On February 24, 2021 Pure Extracts (PULL.C) announced that it has submitted a Notice of New Cannabis Product (NNCP) application to Health Canada seeking approval for its retail cannabis products including cannabis extracts and edible cannabis.

PULL is a plant-based extraction company focused on cannabis, hemp, functional mushrooms and the rapidly emerging psychedelic sector.

The application was made through PULL’s 100%-owned subsidiary, Pure Extracts Manufacturing Corp’s distribution partner.

“The global cannabis extract market size was estimated USD $ 7.8 billion in 2020,” reports Precedence Research, “Cannabis Extracts involve a wide group of products” including “extracts from hemp and marijuana.”

“Canadians bought more than $2.6 billion worth of legal recreational cannabis products in 2020,” states BNN Bloomberg, “More than double the amount purchased the year before.”

“The year ended with roughly 1,400 licensed cannabis stores operating in Canada, up from about 760 shops at the end of 2019.”

“New product formats under the so-called ‘Cannabis 2.0’ banner, like edibles and extracts, helped to draw new consumers to the market,” added BNN Bloomberg.

PULL submitted over 20 Stock Keeping Units (SKU) product identifiers for approval including THC vapes, CBD vapes, 1:1 blended vapes, and 3 different flavours/formulations of gummies.

PULL submitted over 20 Stock Keeping Units (SKU) product identifiers for approval including THC vapes, CBD vapes, 1:1 blended vapes, and 3 different flavours/formulations of gummies.

The term “SKU” is often used synonymously with “Product”. But unlike a product, an SKU is bound to a particular location.

SKUs are used by retailers to identify and track inventory. An SKU is a unique code that identifies the manufacturer, brand, style, color, and size.

Companies issue their own unique SKU codes specific to the good and services it sells.

SKU Velocity is the speed at which your product is finding new retail locations.

PULL plans to launch these products under its ‘Pure Pulls Vapes’ and ‘Pure Chews Gummies’ branded product lines.

Pure Extracts is continuing to develop its portfolio of cannabis 2.0 products with emphasis on its 34 proprietary formulations of ‘Pure Pulls’ branded full spectrum oil (FSO) vape products and on its new line of ‘Pure Chews’ edible gummies manufactured under license from Taste-T, LLC, the manufacturer of Fireball cannabis gummies.

Pure Extracts CEO, Ben Nikolaevsky, remarked, “We create products that are in high demand by provincially authorized distributors and retailers nationwide, and are looking forward to having our high quality, FSO products in consumers’ hands early in Q2 of this year.”

“While Cannabis 2.0 products were federally legal, provinces had to establish their own rules on how these products should be regulated,” states an excellent Prohibition Partners Research Report, “This led to an untimely and irregular rollout throughout the country.”

“Alongside regional differences Health Canada, the nation’s health department, set a limit on approved dosages for products putting a 10mg THC cap on single packaged units of edibles.

The THC cap pushed many experienced adult-use cannabis users away from purchasing edibles as they felt the THC cap was too low.

Cannabis 2.0 beverages segment had a difficult start as taste, and technical difficulties with consistent dosage levels made the products unappealing to consumers”.

“Although Canada’s Cannabis 2.0 rollout faced several difficulties,” confirmed The Prohibition Partners, “the demand and consumption for these products are beginning to take form”.

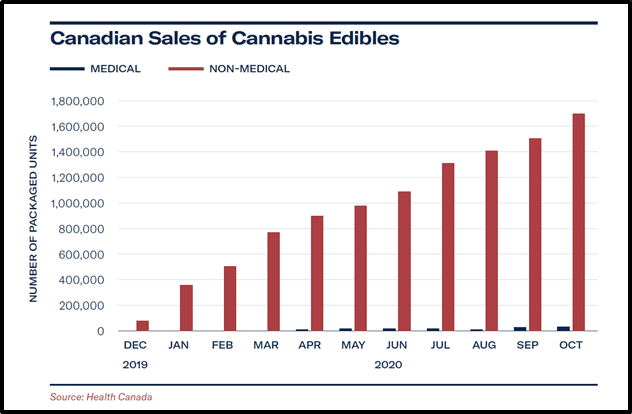

After a bumpy start, Canadian sales of cannabis edibles are now experiencing robust growth.

