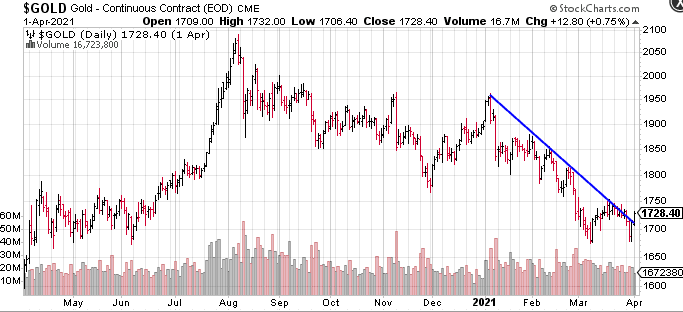

The battle for dominance over the $1850 front line in gold wages on.

We’ve been reporting on this conflict—the brawl between bulls and bears over this key level of support (and resistance)—for a number of weeks.

As I type here in the predawn light of Jan. 14th, 2021, gold bulls are attempting to regain control of $1850+ territory in overseas trade.

The bulls are catching what-for in this particular battle. The metal looks like it wants to go lower, but things can turn on a dime in this market.

I wouldn’t be betting against the metal at this juncture.

Despite this recent chop, spirits remain high among those of us in the bull camp.

Recent headlines

Six of our clients dropped significant headlines in recent sessions—we’ll begin in the order received.

Delta Resources (DLTA.V)

Delta has two highly prospective properties in its project pipeline: Delta-1 and Delta-2.

The third project in the portfolio—the Bellechasse-Timmins Property—was recently monetized reducing the immediate need to raise funds for drilling.

ON JULY 3RD, 2020, DELTA SIGNED AN AGREEMENT WITH YORKTON VENTURES INC TO SELL THE BELLECHASSE-TIMMINS PROJECT FOR $1.7M PAYABLE OVER A PERIOD OF 15 MONTHS FROM THE DATE OF SIGNING. DELTA IS RETAINING A 1% NSR INTEREST IN THE PROPERTY.

This management team is highly protective of its tight share structure.

My maiden piece on the Company examines this, and other compelling fundamentals in some detail…

News released on Jan. 11th concerns the Delta-2 project.

DELTA-2

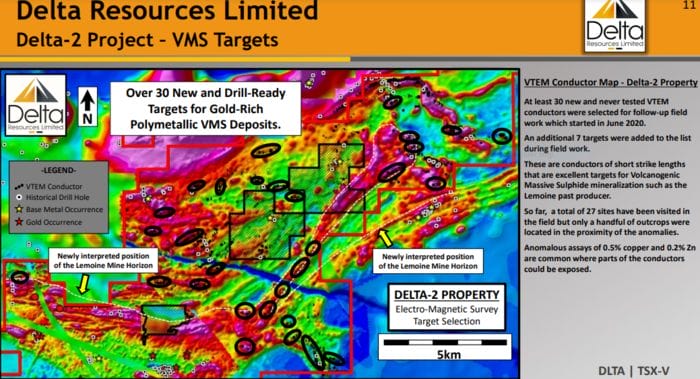

The easily accessed 16,400-hectare Delta-2 project is located along the northeast end of the Abitibi Volcanic Belt, just to the southeast of Chibougamau.

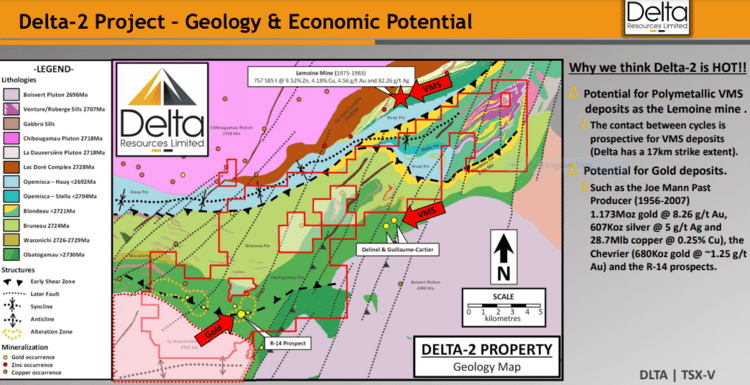

The Company is targeting two types of deposits in the region—Volcanogenic Massive Sulphide (VMS) deposits like the past-producing Lemoine mine (757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag), and Magmatic-hydrothermal Au deposits like the Chevrier Zone (43-101 Resource of 10.8Mt @ 1.22 g/t Indicated and 6.3Mt @ 1.27 g/t Au Inferred).

Interesting to note, the past-producing Lemoine Mine, just two kilometers to the north of Delta-2’s upper boundary, was one of the richest mines in Canadian history, not in terms of size, but in terms of metal content.

Lemoine is located at the top right of the map below, Chevrier on the bottom left (the Delta-2 property is outlined in red).

Despite the discovery potential that exists at Delta-2, the project is largely unexplored. The Company aims to fix that inattention.

The January 11th, 2021 headline:

“In November and December 2020, Delta completed 20 drill holes at Delta-2, for a total of 3425 metres. The first 17 drill holes of the program were aimed at hydrothermal-gold targets in the area of the Snowfall Gold occurrence and between Snowfall and the R-14 Gold prospect while drill holes 18 to 20 were aimed at two VMS targets in the southeastern portion of the property. To date, preliminary results have been received for the first 13 drill holes and there are no significant results to report. Assay results from the last seven drill holes are pending.”

So, of the 20 holes drilled in late 2020, 17 tested the hydrothermal-gold targets on the property. 13 were duds but don’t write off the discovery potential of this hydrothermal-gold setting—assays from the last seven drill holes are pending.

Holes 18 to 20 tested the VMS potential of this vast property. It’s important to understand that the VMS potential here is wide open, and the Company is only just getting started.

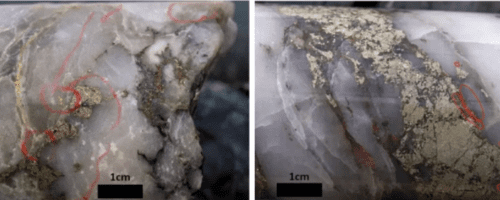

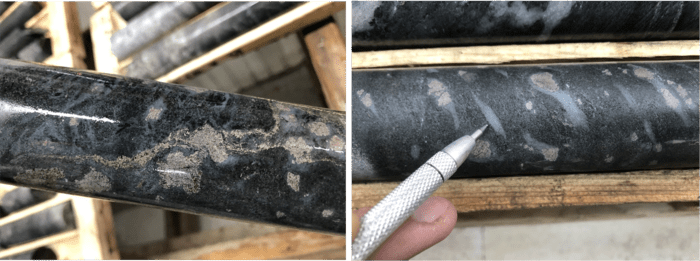

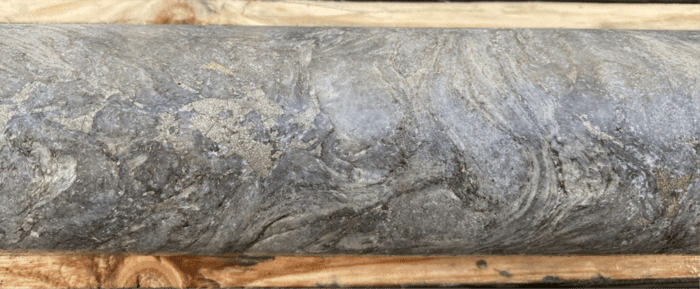

“Drill holes D2-20-18 to D2-20-20, aimed at two VMS targets, were drilled to test conductors sitting on the newly interpreted Volcanogenic Sulphide Horizon. Holes were drilled from footwall to hanging wall and intersected wide sections of intensely altered mafic volcanics, capped by sulphide-bearing felsic tuffs. Alteration in the mafic footwall rocks is characteristic of VMS deposit alteration at amphibolite-grade metamorphism and consists of garnet-sillimanite-amphibole and sericite (see image below). The rocks are also crosscut by sulphide stringers of pyrrhotite-pyrite and lesser chalcopyrite. The mineralized felsic tuffs consist of ash to lapilli-size volcaniclastic rocks with semi-massive and disseminations of pyrrhotite and pyrite, with minor chalcopyrite and sphalerite. The holes confirm Delta’s new stratigraphic interpretation in the area.”

