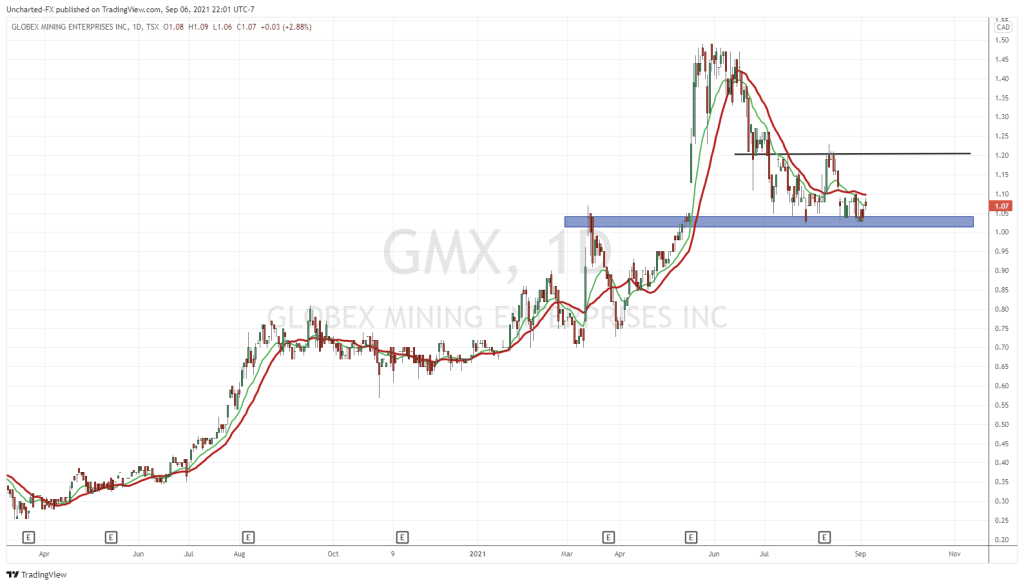

Globex Mining Enterprises Inc. (GMX.T) is an anomaly in the junior exploration arena. It’s been around for ages—decades. It has a mere 55 million shares outstanding (57.69 fully diluted) and there’s never been a roll back.

That’s a remarkable feat in this capital intensive sector where PPs rain down like hailstones amid a high-summer prairie downpour.

I know of companies that rolled back stock within their first year of trade (WTF?)

I know of companies that rolled back stock within their first year of trade (WTF?)

Globex truly is an anomaly in this Wild West of a sector. It’s also a project bank and incubator.

Management’s specialty is sourcing and acquiring high-quality projects in mining-friendly jurisdictions, advancing them through the application of good science (modern exploration techniques), and monetizing them via JVs, royalty agreements, and outright sales.

Intellectual output and boots-on-the-ground exploration carry equal weight at Globex Central.

Some companies take a stab at this business model, very few succeed.

On the subject of management, the following resume belongs to Globex CEO, Jack Stoch (as per the Directors and Senior Management link):

Jack is a major shareholder of Globex and is an experienced geologist with an entrepreneurial spirit, devoted to building Globex into a highly successful public mining and exploration company.

Following a stint with Noranda Exploration Ltd., Jack, in 1976, started acquiring and vending exploration projects, through his own consulting businesses, Jack Stoch Geoconsultant Services Ltd. and Geosol Inc. At one time, Jack was reported to be the largest private mineral rights holder in the Province of Quebec, Canada.

In 1983, Jack Stoch, gained control of Globex and has since amassed a mature exploration portfolio. He has attracted a knowledgeable and well-connected Board of Directors and has expanded the Company’s exploration, evaluation and mining team.

In 1972, Jack earned a B.Sc. in Geology from Sir George Williams University in Montreal, with additional graduate courses at McGill University. He was awarded the designation Acc. Dir., Accredited Director in 2007 by the Chartered Secretaries Canada and is a registered Professional Geologist in Quebec, Canada.

I’ve been studying people—scrutinizing management profiles—since I was a young punk (my old man was a homicide cop).

I’ve never seen a resume quite like Jack’s.

