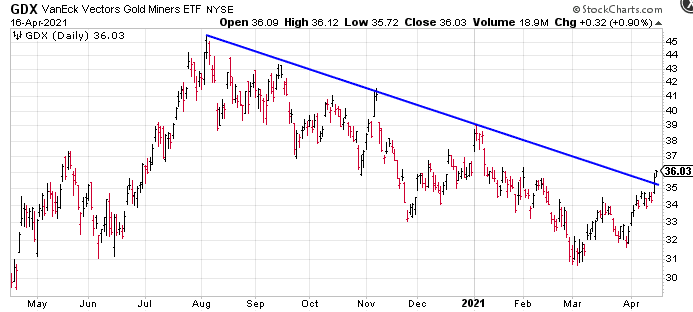

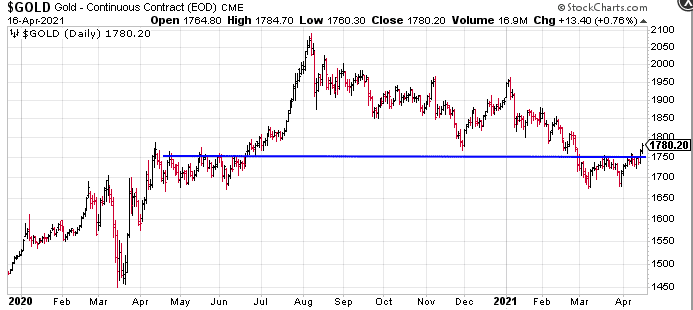

In a recent Guru offering, we noted how the $1850 level in gold—a level we suspected of being surveilled by a whole universe of traders—had turned into a front line in the brawl between bulls and bears.

The above chart shows a bear trap (the late November-early December dip) and subsequent charge through $1850 resistance.

Base metals have also been buoyant. This copper chart is one of my favorites…

There’s a wide range of opinions regarding where commodities are headed next. I certainly have mine, particularly where precious metals are concerned.

Sifting through previous offerings on the subject, I found this bit of soothsaying in a December 2019 piece titled Gold – the time is nigh.

From a fundamental point of view, the backdrop for the metal couldn’t be more favorable: plummeting bond yields, negative interest rates, pervasive geopolitical risk, equity valuations stretched waaaay too far, are all gold friendly.

It’s difficult to imagine a scenario where gold won’t outperform most other asset classes in 2020.

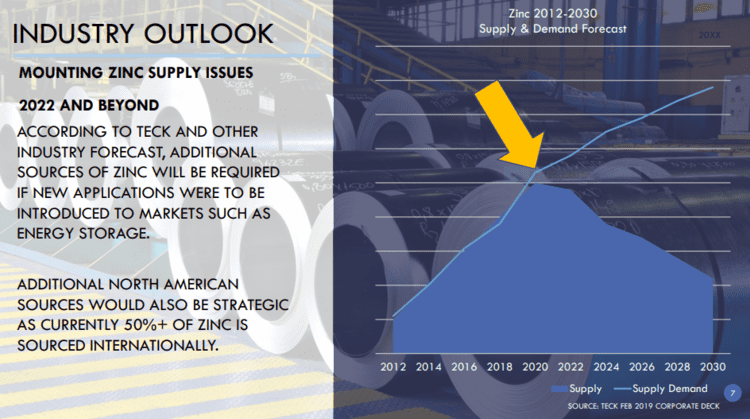

Some analysts believe these are the very early innings of a long term structural bull market—a commodities supercycle if you will.

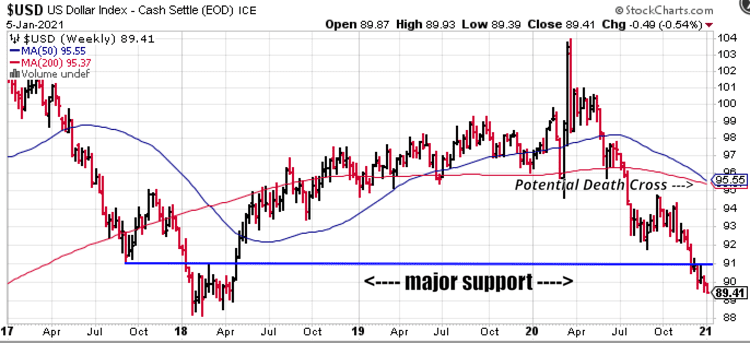

Though some of the underlying (commodity) supply-demand dynamics are compelling, the recent weakness in the US Dollar is at the center of much of this recent price strength (chart below).