Visual assays are always a subjective thing. But when drilling off a target in a VMS setting, the visual cues are often worth reporting.

This press release went onto state that Delta-2 drilling resumed on Jan. 11th.

“Delta is planning between 2000 and 3175 metres of drilling in this second phase of drilling, testing up to 18 isolated, never-tested conductors of short strike length, located in the south-eastern portion of the property. The conductors are all located in proximity to the newly interpreted stratigraphic horizon that hosts the past producing Lemoine Mine north of the property (1975 to 1983: 757 585 tonnes @ 9.52% Zn, 4.18% Cu, 4.56 g/t Au and 82.26 g/t Ag) (Source: www.sigeom.mines.gouv.qc.ca) and are believed to hold excellent potential for similar VMS mineralization.”

“These are all top-priority, high potential targets and we can’t wait for drilling to start” stated Andre Tessier, Delta’s President and CEO.

Newsflow out of both projects—Delta-1 and Delta-2—is only just beginning to ramp up.

I’m watching this one with great interest.

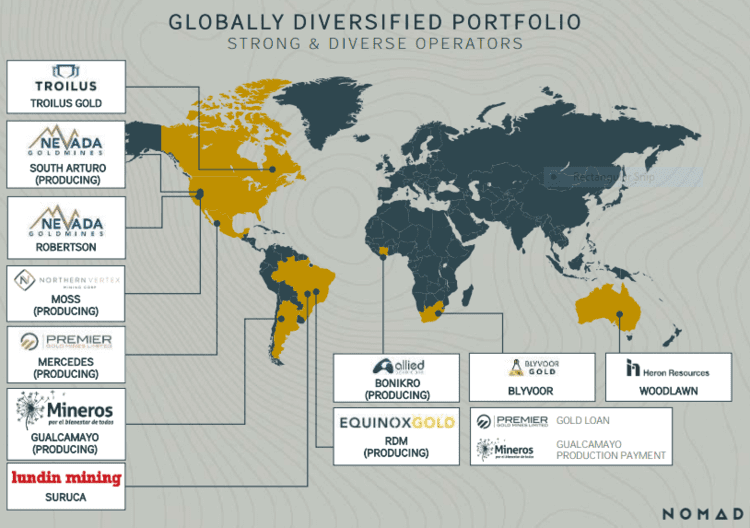

Nomad Royalty (NSR.T)

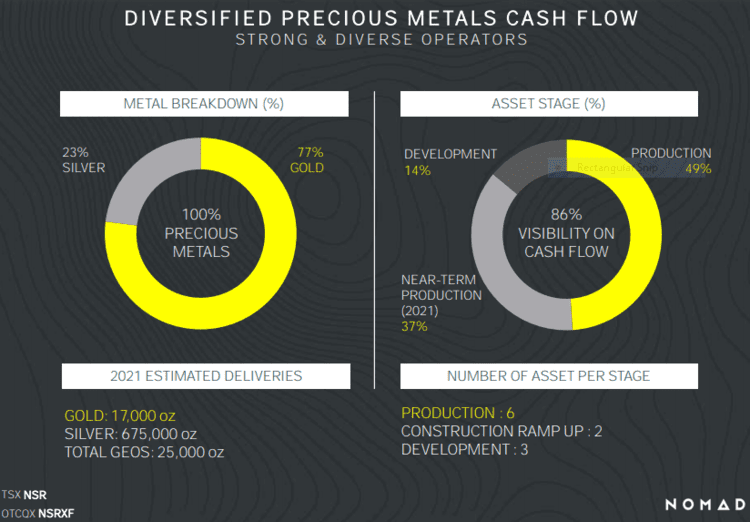

If you’re new to this arena, are looking for exposure but lack a proper compass, the royalty and streaming space might be one of your better options.

Btw, if you truly are new to this arena, I suspect your timing is bang on.

Royalty and streaming plays can offer decent leverage to a buoyant precious metals market while at the same time furnishing a measure of safety.

The key is to select a company with the right mix of assets—a diversified portfolio of assets (at or near production).

Management is also an important consideration.

Experience, vision, drive, and a solid track record of creating shareholder value creation are what I look for in a company.

The Nomad team—the trio of Vincent Metcalfe, Joseph de la Plante, and Elif Lévesque—was at the helm of Osisko Gold Royalties (OR.T) from day one and were a big part of that company’s evolution into what is now a $2.6B market cap entity.

Nomad checks a lot of boxes for me.

Right from the get-go, management set out to acquire high-quality assets, adding to an already robust project portfolio of producing and advanced-stage projects.

These are still days in Nomad’s growth cycle.

On January 11th, Nomad unveiled a shiny new acquisition…

Nomad Royalty Company Acquires a Royalty on the Blackwater Gold Project in Canada

Here, Nomad locked in a 0.21% net smelter royalty (NSR) on the Blackwater Gold Project for a total consideration of US$3.0 million.

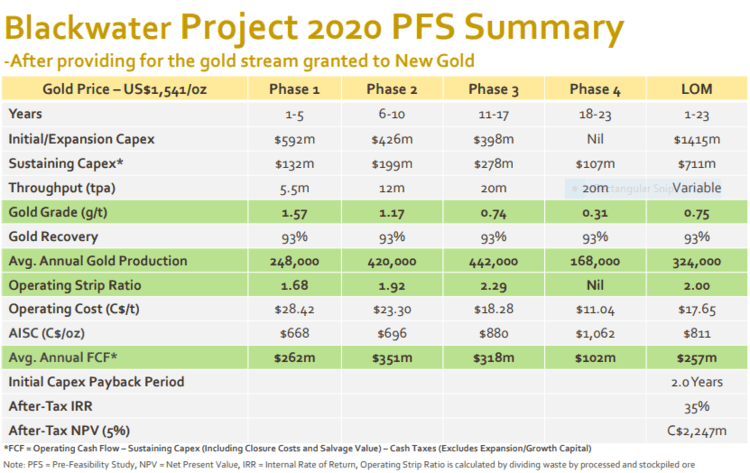

Located in central British Columbia, Blackwater is a long life, feasibility stage development project.

Nomad Royalty sees a clear path to development at Blackwater.

Operated by Artemis Gold (ARTG.V), a definitive feasibility study is currently underway and scheduled for mid-2021. Construction is planned for the second quarter of 2022, with anticipated production in 2024.

At a 0.20 g/t AuEq cut-off, Blackwater’s total Measured and Indicated resource is estimated at 597 Mt at 0.65 g/t AuEq (0.61 g/t Au, and 6.4 g/t Ag) for a total of 12.4 million AuEq ounces.

