The most successful Bitcoin mining companies have a delicate balancing act between amount of output and general size of overhead. Overhead, beyond the physical cost of the units involved in the mining, is usually measured in a relationship to the amount of cash required per wattage hour, usually measured in megawatts now, but sometimes venturing into terrawatt territory.

Riot Blockchain (RIOT.Q) most recent announcement is for an 8 megawatt pilot project they intend to use to determine the productivity to cost ratio for mining opportunities in Texas.

The pilot project is a group effort between Riot and two tech companies, Enigma Digital Assets AG and Lancium. The project’s focus is in evaluating Enigma’s immersion technology to increase mining productivity as well as Lancium’s Smart Response software for reducing energy costs.

Lancium Smart Response software gives data centers the ability to adjust their server electrical consumption based on price, frequency or ancillary service revenue. It’s functional on most Bitcoin mining ASICs.

“Bitcoin mining is about scale, low-cost infrastructure and ultra low-cost electricity. Enigma’s innovative solutions appear to offer a very meaningful improvement on installed cost and productivity. Lancium’s power-ramping and trading expertise perfectly complements this by delivering an innovative solution to provide the pilot project with low-cost, optimized electricity,” according to Michael McNamara, CEO of Lancium.

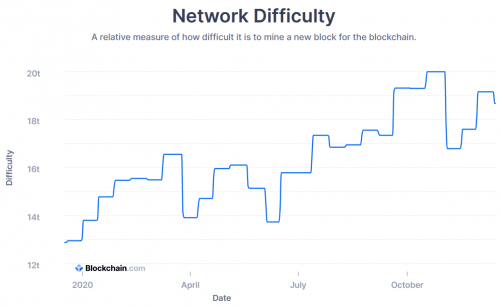

Bitcoin’s trading roughly at CAD$25K at the time of writing, which means that every time the block closes, the block reward is approximately $155K. The relative difficulty of mining combine factors such as amount of resources competing to mine fresh BTC, which changes every 2,016 blocks or two weeks based on the rate of total hash power consumed by the network. If competition slides off as companies bow out of the race, then the difficulty lowers.

That’s not the case right now as the chart indicates.

It’s getting harder to mine as the price increases, so companies need to find ingenious ways to lower their overhead. The major factors that go into overhead in Bitcoin mining operations are split up into two distinct ways: wattage hours to power the actual mining rigs, and electrical output to air conditioning to keep the rigs cool.

Some companies operate in colder climates and let mother nature do the second half of their job for them by flinging open the doors to the outside, but operating in a hotter climate doesn’t provide that option, so another method must be found. It gives companies doing business in arid climates like Texas something of a disadvantage over companies operating in Quebec or New York State, but evidently, part of this pilot project is in testing a solution.

“Our new mining modules are among the world’s most powerful, efficient and heat-resilient solutions for mining Bitcoin. Large economies of scale allows rapid ROI, and resilience to heat enhances operating performance in hotter climates, especially where powered with low-cost electricity. We are extremely excited to launch this relationship with Riot and Lancium,” said Jakov Dolic, co-founder of Enigma.

Lancium is providing 8 MW of power for the project, and the initial 3 MW will be dedicated to a Enigma immersion project to be used with S19 ASIC miners. Another 5 will be available for Enigma’s new immersion module solution, which is in final development and should be ready in early 2021. The new immersion module involves proprietary ASIC chips and a new cooling solution.

“We are pleased to announce the pilot project and look forward to advancing the Company’s relationships with Lancium and Enigma. Enigma’s immersion modules provide significant potential benefits and Lancium’s Smart Response software helps miners reduce their cost of power by being opportunistic in the local energy market. When combined, both technologies have the potential to reduce Riot’s bitcoin production costs, increase hashrates and significantly extend the life of the Company’s bitcoin mining ASICs,” said Jeff McGonegal, CEO of Riot.

They intend to get started in Q1 2021 and if the project is successful, Riot may try and expand on the pilot project in other cities.

—Joseph Morton