There’s a simple narrative to the cannabis market. It came, had its moment and went out in a bang, taking as many companies and investors out with it as it all came crashing down. Then it propped itself up for cannabis 2.0 but failed to have a repeat performance because all the circus performers had gone home, and well, if you listen hard enough walking down Howe Street at the right time of day you can still hear it fizzling out.

But when all the bubbles have popped and the enthusiasm’s gone and the fad-investor’s off chasing whatever new doohickey he’s been told will net him a quick million in the speculation casino, the products don’t dry up and go away. Instead, they draw in a new type of investor—one with less of a gambling mindset—someone interested in a long-term growth trajectory.

They want a company that’s going to do the work.

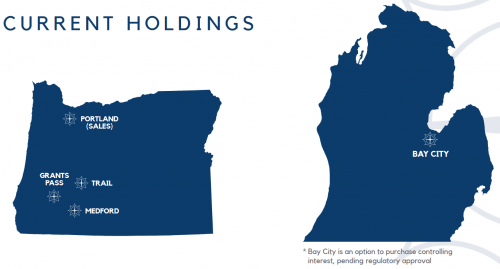

Grown Rogue (GRIN.C) hails from Medford, Oregon in what’s charmingly called the Rogue Valley. They’re a multi-state operator (MSO) in the cannabis space. They’ve been around since 2018, when they bounced onto the scene via a reverse take-over and have been busy filling out their catalogue with accretive acquisitions and product improvements. Given that flower still holds over 50% of cannabis sales, it makes sense for at least one company in the space to not diversify.

It’s called comparative advantage. It’s when a company takes one thing—in this case, flower—and tries to do it better than anyone else. They don’t make widgets. They’re not getting into artificial intelligence next week and blockchain the week after. They’re not into vapes or edibles or topicals or gels, or wellness and beauty products—they’re focused on flower. They’re aiming to keep their cultivation costs low, and producing the best products—and they’ve had some success, winning some awards along the way. We’ll get into that later.

What we like

Strategy

Most MSOs thin out the amount of licenses they get over a large group of states, but GRIN does the opposite. The company places more value on a handful of cannabis-friendly states rather than spreading themselves thin over every state available so they can take advantage of the economics of scale required to maximize profits.

Grown Rogue’s next steps are expanding deeper into the Oregon market, while adding to their portfolio projects in Michigan, and then afterwards looking at strategic expansion possibilities represented by other states. It’s a solid expansion strategy—you build yourself a strong base of operations, with strong revenue mechanics, and expand out from there, minimizing risk as you go.

“The emerald triangle”

The emerald triangle stretches from Southern Oregon to shallow into Northern California and it’s a storied spot world-wide for the quality of the cannabis grown there. More specifically on the California side, Humboldt, Mendocino, and Trinity counties are estimated to produce 60% (or more) of all the cannabis consumed in the United States. The third point of the triangle lands on the Rogue Valley, in Oregon, where GRIN takes advantage of ideal outdoor growing conditions to produce their flower.

Golden Harvests

In Michigan, operations are a bit more of what we’d expect. GRIN’s subsidiary, GR Michigan, entered into a option to purchase agreement to buy 60% ownership in a completely licensed cultivation company located in Bay City, Michigan called Golden Harvests, which includes a 80,000 square foot buildout, of which presently 25,500 square feet is operational.

Award-winning product

Grown Rogue’s flower has won first place in the Growers Cup competition for highest THC content, first for terpene content and third in the grower’s choice category for 2018. They won first place again for highest terpene content in 2019, and achieved an outdoor production potency record for Oregon when the THC potency rate for their Monkey Train cultivar came in at 35.13%.

That’s fairly strong.

Environment

A paean to environmental stewardship is usually the last ditch effort of a company without much to offer, but in this case wherein we’ve laid out the case for GRIN’s intrinsic value, we can discuss what Grown Rogue is doing for the environment without even the slightest trace of artifice.

Their commitment to environmental stewardship begins with their choice of water sources, which are sustainable and with systems in place to maximize the reclamation and recapture from runoff and recycling. Reducing the water a company is a win for frequently water-deprived Californians. The commitment continues to their choice of nutrients and pest management solutions, which won’t pollute the table and do irreparable damage to the ecosystem.

This last point isn’t necessary an environmental point, but it’s no less important: they pay their workers a living wage.

What’s not to like about that?

What we don’t like

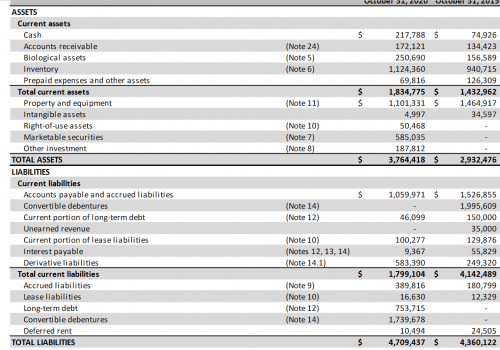

Unfortunately, the balance sheet shows a company suffering growing pains typical to this industry, and by that we mean debt.

Long term debt

Long term debt isn’t as bad as a debenture (which we’ll get into below). If convertibles are akin to PayDay loans, then debt facilities like the one GRIN picked up to finance their push into Michigan, could be considered in the same vein as a low-interest bank loan—the rate of which can be factored into sunk costs from what you’ve bought. The principal was only $600,000 with a two year term and monthly payments of 1% of cash sales receipts from Golden Harvests. When the company repays the loan, each investor will get a monthly royalty of 1% per $100,000 of cash receipts for sales. That’s decently sweet.

It means that eventually their Golden Harvests investment will add substantially to their bottom line, but for right now, any cash is going to pay off what it took to buy it.

What are convertible debentures?

Convertible debentures take the predatory interest rates of a PayDay loan and wrap it up in a bond that converts into a share at a set time. It’s a sweet deal for the owner of the debenture, who can sit on it and gather regular interest payments until the time comes to convert it to a share of the company. It’s not great for companies, though, who have to pay interest on the issue for as long as it remains un-converted.

GRIN has some. After the significant pre-COVID 19 downturn in 2018, it was one of the only ways for cannabis companies to raise funds, and lots of companies had to drink the poison tea to keep the lights on. Grown Rogue’s debentures date back to that shaky market period—specifically October 31, 2018.

The good news is that the maturity date for the debentures is coming—specifically November 1 of 2021, and barring any other extra nastiness waiting in the wings, the company could be otherwise free from it.

Their finances are along the lines of what you’d expect with their debt and reach.

The cash position you’ll see at the top of the chart has been remedied by a recently closed private placement for $4,737,800.25, giving them wiggle-room to pay their bills, but anytime assets are outstripped by liabilities it’s a signal that there’s some changes that need to be made.

The wider picture, however, suggests that this isn’t a company that’s keen on sitting on its laurels and collecting a paycheque on the backs of shareholders. They’ve had to made some tough decisions in the past while navigating rougher seas, but that’s going to be behind them in November. Imagine that liabilities number minus the $1.7 million outstanding for convertible debentures.

That’s a positive step.

They’re trading at $0.25 right now with a market cap of $28.5 million, which seems cheap given this company’s prospects.

—Joseph Morton