This week on Equity.Guru’s cryptocurrency roundup we discuss non-fungible tokens (NFT), decentralized finance (DeFi) and what El Salvador’s and the Lightning Network got up to during their clandestine little conference.

Coinllectibles to hold auction, launch Colligo Series 1

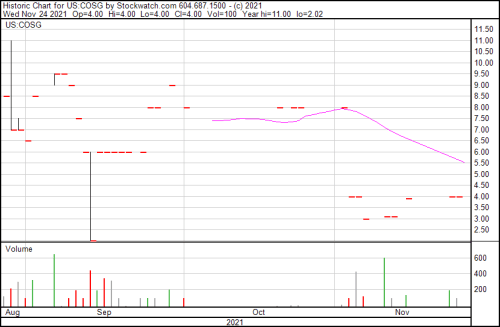

Coinllectibles, a wholly owned subsidiary of Cosmos Group Holdings (COSG.OTC), will be launching Colligo Series 1 on Friday. Colligo Tokens will be accepted to buy Fusion NFTs.

Coinllectibles technically is not the issuer of Colligo Tokens, but will serve as their utility provider. After the launch, Colligo Series 1 will launch through an auction,which will feature two ceramic collectibles each valued between US$38,800 – US$58,200.

- Gilded Blue-and-White Prunus Vase with Patterns of Chrysanthemums, Waves, Banana Leaves and Lotuses; and

- Modern Multicolour Vase with Flared Mouth and Figure Design

The auction will also be open to non token holders, and Coinllectibles will accept BNB, USDT and

credit cards for payment.

Vortex Brands is more than just a Bitcoin miner

Vortex Brands (VTXB.OTC) is a perfect example of what happens to Bitcoin miners that aren’t interested in the kind of spending required to keep up with the rest of the pack.

“Vortex has been mining bitcoin for 60 days and is quickly approaching 0.50 BTC mined to date, with 1,400 terahash currently in operation. Vortex is taking delivery in December on three Bitmain Antminer S19J Pro systems, increasing our terahash to 1,700 by January 2022. We will continue to add equipment and scale up operations until we reach our goal of 150,000 to 200,000 terahash over the next 16 to 18 months.”

One half of a Bitcoin. In earlier editions of This Week in Crypto, we’ve covered some of the hauls of the larger companies—we’re talking that Hut 8 Mining (HUT.T), Marathon Digital Holdings (MARA.Q) and the like with their considerable sized hauls of Bitcoin. Granted, they spend ridiculous amounts of money on their deals with Bitmain for the latest equipment at scale, but you’ll have that. This stuff ain’t cheap, as they say.

But there’s another side to Vortex. They’re not doing this to be a sole bitcoin miner. They’re actually doing this to create cashflow to support their launch of an electricity recycling industry. They’re looking to push something called the Vortex Green Energy brand, using something called Phase Angle Synchronization (PAS) systems designed to capture wasted electricity.

Check out the video on their site. It’s kind of neat.

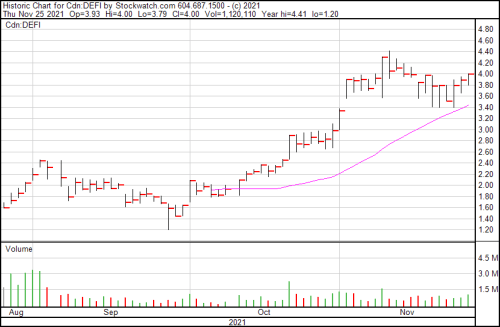

DeFi Technologies continues to expand their infrastructure and governance business

In order to continue pushing their Infrastructure and Governance business across various blockchains, DeFi Technologies (DEFI.NEO) is now staking Blocto Tokens (BLT). These tokens come from Blocto, one of the DeFi portfolio companies through their DeFi Ventures subsidiary, is a wallet hub that lets users conveniently and securely access blockchains, use decentralized applications and receive both their crypto and other cryptassets. BLT is the utility and governance token of Blocto, and serves as the foundation of their ecosystem and the link between the wallet, other Blocto products and users.

“We are extremely excited about the continued expansion and growth of the DeFi Infrastructure & Governance business. This is yet another exciting business for DeFi Technologies. Along with our other business lines, DeFi Technologies remains one of the most innovative companies in the crypto and DeFi ecosystem,” according to Russell Starr, CEO of DeFi Technologies.

Luxxfolio gets more miners

LUXXFOLIO (LUXX.C) picked up another 100 Bitmain S19J Pro Miners from Bitmain. Now their total production rate is 131 PH/s, which is up 6.5% since November. At the present rates, the company expects to earn roughly around 22-24 Bitcoin per month from mining. Ultimately, the new miners should increase their capacity from to 366 PH/s by summer of 2022.

“We are making adjustments every day to improve mining capacity and act on any opportunity to put more miners to work and increase our monthly Bitcoin production,” according to Kien Tran, COO of LUXX Mining Division.

Naturally, though, they have a long way to catch go if they’re going to catch up to the big dogs in the Bitcoin mining game. But getting a little extra every so often can’t hurt their chances. Maybe someday.

