For those of you who aren’t video gaming nerds like me, GameStop is the blockbuster of 2021 (this reference will make sense later). It is a global, multichannel video game, consumer electronics, and collectibles retailer. GameStop operates over 5,000 stores across ten countries.

On January 11, 2021, they announced that Holiday sales were up, but most importantly E-Commerce sales were up by +309%.

GameStop Reports 2020 Holiday Sales Results

“GRAPEVINE, Texas, Jan. 11, 2021 (GLOBE NEWSWIRE) — GameStop Corp. (NYSE: GME), today reported worldwide sales results for the nine-week holiday period ended January 2, 2021, reflecting a 4.8% increase in comparable-store sales and a 309% increase in E-Commerce sales. Total sales declined 3.1% driven by an 11% decrease in the company’s store base due to its planned de-densification strategy, temporary store closures around the world due to government mandates, and lower store traffic, particularly later in December, due to the significant impacts of COVID-19.”

The boom in their E-Commerce cannot be ignored, especially today in a world where you can buy almost anything from online stores. But the main explanatory factors could be that:

In 2019 the management team implemented a corporate strategy that focused on Optimizing the core business, building a frictionless digital ecosystem, and becoming the social/cultural hub for gaming

- Two of their three goals are focused on building an effective internet personality and ecosystem as they have finally noticed a need to escape the brick-and-mortar system and opt to go digital

The last catch-all factor could be the impacts of COVID-19. Since we have been devastated by this global pandemic many businesses have had to either adjust or close-up shop. GameStop opted for adaptation and incurred the necessary costs to keep their doors open, and it paid off.

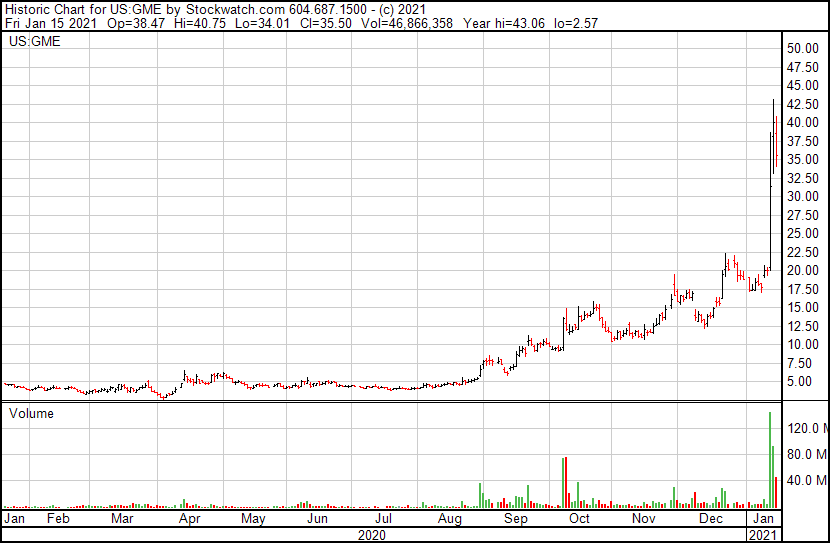

And during all this, the stock ran up +500% year-to-date.

As a shareholder, this would make you happy right? You would actually think about buying more or this wonderful business, right?

The answers to those questions could be, Yes and hell Yes. But the man who ‘predicted’ ( as someone who watches the market, and knowing how volatile it is, nothing has hurt more than typing that) the 2008 housing market bubble, who is a long-time shareholder (since Q4 2018) of GME has started to take his chips off the table.

The man, the myth, the legend, Dr. Michael Burry an American physician turned hedge fund manager has trimmed some of his GME position. In September 2020 his government filing with the SEC reported to the public that he had sold 1 million shares (38% of his original position).

At this time the stock was trading at $12 dollars a share, and his average purchase price was about $5. Dr. Burry is known to sell a portfolio company only if :

- Management allocates capital inefficiently

- The intrinsic business value of the firm has deteriorated

- Or the stock has reached his estimate of economic worth

Since he sold only a portion of his position it is most likely numbers 2 & 3 that we have to think about more. His original purchase might have been under the premise of:

The new generation consoles should be out soon (as reported by Microsoft and Sony) and this would push many people to the retail outlets. Many of the customers with buying power in the USA are filled with nostalgia today. This nostalgia stems from the fact that those with the buying power are millennials, and some older generations with children and they are 40% (128 million) of the USA population. This is not counting the other 10 countries that GME serves as well who have the same buying power.

