement (PLA) with the Executive Officer of the Ontario Public Drug Program for the listing of Redesca and Redesca HP.

Redesca is Valeo’s low molecular weight heparin (LMWH) biosimilar licensed from Shenzhen Techdow Pharmaceuticals. It functions as a higher-end, more predictable and long-lasting anticoagulant, preventing blood clots.

Redesca was approved by Health Canada in December 2020, and Valeo hopes it can play a role in the fight against COVID-19, which has been found to cause blood clots in over 30% of COVID patients in the ICU.

LMWH sales exceeded $200 million in 2018, and Ontario represents 37% of the Canadian LMWH market. A PLA will allow Redesca to gain better market penetration in Ontario.

“With Ontario representing 37% of the Canadian market for LMWHs, the listing of Redesca on the Ontario public formulary is a key milestone for the Redesca commercialization program”, said Frederic Fasano, President and COO of Valeo. “This is welcome news for millions of Canadians who rely on public insurance to access their prescription medications and for the Government of Ontario who will benefit from significant savings resulting from the listing of the first LMWH biosimilar. We anticipate additional provincial coverage will follow.”

In other Valeo Pharma news, they recently upsized and closed a non-brokered private placement. The placement had originally been planned at $4 million, but Valeo felt so confident that they upsized the placement, with insiders getting in for $2.6 million, bringing the total of the placement to $6.645 million.

For the placement, Valeo issued 6,645 debenture units at $1000 per unit. Each debenture unit consists of one unsecured non-convertible Valeo debenture in the principal amount of $1,000 and 200 Class “A” share purchase warrants. The purchase warrants are exercisable at $1.60 and can be used at any time to purchase a Valeo share at any point over the next 24 months.

“The closing of this upsized placement is testament to the confidence and support our insiders and those close to the Company have in management and Valeo’s business model”, said Steve Saviuk, CEO. “I cannot over emphasize what a pivotal year 2021 is becoming with the recent launch of Redesca® and the imminent launches of Enerzair® Breezhaler® and Atectura® Breezhaler®”.

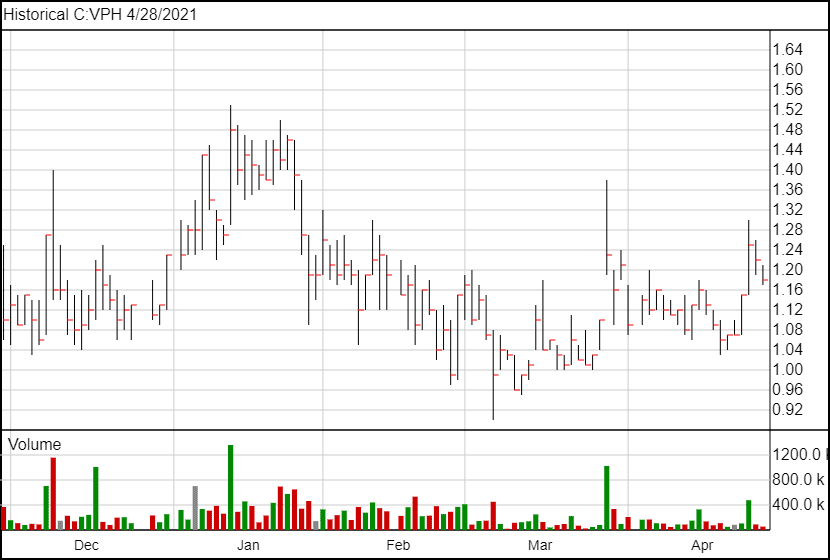

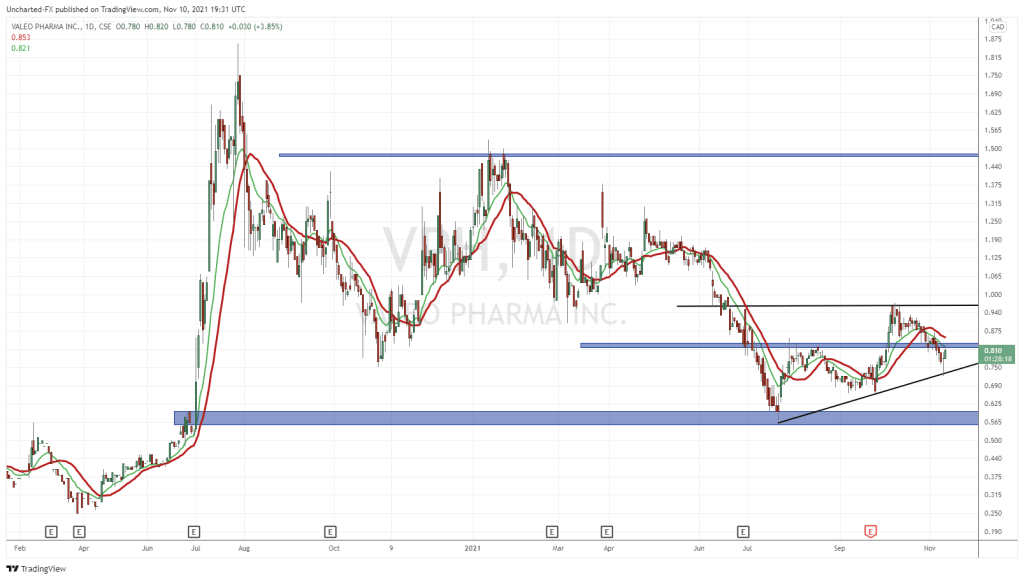

The fact that so many insiders decided to get in on this placement shows their confidence in Valeo, not so much in the debentures (as my Equity Guru colleague Kieran Robertson noted, they are fairly low risk), but because they believe they will be able to cash in on those warrants. Valeo’s share price spent some time above $1.60 in July 2020, peaking at $1.81, but has not traded above that mark since. Obviously, insiders see the stock increasing beyond that mark in the next two years.

Following the news, Valeo’s share price is trading at $1.18.

Full disclosure: Valeo Pharma is an Equity Guru marketing client.