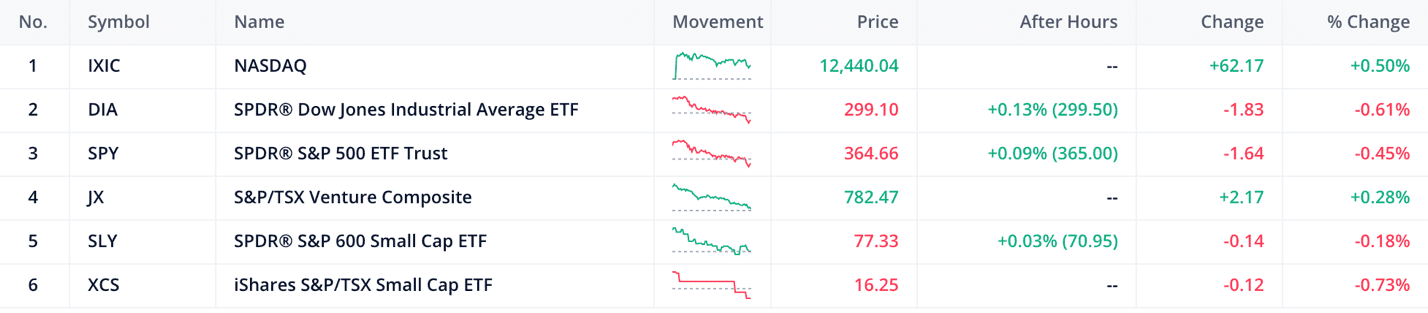

- The S&P 600 is down by 0.18% and the TSX20 by 0.73%

- The Canadian 10-year bond is up by 0.01% and the US 10-year bond by 0.01%

Today’s stock pick of the day is Hello Pal (HP.C), a Vancouver – based mobile platform company. The Company is the owner of the HPI Platform. The HPI Platform, which is a proprietary suite of mobile apps built on a blockchain-based messaging interface that focuses on social interaction, language learning, and travel.

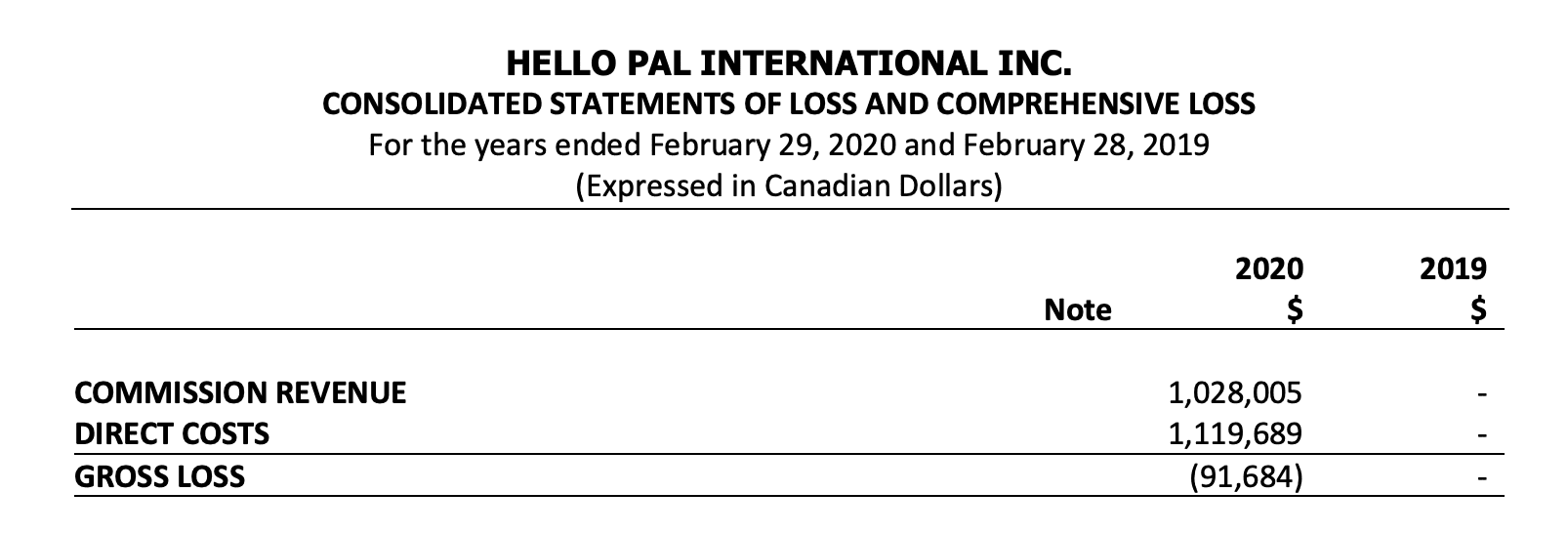

As of the 12 months ended February 29, 2020, Gravitas was able to generate a grand total of $1 million in revenue, utilizing an average of just below $-1 million in net tangible assets. They have negative cash flows from operations and a large amount of debt & liabilities ahead of the common shares.

