Mindset Pharma (MSET.C) announced that their in vivo (in an animal) testing carried out by InterVivo Solutions confirmed that the majority of their patent-pending compounds created effects that correlate to psychedelic effects in humans.

Through the data from these studies, Mindset feels they have identified “a substantial pool” of proprietary compounds with psychedelic effects to move to IND-enabling studies. Of the 19 compounds MSET has tested in vivo, 15 caused behaviour in mice associated with psychedelic effects in humans.

“We are pleased to see such a consistently high rate of success from our in vivo screening program which has encompassed a range of rodent phenotypic screening to elucidate functional agonist properties at the 5-HT2A receptor studies. As we screen additional compounds from our newer psychedelic drug families, our preclinical studies continue to yield positive results. Mindset is well positioned to select promising lead drug candidates to advance into IND-enabling studies from a strong pool of novel compounds. These include not only Family 1 and Family 2, which are emerging as strong acting psilocybin analogs, but Family 3 and Family 4, which Mindset continues to develop and characterize,” stated Malik Slassi, Mindset’s Senior VP of Innovation.

In addition to providing evidence of potential psychedelic effects, these tests also provide information for potency, duration, dosing, and more. One of the main advantages of synthesising psilocybin is it provides the producer more control over the substance, and so data on potency and dosing is important.

“Once Mindset has completed in vivo screening of its compounds, the most promising candidate from each family will be selected as a lead and will then progress into IND-enabling studies. The Company anticipates selecting an initial lead candidate shortly and plans to complete IND-enabling studies by mid-2022,” commented James Lanthier, Chief Executive Officer of Mindset.

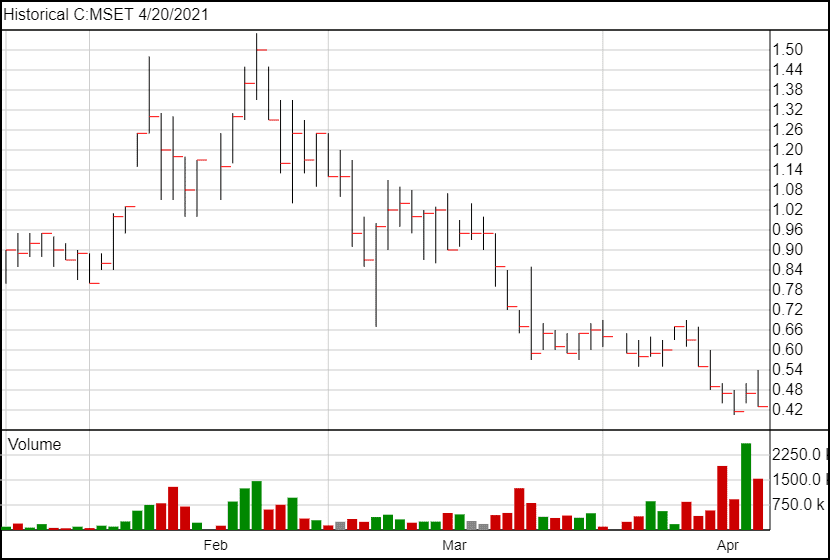

Mindset also announced that the underwriters of their recent public offering had exercised their over-allotment option. The underwriters bought 1,403,598 units at $0.75, raising a total of $1,052,699 for MSET. Each unit provides the underwriters one share of MSET and one warrant, exercisable at $1.10 over the next 36 months.

The underwriters had the option to buy 1,500,000 units, so they did not buy all the available units, although they did buy the vast majority. I wrote last week that it would be interesting to see if the underwriters would exercise their over-allotment option considering the share price is considerably lower than the cost of each unit. By exercising the option, the underwriters expressed faith in Mindset.

Following the news, Mindset’s share price is down 3 cents to $0.43.

Full disclosure: Mindset Pharma is not an Equity Guru marketing client, but there have been some discussions.