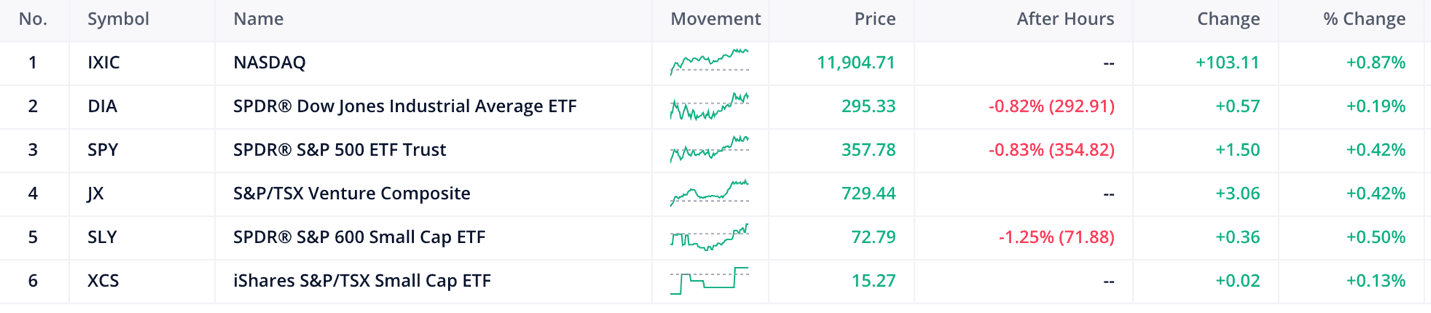

- The S&P 600 & TSX20 are down by 0.13% and 0.50% respectively

- The Canadian 10-year bond up by 0.03% and the US 10-year bond down by 0.04%

Amidst all the chaos there are a few industry Titans that have shown resilience. Today we’re not talking about the large-cap stocks in the NASDAQ or S&P 500 but focusing on companies that haven’t even gone public yet.

These companies are actually anticipating their initial public offerings soon and now we have some data points to look at from their public filings with the SEC.

It is more common for initial public offerings to happen during an economic and stock market boom, this is because during that time optimism and greed are in the air and there is no price too high for investors.

But right now, is not that kind of time and the global economy seems to be in shambles as the stock market continues booming along as it goes further and further away from reality. This is why this chain of IPOs is particularly interesting. The timing and scope of these initial public offerings make no sense on the surface, but a deeper dive always sheds light.

It is best not to quote our lord and savior Mr. Elon Musk, and to be completely honest he might not even be the one who came up with the phrase :

“Out off-season businesses should raise capital when they can and not when they need it, and in-season businesses should raise capital when they need it and not when they can.”

-Maybe Elon Musk

This phrase encapsulates the attitude of both the private business owners and the investment bankers when it comes to initial public offerings. The attitude has always been the same, raise money when you can and not when you need it no matter the cost. But who is really paying for that extra cost when it comes to these initial public offerings? That’s the question we’re going to try to answer poorly today.

There are four big IPO’s that are being talked about by all the news tabloids. Of these four only two have filed with the SEC. We will take a deeper dive into these two and just briefly touch on the ones that have not filed.

Wish is a global e-commerce platform that connects hundreds of millions of merchants and consumers across the world. It was founded by Piotr Szulczewski in May 2011.

Facts :

- 100M Monthly Active Users

- 2M+ Products Sold per Day

- 150M+ Items for Sale

- Over 500,000 Merchants

- China Everbright Investment and Assets Management Cois a minority investor since May 2017

As of November 19, 2020, they are yet to have filed an S-1 but from their new releases, we know they have had approximately 9 capital raising rounds.

Roblox Corporation develops and offers an online social platform for games. It operates an online gaming platform that enables kids to create adventures, play games, role play, and learn with their friends in a 3D environment. It was founded by David Baszucki in May 2004.

Facts :

- 37 Billion hours played since 2008

- 3 Billion Total engagement hours each month

- 5.2 million peak concurrent users

- $241 Million paid to the community developers

- Tencent holding is a minority investor since February 2020

As of November 19, 2020, they are yet to have filed an S-1 but from their new releases, we know they have had approximately 8 capital raising rounds.

![]()

DoorDash operates a logistics platform that connects merchants, consumers, and dashers in the United States and internationally. Its current CEO is Toney Xu and he is also the Treasurer & Director.

It operates the DoorDash marketplace, which provides an array of services that enable merchants to solve mission-critical challenges, such as customer acquisition, delivery, insights and analytics, merchandising, payment processing, and customer support; and offers DoorDash Drive, a white-label logistics service.