“Sales of cannabis 2.0 products saw record sales in August 2020 reached approximately 1,400,000 units compared to 280,000 units in January 2020, reflecting growing consumer demand,” added The Prohibition Partners.

“There is substantial demand for Cannabis 2.0 products in Canada as 48% of Canadian consumers prefer ingesting cannabis, CBD or hemp in an edible or oil format surpassing the traditional flower format.

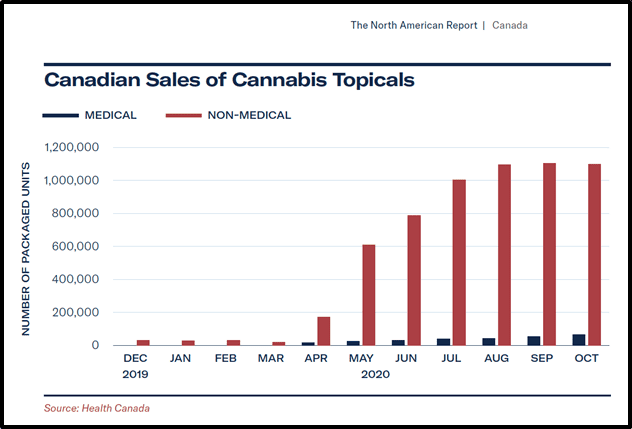

In October 2020, Cannabis 2.0 products saw record sales as cannabis edibles reached over 1.6 m units at a cumulative average growth rate (CAGR) of 35%, cannabis extract sales reached over 1.3 m units at a CAGR of 13% and topical sales reached over 11,000 units at a CAGR of 42%.

The growth correlated with the new product launches and expanded product offerings by various companies”.

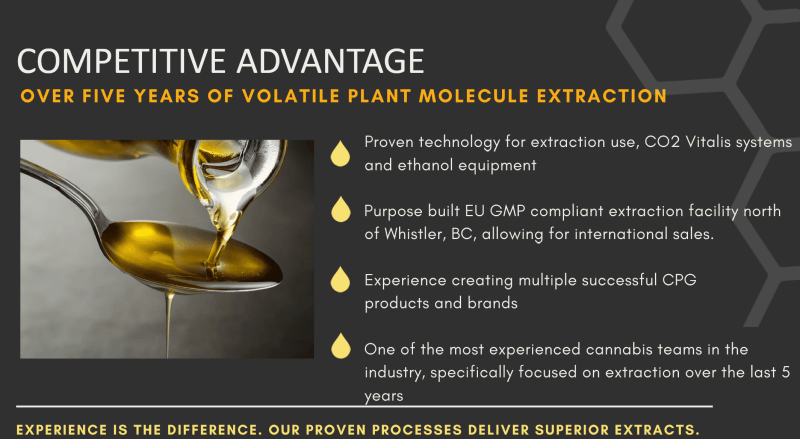

“We started the development of our extraction facility with two main factors in mind – compliance and efficiency,” stated Doug Manville – founder and COO of Pure Extracts, “We use top level consultants like CCI to ensure that our facility was EU GMP compliant. Compliance is going to allow us to export our product worldwide.”

“We also used our past experience to ensure that the facility was as efficient as possible,” added Manville, “And that efficiency allows us to add more plant-based biomass extraction to our product lines like functional mushrooms and later down the road psilocybin.”

Manville states that PULL has deals with three major cultivators in Pemberton, which allows us them to access biomass very easily.

In the November 6, 2020 video interview below, PULL CEO, Ben Nikolaevsky, speaks with Equity Guru’s own, Chris Parry, to outline the company’s cross-market ambitions in plant-based extraction.

“The cannabis market will be legalized in the US in some fashion very quickly,” predicted Nikolaevsky, “And that gives a huge opening for Canadian producers like us to be able to partner, JV whatever the case may be, with people south of the border.”

In the meantime, the 20 SKUs pending with Health Canada could add significantly to PULL’s 2021 bottom line.

- Lukas Kane

Full Disclosure: Pure Extracts is an Equity Guru marketing client