Yesterday saw all major US equities hit record highs. Though price action was more subdued on the Russell 2000 and the Dow Jones, the S&P 500 and the Nasdaq ripped higher. Tech is hot. We all know this. Investors have been jumping in ‘value’ stocks. So much so, that many are trading at what some fundamental analysts would call ‘bubble’ territory. Tesla and Apple have stolen the limelight, but not this week. Enter Netflix.

Netflix is one of those stocks that has done well during the pandemic. It was doing well before that mind you, but binge watching and staying home watching Netflix is sort of the thing to do when people are staying home and not going out. Netflix earnings has reflected on this in the past. Subscription growth came in choppy at times, but one thing remained the same: Netflix has a lot of cash.

Production schedules are returning to somewhat normalcy which means that more series and feature films can be shot. New content is always important. When I covered Netflix in the past, I highlighted the anime (Japanese anime) part. Do not discount this. Anime is so popular and will become even more popular. Netflix has had a constant stream of Netflix original anime as well as adding big titles from Japan.

One pandemic trend has been releasing new movies on subscription services rather than in theatres. James Bond has bucked this trend, but Disney’s Mulan and Wonder Woman 1984 are the big movies which one could watch from home. Netflix is saying that a Netflix original film will be released every week. This is their counter. However, with the vaccine now rolling out, will studios shift back to cinema releases?

One major part of valuation for tech companies is if the subscriber base shrunk or grew. Some analysts look at Disney Plus, Amazon Prime, and Apple TV as competitors but is that really the case? These days it seems many people have multiple subscriptions. My household has Netflix, Amazon Prime, Disney Plus and Crunchyroll. Of course, as the real economy declines, some households will be thinking of cutting back. This is where content becomes important (personally I think Netflix has the edge here), and something else to consider is the eventual addition of subscription levels ie: basic or premium memberships.

Before we delve into the technicals, let’s look at the Netflix earnings report which saw the stock shoot up 18%.

Net Sales: $6.64 billion versus $6.63 billion estimate

Diluted EPS: $1.19 versus $1.36 estimate

Global paid subscriber additions: 8.51 million versus 6.03 million expected

Netflix also surpassed 200 million paid subscribers for the first time, and beat subscriber expectations in all major territories. Impressive, even after a price hike in October of 2020.

Netflix ended 2020 with 203.7 million subscribers worldwide, including 73.9 million in the U.S. and Canada. It added 860,000 new subscribers in the U.S. and Canada in the December quarter, despite implementing a price hike.

There were also three things which stood out:

Netflix guided to a first quarter operating margin of 25%. That would be a meaningful step up from the already impressive 14.4% rate in the fourth quarter. Netflix’s highest operating margin of 2020 came in the second quarter at 22.1%

“we believe we no longer have a need to raise external financing for our day-to-day operations.” The company also raised its cash flow guidance for 2021 by $1 billion to breakeven. “We’re super proud of where we are from a free-cash-flow perspective,” Chief Financial Officer Spencer Neumann said on the earnings call. “The ability to self-fund our growth going forward (is a) pretty big milestone for us.” He said Netflix expects to have a positive cash flow starting in 2022.

The third thing is a that management hinted Netflix stock buybacks will resume soon.

