Supersized bought deal

Field Trip (FTRP.CN) announced on Friday that it raised a whopping $95.3M CAD through a bought deal. The deal was originally for proceeds of $50M CAD but was later upsized to $82.9M CAD. It was priced at $6.50 CAD per share, adding 12.8M shares to the pool, bringing the number of shares outstanding from 37.9 million to 50.7 million. As of February 16th, 2021 the company had $9M CAD in cash, combined with two recent raises the company’s cash position currently sits at around $134M CAD, with a market cap of $269.42M CAD.

Field Trip intends to use the cash from the bought deal for the ongoing development of the “FT-104” novel psychedelic development program. According to the company, FT-104 was selected for its simplicity as well as its potential to distinguish itself with respect to its pharmacological features relative to naturally-derived substances, such as psilocybin, DMT, and LSD.

Scaling up

The company will also be using the money from the raise to scale the clinic side of their business, opening new locations in San Diego and Houston – bringing their total to 8 clinics. Field Trip plans to have 20 clinics operating by 2022, which the company projects will cost $4.1M CAD according to their recent MD&A. They currently operate in Toronto, Los Angeles, New York, Chicago, Atlanta, and Amsterdam.

Since the 1960s ketamine is one of the most unique anesthetic agents used today and also one of the most promising and exciting in terms of its therapeutic potential, in the 1970’s it became a popular battlefield anesthetic and continues to be used in military conflict. In the 1980s and 1990s ketamine was more known as a party drug, and was often improperly sold as ecstasy. This caused some of the medical momentum around the drug to change, and ketamine became a schedule 2 narcotic under the FDA. This didn’t stop researchers. Ketamine’s link to helping with mental health conditions like depression, PTSD, bipolar, and suicide ideation has been studied more and more in the past couple of decades.

Recent neuroimaging studies support potential anti-anhedonic and anti-depressant effects, demonstrating its ability to alter glucose metabolism in regions implicated in mood disorders.

Field Trip’s ketamine-based treatment psychotherapy program lasts 11-16 sessions over a 3-4 week period and costs $2,000 CAD for the first module, and $1,750 CAD for each additional following module. Field Trip recommends doing 3 modules, coming to a total cost of $5,500.

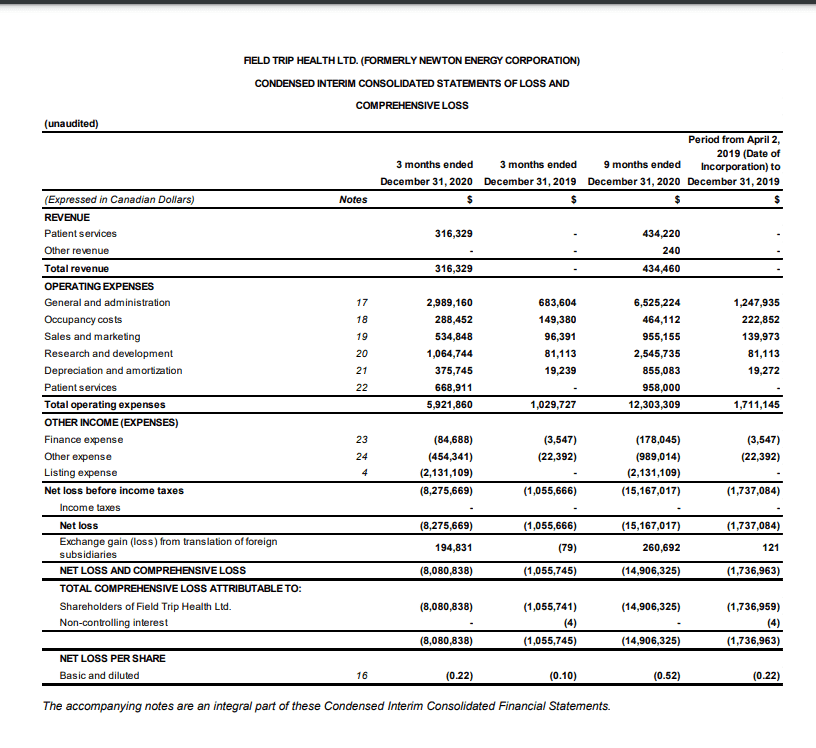

The program generated $434,220 CAD in revenue last year for Field Trip.

https://equity.guru/2021/02/12/mindset-pharma-mset-cn-is-making-safer-drugs-to-combat-ptsd-anxiety-depression/

Field Trip notes in its company video that ketamine-assisted therapy can speed up psychotherapy, taking months or years off of the process as ketamine ‘opens the mind and heart’. The patient is thus believed to be in a more receptive state to more traditional forms of talk therapy.

Trauma survivors often block out painful memories in their subconscious as a defense mechanism, psychedelics can also help patients access these memories clearer for therapeutic purposes.