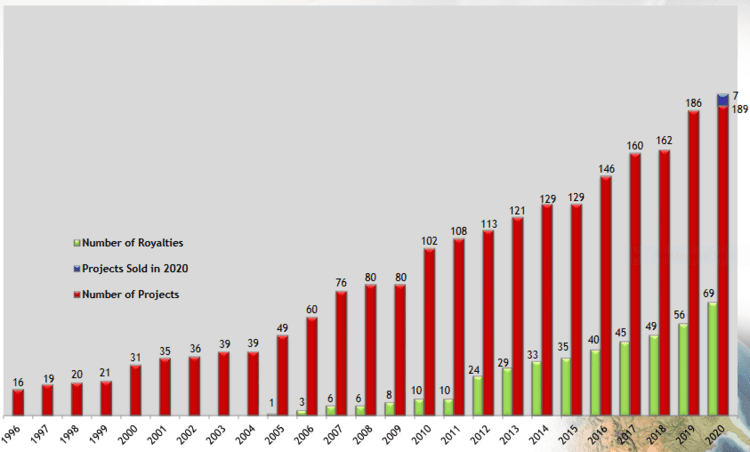

With a total of 189 properties in the Company’s project portfolio, 95 are prospective for precious metals, 60 for base metals, and 34 for specialty metals (lithium, manganese, scandium, and the like).

Breaking things down further, 69 of these properties have an underlying royalty controlled by Globex, three have been optioned out, and importantly, 54 have a mineral resource (historical or 43-101 compliant).

Remarkably, CEO Stoch has expanded Globex’s project portfolio over the decades with barely a pause—zero slippage.

Note the number of projects CEO Stoch monetized in 2020 (blue bar, far right), one of the strategies employed to preserve this enviable cap structure.

The following link offers a deeper dive into this (singular) junior entity:

Globex Mining (GMX.T) – an undervalued Project Bank, Incubator, Explorer, and Royalty Company

On December 22nd, Globex delivered the following update:

This update features a number of noteworthy highlights. Let’s walk through them, one by one…

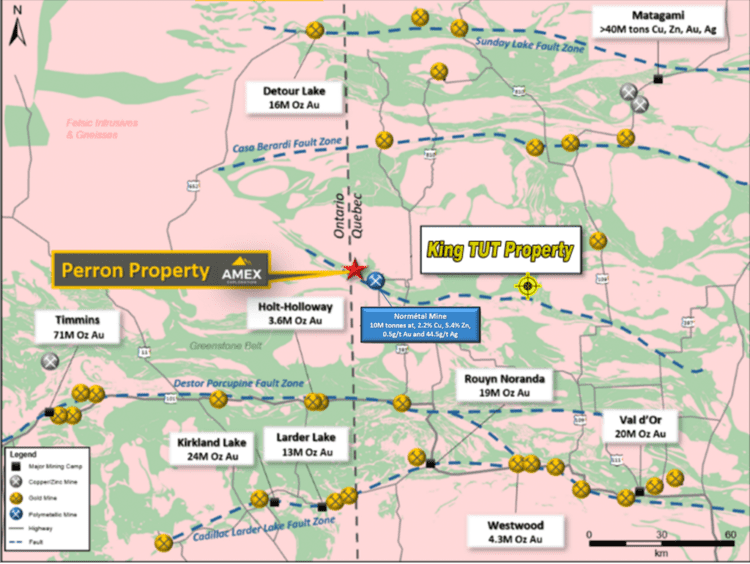

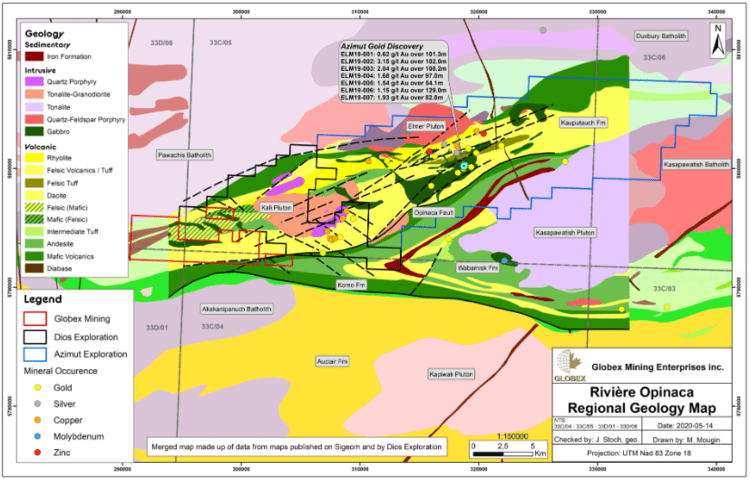

Globex engaged Novatem Airborne Geophysics to conduct a detailed (25-meter spacing) aeromagnetic survey over the Opinaca River gold property located on strike and to the southwest of Azimut’s (AZM.V) Elmer Property gold discovery.