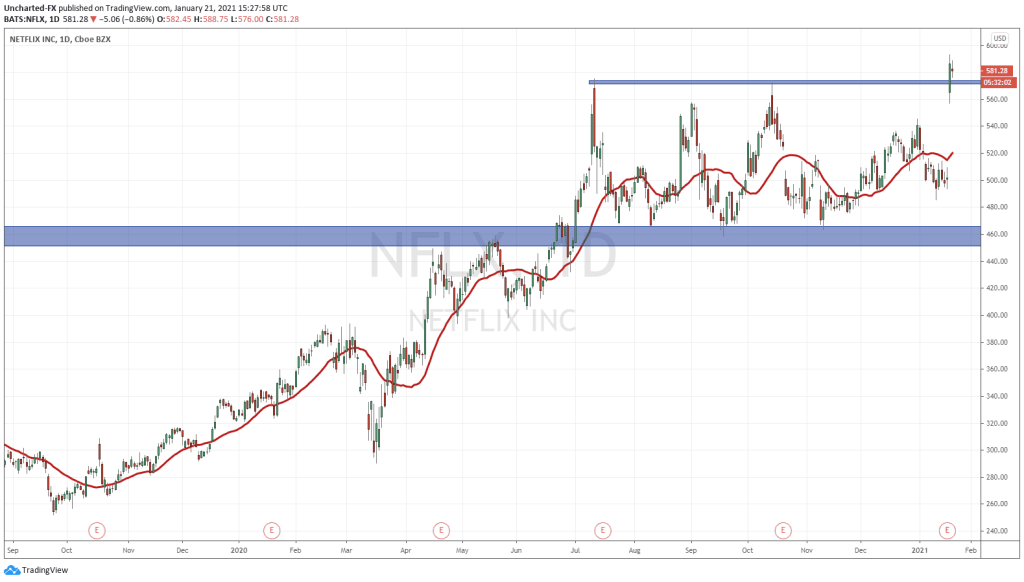

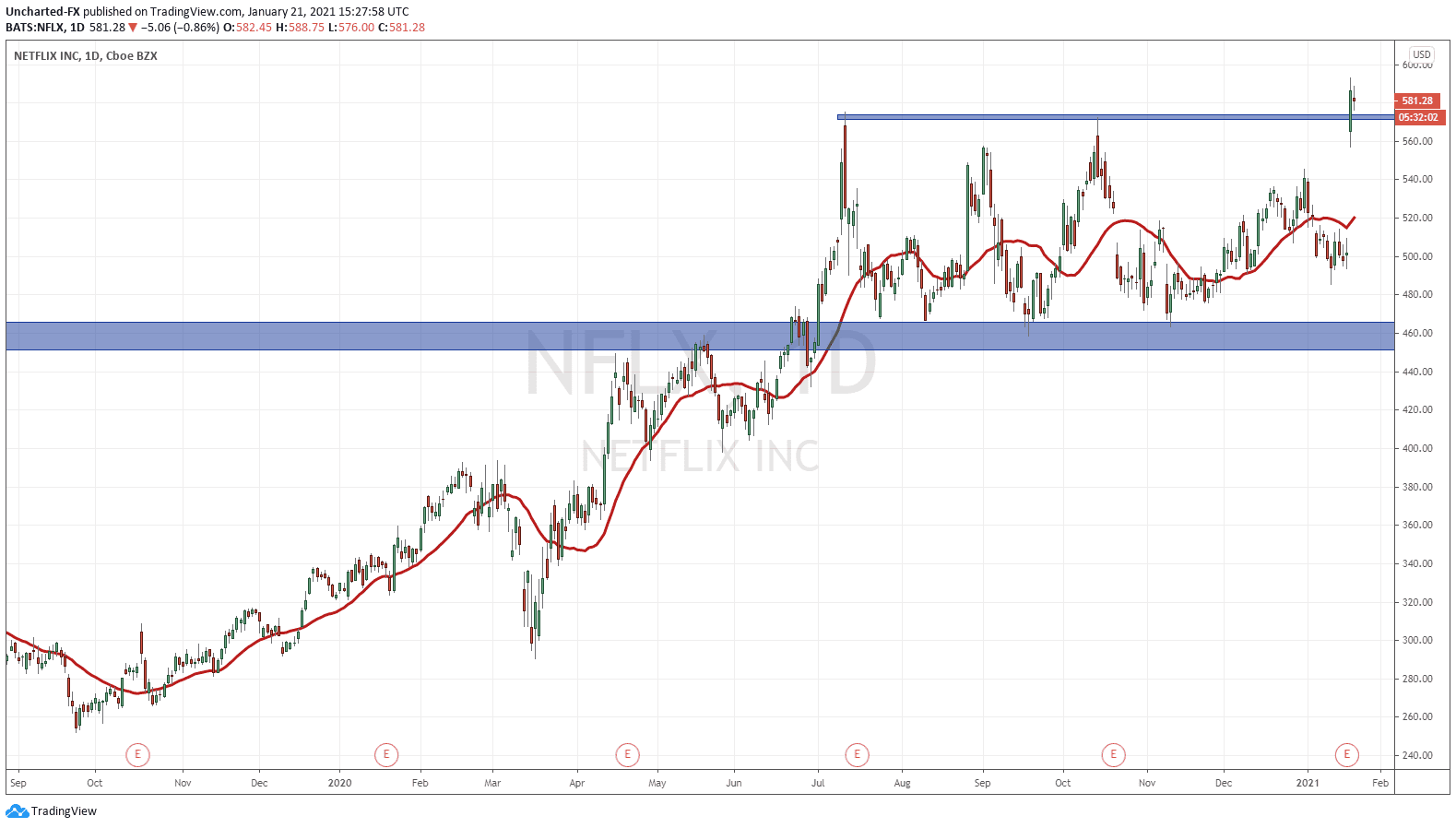

As mentioned earlier, Netflix popped 18%. The gap up from $500 to $560 was spectacular. Over at Equity Guru’s Trading Discord Room, we have been following Netflix since Summer of 2020. $460 was a zone we wanted to see hold, and what occurred was that price ranged. Netflix ranged from $460 to the $573 zone for over six months!

There were opportunities to play the range, and we gave buy orders near $460 as we saw a reversal pattern on the 4 hour chart. These patterns just keep repeating themselves, and our job as traders is to wait for them to develop and trigger. That’s it.

The range broke, and with a strong candle post earnings. Wednesday’s close triggered a breakout of the range, and Netflix hitting record highs. Today, price has retraced. Even though we would have liked to see the momentum from yesterday’s price action continue, a retracement is normal. Breakouts tend to pullback to the breakout zone, before seeing buyers step in and join the next wave higher. So far, buyers are stepping in. For a trade, many would be placing their stop losses just below the breakout candle and ride this wave. $600 seems like the next best target, but in this market, Netflix will not stop at $600. I see more record highs coming as investors price in stock buybacks and positive cash flows. Breakout is triggered, now we ride it.

Cool dear.. I m reading catching fire once it’s over I ‘ll start divergent series