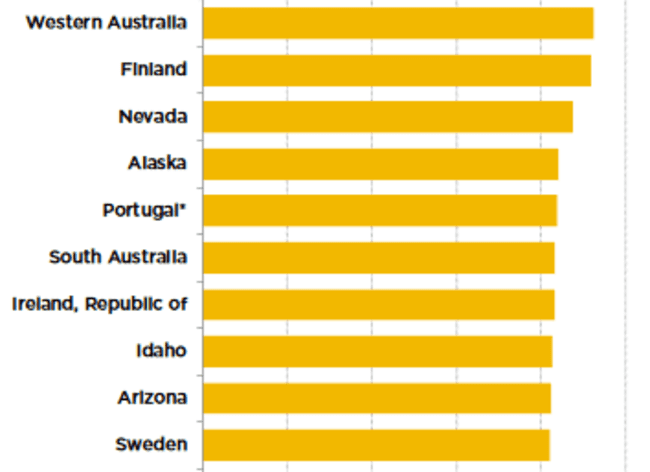

Fremont Gold (FRE.V) is focused on the discovery potential in one of the most prolific and mining-friendly jurisdictions in the world—Nevada.

Location is an important consideration when shortlisting companies in the junior exploration arena.

According to the esteemed Fraser Institute, in its most recent investment attractiveness survey, Nevada continues to roll out the welcome mat. It’s ranked in the top three mining jurisdictions worldwide.

Fremont controls four gold projects along Nevada’s Carlin, Cortez, and Independence Trends.

Fremont controls four gold projects along Nevada’s Carlin, Cortez, and Independence Trends.

- The North Carlin project is located on the Carlin Trend. The company is targeting a Carlin-style gold deposit and/or low-sulfidation epithermal mineralization.

- The Cobb Creek project is located on the Independence Trend—the target is a Carlin-style gold deposit.

- The Griffon project is located on the Cortez Trend—the target is Carlin-style gold.

- The Hurricane project is located on the Cortez Trend—the target is a Silica replacement-type gold deposit.

A recent drilling campaign at the company’s Griffon project failed to meet expectations. The project isn’t dead—the Company is still waiting on results from the bottom of hole #2—but management isn’t wasting time weighing its options. It’s boldly shifting focus and pushing forward. Aggressively.

The North Carlin Project now bears flagship status.