- “The property covers 13 kilometers of the rock units that house the Elmer gold discovery and totals 65 claims including 4 separate claims to the north such that our 3431-ha land package also adjoins on both the south and northwest of Dios’s K2 gold target which Dios has just completed drilling.”

In a recent acquisition, subject to court approval, Globex acquired a permitted Silica Quarry in Wyse Township, Ontario, near the Quebec border.

- “Included in the purchase are an array of stackers, two 43-foot house trailers, a large hydraulic shovel, a generator and miscellaneous other equipment. The property has a large historical resource of high-grade silica grading in the range of +98% SiO2.”

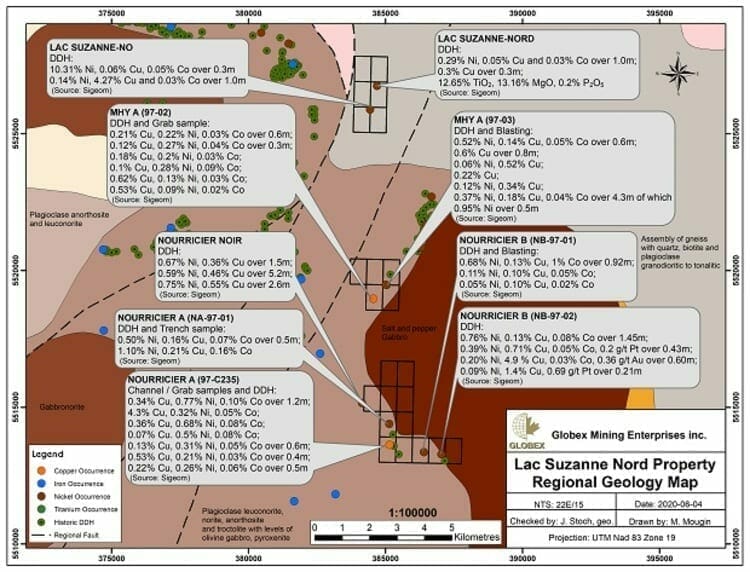

Globex optioned the Lac Suzanne Nord Ni-Cu-Co property to Enertourbe Inc. This 1,278-hectare project hosts numerous nickel, copper, and cobalt showings (in sulphides).

In keeping with CEO Stoch’s prospect-generator biz-model strategy, Globex signed Confidentiality Agreements (CAs) where due-diligence is currently being performed on a number of Company properties.

Data has been made available to the various parties and studies are ongoing.

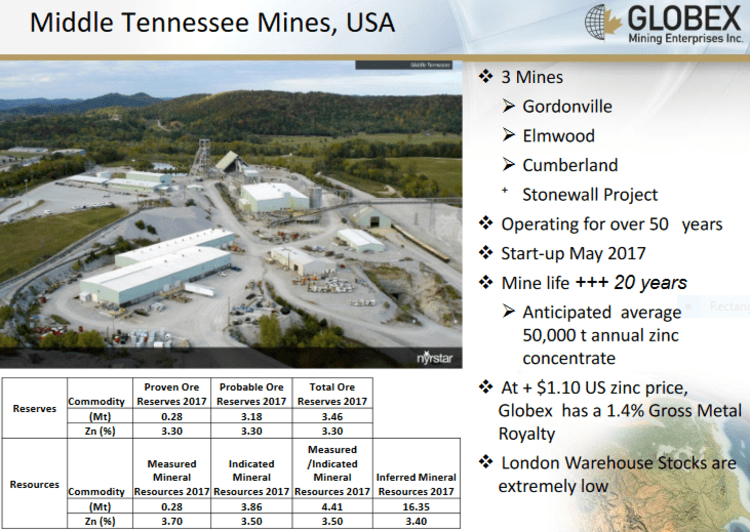

Highlighting the buoyant market for precious / base metals and the impact on revenue (yup, Globex is an earner), a rising zinc price is reflected in escalating royalty payments from the Mid-Tennessee royalty property operated by Nyrstar.

- “Payments currently have risen to over $100,000 per month and are expected to rise further as the zinc price continues to climb.”

Aside from the Mid-Tennessee royalty, the Company also books revenue from its property options. Example: Tres-Or Resources confirmed that a $200,000 option payment on the Fontana gold property will arrive on January 11, 2021.