The numbers used above are pulled from reports from10 months ago, and the last report that they published on their website was from last year(Q4 2019) If we’re basing sentiment solely off of financial, audited reports, there’s been nothing published that would breathe any new life into the company. So why has the market given them a fresh new coat of paint with a shiny $33 million dollar valuation?

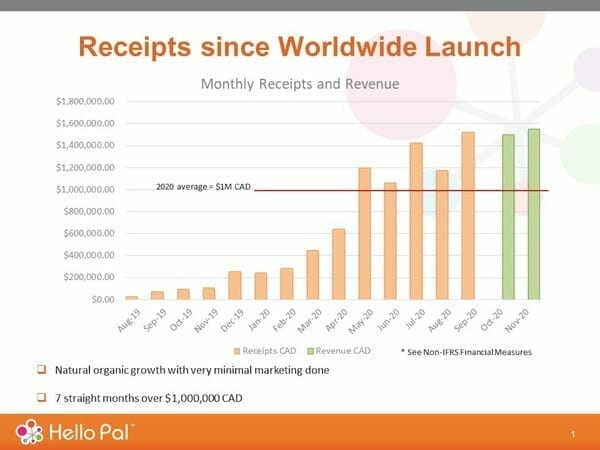

Marketing is the key here. The CEO announced today that they have broken their previous revenue record. It should be noted that this announcement isn’t paired with any independent audit financials. Of course, we take the CEO’s words at face value, because generally speaking, they won’t straight-up lie about their numbers (except for Luckin Coffee of course *coughs hard*). But maybe they’ll obfuscate a little because the revenues are of course only half of the story.

Hello Pal’s November revenue at $1.55-million

2020-12-10 09:57 ET – News Release

Mr. K.L. Wong reports

HELLO PAL ANNOUNCES NEW RECORD OF $1,550,000 IN REVENUE FOR NOVEMBER 2020

Hello, Pal International Inc. achieved over $1,550,717 (7,869,088 renminbi) in revenue for the month of November.

Since February, Hello Pal has grown revenues by at least 55%, and by what seems like a mere coincidence the common stock up 61% on this news. This kind of rapid market reaction should always be viewed with skepticism at the peak of a bull market. And today we will try to be sensibly critical skeptical by doing a business valuation that is not influenced by the current market price.

The best starting point is trying to get a better understanding of what the business actually does.

The HPI platform generates all of its revenue from its live-streaming services. The live streaming allows Hello Pal users to broadcast themselves to other users in real-time and receive virtual gifts which they can redeem for cash. The company generates revenue from taking a partial sales commission off of virtual items sent through their proprietary platform to streaming hosts.

As of October 2020, the platform has over 5 million registered users from over 200 countries and regions. Management believes this rapid growth is due to the user-friendly technology, allowing easy learning by the user and the platform’s integration with blockchain technology that enables payments via the platform.

They break down the process into two easy stages each with 5 steps :

The Live Stream Stage

Step 1: Set up a free account and start a live stream using the interface

Step 2: Fill in some details and then click “Start Livestreaming”

Step 3: The host receives Gifts in the Livestream room from appreciative viewers

Step 4: After the Livestream ends, the total Charm value will be displayed to the host.

Step 5: The Charm value can be used to withdraw cash or exchange for Coins.

Seems simple enough! As the host you receive any of the net income generated from the stream; that is, after commission paid to Hello Pal.

The next stage is the withdrawal of the money:

Step 1: In the bottom menu, go to Me (Settings).

Step 2: On the Me page, select My Earnings.

Step 3: From the top, tap on the Withdrawal button.

Step 4: Enter the withdrawal amount, choose a payment method, and tap Confirm Withdrawal.

Step 5: Enter the required information, press Withdraw Now and wait for the approval. This takes about 2-3 business days.

On top of this, they have value-added services like the Moments Features that allow people to share ‘moments’ of their lives, in the form of pictures, short videos, audio, and text.

