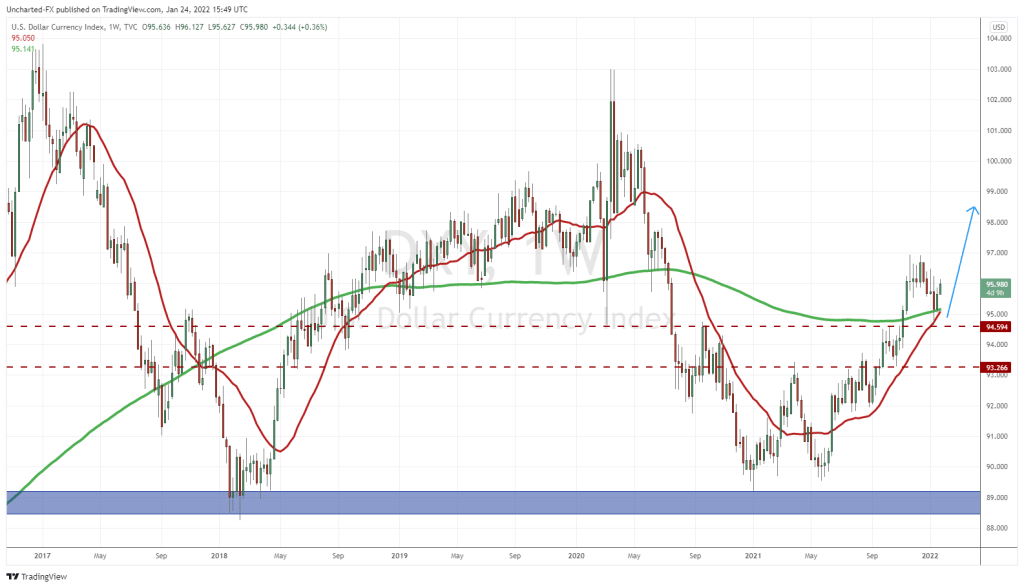

I have written plenty of stuff on the US Dollar (DXY) here on Market Moment. Recently, I have said the US Dollar chart is the most important to watch regarding geopolitical and economic trends going forward. My last article saw the Dollar bouncing at our major support and trendline. In that same article, I warned about a currency war and the pros and cons of a weaker Dollar. You can read that here.

I will highlight the pros and cons because I think this is very important:

-

With a weaker Dollar, it does not benefit the American citizen because they are losing purchasing power. It takes more weaker Dollars to buy something. We Canadians know about this all too very well. Inflation is the term used here.

-

Similar to point 1, but a weaker Dollar is positive for the US stock markets. Yes, it means companies can export more with a weaker currency. But the main point is that it also takes more weaker US Dollars to buy a share of a company.

-

Now to some positives. The first positive is that a weaker Dollar is great for the US government. We all know about the debts incurred by the government. A weaker Dollar means that debt can be paid back with cheaper dollars. Inflating a currency has been a strategy used before…although it does not end well. The icing on the cake here would be negative interest rates.

-

Since interest rates have been low in the US since 2007, many foreign nations have decided to borrow more Dollars. Especially among the emerging markets. Interest Rates in emerging markets have been high, generally over 8%. Even with the currency rate, many preferred to borrow from the US due to the lower interest rates. The problem is when the Dollar gets stronger. So a weaker Dollar is seen as a positive for the emerging markets. I have even speculated that the Dollar dropping may have been to try to help Turkey. A country which is seeing its Lira get decimated, and also has a high amount of Dollar denominated debt, with not enough Dollar reserves.

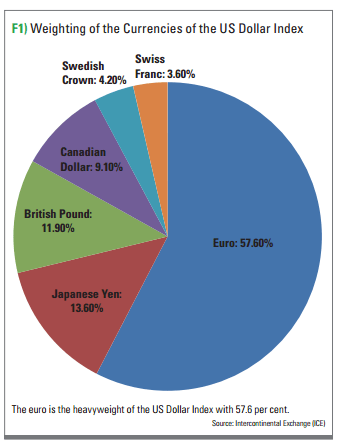

But the main issue is a weaker US Dollar means a stronger Euro, Loonie, Aussie Dollar etc. Fundamental news can affect currency as we are seeing the Dollar strengthen against the British Pound due to Brexit issues. The Canadian Loonie has a close correlation with Oil, which has broken out and subsequently, USDCAD broke below 1.30. It really is about the Euro. Why?

