2020 is being dubbed the year of IPO’s. Snowflake (SNOW), CureVac (CVAC), and GoodRx (GDRX) are the top performing IPO stocks of the year. Peter Thiel’s Palantir (PLTR) is one that is also getting the headlines, but perhaps for the wrong reasons. Dubbed a ‘casino’ by Citron Research, but still a favorite for long term investors. And we are not done. Air BnB is set to begin trading on the Nasdaq this week, followed by DoorDash and Wish by the end of this month. Both Air BnB and DoorDash IPOs are highly anticipated by traders/investors. One of the darlings, and perhaps somewhat under the radar, is BigCommerce (BIGC).

BigCommerce (BIGC) is an ecommerce platform with the flexibility of an open software as a service (SaaS). Features also include search engine optimization (SEO) and web hosting.

The company has been around since 2009, and filed for IPO this year in July.

I can tell you that all my tech friends love this stock. This is a long term hold for them.

This brings up the distinction once again between trading and investing. If I were investing, I think a stock like BigCommerce, Palantir, heck even AirBnB and Doordash, are great long term holds because these companies will be here for the next 10 years. With how the markets are currently, they seem cheap compared to everything else tech, so traders and investors see these stocks as undervalued. Cannot blame them. I still remember the Facebook IPO days when analysts said the stock would never go past $30 per share. It hit highs of $305 recently.

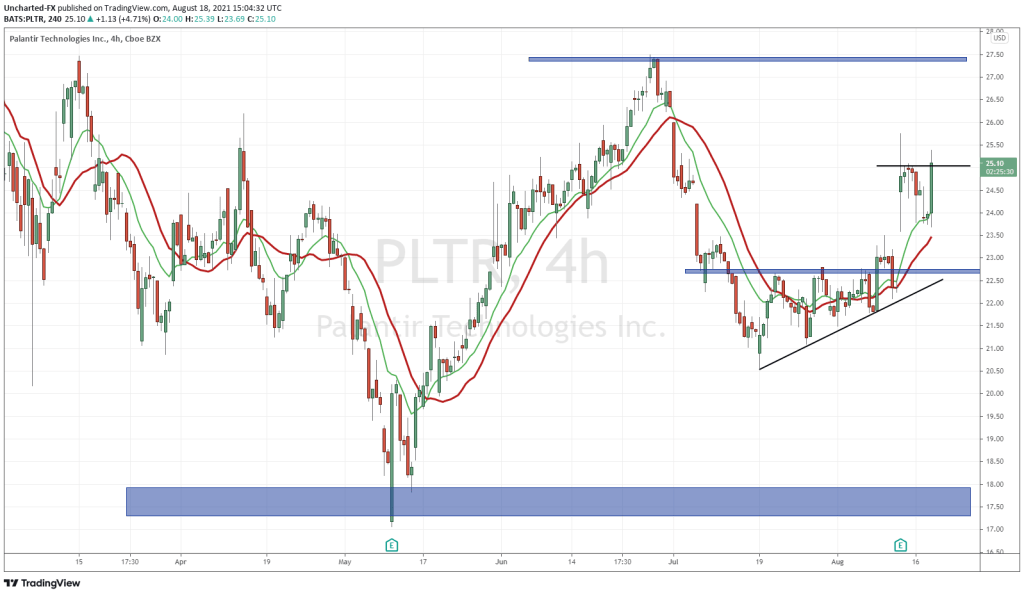

As traders, we have never played IPO stocks on the day they go public. Too much volatility and drama…BUT there is an opportunity to day trade if one wants to. Never chase the initial surge move. Wait for the pullback and that is a sign to enter. Some traders on our Discord Trading Room have seen great results daytrading IPO’s like SNOW, PLTR, and BIGC this year.