This update goes on to state that various companies are active on the royalty front, including:

This update goes on to state that various companies are active on the royalty front, including:

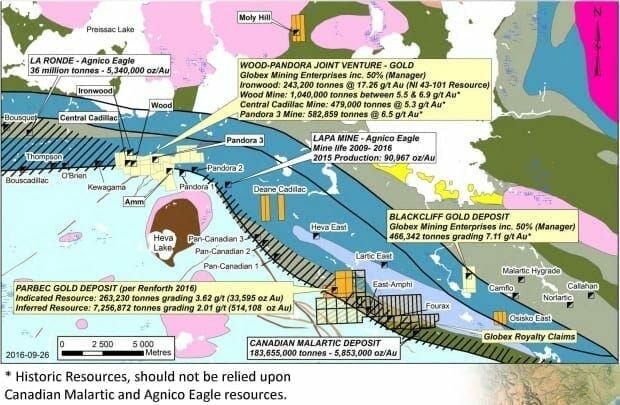

- O3 Mining (OIII) on the Nordeau East and West assets located east of Val-d’Or, Quebec;

- Tres-Or Resources and Kiboko Exploration on the optioned Fontana gold property;

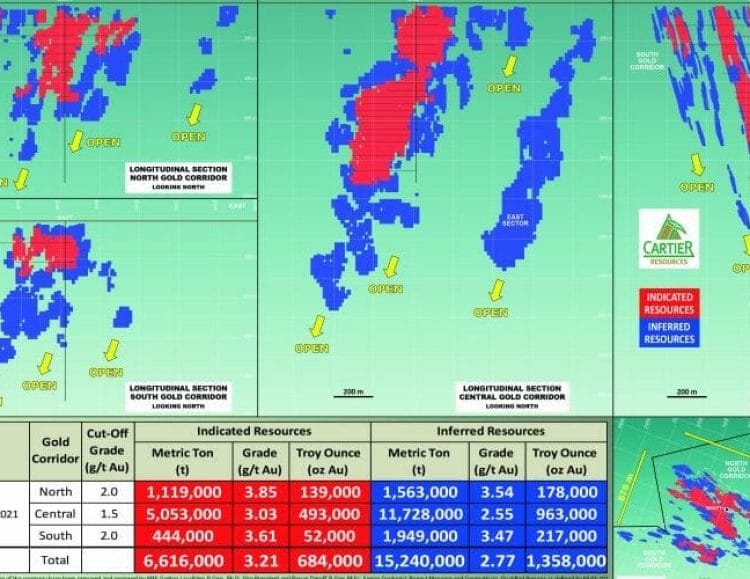

- Renforth Resources (RFR.C) on the Parbec gold royalty property—9,644 meters of a 15,000-meter drilling campaign were recently completed (phase-1 drill results are pending—a phase-2 campaign is set to commence next quarter);

- Radisson Mining (RDS.C) on adjoining claims where gold zones plunge into Globex’s Kewagama Gold Mine royalty asset (Radisson is currently drilling);

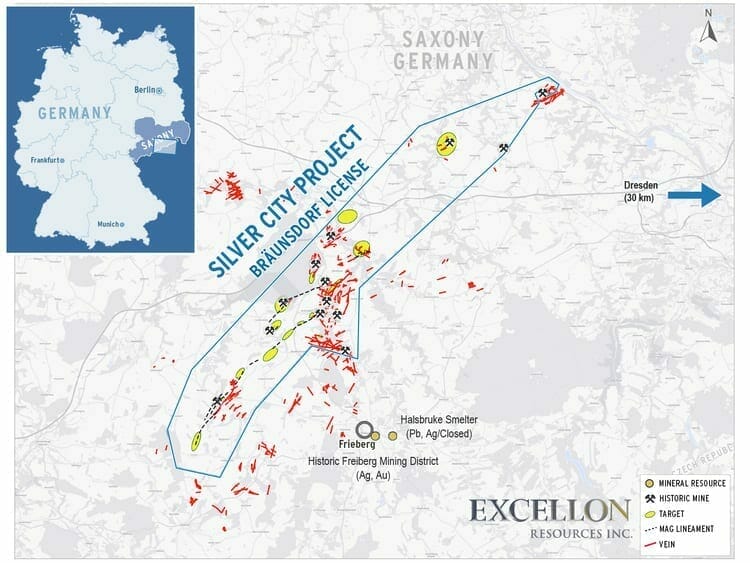

- Excellon Resources (EXN.T) on the Silver City option in Saxony, Germany where it’s completing 14-plus drill holes.