Stated another way, the project holds…

- 8 million ounces of P&P gold reserves;

- 62.3 million ounces of P&P silver reserves;

- 11.7 million ounces of M&I gold resources (including reserves);

- 122.4 million ounces of M&I silver resources (including reserves).

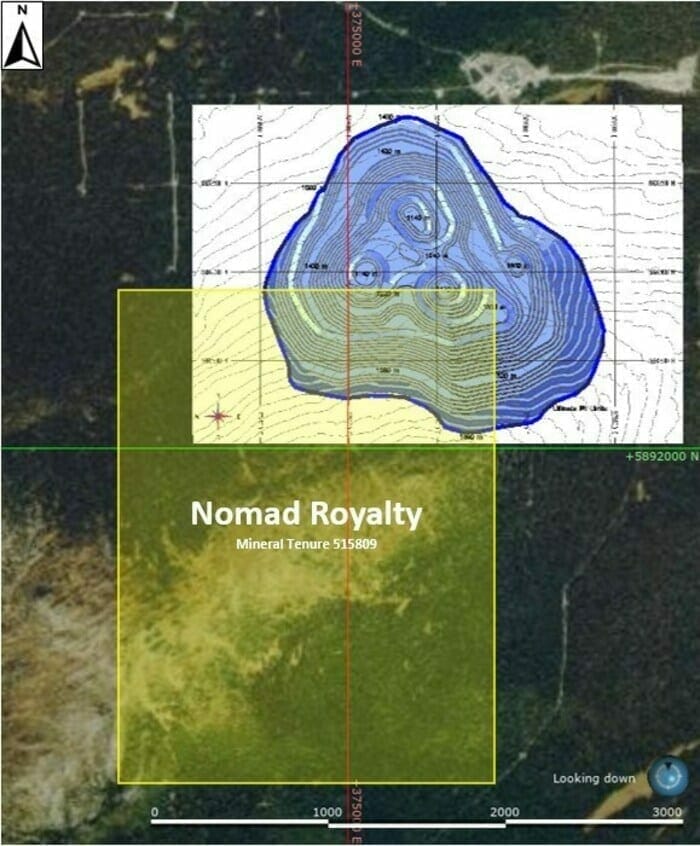

“The Royalty consists of a 0.21% net smelter return royalty on all metals and minerals produced from mineral tenure 515809 which covers a portion of the Blackwater Gold project and the higher-grade starter pit area (figure below).”

“The Operator’s revised development approach includes a reduced initial development capital, a focus on high-grade starter zone located in the southwestern zone of the deposit and improved gold and silver recoveries. The Proven & Probable Reserves currently stand at 334.0 million tonnes at grades of 0.75 g/t Gold and 5.8 g/t Silver for contained 8.0 Million ounces of Gold and 62.3 million ounces of Silver.”

The Potential Resource Upside:

“In November 2020, the Operator began the first 35,000 meter grade control program which will focus on delineating an area in the southwestern portion of the Blackwater pit (scheduled in the 2020 PFS to be mined in year 1 of operations), which returned significant near-surface high-grade mineralized intercepts.”

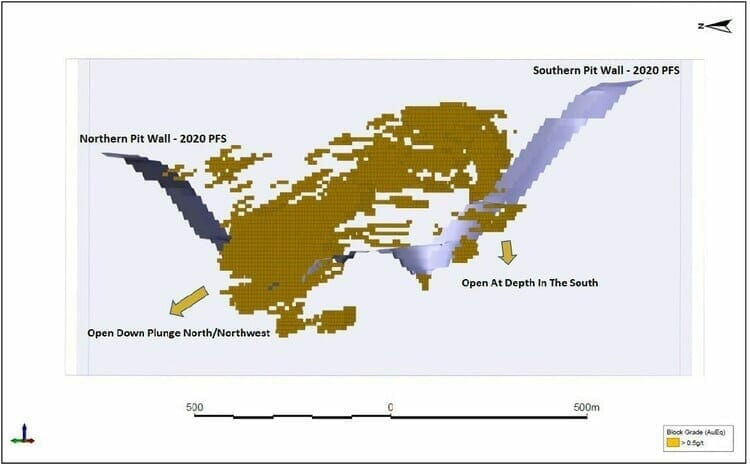

Despite a high level of drilling density—more than 300,000 meters of diamond drilling to date— the deposit remains open to (potentially) substantial expansion.

The deposit remains open to the north, north-west, and at depth to the southwest (map below).

Artemis plans to complete a limited diamond drill program in 2021 to test for extensions of the known mineralization. Follow the arrows (above map)

Vincent Metcalfe, Nomad CEO:

“We are very pleased to announce the acquisition of a royalty on a large gold deposit with significant potential for resource expansion, and with a clear path to development. The Blackwater Gold project represents one of the few sizeable near-shovel ready projects worldwide. Furthermore, the addition of the royalty now adds British Columbia, Canada to Nomad’s growing list of jurisdictions where we own precious metal royalties and streams.”

Getting back to management, the following link offers a spirited interview with Company founders Vincent Metcalfe and Joseph De La Plante…

I suspect there’s significant re-rating potential in this stock as management continues bulking up its cash flowing, and advanced-stage project base.

Pushing for scale, with a goal of attaining a $3 to $5B market cap in the medium to long term, the Company should begin commanding multiples that the very largest entities in the space enjoy.

The royalty sector is a no-brainer for the generalist investor. Once again, a company with a high-quality portfolio of royalty and streaming deals—deals that are in or near production—can offer investors a low risk/high reward vehicle to ride this next wave in precious metals higher.

Freeman Gold (FMAN.C)

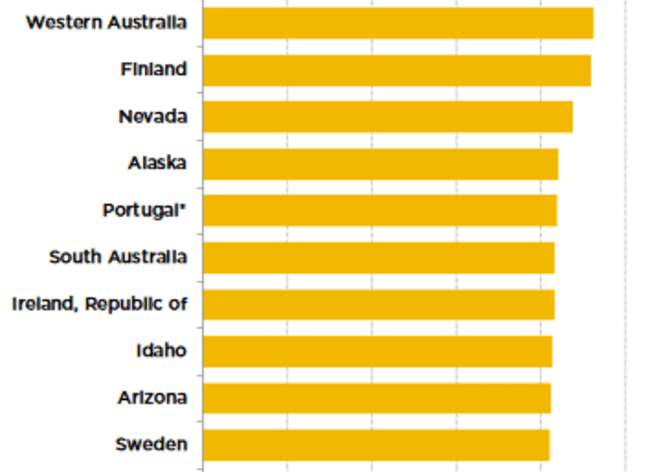

There’s much to be said for choosing a safe mining-friendly destination when compiling an ExplorerCo shortlist, especially in this era of global economic/political uncertainty.

Resource-rich countries getting their asses kicked during this economic rout, particularly those with twitchy policy-makers at the helm, might ponder a revision of their mining codes—raising taxes on foreign entities operating mines within their borders, bullying their way in for a larger piece of the action, or even outright expropriation.

It’s been known to happen.

Freeman operates the Lemhi Gold Project

Lemhi is located in Idaho, a mining-friendly state that boasts an extensive and rich mining history.

According to the esteemed Fraser Institute, in its most recent “investment attractiveness” survey, Idaho is ranked in the top ten jurisdictions where exploration and mine development is concerned.