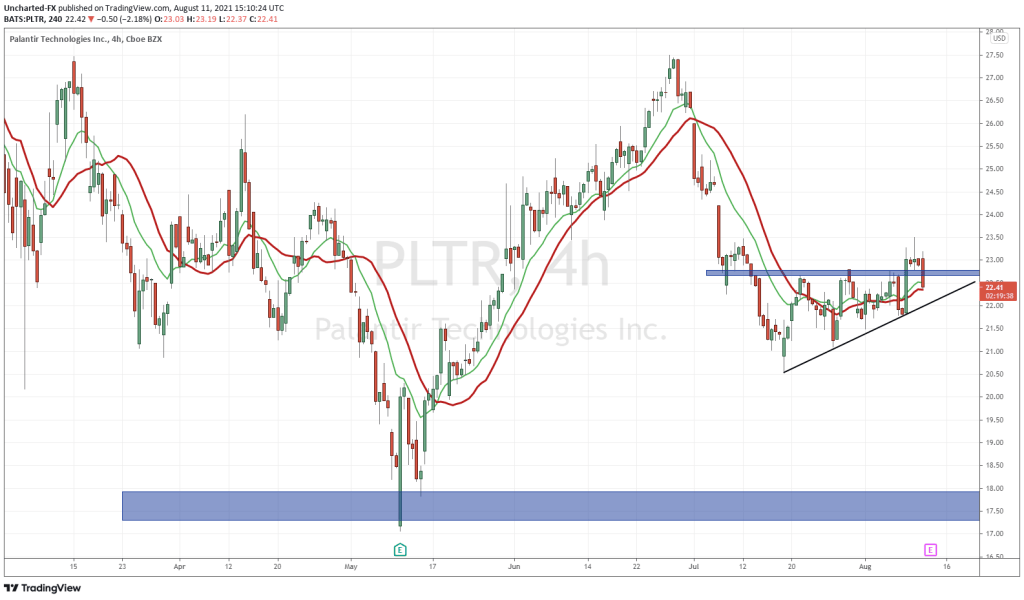

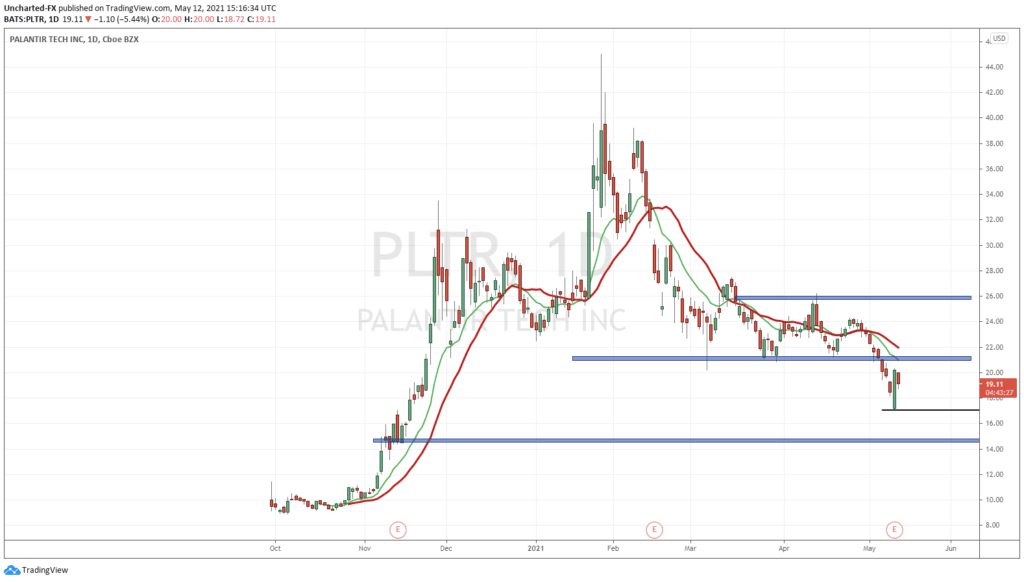

I think there is a better opportunity playing the longer term charts, especially for an IPO once we have some price levels to work with. This generally means we need a few months of price action.