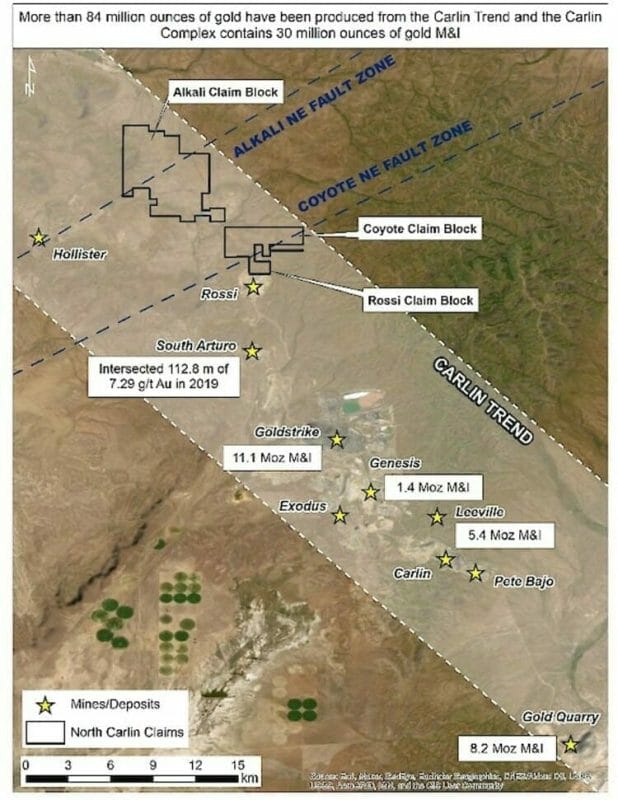

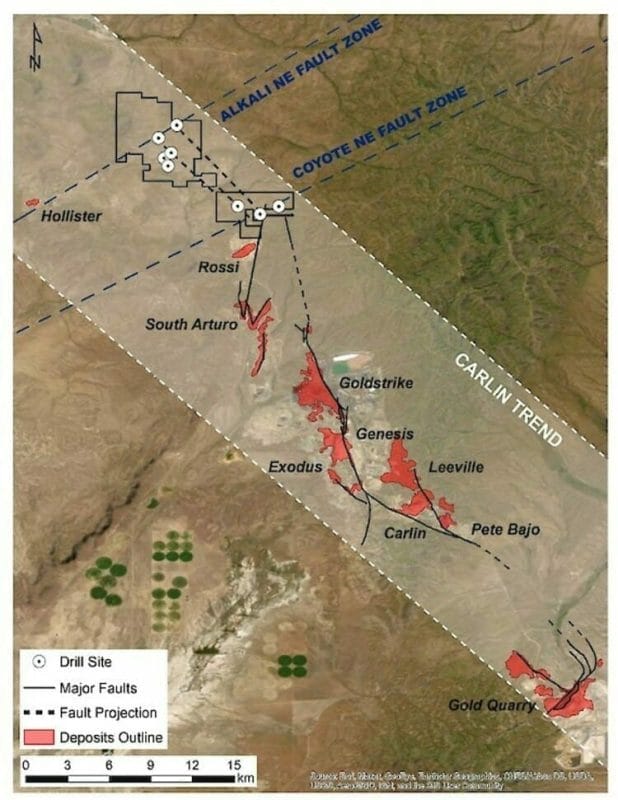

The Carlin Trend—arguably the most celebrated gold trend on the planet—has produced in excess of 84 million ounces of gold since the first discovery nearly six decades back.

The Carlin Trend—arguably the most celebrated gold trend on the planet—has produced in excess of 84 million ounces of gold since the first discovery nearly six decades back.

The 42-square kilometer North Carlin Project is located at the very northern end of the Carlin Trend and is comprised of 3 claim blocks—Alkali, Coyote, and Rossi.

North Carlin’s southern boundary is located only 6 kilometers north of and on-strike with the South Arturo mine operated by Nevada Gold Mines (NGM)) and Premier Gold (PG.T). The deposits comprising the South Arturo package have produced roughly 2.3 million ounces of gold to date (NGM is a joint venture among mining giants Barrick and Newmont).

Recent drilling at South Arturo tagged an exceptionally fat 39.6 meters of 17.11 g/t gold.

A further 6 clicks to the south is NGM’s Goldstrike mine which hosts 11.1 million ounces of gold in the Measured and Indicated category.

Hecla’s (HL.NYSE) high-grade Hollister mine is located 6 kilometers from North Carlin’s western border.

This is an area where one can get away with trotting out metaphors like ‘elephant country‘, without getting what-for from jaded, battle weary resource speculators.

This is an area where one can get away with trotting out metaphors like ‘elephant country‘, without getting what-for from jaded, battle weary resource speculators.

This truly is elephant country.

North Carlin is drill ready

Since acquiring the North Carlin claims back in 2017, the company has advanced the project using good science—soil geochemistry, gravity and geomagnetic surveys… the projection of key faults that control gold mineralization throughout the region—and now has a number of high-priority drill targets in its crosshairs.

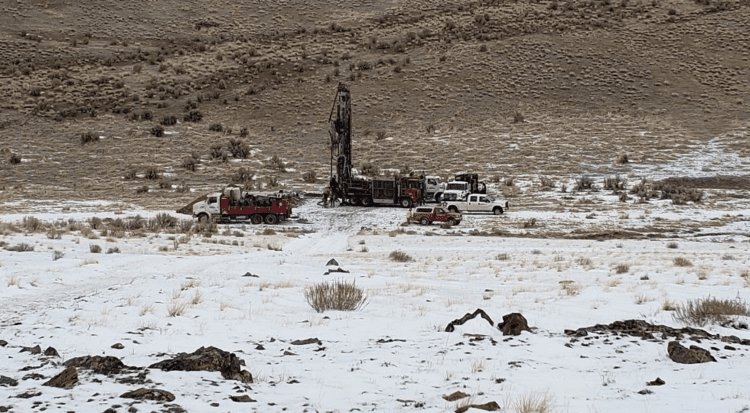

The Company is in the process of permitting ten drill sites at North Carlin and plans to drill a minimum of 1,500 meters in a reverse circulation campaign scheduled to commence in mid-November.

The exploration window in this area of Nevada typically closes in mid to late December. Timing will be key.