They also use Paltos – Blockchain-Utility Tokens that can be exchanged by users to exchange for services. Simultaneously, active posters can be reimbursed in Paltos, as gifts from other users. And finally, Hello Pal has a simple Chat feature.

Now that we know more about what Hello Pal does, we can see that the technology behind the business is important for its long-term success. Knowing this, it’s important to look at how expensive it would be to maintain the platform and maintenance, as well as any other software needed to stay competitive in the sector.

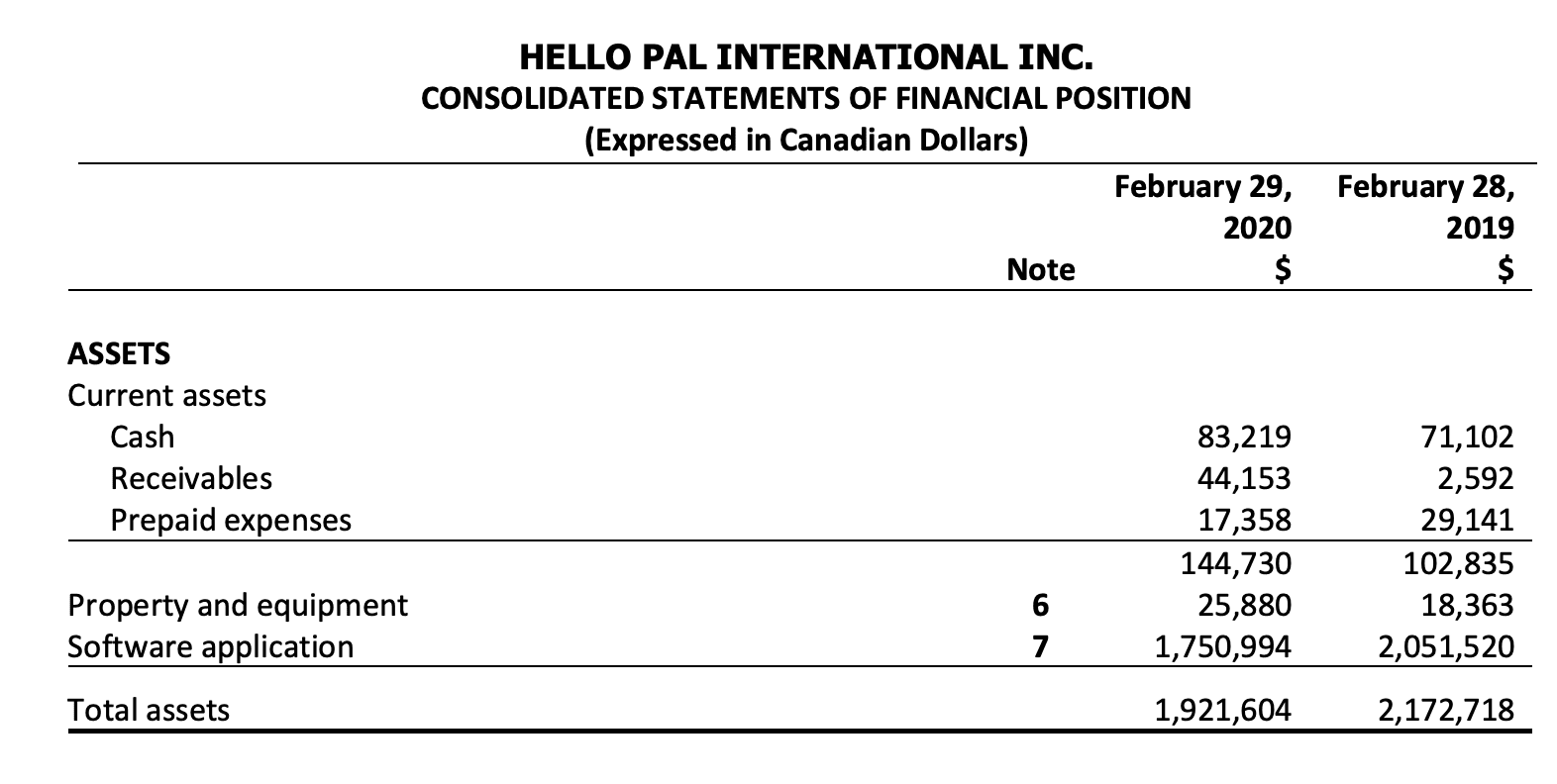

The extract above from the balance sheet shows that the software is close to 90% of the “total assets net of cash and other receivables”. This is pretty significant and further emphasizes the importance of technology to the profitability of the business.

