On March 9, 2021 Falcon Gold (FG.V) announced that the TSX Venture Exchange has approved the purchase of the Gaspard Gold Claims located in central BC.

The Gaspard Property comprises 3 mineral claims, covering 3,955 hectares in the Clinton Mining District of central British Columbia.

That’s about 10 X bigger than Stanley park.

The Property has year-round, all-season road access with a good network of active logging roads.

The City of Williams Lake located 60 kilometers northeast of the Property is a regional supply centre for mining, logging and ranching.

The Acquisition Agreement

To acquire 100% interest in the Gaspard Gold Claims, Falcon shall pay to the Vendor as follows:

- $15,000 within fifteen (15) days of the Effective Date where the Effective date occurs within 5 days following regulatory approval of the acquisition;

- 200,000 common shares in the Company within fifteen (15) days of the Effective Date; and,

- 200,000 warrants at $0.20 per share for a 2-year term within fifteen (15) days of the Effective Date.

Falcon has agreed to complete $34,000 in exploration expenditures on the property during the 2021 field season.

The vendor will retain a 2% Net Smelter Returns royalty (NSR) on the Gaspard Gold Property.

A Net Smelter Royalty is defined percentage of the gross revenue from a resource extraction operation, less a proportionate share of incidental transportation, insurance, refining and smelting costs.

Falcon may at any time purchase 1% of the NSR for $1.5 million.

All the Falcon shares and share purchase warrants issued will be subject to a 4 month hold from the date of issuance.

The Gaspard Gold property is located immediately east of the northernmost mapped limit of the Spences Bridge Group, in an area that is presented on regional BC geological maps as unnamed Eocene-age, intermediate to felsic volcaniclastic rocks bearing remarkable similarity to the Spences Bridge Group.

The closest gold deposit to the Property is located approximately 26 km to the south and is the Blackdome Gold Mine Project.

The Blackdome reportedly has the following resources;

144,500 tonnes Indicated grading 11.29 grams per tonne gold & 50.01 g/t silver, and 90,600 t Inferred grading 8.79 g/t gold and 18.61 g/t silver (as currently reported by Tempus Resources Ltd.)

The Blackdome mineralization is characterized as volcanic-hosted epithermal gold and silver class and may represent the target-type for the Gaspard Gold Claims.

Next Steps for the Gaspard Gold Claims

In an internal report by the vendor, the next recommended steps include an initial high-resolution helicopter-borne magnetic survey to provide further definition over the claims area, including 320 kilometers of flight lines, with a flight line spacing of 150m along East-West oriented flight lines, with N-S oriented tie-lines.

The E-W oriented flight lines are optimal for the delineation of both northeast and northwest trending structures.

Also, a further 60 regular and 60 heavy mineral stream sediment samples are required over the areas of deep overburden cover across the remaining Gaspard Property.

In addition, more prospecting, mapping and sampling of the brecciated rhyolite with quartz vein stockwork is needed to determine the source (or sources) of the gold stream and soil anomalies.

The same vendo-commissioned internal report suggested that these next steps would require a budget of approximately $250,000 and should result in well-defined gold mineralization drill targets.

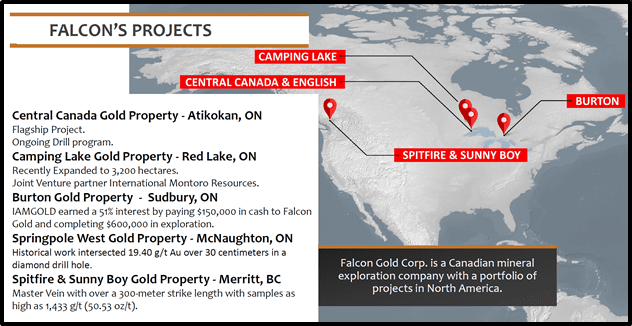

This new BC property is not FG’s only iron in the fire.