The drill targets

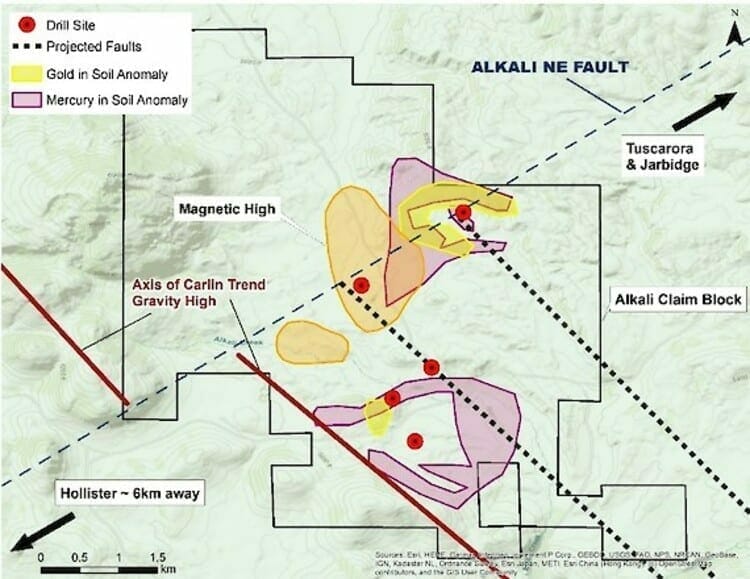

At the Alkali claim block, the Company is targeting two deposit types—a Carlin-type gold deposit in the southwest and a low-sulfidation epithermal vein deposit in the northeast.

The Carlin-type target is based on favorable soil geochemistry and the projections of major subsurface structures (faults) in the region.

The low-sulfidation epithermal vein target is associated with a possible intrusive body and significant (soil) geochemical anomalies.

“The geochemical anomalies occur on the flank of the possible intrusive body near the intersection of a projected Carlin Trend fault and a northeast-trending fault.”

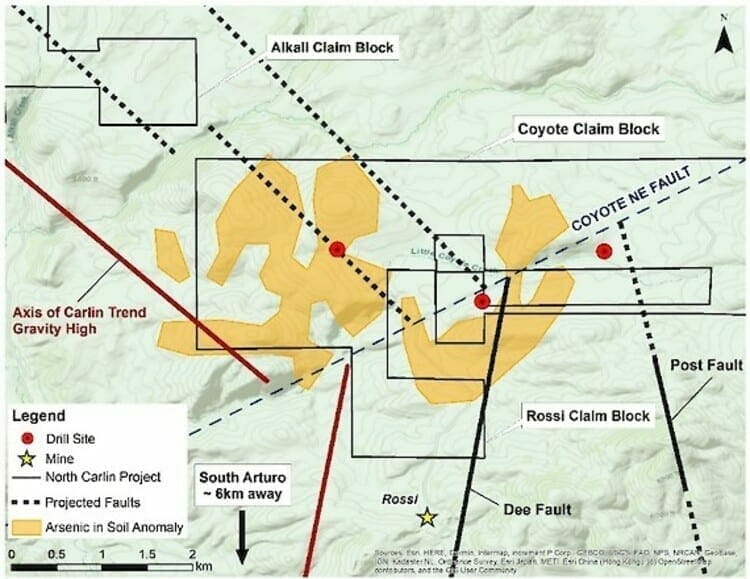

At the Coyote and Rossi claim blocks, the target is a Carlin-type deposit in lower plate units. This is the same type of unit that hosts gold mineralization a few kilometers to the south in the Devonian Rodeo Creek Formation, the Devonian Popovich Formation, and the Silurian Roberts Mountains Formation.

North Carlin – Alkali

Alkali is located at the intersection of the projected Carlin faults, and a northeast-trending structural corridor—the Alkali NE fault—that hosts Hecla’s Hollister mine to the southwest, and Tuscarora & Jarbidge to the northeast.

There’s a good correlation between structure, geophysics, and geochemistry here—the Alkali NE fault cuts through a 1,500 meter by 2,000-meter magnetic high, and coincident gold-mercury soil anomalies that occur on the eastern flank of the magnetic high (above map).

There’s a good correlation between structure, geophysics, and geochemistry here—the Alkali NE fault cuts through a 1,500 meter by 2,000-meter magnetic high, and coincident gold-mercury soil anomalies that occur on the eastern flank of the magnetic high (above map).