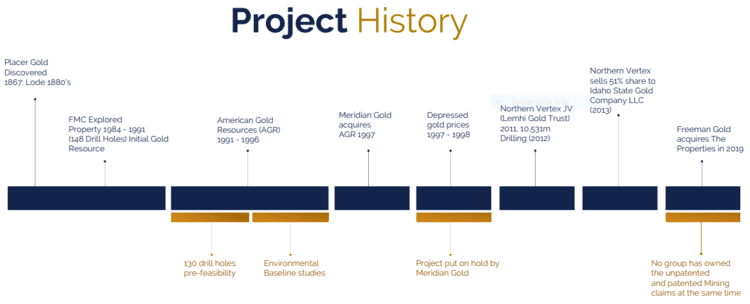

Lemhi is a classic story of a real gem, one hidden from the mining world for over a decade, suddenly comes into play after private hands relinquish control.

The Company’s goal is to define a 1.5M – 2M ounce (primarily oxide) open-pit deposit. The project’s history puts that goal within reach.

The historical resource estimates at Lemhi range between 500k and one million-plus ounces of oxide material. The contrast in these estimates was due to property boundary constraints that seesawed over time. A recent consolidation of many of the key claims in the region resolved those issues. This was a real heads-up move and a clear display of management’s deal-making savvy.

The historical resource estimates at Lemhi range between 500k and one million-plus ounces of oxide material. The contrast in these estimates was due to property boundary constraints that seesawed over time. A recent consolidation of many of the key claims in the region resolved those issues. This was a real heads-up move and a clear display of management’s deal-making savvy.

Quoting a recent Guru offering…

Lemhi is a near-surface deposit

Much of Lemhi’s oxidized rock extends 30 to 50 meters below surface (oxidized ore often produces robust economics).

This oxidized material, where there is a healthy component of free gold, opens up the possibility of a low-cost open-pit heap leach mining scenario.

Freeman’s first step will be validating the historical data via an aggressive drilling campaign, one designed to move the historic ounces into 43-101 compliant categories.

The second step will be growing the ounce count via resource expansion and exploration drilling.

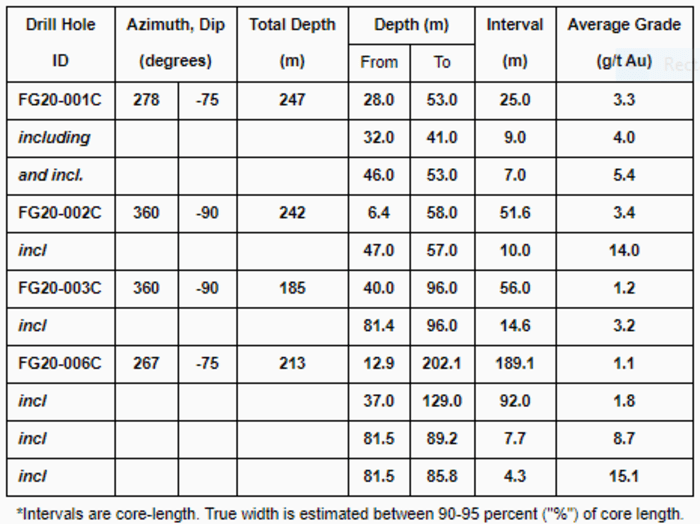

The Company began drilling Lemhi last summer—a two rig campaign wrapped-up last month with 34 holes drilled for a total of 7,149 meters.

Set with the first four holes from this recent campaign, the Company dropped the following headline on Jan. 12th:

All four holes tagged (shallow) high-grade oxide gold.

Highlights:

- 3.3 g/t Au over 25 meters (including 5.4 g/t Au over 7 meters);

- 3.4 g/t Au over 51.6 meters (including 14 g/t Au over 10 meters);

- 3.2 g/t Au over 14.6 meters;

- 1.8 g/t Au over 92 meters (including 8.7 g/t Au over 7.7 meters (and also including 15.1 g/t Au over 4.3 meters));

“Gold mineralization extends to at least 200 meters and is open at depth. Of note, the high-grade zones lie within broader lower grade mineralized envelopes, such as 1.1 g/t over 189.1 meters. Drill holes reported in this press release cover an area of 150 by 50 meters of the Lemhi deposit.”

Solid hits…

Full table of results…

In this press release, the Company went on to describe the geological setting.

“Geologically, the Lemhi Gold Project lies within the Idaho-Montana porphyry belt, a northeast-trending alignment of metallic ore deposits and mines related to granitic porphyry intrusions. These extend north-easterly across Idaho and are related to the Trans-Challis fault system, a broad (20-30 km-wide) system of en-echelon northeast-trending structures extending from Boise Basin more than 270 km into Montana. At Lemhi, gold mineralization is hosted in Mesoproterozoic quartzites and phyllites within a series of relatively flat-lying lodes consisting of quartz veins, quartz stockwork and breccias. Mineralized lodes are associated with low angle faults, folding and shear zone(s). The mineralized zones have varying amounts of sulphides (pyrite, chalcopyrite, bornite, molybdenum, and occasionally arsenopyrite) where free gold is common. Gold mineralization at Lemhi is open at depth and on strike.”

Will Randall, Freeman President and CEO:

“These initial results clearly demonstrate the high-grade nature of the Lemhi gold project, including project enhancing thick shallow high-grade oxide gold zones. This is a great start to the drill campaign confirming historically defined mineralization as well as providing a more comprehensive understanding of the gold mineralization and its controls.”

Near term catalysts for the stock include continued newsflow out of this recent drilling campaign and a maiden NI 43-101 compliant resource, scheduled to drop later this quarter.

In a sector facing the likelihood of Peak Gold (Gold: uncharted waters – the technicals, the peak of discovery, the opportunity) and lean project pipelines, Lemhi may fall prey to a resource-hungry predator—a producer looking to bulk up its mineral inventory.

Defense Metals (DEFN.V)