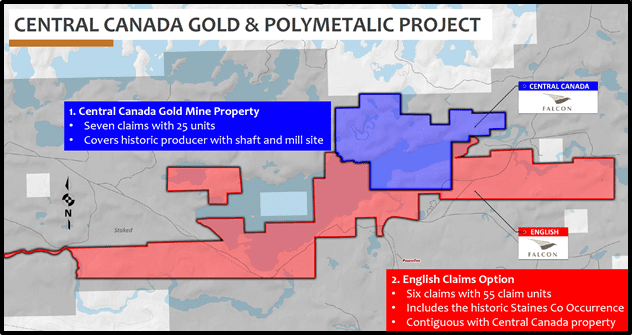

Last summer, FG released strong results from its 2nd drill hole in Central Canada Gold Mine project in Ontario.

“The company’s flagship asset is its Central Canada Gold Project (CCGP), located roughly 160 kilometers west of Thunder Bay Ontario (in proximity to Aginco Eagle’s Hammond Reef deposit), confirms Equity Guru’s mining expert Greg Nolan in an August 6, 2020 round-up article.

Central Canada Gold Mine History:

- 1901 to 1907 – Shaft constructed to a depth of 12m and 27 oz of gold from 18 tons using a stamp mill.

- 1930 to 1934 – Central Canada Mines Ltd. installed a 75 ton per day gold mill. Development work included 1,829 m of drilling and a vertical shaft to a depth of 45 m with about 42 m of crosscuts and drifts on the 100-foot level. In December, 1934 the mine had reportedly outlined approximately 230,000 ounces of gold with an average grade of 9.9 g/t Au.

- 1935 – With the on-going financial crisis of the Great Depression, the Central Canada Mines was unable to fund operations and the mine ceased operations.

- 1965 – Anjamin Mines completed diamond drilling and in hole S2 returned a 2 ft section of 37.0 g/t Au and hole S3 assayed 44.0 g/t Au across 7 ft.

- 1985 – Interquest Resources Corp. drilled 13 diamond holes totaling 1,840m in which a 3.8 ft intersection showed 30.0 g/t Au.

- 2010 to 2012 – TerraX Minerals Inc. conducted programs that included line cutting, geological surveys and 363 m of drilling.

July 2020 to December 2020- Falcon Gold Corp. completed its inaugural 17-hole program totaling 2,942.5m of core.

In addition, the Company acquired by staking an additional 7,477 ha of mineral claims consisting of 369 units immediately south and northwest of Agnico Eagle Mines Ltd.’s Hammond Reef property.

“Little Falcon Gold (FG.V), that only recently boasted the sort of market cap that would have bought you a 3 bedroom in Red Deer, announced Thursday it is enjoying such success it has now tripled its land holding in the Antikokan gold camp,” writes Equity Guru’s Chris Parry.

“Falcon Gold has acquired an additional 7,477 hectares of mineral claims, consisting of 369 units, in the rapidly developing Atikokan gold camp, growing the company’s land position to 10,392 hectares and a new project total of 507 units”.

“That’s a big chunk of land,” continued Parry, “and brings them right up alongside Agnico Eagle Mines (AEM.T) property”.

The Company also holds 4 additional projects.

- The Camping Lake Gold property in the world-renowned Red Lake mining camp

- a 49% interest in the Burton Gold property with Iamgold near Sudbury Ontario

- the Spitfire-Sunny Boy Gold Claims near Merritt, B.C.

- The Springpole West Property near Red Lake, Ontario.

Over the last six months, gold has fallen out of favour, dropping from USD $1,960 to USD $1,677.

Despite this painful correction, the forces pushing gold prices higher appear to be getting stronger.

In 2021 – more than ever – gold is a contrarian bet.

Maybe the world can live off credit cards forever with no consequences.

If that turns out not to be true, history suggests that aggressive little explorers like Falcon Gold will benefit from a stampede into hard assets.

Today, gold is up 2% to USD $1,714.

By mid-morning, Falcon is up .01 to .09 (+12%) on 48,000 shares traded.

FG.V now has a market cap of $8.6 million.

The Gaspard Property adds significantly to FG’s growing gold portfolio.

– Lukas Kane

Full Disclosure: Falcon Gold is an Equity Guru marketing client.