Mogo invests in Winklevoss Twins, Gemini Exchange

Mogo (MOGO.T) made a minority investment in Gemini’s $400 million financing. Gemini is the New York based cryptocurrency exchange founded by Tyler and Cameron Winklevoss—the same two twins as depicted getting ripped off by Mark Zuckerberg in The Social Network. They’ve done well for themselves, as it turns out.

“Over the past year or more, we have been migrating our investment portfolio from legacy investments into businesses within our broader ecosystem that have significant stand-alone growth potential and, equally important, bring strategic value to Mogo and deepen our expertise in areas that we believe are increasingly relevant for a next-gen fintech platform and digital wallet,” said Greg Feller, president and chief financial officer of Mogo.

The investment in Gemini adds to Mogo’s portfolio, which now includes crypto, gaming and the newly emergent metaverse. At the quarter-end, the company’s digital assets and investments were approximately $150 million.

The portfolio includes:

- Coinsquare, one of Canada’s leading crypto platforms (of which Mogo owns approximately 39 per cent);

- Tetra Trust, Canada’s first qualified custodian for cryptocurrency assets;

- Enthusiast Gaming, a fast-growing media platform for video game and e-sports fans to connect and engage worldwide;

- Eleven Gaming, a Toronto-based professional e-sports organization;

- Tiidal Gaming, a professional e-sports, betting and entertainment organization;

- The portfolio also includes investments in bitcoin and ethereum.

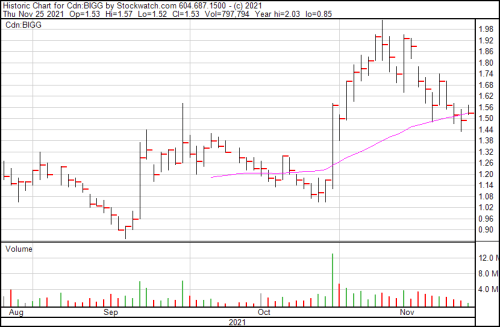

BIGG Digital Assets levels up with 500 Bitcoins in treasury, while Netcoins adds EOS and ALGO

It might seem like a bit of a brag, but Bigg Digital Assets (BIGG.C) has a treasury with more than 500 bitcoin, with a market value over $35 million. It’s not, though. This is a company that understands that BTC’s store of value along with its tendency to appreciate over time is a smart way to manage their treasury alongside what they hold in fiat.

They’re not going to slow down their fiat accumulation, primarily because they believe as many do that $100,000 per coin is not out of the realm of possibility. Actually, they see it as a measure of supply in the market, along with on-chain metrics and the development of interest in the coin.

“Our bitcoin treasury continues to grow, as we receive payment for products in bitcoin and also buy price dips. As previously mentioned, our bitcoin holdings continue to perform very well, and we expect to see significant upside in the value of bitcoin over the coming months and quarters. Further, by adding more crypto assets to Netcoins for trading, we open up more revenue streams. We look forward to continuing to broaden our available crypto assets to meet the demands and desires of our customer base,” said Mark Binns, BIGG CEO.

Bigg subsidiary Netcoins has also officially launched EOS and ALGO on their desktop trading platform. These coins join USDC and XLM which have been added since Netcoins’ received its restricted dealer license in September from the Canadian Securities Administrators (CSA). The company anticipates more coins in the near future.

Wondr Gaming teams up with Toronto Maple Leafs captain John Tavares on NFT deal

Wondr Gaming (WDR.C) has entered into a strategic partnership with John Tavares, the captain of the Toronto Maple Leafs and his foundation, the John Tavares Foundation. Tavares is a six time All-Star, 2014 Olympic Gold Medalist, 2016 World Cup Gold Medalist and considered a role model in the NHL. His organization works to help kids understand the importance of nutrition and healthy lifestyles.

What they’re doing here is minting and selling NFTs from Tavares career and sharing all the proceeds from the sale of said NFTs on Wondr’s platform with the foundation to help its initiatives in the community.

“My family and I are very passionate about helping children understand the importance nutrition and leading a healthy lifestyle. The John Tavares Foundation will benefit greatly from Wondr’s sponsorship, and the revenue generated from the sale of my NFTs. Being able to partner with Wondr to mint and sell NFTs from moments in my career to generate much needed funds for our foundation is a great way to help more kids in our community.” – John Tavares, Toronto Maple Leafs.

As a Leafs fan, the only thing I really want to know is whether or not he’s going to stay healthy this season. No. I’m not bitter. Why do you ask?

Intellabridge launches Kash Decentralized Exchange

In the past little while we’ve started to see the rise of the mainstream decentralized exchange (DEX). DEX’s have been around since 2014 but they were always under-the-radar things—generally thought to be up to no good, where malcontents hid their gains from Silk Road before they could shoot a portal to the dark web to buy their nefarious goods.

It’s not quite the truth and therefore a prime example of how some narrative-crafting types refuse to let the facts get in the way of a good story.

