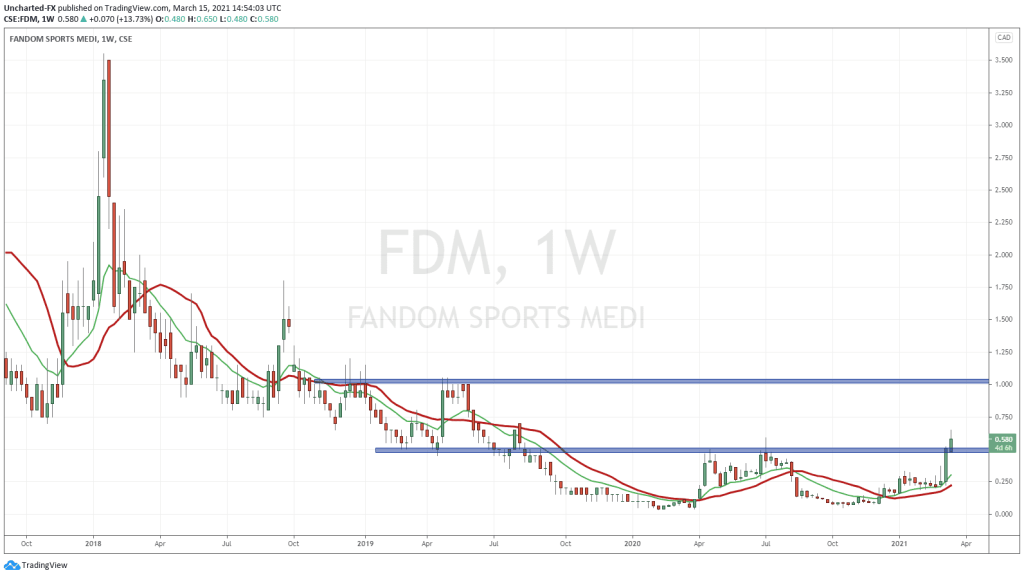

Fandom Sports Media (FDM.C) got started on the requested upgrades to the Fandom e-sports platform based on private beta launch feedback from prospective partners and and users today, according to a press release.

Discussions regarding future partnerships are ongoing and the company will regularly provide updates on what features they’re adding next, which they anticipate will help with defining business terms for localized platform launches. The company is presently looking at corporate structures and governance in support of their impending i-gaming wagering launch upon their interface.

“Having already determined the infrastructure requirements required for a global launch, we continue to develop innovative and proprietary technologies that will give Fandom players a transformative way to play predict and get rewarded for interacting with e-sports data feeds,” said David Vinokurov, chief executive officer and president.

Some of the features and functions integrated into the platform include, but aren’t limited to:

- Platform-wide multistream viewing capabilities that facilitate multiple game streams to be viewed in a floating picture-in-picture format whilst maintaining in stream predictions and wagering;

- Verified log-ins from major international social and messaging platforms;

- Preferred e-sports streaming platform selection;

- User-generated predictions for both all ages predictions and regulated i-gaming wagering;

- Global and direct challenges on all predictions and wagers;

- Curated news and action feeds;

- Development of game publisher and tournament direct application program interfaces (API);

- Custom data analytics and https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistration portals.

In other news, the company also reports that they’ve engaged in a debt settlement agreement for 45,000 shares for $0.20. The shares have been issued instead of a $9,000 payment, and are subject to the standard four-month hold period.

—Joseph Morton