Giving this bet a 50/50 chance of happening at least + 60 million buyers would rush to the stores, and the online platform to get their hands on the new consoles. This last push of business would give GME one final boost of profitability and this is where you can consider taking a profit.

![]()

This my dear friends is a classic cigar butt investment style. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the ‘bargain purchase’ will make that puff all profit.

The stock today is trading at $35 per share and the next filing from Dr. Burry will be sometime in March. But as of now the 1 million shares he has left have an unrealized capital gain of +600%.

So, the million-dollar question I have to ask all those who are buying GME stock today is obviously … PS5 or Xbox Series X?

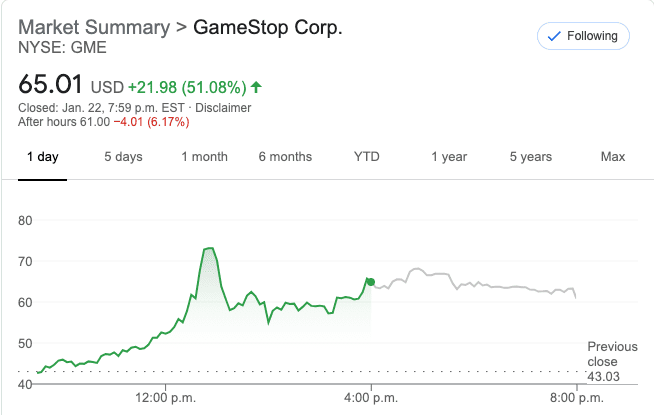

Update(Friday January 22, 2021)

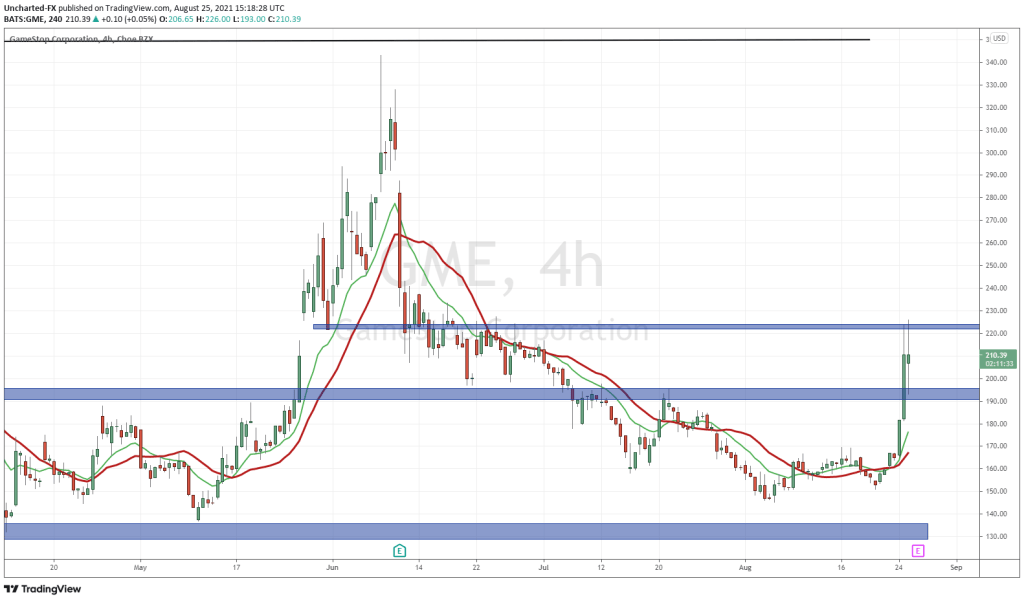

On the back of his appearance on YouTube yesterday, where he shared more of his short thesis, today GME’s stock ran up by 51% reaching a market high of above $70.00 per share compared to the closing price yesterday of $43.00 per share.

Short Sellers today

Update(Monday, January 25, 2021)

Update(Monday, January 25, 2021)

The market just hit a new high today touching $144 dollars per share. What does this say about the buying power implicit with options contracts?

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.