Red tape

The high cost of these therapies is almost inescapable at this point, especially for for-profit companies.

Psychedelics are a cash-intensive business, which is why huge raises like this are going to be necessary for these companies to scale and remain operating. One advantage of the clinic business model is the company can start earning revenue immediately.

But with offices in spots like Manhattan and Santa Monica employing 5-10 psychotherapists, their overhead is pretty high. as operating expenses were $12.3M CAD in 2020, as well as $6M in lease obligations.

Founders of Field Trip Ronan Levy, Hannan Fleiman, and Joseph del Moral have the right background to execute this business model, as they sold their cannabis patient business CanvasRX to Aurora (ACB.T) for $15M for cash and stock back in 2016.

At the time it was Canada’s largest medical cannabis patient outreach service, with over 7,000 patients across 17 locations. In terms of size, this appears to be around Field Trip’s near-mid term scaling plans.

Digging through the company’s most recent MD&A it’s obvious how many rules and regulations there are the company needs to follow in each of its locations. I won’t bore you to death with those details here, but just know that each jurisdiction has vastly different rules and regulations.

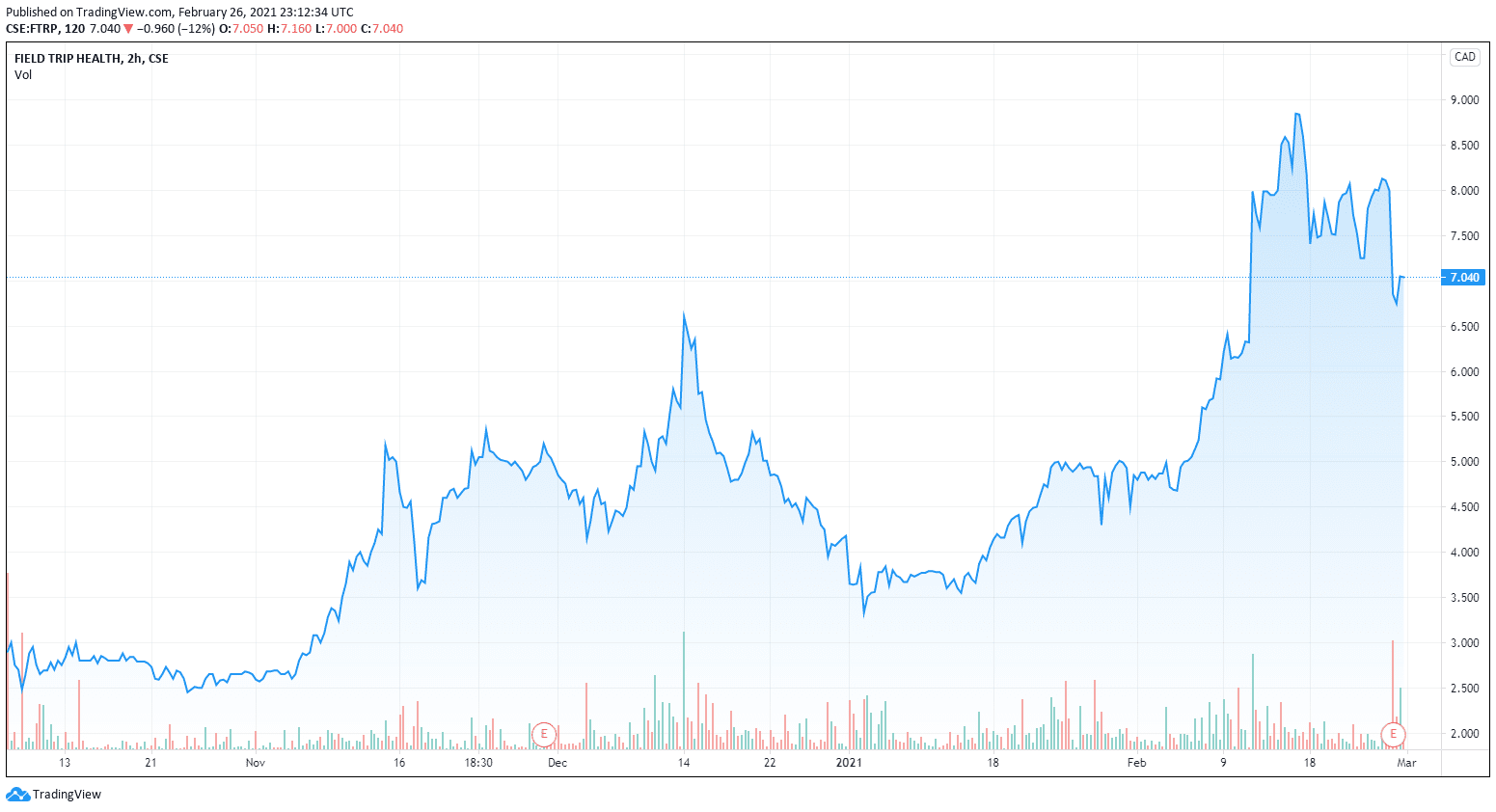

The fact that management has basically been down this exact road before does give me faith as both are pretty unique situations that required a lot of red tape. The company has a tight share structure (37.9m pre raise), and a low float (20M), so the stock price naturally took a bit of a hit on Friday with news of the bought deal.