The Euro makes up 57% of the DXY, meaning there is an inverse correlation. When DXY drops, the Euro (EURUSD) moves up or the Euro appreciates against the Dollar. When the DXY rises, the Euro (EURUSD) moves down or depreciates against the Dollar.

I will speak more about the EURUSD and the European Central Bank (ECB) in another post this week because this move in the Dollar just heats up the currency war…and we have a major ECB event this week. All major central banks are trying to weaken their currencies to manage debt but also to attempt to boost their economies. It is a race to the bottom, and it will get worse. This is why I believe people are running into crypto, commodities and other hard assets. Anything other than fiat to preserve purchasing power as central banks wreck their currencies.

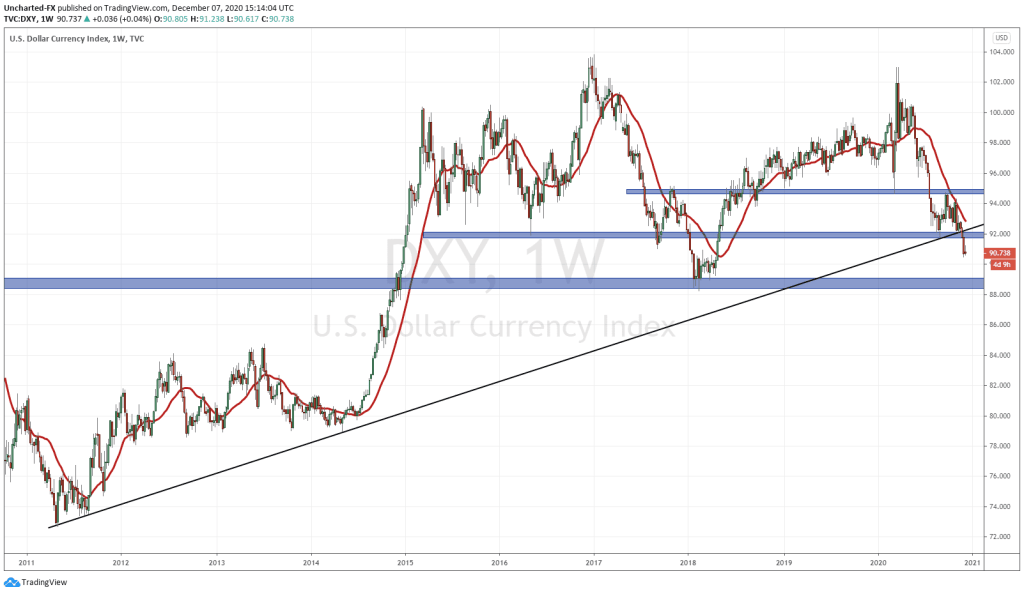

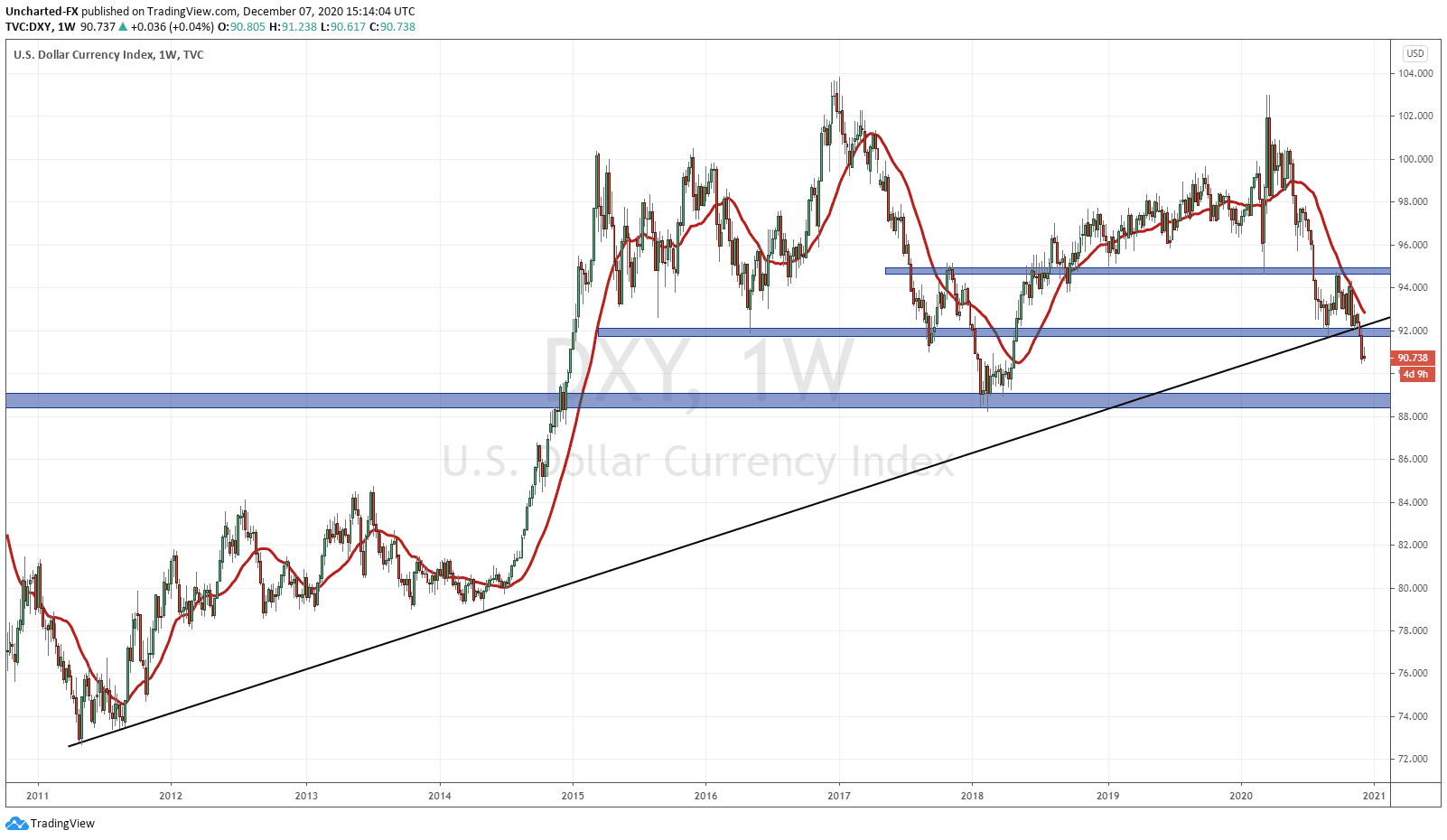

If you checked out my previous article that I linked above, notice that price has broken below our major zones. We did not get the bounce.

This weekly candle close, which was confirmed on Friday, below 92 breaks an uptrend line going back to 2012. Technically, the Dollar uptrend is over, and we should expect a downtrend. Keep in mind, this will mean a stronger Euro, and even a stronger Chinese Yuan.

There has been some theories that the Dollar weakness could be a trade war move against the Chinese. The Yuan is strengthening on a weaker Dollar and the People’s Bank of China cannot do anything to weaken the Yuan.

Technically, the next level to the downside comes in around the 88 zone. If that breaks, then 84.