According to the October 7th press release…

“The magnetic high at Alkali may indicate an intrusive body at depth. Magnetic highs representing intrusive bodies coincident with Carlin-type deposits can be found at Gold Standard Venture Corp.’s Railroad-Pinion project at the southern end of the Carlin Trend. They are also known to be associated with epithermal vein deposits at Hollister and Tuscarora.”

North Carlin – Coyote

Coyote is located at the intersection of the projected Carlin faults and the Coyote NE Fault. The surface geology consists of upper-plate Ordovician Vining Formation, which is likely underlain by the Roberts Mountain thrust and lower plate Paleozoic carbonate rocks. These are common host rocks for Carlin-style gold deposits.

On surface at Coyote, the Company has identified broad areas of chalcedonic breccias and siliceous alteration—rock frequently associated with (concealed) gold mineralization in the Carlin Trend.

On surface at Coyote, the Company has identified broad areas of chalcedonic breccias and siliceous alteration—rock frequently associated with (concealed) gold mineralization in the Carlin Trend.

Surface sampling at Coyote has also defined a large arsenic-in-soil anomaly. Arsenic is the most important pathfinder for gold in Carlin-style deposits.

Blaine Monaghan, Fremont CEO:

“We are very excited to start drilling North Carlin. In terms of periodicity and alignment, the Project is strategically located at the northern end of the Carlin Trend. Based on North Carlin’s geological setting and the exploration results to date, we believe that it holds excellent potential for the discovery of a new Carlin-type deposit.”

With the exploration window slowly closing at North Carlin, Fremont quickly pulled the trigger on a $1M non-brokered private placement, a PP that was subsequently increased to $2M…

Some questioned the size of this raise.

The following is a recent post directed at CEO Monaghan by a concerned shareholder over on Tommy Humphreys’ ceo.ca…

[@v0x] @bmonaghan, 40M shares + 40M warrants, that’s 50%+50%=100% dilution at this level if my math is approximately right, could you comment on the reasoning behind that? Sincere question.

CEO Monaghan (aka @bmonaghan), an uncommonly approachable and accessible CEO, responded with:

[@bmonaghan] @v0x, the money was there and I wanted to make sure that Fremont was well capitalized – has been an issue for the company in the past. The additional capital gives us a lot more flexibility. Will enable us to drill North Carlin, and add more holes if we want to, conduct exploration and start the permitting process at Cobb and fund G&A for a year.

Fair enough…

Cobb Creek was referenced in both the October 19th PP update and CEO Monaghan’s reply on ceo.ca.

A few details re Cobb

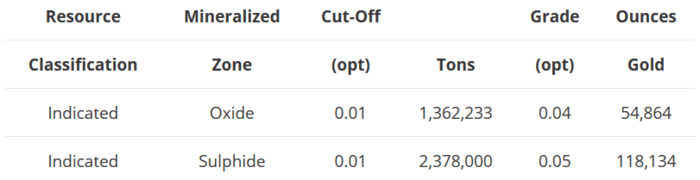

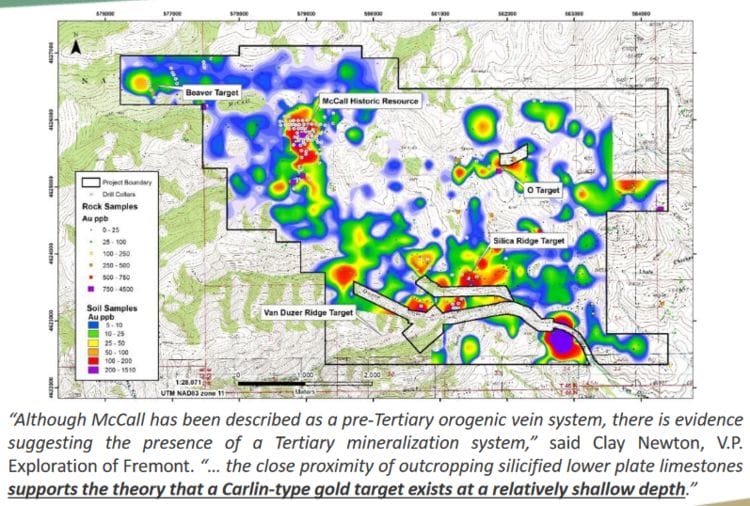

The project has a historical resource estimate (non 43-101 compliant) at its McCall prospect, one target area within the Cobb Creek claim block.

