Stay the Course!

John C. Bogle

Victory Square Technologies Inc (VST.CSE)

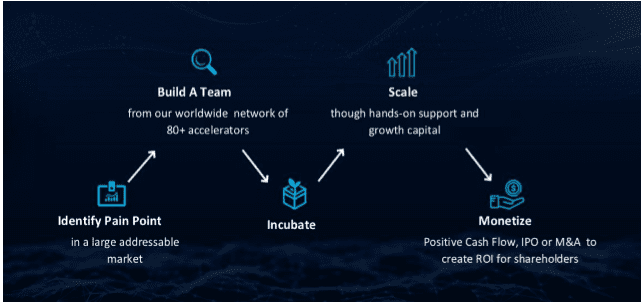

VST partners with a global network of incubators and accelerators to source top start-ups from North and South America, the Middle East, India, throughout Africa, and beyond. From thousands of candidates, they have assembled their current portfolio of 20-plus companies.

Finally, VST integrates a strong ESG (environmental, social, and corporate governance) component throughout its operations. Their portfolio highlights minority entrepreneurs, often overlooked by traditional investors, including many from developing countries. They also have an explicit philanthropic mandate to support vulnerable youth in securing access to education, healthcare housing, and nutritious food.

Portfolio Companies

The VST way is simply to invest in the stock or units of a start-up in an industry that is both disruptive and innovative. They inject not only financial capital but social capital as well, from the vast network of professionals they have on board.

They incubate and offer their expertise to the portfolio companies with the strategic goals of expanding the organic business growth. Organi growth is related to the growth of natural systems and organisms, societies, and economies, as a dynamic organizational process, that for business expansion is marked by increased output, customer base expansion, or new product development, as opposed to mergers and acquisitions, which is inorganic growth.

Once they have established a foothold in a Target market and the incumbent has achieved profitability they will sell this business to the general mark by way of IPO or to interested parties through Mergers and Acquisitions.

Some of the flagship companies in their portfolio are below :