Aside from the breakdown of multi-year support (horizontal blue line), a death cross—a widely recognized technical chart pattern indicating the potential for a major selloff—appears to be setting up in the moving averages…

Here, the 50-day moving average (blue line) looks to be on the verge of crossing over the long-term 200-day MA moving average.

A healthy dose of skepticism is best applied when sizing up these technical patterns. Alone, they are meaningless IMO. But when additional (supportive) fundamentals and technicals lean in the same direction, they gain validity.

Moving along…

Blue Moon Zinc (MOON.V)

- 119.55 million shares outstanding

- $8.37M market cap based on its recent $0.07 close

As the name suggests, Blue Moon has zinc in its crosshairs.

Like the other base metals, this blue-silvery galvanizing metal has been rather lively of late.

The following is a 10-month chart, courtesy of the London Metal Exchange…

An interesting real-time note: while gold, silver, and copper are off 2.4%, 2.5%, and .1% respectively, zinc is up 1.0% on the session so far today.

The following supply-demand chart was pulled from the Company’s pitch deck, slide # 7…

The flagship

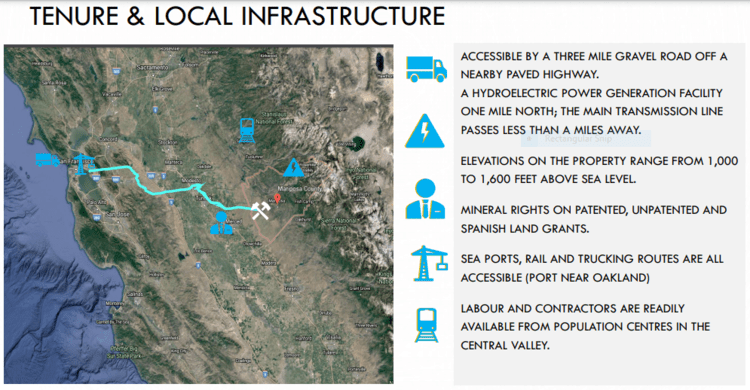

The Company’s wholly-owned, advanced stage Blue Moon project, an underground polymetallic deposit located in east-central California in the Mariposa County foothills, currently bears flagship status.

I know what you’re thinking: California? Is it even possible to build a mine there this day n age?

Fair enough. In the Fraser Institute’s most recent Investment Attractiveness Index, California is ranked pretty far down the list. But mines do get built. Example: Soledad Mountain, a gold and silver producer in Mojave, Kern County, California.

Golden Queen received their state operating permits in 2014 and development work on Soledad Mountain began soon after. Today Golden Queen utilizes conventional open-pit mining methods, cyanide heap leach, and Merrill-Crowe processes to recover gold and silver from crushed, agglomerated ore.

Perhaps California is best characterized as a responsible mining state?

Taking a closer look at the state’s permitting process, I discovered that the local county can elect to become the lead agency for permitting mine development.

To say Mariposa County is mining-friendly might be a bit of an understatement.

The region is steeped in mining history.

It all began in the mid 19th century when miners settled the area, panning the streams, chasing the gold-rich veins underground.

Bullion Street, Silver Bar Road, Gold Creek Lane, Mount Bullion Ridge Road, Gold Leaf Drive… these are just some of the thoroughfares in Mariposa town. Mining has deep roots here.

In a community where meaningful employment is difficult to come by, mining’s high-paying jobs would be a welcome economic benefit.

My thinking: if Soledad Mountain, a cyanide consuming open-pit in close proximity to Los Angles, was able to ease its way through the permitting process, Blue Moon’s zinc project—an underground scenario with a (potentially) modest environmental footprint—should be a walk in the park, comparatively.

Having the locals onside is a weighty consideration.

So is a project’s accessibility and proximity to infrastructure.

Hecla (HL.NYSE) first mined the property back in the 1940s. Production was roughly 55,656 tons grading 12.3% zinc, 0.36% copper, 0.48% lead, 3.75 ounces per ton silver, and 0.062 ounces per ton gold.

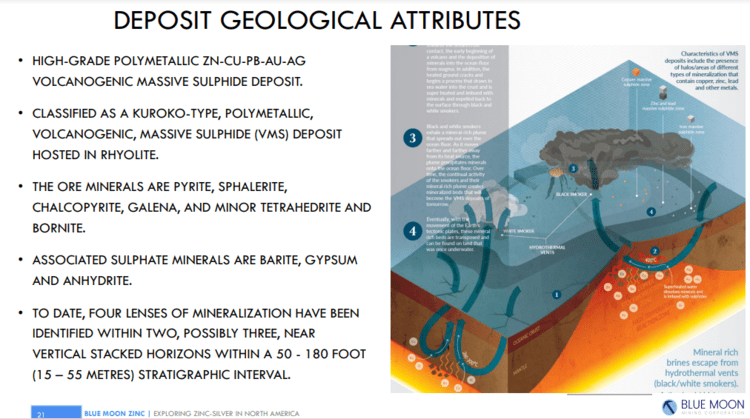

This is a volcanic massive sulphide setting—a polymetallic Zn-Cu-Pb-Au-Ag VMS—Kuroko-type—deposit.