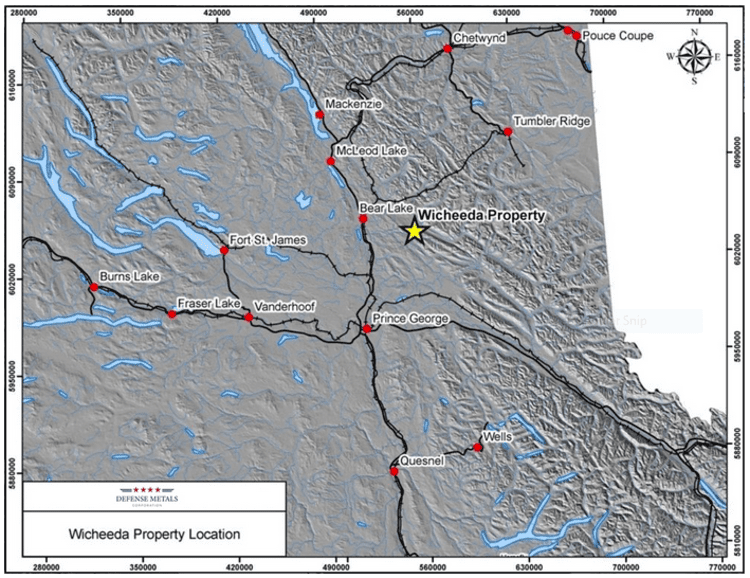

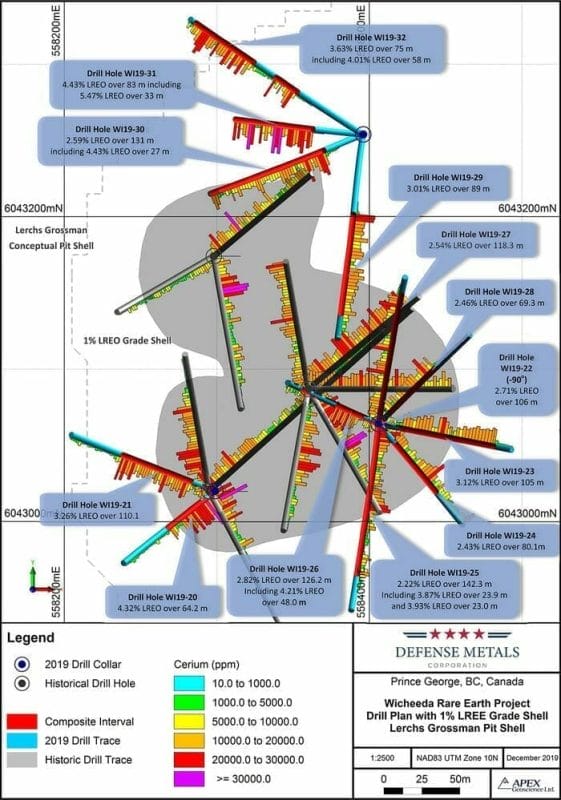

Defense is no stranger to these pages. We’ve followed developments every step along the way as the Company pushed its strategic, wholly-owned Wicheeda REE Project further along the development curve.

The push is far from over.

Wicheeda—a 1,708-hectare chunk of REE-rich terra firma—is located in the mining-friendly region of Prince George, B.C.

Road accessible and surrounded by all the necessary infrastructure required to build and run an efficient operation, Wicheeda is a standout in the REE arena.

The Wicheeda resource currently stands at 4,890,000 tonnes grading 3.02% LREO (Light Rare Earth Oxide) in the Indicated category, and 12,100,000 tonnes grading 2.90% LREO in the Inferred category.

An enormously successful drilling campaign completed last year (highlight interval: 4.43% LREO over 83 meters including 5.47% LREO over a drill core interval of 33 meters) may see another phase of drilling as spring approaches the BC interior.

The Wicheeda resource appears destined to grow. Note the significant mineralization tagged outside the current resource base (gray rubber ducky image, map below).

From a metallurgical standpoint, positive flotation and hydrometallurgical testwork achieved a high-grade 50% LREO concentrate at >85% recovery.

Hydrometallurgical testwork demonstrated a 90% extraction rate for REEs—a rate that could see further improvement.

The Company recently validated its laboratory flowsheet at a pilot plant scale, generating the necessary data for engineering design and the production of high-grade concentrate.

This next vid offers a good overview of the deposit, the market, and the strategic importance of this high-grade REE deposit.

Yesterday, on Jan. 13th, the Company dropped the following headline:

Here, the Company announced having commissioned the Saskatchewan Research Council (SRC) to complete an X-Ray Transmission (XRT) sorting amenability study.

“Defense Metals and SRC have been awarded National Research Council of Canada Industrial Research Assistance Program (NRC IRAP) funding, a Government of Canada funded program mandated to provide financial support for technology innovation. Funding awarded under the NRC IRAP will cover approximately 70% of the estimated cost of the XRT amenability study test-work.”

This is all about ore sorting—removing a portion of the unmineralized waste rock prior to processing.

Reducing waste rock—concentrating the valuable ore—can result in significantly lower processing costs (lower OPEX) and vastly superior project economics.

“The objective of the SRC amenability study is to investigate XRT sorting for the purpose of upgrading Wicheeda REE mineralization prior to downstream processing. Sensor-based sorting has several advantages when applied to REE mining projects in that beneficiation occurs without water and with reduced grinding requirements. The investigation will assess how much gangue can be removed from the head feed. The investigation will then carry out an iterative study of different sorting sizes to process in the XRT sorter assessing both the grade of the upgraded concentrate and the grade of the waste for economic studies whereby the optimum operational parameters can be determined.”

XRT sorting has the potential to realize several significant project benefits, including:

- Relatively low-cost gangue (unmineralized waste) removal and volume reduction at the front-end of the Wicheeda REE processing stream;

- Potential to have a significant positive benefit on downstream flotation and hydrometallurgical processes via reduced water, heating, and reagent consumption costs;

- Depending on the success of the test-work these reductions may contribute to overall lower size / throughput and capital cost of potential future commercial REE concentration and refining facilities at Wicheeda.

Craig Taylor, the Company CEO:

“Defense Metals looks forward to investigating the potential of low-cost front-end upgrading of Wicheeda REE mineralization via XRT sorting. We have already demonstrated the ability to produce a greater than 50% REO concentrate during flotation pilot plant test-work and we hope unlocking the benefits of XRT sorting will yield downstream processing benefits of increased head grade, flotation concentrate, and hydrometallurgical feed streams“.

Details of XRT Study Methodology

X-ray Transmission (XRT) Analysis:

The XRT investigation requires the selection of large samples containing both gangue and REE mineralization for analysis. The samples are analysed using:

- Dual energy X-ray transmission measurements (DE-CT), and

- QEMSCAN for calibration and mineral identification and modal mineralogy.

Photographs of the polished QEMSCAN samples are used to verify the atomic differences measured by DE-CT. The modal mineralogy is used to determine REE grades.

Image Analysis:

The DE-CT images are analyzed using different sized grids to determine how much gangue can be removed for a range of particle sizes. This process determines the upgrading possibilities for different sorting sizes, the grade of the concentrate and the grade of the waste.

This is a very positive development, and a very cool one, as the Company continues to push Wicheeda towards a (potential) production scenario.

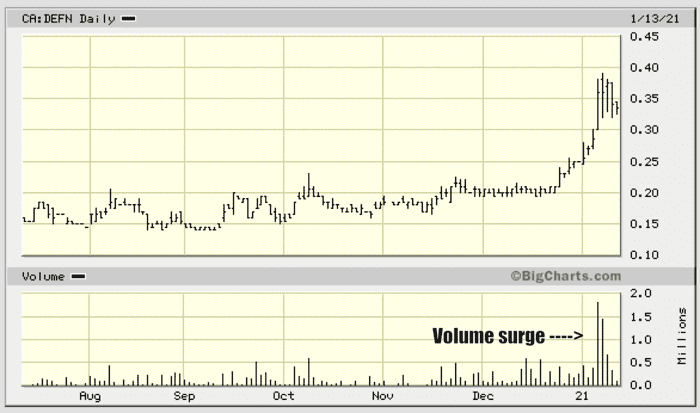

Defense shares have gone on a high volume tear of late. The market appears to be (finally) waking up to the importance of this highly strategic REE resource.

Fremont Gold (FRE.V)

Fremont is focused on tagging a potential discovery in one of the most prolific and mining-friendly jurisdictions on our planet—Nevada.

According to the Fraser Institute’s most recent investment attractiveness survey, Nevada continues to roll out the welcome mat to miners. It’s currently ranked in the Top Three.