Facts :

- As of the 9 months ended September 30, 2020, the business was made $1.9 billion in revenue and their gross margin % was 53%.

- But their total costs to run the firm exceeded the revenue by $131 million.

- As of the 9 months ended September 30, 2020, the business had a total of $543 Million orders. This is $362 million more orders than the same time period in 2019.

- As of September 30, 2020, the business had $1.5 billion in cash and cash equivalents. A current asset position of $1.9 billion and Property planting equipment worth $182 million

- Door dash has a current liabilities account worth $834 million, meaning they have a positive working capital position of $1 billion.

- The business has more assets than liabilities and the amount comes out to be around $1.4 billion in net assets.

- It’s also important to note that in that same nine-month period they generated a total of $300 million in cash from operations before a deduction of $86 million in capital expenditures.

As of November 19, 2020, they have filed an S-1 but from their new releases, we know they have had approximately 11 capital raising rounds. And they anticipate a $100 million valuation on their IPO.

LINK TO 1246 PAGE DOOR DASH S-1 FILE – they definitely want you to read this.

Airbnb operates a platform for stays and experiences to guests worldwide. The company’s marketplace model connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms and luxury villas. Its current CEO is Brian Chesky, CSO is Nathan Blecharckzyk and Joe Gebbia are all the Co-founders. It was formed in 2007 amidst the financial housing crisis.

Facts :

- As of the 9 months ended September 30, 2020, the business was made $2.5 billion in revenue and their gross margin % was 73%.

- But their total costs to run the firm exceeded the revenue by $490 million.

- As of the 9 months ended September 30, 2020, the business had a total of $146 million Nights and Experiences Booked. This is $105 million fewer Nights and Experiences Booked than the same time period in 2019.

- As of September 30, 2020, the business had $4.5 billion in cash and cash equivalents. A current asset position of $7.2 billion and Property planting equipment worth $261 million

- Airbnb has a current liabilities account worth $4.4 billion, meaning they have a positive working capital position of $2.8 billion.

- The business has more assets than liabilities and the amount comes out to be around $1.8 billion in net assets.

- It’s also important to note that in that same nine-month period they used a total of $490 million in cash from operations before a deduction of $29 million in capital expenditures.

As of November 19, 2020, they have filed an S-1 but from their new releases, we know they have had approximately 14 capital raising rounds. And they anticipate a $1 billion valuation on their IPO.

LINK TO 1406 PAGE AIRBNB S-1 FILE – they definitely want you to read this.

To avoid going into the intricacies of the securitization and underwriting process we can break it down into a simple format :

IPO Price =

Add: Fair Value of stock ( Using a Discounted Cash Flow or similar IPO multiples like EBITDA )

Add: Underwriting Costs ( Fee paid to the investment house to issue the common stock to the public and do the marketing for the new IPO)

Add: Legal Fees ( Fees associated with regulatory registration and processes)

Add: Other costs ( Vested stock options given to management and sometimes given to investment bankers and private investors)

Because of this structure in the industry IPO’s are usually overpriced because of all the fees and back-end stuff that is needed for the stock to be issued in the secondary market. This is obviously an overgeneralization there are many factors that have been left out like general demand for the stock or the underwriters who have been given the job.

Having looked deeper I believe investing in either Airbnb or DoorDash should not be done under the guise of an investment operation. It would be proper for the speculator to purchase the shares in anticipation of capital appreciation. With this premise of capital appreciation, the speculator knows going into the purchase that the market might not react to how they anticipated. As for now the valuation for both these businesses will not be close to economic reality but be dictated by the demand and supply forces of the general stock market.

At the end of the day of each business’s IPO, the winner will be the one who is more popular rather than who is more profitable or sustainable. Once the initial IPO rush has calmed down the intelligent investor will appraise the information differently and the price would adjust to a truer indication of true intrinsic/fair value over time.

But again, this is merely a guess. The reality of the beauty contest that is the stock market is that if every stock is somebody’s favorite, then every price should be viewed with skepticism even those that may seem like risk-free investments.

HAPPY HUNTING!

Legal Disclaimer The information on this article/website and resources available or download through this website is not intended as and shall not be understood or constructed as financial advice. I am not an attorney, accountant, or financial advisor, nor am I holding myself out to be, and the information contained on the website or in the articles is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. We have done our best to ensure that the information provided in the articles/website and the resources available for download are accurate and provide valuable information for education purposes. Regardless of anything to the contrary, nothing available on or through this website/article should be understood as a recommendation that you should consult with a financial professional to address our information. The Company expressly recommends that you seek advice from a professional.