Continuing along the list of active royalty projects…

Continuing along the list of active royalty projects…

- Starr Peak Exploration (STE.V) is undertaking a magnetometer survey on the Normetal/Normetmar base metal mines royalty property, as well as surface sampling on the Rousseau and Lac Turgeon gold royalty properties;

- BMEX Gold (BMEX.V) is currently drilling off the Tut gold royalty property;

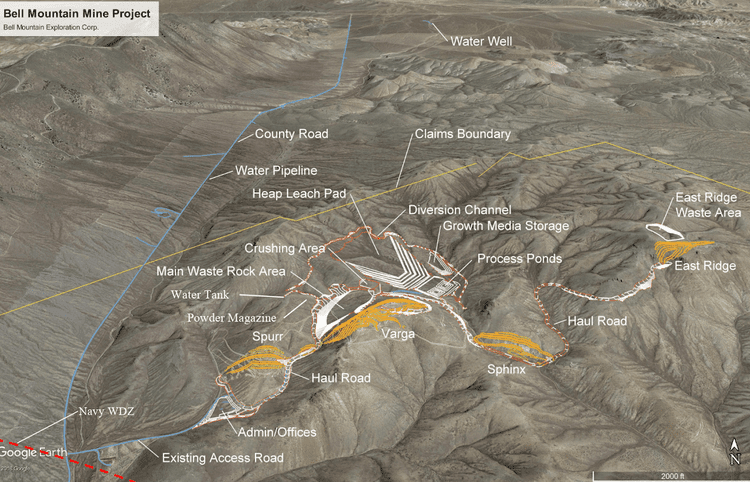

- Eros Resources (ERC.C) is undertaking permitting and engineering work to advance the Bell Mountain gold/silver property towards production;

- Nippon Dragon Resources (NIP.V) has started underground operations at the Rocmec-1 Gold Project;

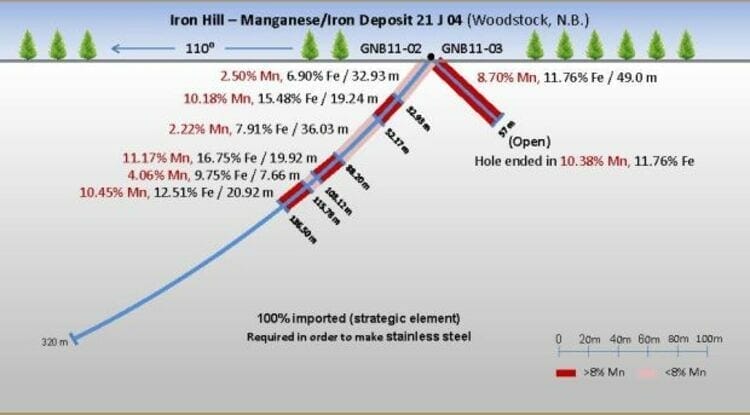

- Maganese X (MN.V) has recently completed 28 drill holes totaling 4,509 meters on Globex’s Battery Hill Manganese royalty property.

The Company is also gaining a better understanding of some of the more advanced-stage assets in its portfolio, generating 3D models on the following projects:

The Company is also gaining a better understanding of some of the more advanced-stage assets in its portfolio, generating 3D models on the following projects:

- the Francoeur Gold Mine;

- the Vauze polymetallic Mine;

- the Ramp Gold Mine;

- the Wrightbar Gold Mine;

- the Tarmac Gold Project (various gold zones);

- the Standard Gold Mine;

- the Lac Fortune Gold Mine;

- the Blackcliff Gold Mine, in partnership with Altai Resources (ATI.C).

Further, the Company has flown detailed aeromagnetic surveys over the following projects:

Further, the Company has flown detailed aeromagnetic surveys over the following projects:

- the Francoeur/Arntfield/Lac Fortune gold property;

- the Silidor/New Marlon Gold Mine property;

- the Standard Gold Mine property;

- the Blackcliff Gold Mine property;

- the Laguerre/Knutson gold property;

- the Courville, Venus, Randall, and Napping Dwarf properties;

- the McNeely lithium project.

Wrapping up this press release, the Company states that it has contracted Novatem Airborne Geophysics to scour additional properties, those next in line for a push along the curve.

Final thoughts

IMO, Globex deserves a re-rating. Its tight set-up, its revenue streams, its well-endowed project pipeline, its crew (three senior geologists, one mining accountant, one senior finance professional), and its latent discovery potential, check all of my boxes.