Vertical: Sports Betting, Gaming, eSports

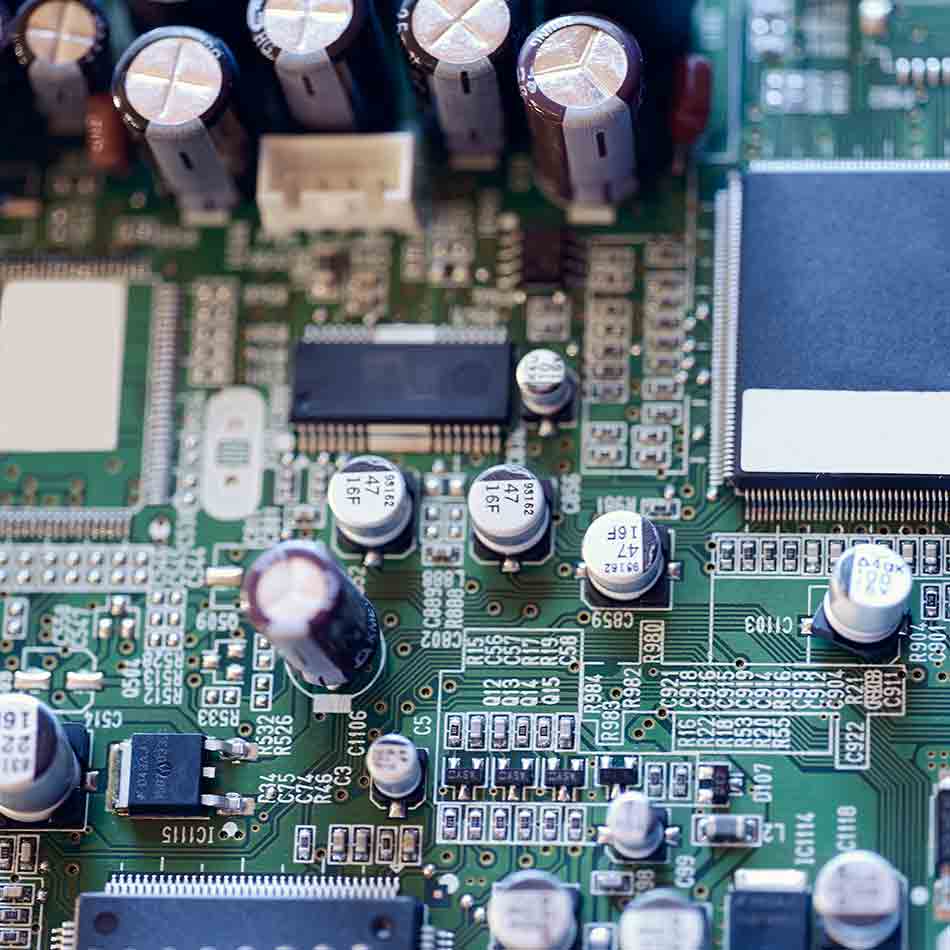

Vertical: Cyber Security

Vertical: Virtual Reality, Augmented Reality

Vertical: e-Gaming, eSports

Vertical: Automation, Artificial Intelligence

Vertical: SD-WAN

Vertical: Insurance Tech

Vertical: Cloud Computing

Vertical: Plant-Based Science

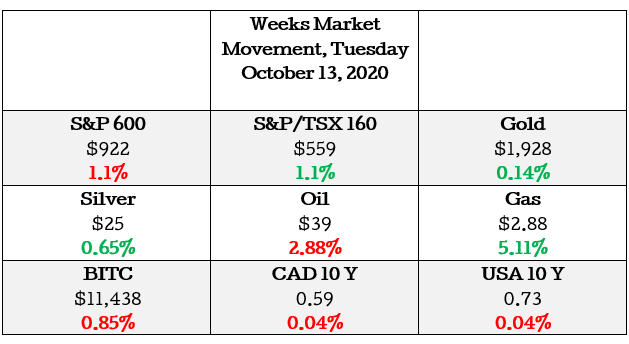

Financial Breakdown

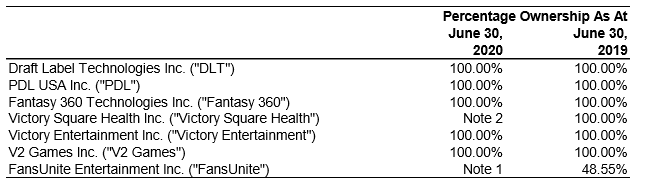

The financial statements that are published by VST are consolidated as follows:

If your company’s financial statements are prepared in accordance with generally accepted accounting principles, or GAAP, the rules provide alternative ways of reporting the ownership interests you have in other businesses.

Whether these interests require consolidating financial statements or reporting under the equity method generally comes down to the level of control your company has over the businesses in which it invests.

Consolidation of financial statements and equity method accounting, however, does not apply to the typical or casual stocks you acquire.

These are the companies that are going to contribute to the financial performance for VST now. As they do have a large economic interest in the operating performance and decisions of their portfolio companies. To exercise this economic control the investor usually needs to take on the majority of the risks associated with the business. This has been defined by regulators as owning 50% to 100% of the outstanding common stock of the subsidiary and having the majority voting rights of the business.

Although this is a complicated business model to grasp it has provided value to those who take part in its intricate nature. The structure is similar to what Private Equity firms do, but these involve more leverage and companies at a later stage of profitability.

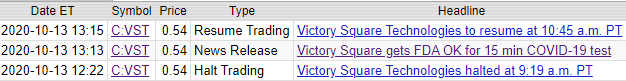

15 min COVID-19 test

This news release has pushed the stock of VST up by 27% for the day as one of their portfolio companies capitalizes on the global pandemic.

The real question any rational reader will have is on what basis the market has for giving this stock a 27% increase of one of its portfolio companies. Sadly this goes beyond the due diligence of this market day wrap up and needs a full-scale article for itself.

But again, this is merely a guess. The reality of the beauty contest is that if every stock is somebody’s favorite, then every price should be viewed with skepticism.

Victory Square gets FDA OK for 15 min COVID-19 test (Full Article)

2020-10-13 13:13 ET – News Release

Mr. Shafin Tejani reports

VICTORY SQUARE HEALTH RECEIVED FDA PERMISSION TO COMMENCE MARKETING, SALES, AND DISTRIBUTION UNDER EUA FOR SAFE TEST 15 MINUTE RAPID TEST IN THE UNITED STATES ON OCTOBER 9, 2020

Victory Square Health Inc., a portfolio company of Victory Square Technologies Inc., has been granted permission by the Food & Drug Administration (FDA) in the United States to commence marketing, sales, and distribution under the emergency use authorization (EUA) for its Safetest 15-minute rapid test COVID-19 assay.

Highlights:

- The Safetest 15-minute COVID-19 rapid test has a 96.6-per-cent sensitivity.

- Over 7.8 million COVID-19 cases and 217,000 deaths reported in the United States as of Oct. 9, 2020;

- This FDA permission under EUA for the Safetest 15-minute rapid test is in addition to the Elisa test permission issued by the FDA (under EUA) on Aug. 25, 2020;

- Safetest COVID-19 rapid test can confirm whether one is currently infected with the virus causing COVID-19 or whether one was infected before and was unaware of the infection;

- The company’s application for the Safetest 15-minute COVID-19 rapid test is currently under review by Health Canada.

HAPPY HUNTING!