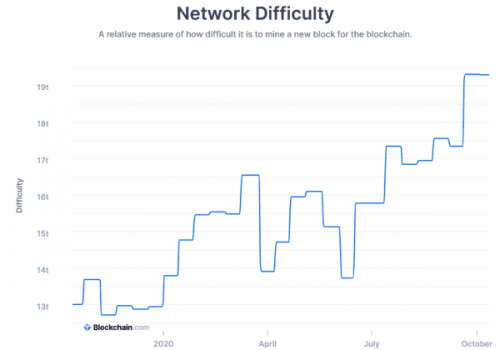

There will never again be a time when it’s cheap to mine bitcoin. For those involved in the scene this isn’t a revelation—there’s still a possibility that Bitcoin’s ass may fall off and its hashrate and mining difficulty bottoms out—but it’s highly improbable. If you’re new here and just heard from your cousin who’s been heating their house with GPU’s mining Ravencoin or BEAM and want to get into Bitcoin, rethink it.

Here’s the network difficulty chart presently registered in terrawatt hours:

Bitcoin mining is best left to the big guys like Marathon Patent Group (MARA.Q) and even they have to scale their production to meet the increased demand. That’s what their latest joint venture with Beowulf Energy is doing for them by helping them deliver low cost power to MARA’s Bitcoin mining operations.

Here’s what Beowulf offers:

Marathon’s agreement with Beowulf includes the colocation of their Bitcoin mining data center at the Big Horn Data Hub, which stretches across 20 acres of land next to Beowulf’s Hardin generation station, which is a 105 MW power facility located in Hardin, Montana. The Hardin plant will be serving the data centre for $0.028 per kilowatt hour, and Beowulf will become an equity shareholder in Marathon.

Introduction of the data centre will reduce Marathon’s mining costs for electricity and data centre management to $0.034 kilowatt hours, which is 38% below what the company’s presently paying. This reduces Marathon’s breakeven costs for Bitcoin mining from $7,500 per Bitcoin to $4,600 per Bitcoin, and gives them a considerable chance of surviving to meet the next halving. Consider that Bitcoin is presently trading at a little north of $11K USD, then this drop in overhead puts this move into perspective.

“The closing of this joint venture with Beowulf represents the completion of a long journey to own a Bitcoin mining facility. Partnering with an experienced independent power producer enables us to maintain control and certainty of Marathon’s energy and operational costs, at rates that represent some of the lowest in North America,” said Merrick Okamoto, chairman and CEO of Marathon.

Right now, Beowulf’s total amount of electric generation capacity is around 2.3 Gigawatts, and they have set aside 500 megawatts for future blockchain and data centre expansion.

Marathon will own 100% of the data centre, and the numbers are anticipated to be 1.265 exahash per second (EH/s) by Q2, 2021, with an option to scale to 3.320 EH/S. This will make them one of the lowest energy costs in the United States for a Bitcoin mining operation. Don’t fret if you don’t know your exahashes from your gigahashes—we got you, boo.

A hash is problem solving with algorithms. It’s an algorithm that turns an arbitrarily-large amount of data into a fixed-length hash. Like all computer data, hashes are large numbers, and are usually written as hexadecimal. An exahash solves 10^18 hashes per second, which means the network’s hashrate is processing beyond exa-scale computing seconds, which is roughly over four quintillion hashes per second.

All of those exahashes require industrial levels of electrical output and it’s the reason why you can’t mine bitcoin at home anymore. Your computer can’t handle it.

“In pursuing the co-location of a Bitcoin mining operation at Hardin, we sought to capture the inherent value to the Data Center of securing a long-term supply of reliable, secure, and low-cost power while benefitting from the significant on-site technical expertise to ensure efficient operations. Our expert in-house engineers and technicians have designed the Data Center to support the immense computing speeds of the latest generation S19 Pro Antminers. Located in Eastern Montana, the Data Center has a meaningful competitive advantage on energy pricing, moderate climate, and regulatory stability. Beowulf has also earmarked an additional 500 megawatts of generation capacity for subsequent blockchain and data center expansion,” said Nazar Khan, executive vice president of Beowulf.

Naturally, Marathon will keep any of the Bitcoins it mines at the centre, which isn’t as important as what they’re using to make the most effective use of the power they’ve tapped into. For that, they’re installing the 11,500 S19 Pro Antminers (which mine at roughly 110 TH/s) they acquired through their partnership with Bitmain. The miners will generate 1.265 EH/s when completely deployed, and they anticipate this deployment through Q2 2021. Right now, the company has 500 antminers delivered and deployed at the centre, and it has the capacity to expand to 30,000, which will generate 3.320 EH/s, and considerable expansion potential.

—Joseph Morton