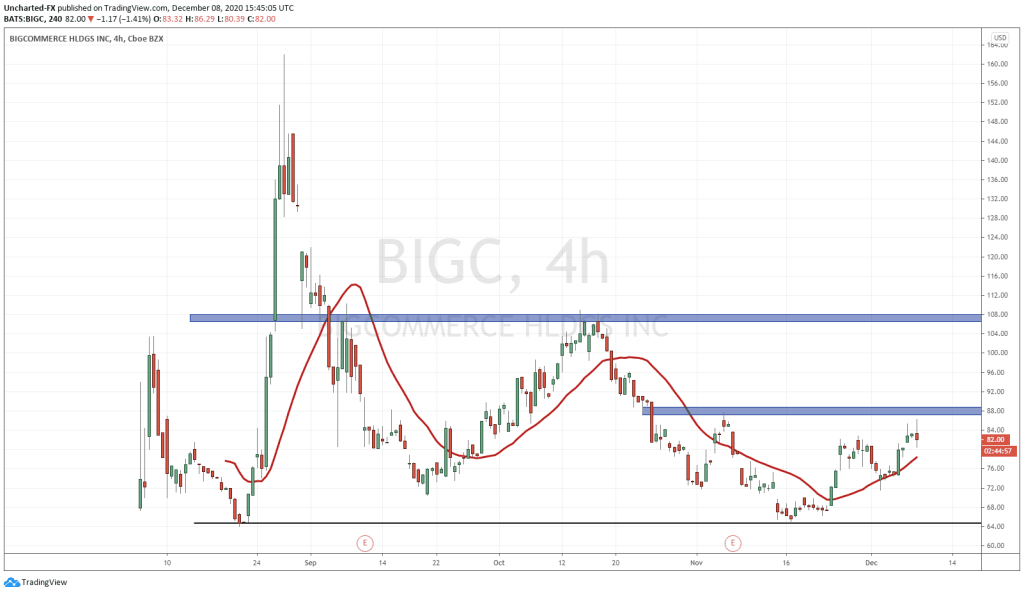

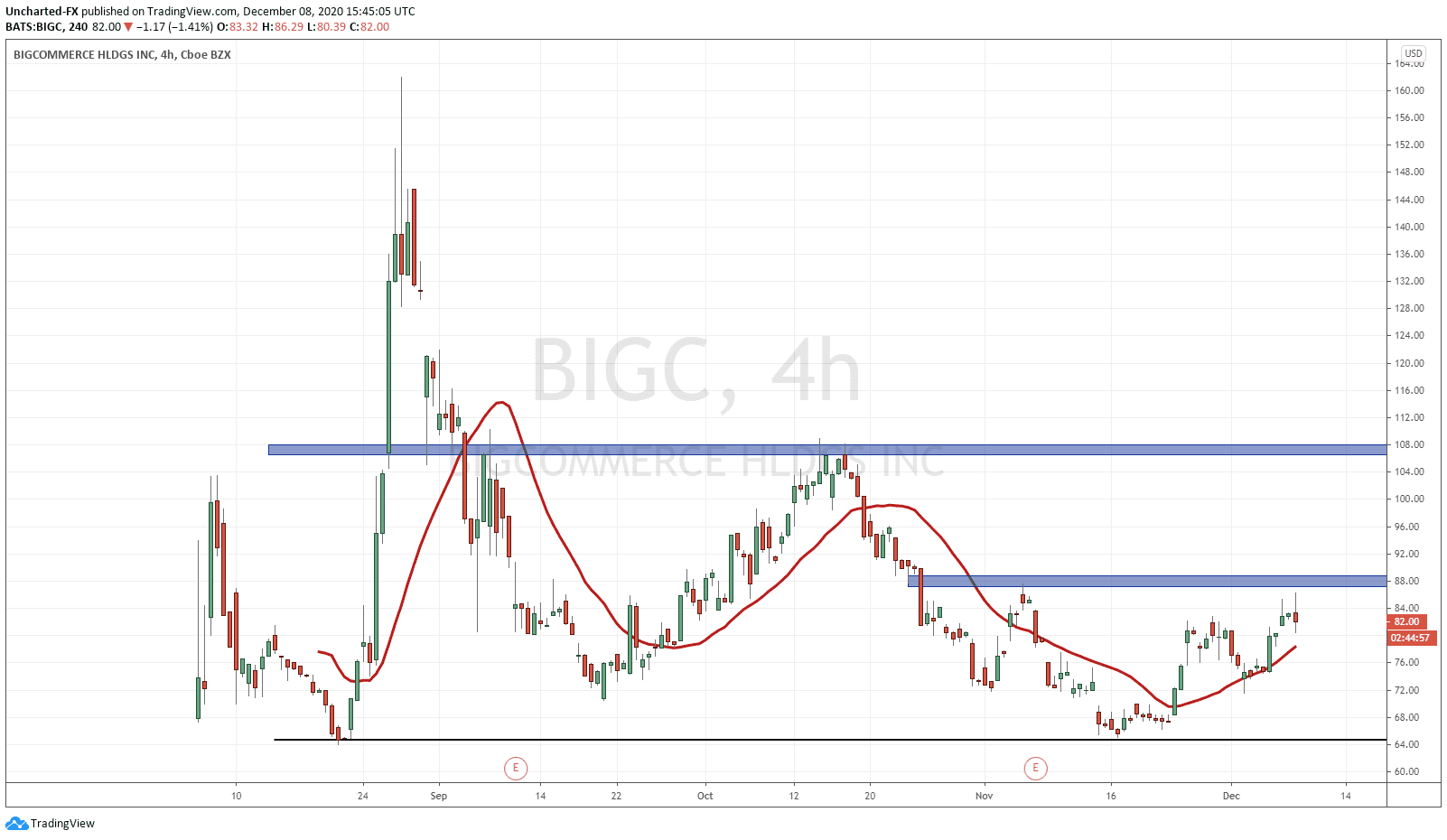

Take for example the chart of BigCommerce. This is the 4 hour char, but the same pattern can be seen on the daily chart. In my experience, a daily and 4 hour combo give some of the best high probability set ups.

Back in August, BigCommerce did slightly dip below the IPO support. In fact we had three daily closes below it. Then the reversal, or what we can call a fake out and trap pattern. The shorts were squeezed, and BigCommerce took off, rallying up to record highs of $161.97.

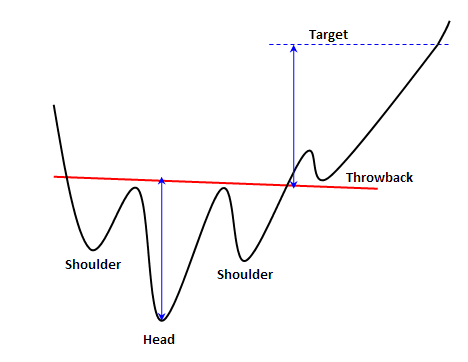

In the middle of November, price came back down to retest the important IPO support (price floor) zone. We held. Now we have formed one of the most important, and personally my favorite, reversal pattern. The one and only: Head and Shoulders pattern. Or the inverse head and shoulders to be exact.

Now we await the breakout. The better entry would be to wait for the break above the $87.60 zone. This is the resistance zone (price ceiling) highlighted in blue, but in regards to a head and shoulders pattern, we call it the neckline.

Alternatively, you could enter now frontrunning the breakout. This is what most option traders do since the premiums begin to be priced in now. When the breakout happens, the contracts are already expensive. This approach gives you a better risk vs reward set up, but the probability of success slightly decreases because the trigger is the actual breakout. Without that breakout trigger, price can hit our resistance zone and potentially sell off lower, making new lows.

For a trade set up, my first target would be the $108 resistance zone, with a stop loss below the $87.60 zone ONCE we break out. After that, we would be targeting previous highs at around $162.