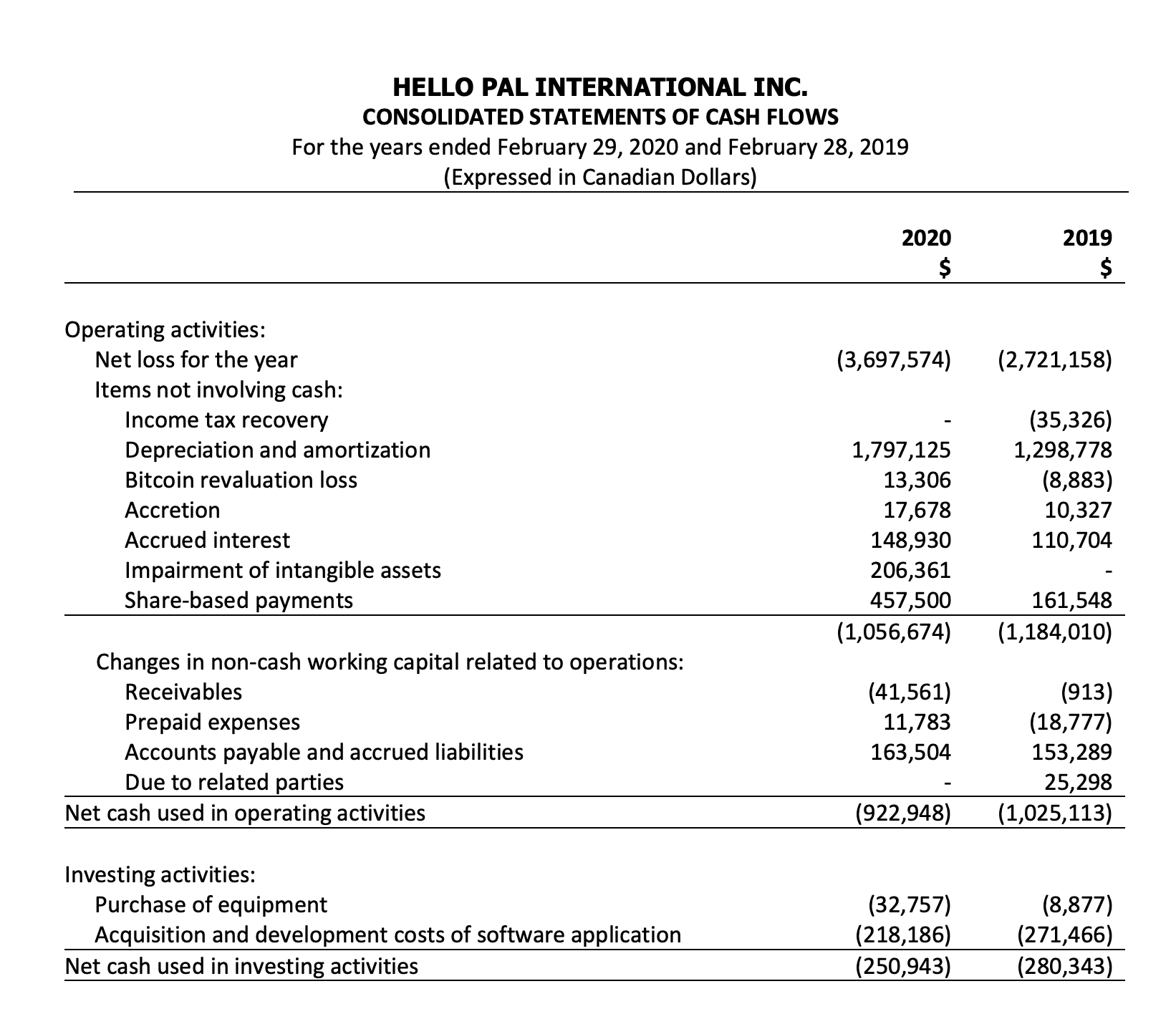

Using the same balance sheet, we know that the assets have depreciated by an average of $1.5 million in the last two years. To maintain the depreciated assets Hello Pal needs to do two things. The first being spending money internally to improve and maintain the software and the second could be through external software purchases or business acquisitions.