As readers of these pages may already know, VMS deposits typically occur in clusters or pods.

The extent of Blue Moon’s mineralization and alteration suggests they may be tapping into a large system.

The resource

Blue Moon’s current NI 43-101 mineral resource stands at 7.79 million tons with a zinc equivalent grade of 8.07%. This works out to 771 million pounds of zinc, 71 million pounds of copper, 300,000 ounces of gold, and 10 million ounces of silver, all in the Inferred category.

The real speculative appeal here, IMO, is the exploration upside in Blue Moon’s subsurface layers.

Example: back in early 2019, the Company tagged the following values:

- 9.35 meters grading 30.3% zinc, 1.7% copper, 1.67 g/t gold and 71 g/t silver for a zinc equivalent grade of 36.8% (all within a broader interval of 36.5 meters grading 9.45% zinc, 0.58% copper, 1.1 g/t gold and 42.9 g/t silver for a zinc equivalent grade of 12.61%)

Additional high-grade hits include:

- 7.46 meters grading 25.6% zinc, 0.9% copper, 0.7 g/t gold, and 17 g/t silver (28.5% ZnEq)

- 19.58 meters grading 8.4% zinc, 0.5% copper, 1.2 g/t gold, and 83 g/t silver (12.4% ZnEq)

The deposit is open at depth and to the south. Extensions to the various zones—West, Main, and East—have yet to receive a proper probe with the drill bit.

Blue Moon’s mineralization can be traced for over 900 meters.

Metallurgy

The one facet of exploration and development that can trump all others—just ask any seasoned mining man (or woman) in this arena—is metallurgy.

Metallurgy is the science (some prefer the word ‘art’) of extracting valuable metals from their ores and modifying them for their intended use.

Companies developing past producing assets are at an advantage as historical production records often provide invaluable insights into the character of the rock and consequent economics.

I always like to get a feel for a project’s topography. Gently sloping contours, as opposed to steep and treacherous terrain, makes life easier for mine builders.

This drone footage gives you a very good sense of the Blue Moon’s lay…

The other property in Blue Moon’s project pipeline is Yava, located in the Mackenzie Mining District of Nunavut.

We’ll take a closer look at Yava, its historical resource, and its proximity to Glencore’s Hackett River project along the Hackett-Back River greenstone belt another day. Until then, the following excerpt from the Company’s project page offers a preview…

The north end of the Hackett-Back River greenstone belt hosts the Hackett River base and precious metal resource currently being held by Glencore. Glencore (Xstrata) paid $50 million for the Hackett River project. According to Xstrata’s December 31, 2012 report, Hackett River’s resource estimate includes 25 million indicated tons of 4.2% zinc, 0.6% lead, 0.5% copper, 130 g/t silver and 0.3 g/t gold as well as 57 million inferred tons of 3.0% zinc, 0.5% lead, 0.4% copper, 100 g/t silver and 0.2 g/t gold.

Management

Blue Moon management appears solid. And importantly, they have skin in the game—officers and directors own ~20% of the outstanding common.

Speaking of management, on Jan. 5, 2020, the Company trotted out a new hire:

Blue Moon Appoints Jonathan Gagne to Board of Directors

Patrick McGrath, Blue Moon’s CEO:

“On behalf of the board, I welcome Mr. Gagné to the board of directors. Mr. Gagné’s engineering, feasibility and construction experience will be invaluable to Blue Moon as it advances its projects. Of particular relevance is Mr. Gagné’s involvement in numerous zinc projects with Glencore Zinc, which owns the Hackett River deposit in Nunavut and is adjacent to the Company’s Yava Property. Hackett River is one of the largest undeveloped zinc-silver projects in North America and we believe Mr. Gagné’s extensive experience with zinc projects and the Canadian Arctic, will add significant value to Blue Moon.”

Final thoughts

To push Blue Moon further along the development curve, the Company needs to drill. A significant $1 to $2M raise will likely be the next major headline to drop.

We should see an aggressive drilling campaign in Q2 of 2021.

END

—Greg Nolan

Full disclosure: Blue Moon is an Equity Guru marketing client.