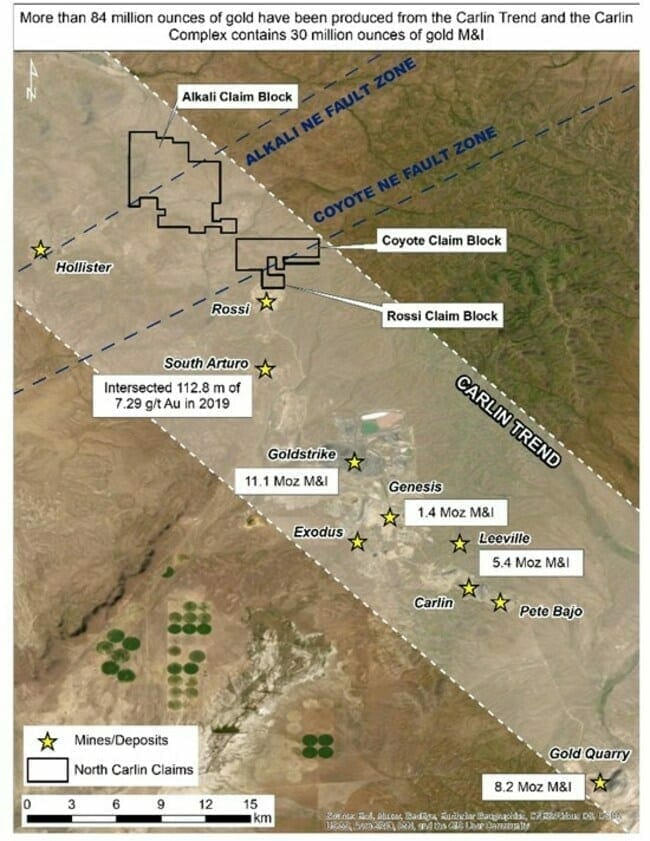

Fremont controls four gold projects along Nevada’s Carlin, Cortez, and Independence Trends.

- The North Carlin project is located in the Carlin Trend. The company is targeting a Carlin-type gold deposit and/or low-sulfidation epithermal mineralization.

- The Cobb Creek project is located in the Independence Trend—the target is also a Carlin-type gold deposit.

- The Griffon project is located in the Cortez Trend—the target is Carlin-type gold.

- The Hurricane project is located in the Cortez Trend—the target is a Silica replacement-type gold deposit.

The North Carlin project currently bears flagship status.

On January 13th, the Company dropped the following headline:

Drilling Underway at Fremont’s North Carlin Gold Project

Here, the Company announced the commencement of drilling with multiple high-priority targets in its crosshairs.

These targets were generated through the application of good science—soil geochemistry, gravity / magnetic surveys, and the projection of key faults that control gold mineralization along the Carlin Trend.

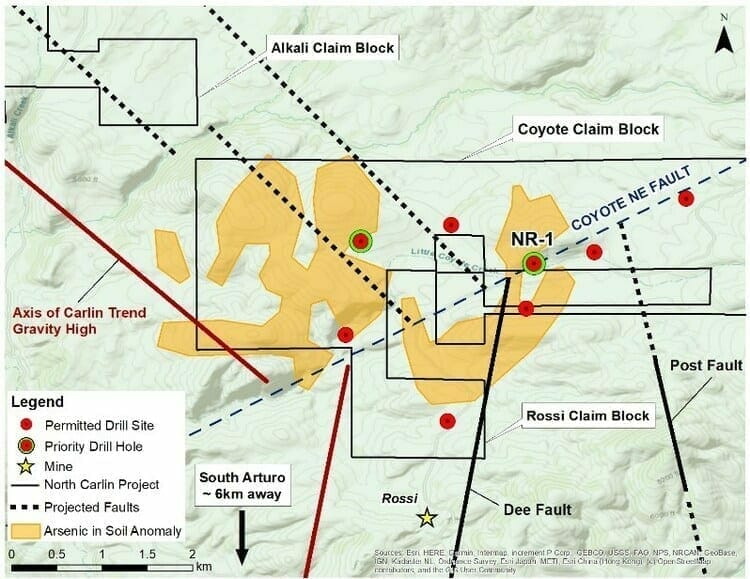

North Carlin – Coyote and Rossi claim targets

The first drill hole has been sited at the intersection of the Dee Fault and the Coyote NE Fault on the edge of a large multi-element soil anomaly (map below).

The Company is targeting a Carlin-type deposit in lower plate units.

“Coyote is located at the intersection of projected Carlin Trend faults and the Coyote NE Fault. Surface geology is upper-plate Ordovician Vining Formation, which is likely underlain by the Roberts Mountain thrust and lower plate Paleozoic carbonate rocks – common hosts of Carlin-type deposits.

Fremont has identified broad areas of chalcedonic breccias and siliceous alteration on surface at Coyote, frequently associated with concealed gold mineralization in the Carlin Trend, and sampling has defined a large arsenic-in-soil anomaly. Arsenic is the most important pathfinder for gold in Carlin-type deposits.”

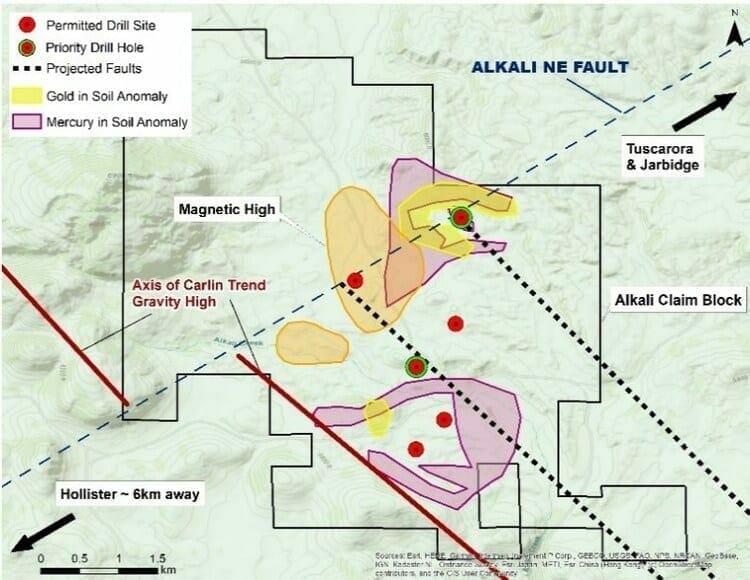

North Carlin – Alkali claim block targets

Alkali is located at the intersection of projected Carlin Trend faults and the Alkali NE Fault, a northeast-trending structural corridor that hosts Hollister to the southwest and Tuscarora and Jarbidge to the northeast (map below).

Significant deposits are often found at the junctions of these dominant geological structures.

The Alkali NE fault cuts through a 1,500 meter by 2,000 meter magnetic high and coincident gold-mercury soil anomalies that occur along the eastern flank of the magnetic high.

This is data stacking at its best—the correlation between geochemical and geophysical anomalies suggest the presence of gold mineralization beneath the alluvial cover.

“The magnetic high at Alkali may indicate an intrusive body at depth. Magnetic highs representing intrusive bodies coincident with Carlin-type deposits can be found at Gold Standard Venture Corp.’s Railroad-Pinion project at the southern end of the Carlin Trend. They are also known to be associated with epithermal deposits at Hollister and Tuscarora.”