Management believes Cobb holds the potential to host a Carlin-type deposit—potential unrecognized by the previous operators.

Management believes Cobb holds the potential to host a Carlin-type deposit—potential unrecognized by the previous operators.

The last time Cobb received a proper probe with the drill bit was 1992. The majority of this historic drilling was shallow in nature.

Highlights from this historic drilling include:

- Drill hole COBRC-3: 15.3 meters of 2.86 g/t gold (from 13.7 meters to 29.0 meters);

- Drill hole COBRC-84: 33.5 meters of 1.92 g/t gold (from 18.3 meters to 51.8 meters), including 12.2 meters of 4.09 g/t gold.

A number of exploration targets—Beaver, Silica Ridge, O, and Van Duzer Ridge—despite having returned very anomalous gold values, were never tested with the drill bit.

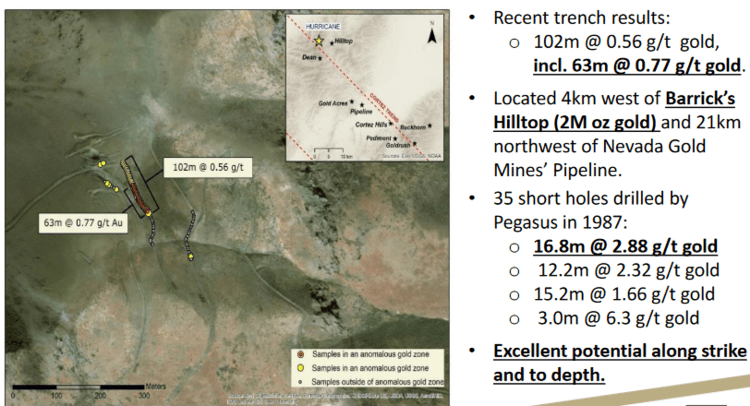

Fourth on the list in the Company’s project portfolio sits the Hurricane Project. Though currently idle, it looks like it might deserve some attention too…

Fourth on the list in the Company’s project portfolio sits the Hurricane Project. Though currently idle, it looks like it might deserve some attention too…

At the top of the page, I emphasized how ‘jurisdiction’ is an important consideration when shortlisting companies in this arena. So is management. As I’m oft heard to say, “you can have a great project, but without the right team in place, shareholder-value-creation is often compromised.”

At the top of the page, I emphasized how ‘jurisdiction’ is an important consideration when shortlisting companies in this arena. So is management. As I’m oft heard to say, “you can have a great project, but without the right team in place, shareholder-value-creation is often compromised.”

Let’s face it, management is everything in the junior exploration arena (okay, nearly everything). You can have a great, company-maker of a project in the friendliest jurisdiction, but without the right team in place—a combination of gifted rock kickers and enterprising business types— things can fly apart at the seams.

Operational inefficiencies often create a processional effect that can lead to an erosion in shareholder value via reckless spending and an endless cycle of heavily dilutive raises (PPs).

This is not a lifestyle company. This is a highly motivated team with an appetite for discovery.

Importantly, this is a team with heaps of Carlin experience. Example: Andy Wallace (aka Mr. Nevada) is on the Advisory Board (if a world-class deposit is indeed lurking somewhere in the subsurface layers at Carlin North, this crew will undoubtedly tap it).

This team also has a solid track record of creating shareholder value.

Looking at CEO Monaghan’s resume, the man was aboard True Gold Mining (acquired by Endeavour Mining in 2016), Canplats Resources (acquired by Goldcorp in 2010), Western Prospector Group (acquired by a subsidiary of China Nuclear National in 2009), Nu Energy Uranium (acquired by Mega Uranium in 2007) and Wheaton River Minerals (which merged with Goldcorp in 2005).

Impressive.

Skin in the game? Fremont management owns 17% of the shares outstanding—values are aligned.

Final thoughts

This is a great team with a highly prospective asset in one of the best mining jurisdictions on the planet.

The stock has been beat up recently, which could represent an opportunity at current levels.

END

—Greg Nolan

If you’re interested, here is a recent video we produced for Fremont and its potential. Tune in!

Full disclosure: Fremont is an Equity Guru marketing client.