NetCents Technology (NC.C) and Vesto singed into a term sheet outlining a proposed joint venture which to offer crypto banking-as-a-service, and cement NC’s entry into the decentralized finance space, according to a press release.

On Friday, NC signed an original agreement with Vesto that will give the company the ability to open their platform to DeFi investing.

“DeFi is a great concept – but it needs a platform like NetCents to make it understandable to the mainstream – and we are uniquely positioned to achieve that. Regulators aren’t going to be excited about DeFi without someone like NetCents there to protect investors from loss in some way. NetCents intends to screen DeFi players, and will make sure that investors will continue to be able to have access to their funds even if a user does something like forget the password they have on their account,” said Clayton Moore, founder and CEO for Netcents.

Moore’s not wrong. DeFi and its reasons for existing are fairly incomprehensible to most people familiar only with basic blockchain. Blockchain (and cryptocurrency) have been touted as the essential privacy ensuring mechanism that paradoxically anyone can read—forever. Seems like a contradiction until we consider that anyone can read it if they speak the language and for the longest time, not many people could. Now law enforcement and governments are catching on, and DeFi is the next step in the ongoing arms race on keeping big government out of your business, or alternative, keeping ahead of law enforcement if your business is somewhat less than savoury. Now the ball’s in law enforcement’s court again.

Here’s the Coin Telegraph’s definition of DeFi:

“DeFi protocols allow users to become lenders or borrowers in a completely decentralized fashion, such that an individual has complete control over their funds at all times. This is made possible via the use of smart contracts that operate on open blockchain solutions such as Ethereum. In contrast to CeFi (Centralized Finance), DeFi platforms can be used by anyone, anywhere without them having to hand over their personal data to a central authority.”

Regardless of the reasoning behind it (or your ideological take on it), there’s money to be made and there is legitimate business to be done in DeFi circles. It makes good solid sense for NetCents to be there.

Here’s what they’re offering:

- Multi-Sig vWallet –

- Cold Storage –

- Crypto Deposit Insurance- ,

- DeFi Insurance –

- Advanced DeFi Protocols –

- BTC buy / sell,

- BTC Payments via POS Retail & Online Merchants –

- EMV Payments & Global Transfers via Stablecoins (USDC & Dai), and

- Fiat On / Off Ramping Bank Partners, among other key attributes.

What’s most interesting about the above list of perks is the crypto-deposit insurance and DeFi insurance through Lloyds of London, because decentralized finance by its very nature is insurance resistant and risk intensive. There’s no information on actual pricing, but the probability that this isn’t a cheap service is high, reflecting the increased risk. Add that to the extortionate price of doing business on the Ethereum blockchain, where most DeFi takes place, and the downside is the damage it does to your pocketbook.

Another solid upside to the agreement is that Vesto defaults to USDC instead of Tether/USDT for their stablecoin partnership. In a perfect world this would become industry standard, because iFinex, the company behind Tether, has proven they cannot be trusted.

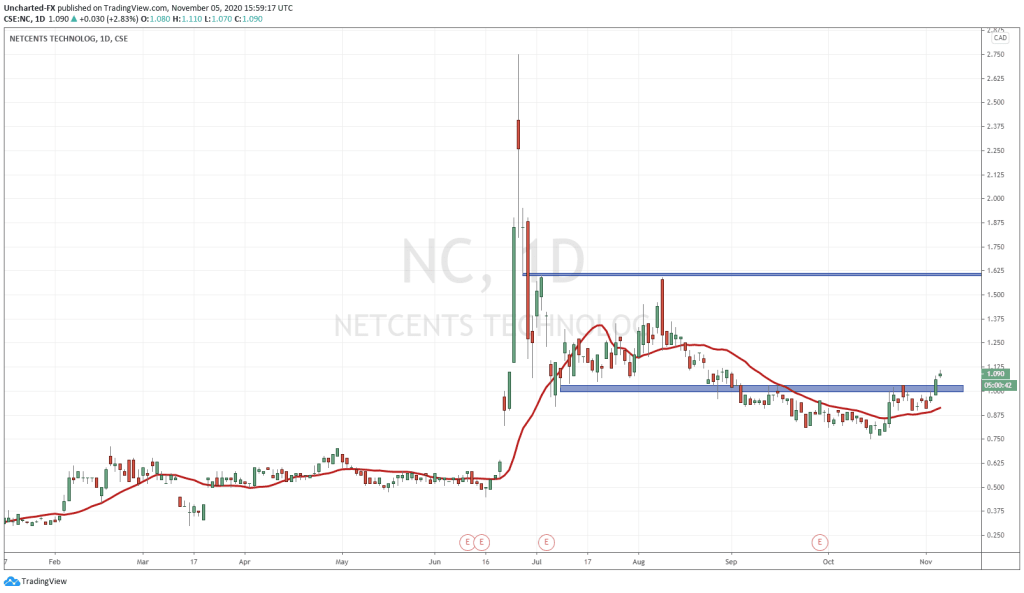

NetCents stock rose $0.05 today and closed at $1.01.

—Joseph Morton