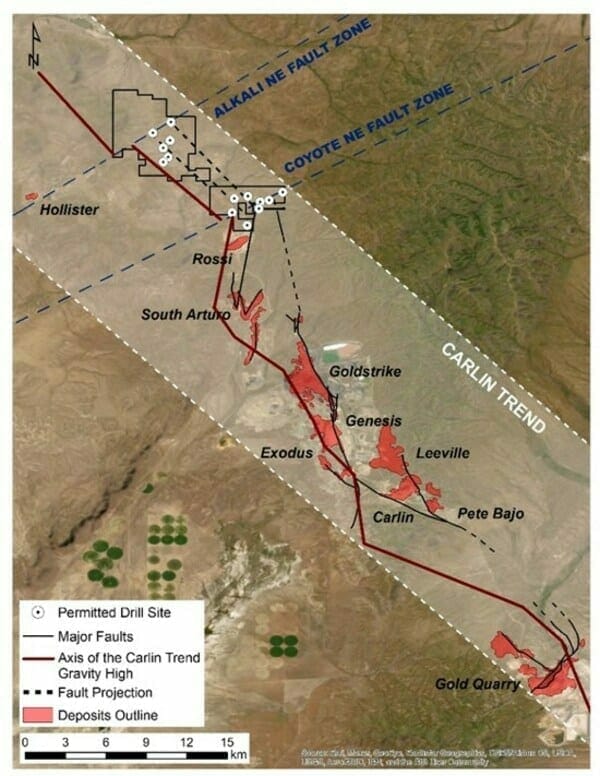

North Carlin highlights (as per this Jan. 13th press release):

- 100% owned by Fremont, North Carlin is over 42 km2 in size and is comprised of three claim groups (Alkali, Coyote, and Rossi) located at the northern end of Nevada’s prolific Carlin Trend;

- The Carlin Trend is one of the richest gold mining districts in the world having produced over 84 million ounces of gold since the early 1960s(1); Nevada Gold Mines‘ Carlin Complex hosts 30 million ounces of gold in the measured and indicated category(2);

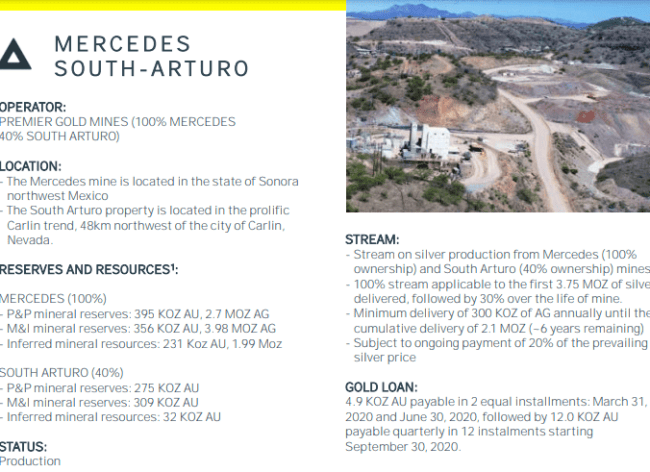

- North Carlin is approximately 6 km north of and on-strike of Nevada Gold Mines/Premier Gold Mines’ South Arturo mine, where recent drilling intersected 39.6 metres of 17.11 g/t gold(3), and 12 km northwest of Nevada Gold Mines’ Goldstrike mine, which hosts 11.1 million ounces gold in the measured and indicated category(2). The western edge of the Project is approximately 6 km east of Hecla Mining’s Hollister mine;

- Fremont has identified several priority drill targets at North Carlin based on soil geochemistry, gravity, and magnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend (map below);

- The Company has permitted 14 drill sites at North Carlin and plans to drill a minimum of three holes, totaling 1,500 meters, in a reverse circulation drill program.

1 Muntean, J.L. 2016. Nevada Bureau of Mines and Geology Special Publication MI-2014

2 Carlin Complex Technical Report (March 2020)

3 Premier Gold Mines Limited news release dated September 21, 2020

“We have developed a number of compelling drill targets in an underexplored area of the Carlin Trend,” said Blaine Monaghan, CEO of Fremont. “This is an excellent geological setting for the discovery of a major gold deposit.”

I don’t need to tell you what a significant new Carlin discovery would do to the market cap of a company like Freemont (current mc = $9.22M).

Baru Gold (BARU.V)

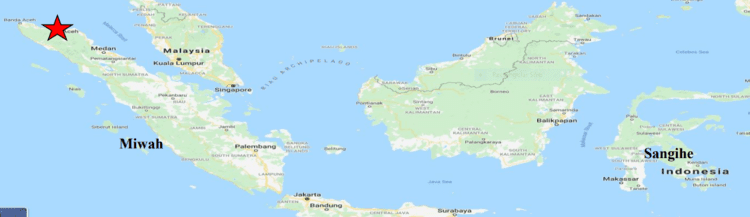

Baru controls two highly prospective Indonesian based properties in its project portfolio—Sangihe and Miwah.

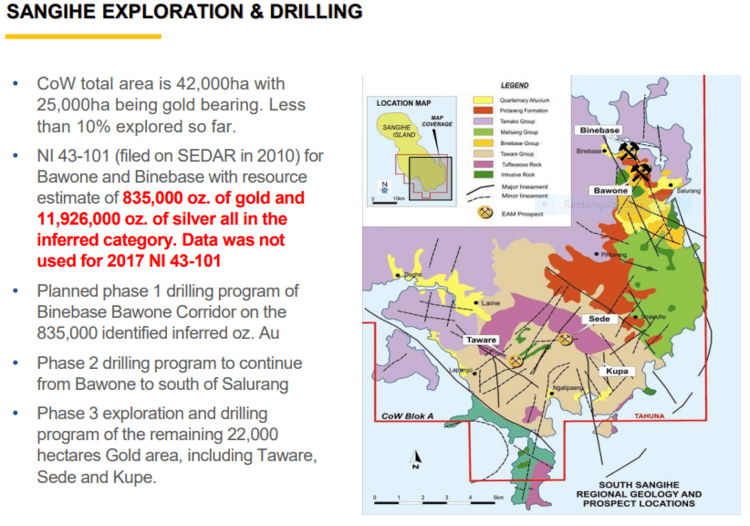

The Sangihe Gold Project consists of 42,000 hectares covering the southern half of Sangihe Island, located between the northern tip of Sulawesi Island (Indonesia) and the southern tip of Mindanao (Philippines).

Baru has a 70% working interest in the project—three Indonesian companies hold the remaining 30%. Baru, with its seasoned team of mine builders and rock kickers, is the project operator.

Sangihe is being fast-tracked to production and could begin cash-flowing as early as Q2 of 2021.

Baru management has its sights set on a modest heap leach production scenario at Sangihe.

Stage One of the Sangihe mine plan will see the extraction of roughly 1,000 ounces of gold per month when the production facility is fully operational (the Company has plans to scale the project higher).

Estimated all-in costs are expected to ring in at less than $700 per ounce.

If you factor in current gold prices at ~$1,850 per oz, simple math sheds light on some compelling economics.

This cashflow will allow the Company to self-fund exploration across its extensive land base, augmenting the current ounce count.

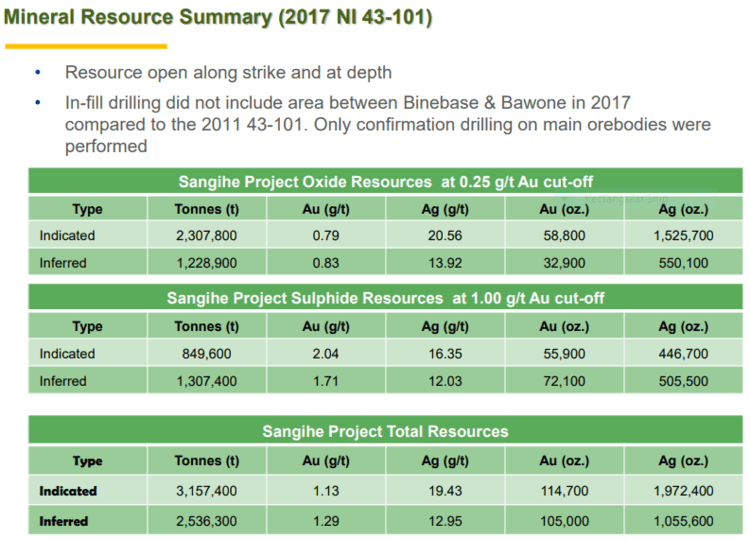

The resource slated for production includes >266,000 gold equivalent (AuEq) ounces in the Indicated & Inferred categories.