In the last two years, they’ve spent an average of $250 thousand on equipment and software related capital expenditures. is well below the average depreciation of the assets over the last two years; this means that their software is depreciating in value much more than the value of what they’ve reinvested into the technology. If this is to persists, the software might become obsolete and cause the business to realize a large impairment loss. This impairment loss can be thought of as a reduction in the book value of the business

Since they are not producing positive cash from operating activities at this moment it is really important that the management team has the experience and the foresight to continue deploying capital in productive ways. Leading this team, we have KL Wong who is the Founder, Interim Chief Executive Officer, and Director.

Mr. Wong graduated with a law degree from Cambridge University and started off his career with prestigious international law firm Clifford Chance in the UK and Hong Kong. He then worked in senior management positions at Chinadotcom Corporation and later at Softbank International Investment, before eventually founding BrillKids, an online platform based in Hong Kong that helps with early child development.

Mr. Wong and his team have over 30 years of experience in many industries, but this experience has not necessarily translated into shareholder value. It’s however important to note that over the last five years, the stock has outperformed the general market by returning 886%.

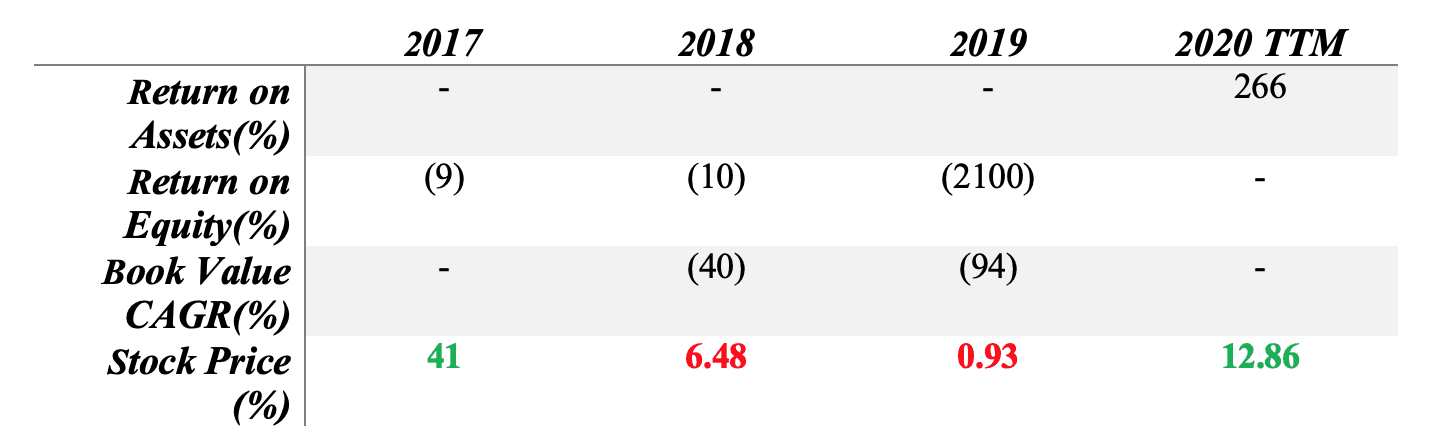

While the performance measure of +886% is impressive, when the fundamentals are broken down into individual years, the story is different. The return on assets has been negative, until recently where they have returned over 266% with the invested assets. This performance is amazing when taken on its own. However, when put into context by getting contrasted with Hello Pal’s return on equity (which has plummeted by 2100%), it isn’t so great. Book value has followed the same fate by decreasing by a total of 94% in 2019.

This could be seen as a misuse of shareholders’ funds by management. By this, I mean that instead of investing in profitable assets with high gross margins, management might be investing in assets that have a low internal rate of return, which can be a drag on the intrinsic value of the business over time. Although sales are increasing, the net worth of the business has done the exact opposite.

This misuse of funds does not fare well for the valuation of this common stock, but it does not stop us from doing a discounted cash flow and a book value analysis. These two methods would give us a range of what we think the intrinsic value of the stock should be.

Our starting point will be the calculation of tangible book value. We start by taking the total tangible assets and subtracting the liabilities to find an equity value. Once we have the equity value, we divide this by the total number of shares outstanding. From this simple formula, we get a value of $(0.009) per share.

Next, we have the discounted cash flow model to build. To do this, we necessarily have to make an assumption about the future of the business and the predictability of its future cash flows, as well as some miscellaneous timelines of expected business decisions and macro-effects of the economy. By looking at the general trend of earnings (losses) over the last five years, we know there’s about a 70% chance of the business returning $(0.01) per-share earnings in 2021. The investor needs to be compensated for the risk of inflation and loss of capital. To compensate for this risk, we will discount the cash flows, using long- term government bond return rates as our comparative risk-free rate. With these assumptions in place, over the next 10 years, we expect the business to have an enterprise value of $(0.066) per share.