Investor expectations

A couple of Redditors were angry, but even with the dip, the stock has been absolutely humming the last few months. Investors in this space are incredibly bullish. Yes, there are probably some unrealistic expectations return-wise for those who think this is cannabis 2.0, but I don’t think they are necessarily out to lunch on this one.

In terms of the bought deal affecting short-term pricing, if we zoom out a bit, yeah. Field Trip has been on a tear.

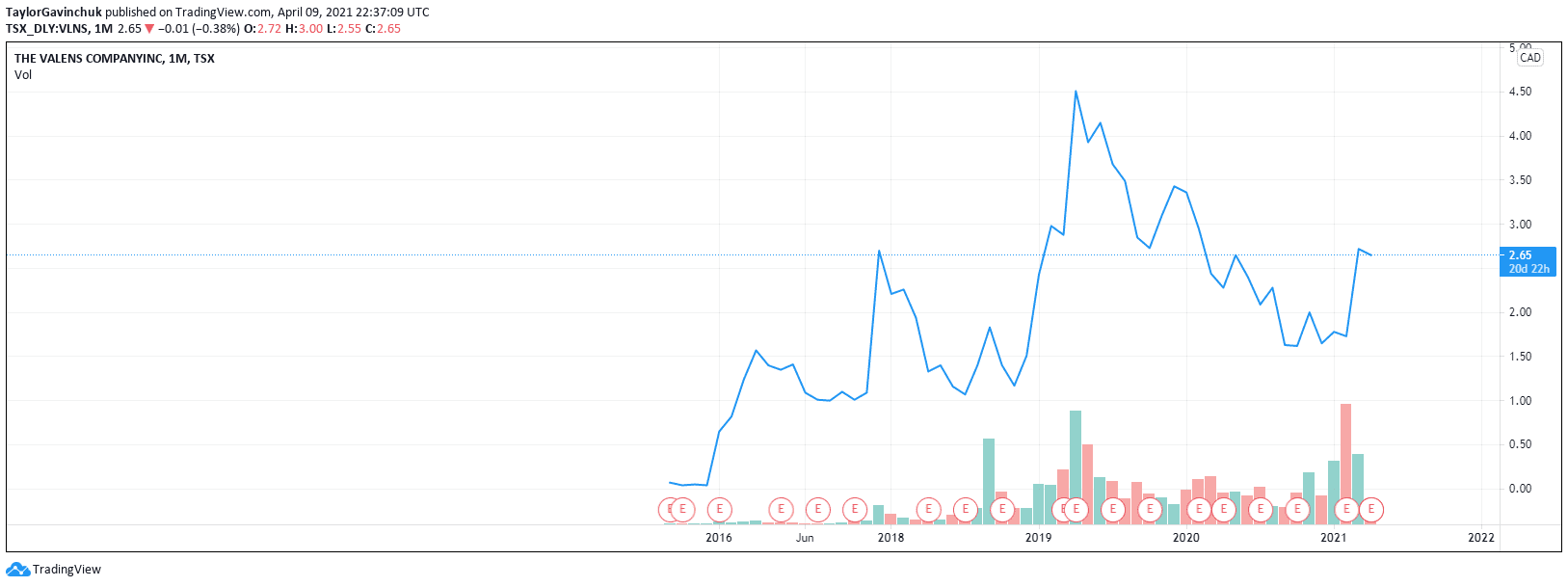

Similar to cannabis, psychedelics are a once-in-a-lifetime event with regards to legalization. Ex. Canopy (CGC.N) CEO and current MindMed (MMED.NE), Red Light Holland( TRIP.CN) (damn I bet Field Trip wishes they grabbed that ticker) investor and adviser Bruce Linton said he sees a huge opportunity in psychedelics (and cannabis) because they are ‘highly regulated substances being controlled by dumb people.’ COVID has also made the mental health issues these companies are dealing with 3-4X more prevalent than they were just 18 months ago. Field Trip reported a slight decrease in foot traffic in California and Ontario, but nothing they weren’t braced for, and things have more or less gone back to normal with regards to patient inflow, according to the company in a recent MD&A.

What’s the future of this company?

Management previously sold CanvasRx to cannabis giant Aurora, so could Field Trip become an M&A target for a giant like MindMed (MMED.NE) or Compass Pathways (CMPS.N)? It’s possible.Or, is a $95M CAD raise proof that Field Trip is going to be the one who is shopping?