This resource represents only a fraction of what lies in the Sangihe’s subsurface layers.

Between Binebase and Bawone (map below, top right) lies an Inferred resource of 835,000 oz. of gold and 11,926,000 oz. of silver.

A planned phase one drilling campaign along the Binebase-Bawone Corridor will put these additional ounces into play.

Highlighting Binebase’s exploration upside, previous probes with the drill bit tagged the following values:

- Hole BID-14 tagged 96.2 meters of 1.30 g/t gold, 48.25 g/t silver and 0.05% copper from surface (including 42.0 meters of 2.67 g/t gold, 86.38 g/t silver and 0.09% copper from 3.0 meters depth);

- Hole BID-15 tagged three separate intervals: 62.0 meters of 2.00 g/t gold plus 45.5 meters of 1.98 g/t gold plus 8.5 meters of 2.28 g/t gold.

All told, there are 25,000 geologically prospective hectares that geologist Frank Rocca—a former Barrick man—sees the potential for at least 2,000,000 ounces of Au (less than 10% of the region has seen any modern exploration).

The pace of Sangihe’s development has been hampered by the pandemic, to a degree, but management is still making progress on multiple fronts.

On Jan. 7th, Baru inserted the following headline to its newsflow:

BARU GOLD RECEIVES APPROVAL FOR PT TAMBANG MAS SANGIHE WORK PLAN & BUDGET AND GRANTS OPTIONS

Regarding this RKAB approval, Baru’s CEO, Terry Filbert:

“While the Company awaits the upgrade of our licence to production status, this approval demonstrates strong support and commitment to the development of the project by the Indonesian government”.

On Jan. 13th, the Company dropped the following headline:

Baru Gold Corp Updates Land Acquisition at Sangihe Gold Project

Here, Baru updates stakeholders on the progress made by its legal team on the land acquisition process previously announced on August 22, 2020.

The land acquisition survey allowed the Baru team to identify areas of interest that will come into play as the project is pushed further along the curve.

“The land acquisition team of Martin Jati will now commence with the land acquisition of the Phase One Mining Area with the aim of finalizing the results from the survey in Q1 2021 and to pay for the land packages so construction can commence in the next month.”

CEO Filbert again:

“I am incredibly pleased with the progress that the Baru Gold team made as they continue to push forward in the acquisition of the mining pit, waste dump, access roads, and heap leach pad operations area for our Phase One mining land package. Administratively, this has not been easy with the second wave of COVID-19 sweeping through Indonesia. I commend the team for their focus and dedication and thank all parties who worked with our team for being diligent on our filings and for being creative in facilitating virtual meetings during the current pandemic situation in Indonesia.”

After checking in with CEO Filbert yesterday eve, I came away with the following insights:

Last week, the Indonesian Ministry of Energy and Mineral Resources re-opened its offices for business. During this brief period of activity, gov’t officials signed off on everything… except Sangihe’s Operational License. That final permit was expected to drop earlier this week.

Last Monday Covid related concerns forced them to close their doors for an additional two weeks.

These gov’t offices are scheduled to reopen on January 28th, and the Operational License should drop soon after, perhaps within days (the issuance of the license is a mere formality from what I understand).

Next week, Baru’s COO and the operational team are scheduled to arrive at the Sangihe project. This isn’t a visit—they plan to settle in lock stock and barrel. Engineering work will commence soon after.

The Company plans to hire 100 employees during the month of February—most of the positions will be construction related.

The Company is targeting early March to begin construction—roads, heap leach pads, the pit, etc—a process expected to run six weeks.

The Company is targeting mid-April to begin loading the pads with ore.

Mid-May is CEO Filbert’s target for the first gold pour.

These are reasonable targets and timelines, but be mindful that the pandemic could impact the pace at which things progress should it blow out of control.

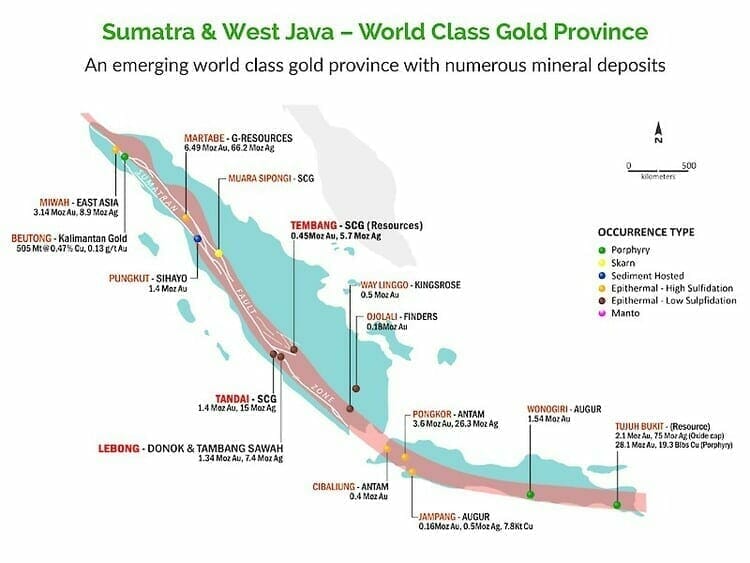

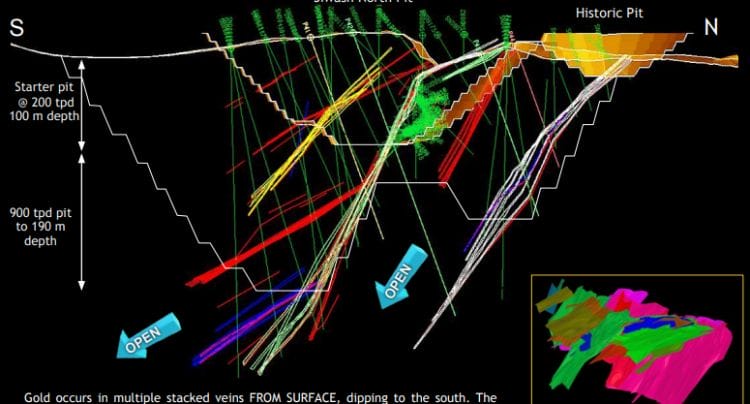

Before leaving Baru, the following slide pertains to the second property in the Company’s project pipeline—Miwah.

Miwah is a high-level, high sulphidation epithermal gold prospect.

The project, located within a Protected Forest Reserve, currently boasts a resource of 3,140,000 ounces of gold.

The deposit is open along strike, across width, and at depth.

The ‘Protected Forest Reserve’ status that currently shelters the project will be lifted once local stakeholders are confident that this crew is the real deal… that the Baru team are serious and responsible project developers and operators.

We stand to watch.

END

—Greg Nolan

Full disclosure: all of the companies featured in this roundup enjoy a marketing relationship with Equity Guru. We own stock in all the companies featured above. Color us biased (do your own due diligence).