These negative values should not come as a shock as we noticed a weakness in the competitive advantage of the firm. Although revenues are increasing at a rapid rate, we can expect profit margins to decrease, partially offset by increases in corporate efficiencies.

With a current stock price of $0.29 per share, we can conclude on a conservative basis that the business might be overvalued. The reason behind this overvaluation could be argued for many different ways as it is with most securities. But this one seems to be an ‘obvious’ overreaction to the good news.

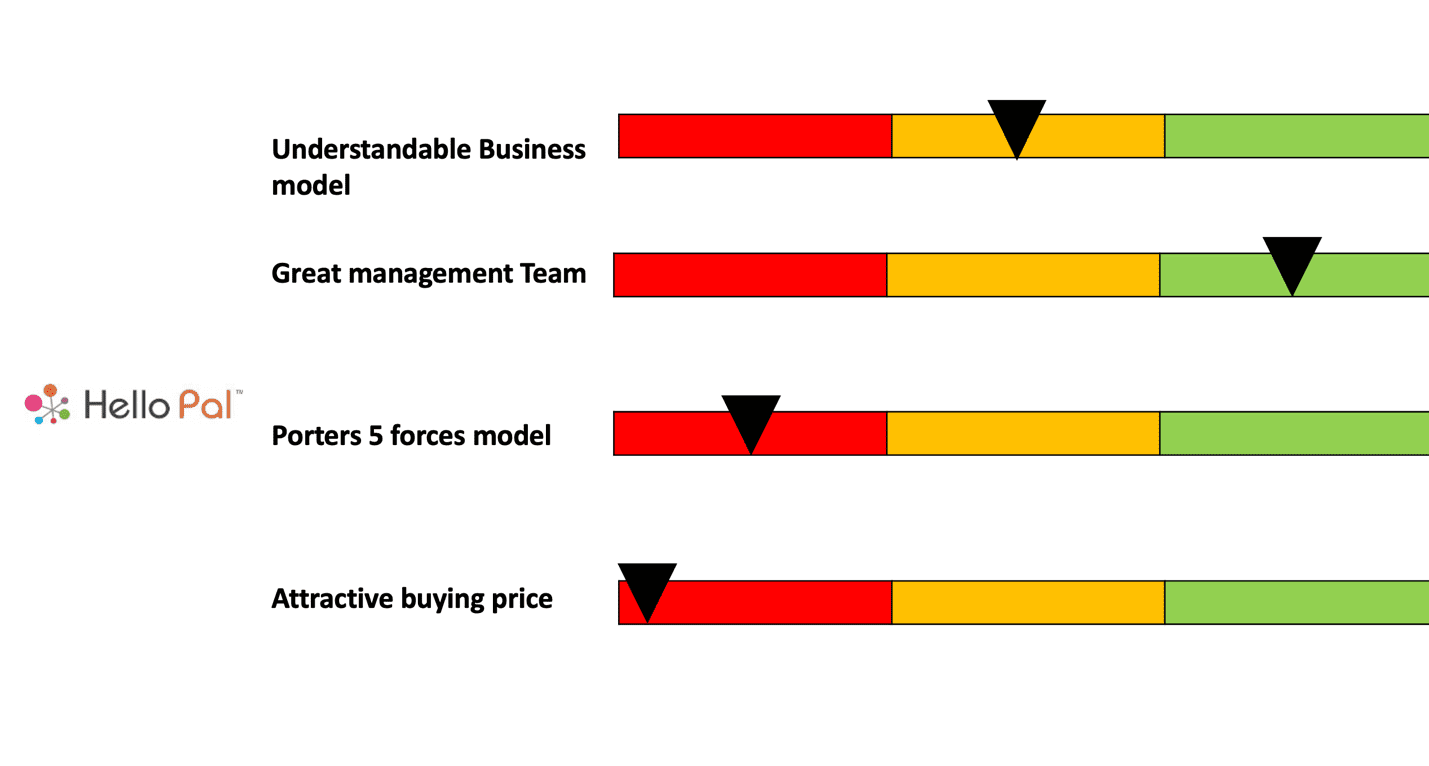

Below is a great visual summary of our analysis and shows how subjective the investment analysis process can be.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Click this link, to subscribe for your weekly finance updates! https://takundachena.substack.com.

Thank you for reading and subscribing.

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.