Fast forward a few years and we’ve started to see DEX’s hit the mainstream. Ethereum put out Uniswap, Binance the same with PancakeSwap. Other coin-companies put out their own. Now with regulators starting to circle the wagons around centralized exchanges (CEX), we’re seeing DEX’s come to the fore as both alternatives to their centralized counterparts to help them skirt regulations, but also as a more democratic option to avoid the centralized structure of companies running the CEX’s—grown fat on being the only game in town for too long.

When decentralized finance started to take off, they offered yet another option and reason for their continued existence. DeFi brought opportunity, and opportunity brought more players into the space, and one of those players is Intellabridge Technology (KASH.C), which launched their Kash Decentralized Exchange for ethereum and terra assets. The intent behind which is to bridge the ethereum and terra ecosystems and make DeFi more accessible to their customers.

“After several months of development, we’re excited to launch this exchange and open the market for ethereum customers as part of a broader ethereum integration,” said John Eagleton, chief executive officer of Intellabridge. “Our strategic goal continues to give customers in the ethereum ecosystem an easy way to access the benefits of the terra ecosystem through Kash.”

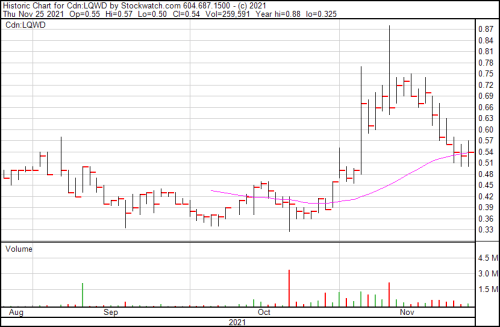

Central American Bitcoin summit showcases the future of money

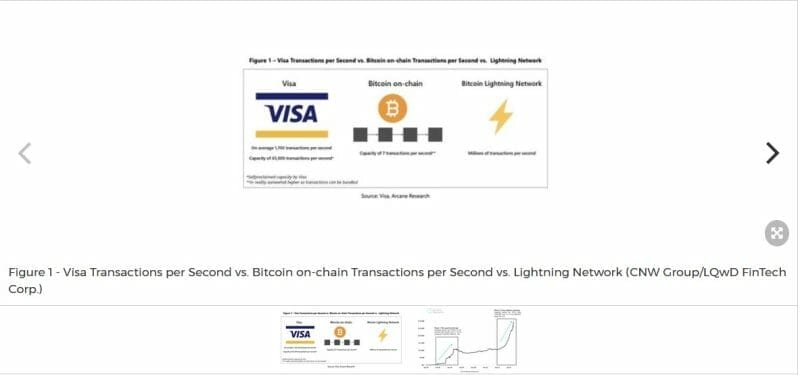

LqwD Fintech (LQWD.V) participated in the recent Adopting Bitcoin – A Lightning Summit in El Salvador from November 16-18. The conference brought in a group of industry expects in the Bitcoin and Lightning Network communities for discussions about the future of money and payments in Central America and beyond.

The Lightning Network is supposed to be the solution to Bitcoin’s scaling problem for microtransactions globally. It costs less and has instant settlement times. It has grown since January 1, 2021, with node growth doubling and Bitcoin capacity increasing 181% to September 30, 2021. It’s also picked-up some high profile endorsements, including Jack Dorsey’s Twitter and Square, which have shown interest in incorporating the network into their platforms.

The suggestion here is that Bitcoin’s Lightning Network is going to resolve Bitcoin’s scaleability problem and we’ve heard that one before. Sadly there are no details beyond that graphic. Mostly, as with all things Bitcoin scalability and especially lightning network, take it with a grain of salt.

Morgan Stanley increases their Bitcoin exposure

If you’re unfamiliar, Morgan Stanley is one of the largest investment banks in the United States. They have a notorious on-again off-again love-hate relationship with Bitcoin that’s been going on for years. Lately, though, they’ve been having a hint of a rekindling of interest with Bitcoin now that BTC’s a commodity that’s making people rich.

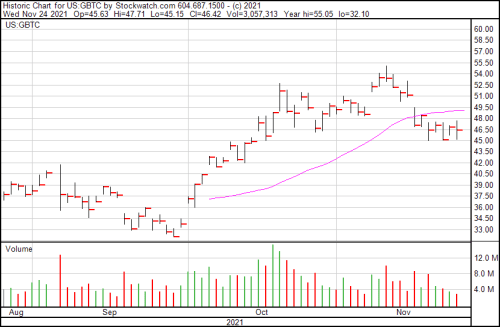

Well, they’ve increased their Bitcoin exposure to over $300 million through purchase of additional shares of Grayscale Bitcoin Trust (GBTC.Q) for three funds in Q3.

In new SEC filings, Morgan Stanley has disclosed a dramatic increase in Bitcoin exposure in its asset management business.

Earlier this year, Morgan reported buying Grayscale BTC in a large number of investment funds. For the three funds with the largest Grayscale holdings…

— MacroScope (@MacroScope17) November 24, 2021

The company’s next biggest purchase of GBTC shares in Q3 was made through the Morgan Stanley Insight Fund. The fund grew its holdings by 63% to 1,520,549 GBTC shares at the end of Q3, up from 928,051 shares in the previous quarter.

—Joseph Morton