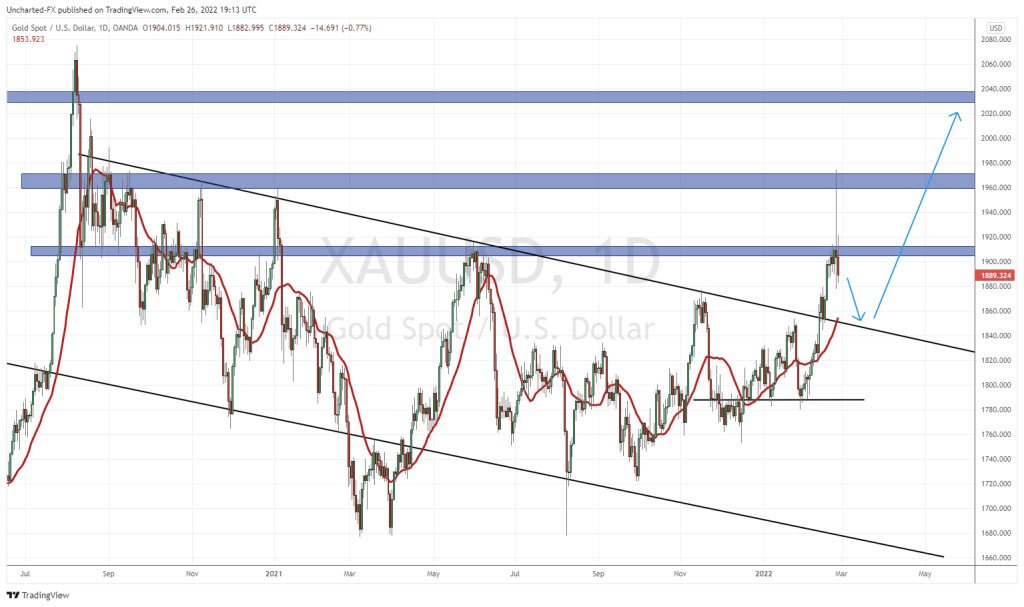

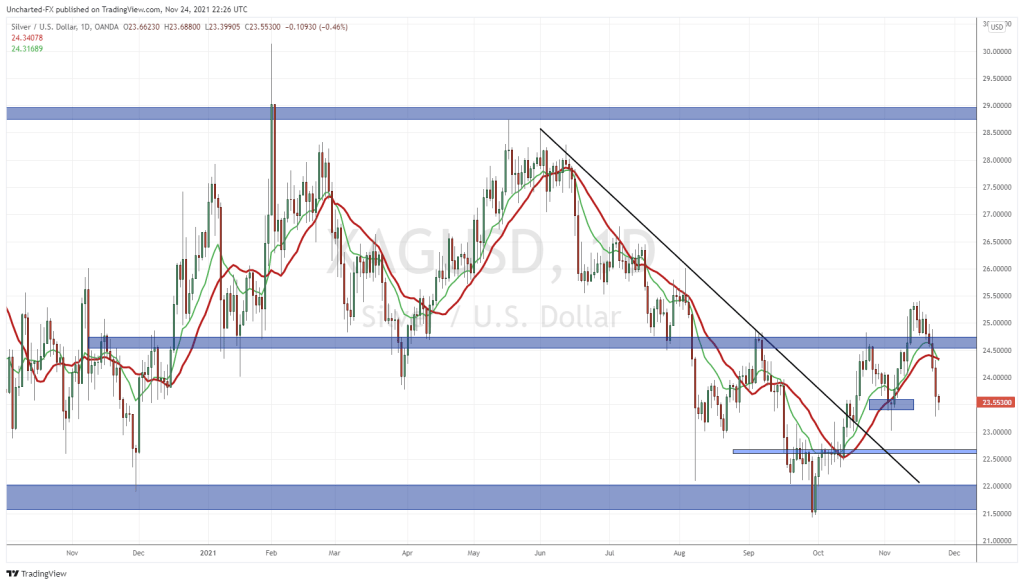

If (when) Gold finds a near gear and takes out its historic price highs, Globex’s risk/reward profile is bound to attract a much wider audience, from those in search of deep value.

For now, Globex is one of the junior arena’s best-kept secrets.

Globex also trades on the Frankfurt Stock Exchange under the symbol G1MN and in the US (OTCQX International) under the symbol GLBXF.

END

—Greg Nolan

Full disclosure: Globex is an Equity Guru marketing client.