There is a possibility that the Dollar bounces back up to retest the breakdown zone at 92. What was once support, now becomes resistance. But so far, any relief on the Dollar gets sold off with strength. It is very weak.

Many macro analysts find this US Dollar move a bit strange. Generally, the US Dollar is seen as the safe haven. When things are crazy in the world, you run into the US Dollar and the Japanese Yen. Perhaps the Dollar weakened due to the US elections and the uncertainty that there still possibly could be. But with US stocks moving higher, many have expected foreign money to enter the US markets. To do so, they would need to buy US Dollars.

The main point for Dollar weakness is all the fiscal programs and money printing. We are still expecting another stimulus to be approved by the end of the month.

Some market analysts believe this stimulus will not happen because it would weaken the US Dollar even more. Then the media would have a hard time hiding the fact that Americans are losing their purchasing power. I disagree because I believe the Dollar has dropped because it is pricing in this stimulus and more money printing. Easy money cannot stop.

But this is not only the case for America. Most countries around the world are in the same position. The US just gets the ‘exorbitant privilege’ that comes from the Dollar being the reserve currency, meaning the Americans can print as much Dollars and not worry about the debt. They can, and have been, bailing out the world and opening Dollar swap lines with central banks.

This is the currency war I have been warning about since before Covid. While many are occupied with the stock markets, I think the biggest moves to come, and which will affect us more on a day to day basis, will be seen in the Forex/Currency markets.