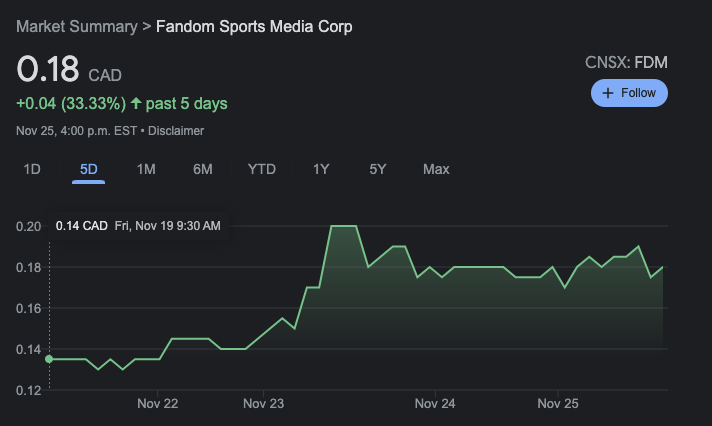

Fandom (FDM.C) to offer payment services for Skrill, Neteller

FDM has teamed with Paysafe to provide the Skrill and Neteller payment services. David Vinokurov, chief executive officer and president of Fandom Sports, commented:

“We’re very excited to be working with Paysafe and providing our customers with flexible and easy ways to onboard to our wagering platform. After completing our banking and payments integrations, we will be expanding our peer-to-peer wagering market from e-sports to sports and then ultimately to having a full odds line wagering platform.”

Skrill and Neteller are part of the Paysafe Group, a leading payments platform. The fundamental purpose of Paysafe is to enable businesses and consumers to connect and transact seamlessly through capabilities in payment processing, digital wallet, and online cash solutions.

The firm has over 20 years of online payment experience, an annualized transactional volume of over $US98 billion in 2019, and approximately 3,000 employees located in approximately 12 global locations.

- Neteller is a digital wallet, which offers people the ability to send and spend money online from a simple account. It allows customers to upload finances from credit and debit cards and a variety of alternative payment methods and use those finances to send money to friends and family or spend online wherever they see Neteller at the checkout.

- Customers can also use a prepaid Net+ card wherever MasterCard is accepted. For businesses, Neteller connects them to millions of wallet holders around the world.

Bragg’s Oryx Gaming (BRAG.T) receives a U.K. supplier license

“Receiving a U.K. supplier license offers significant growth opportunities for Bragg as we bring first-class iGaming entertainment to U.K. players together with local operator partners. This license and our pending entry into the U.K. market before the end of the year will help to accelerate our international growth trajectory and offers another proof point of the success, we continue to achieve with the execution of our global market expansion initiatives.”

Chris Looney, chief commercial officer of Bragg Gaming Group

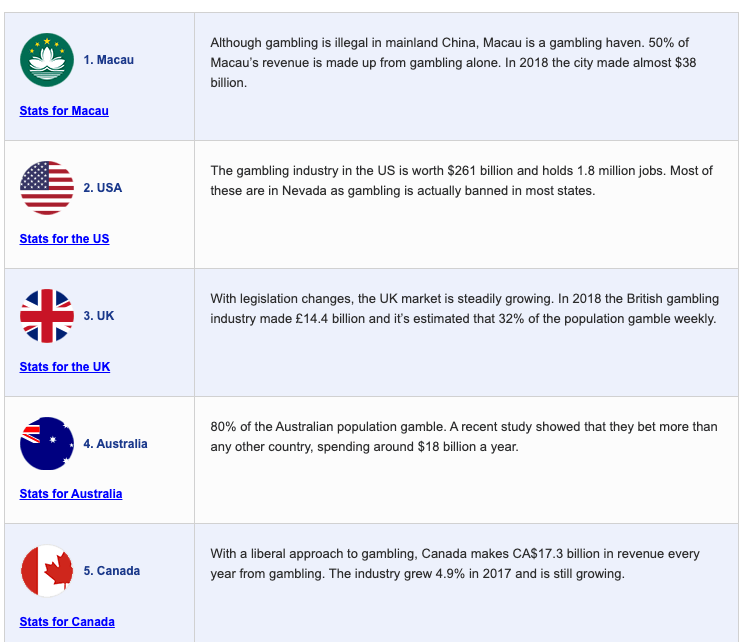

Oryx Gaming, a BRAG company, has been permitted a U.K. license, which is a significant milestone that will see the company enter one of the world’s most established iGaming markets and hopefully would considerably increase the firm’s global reach to the largest online gambling market.

The supplier license will enable BRAG to provide its content to a wide range of operators, including some of the biggest and most recognized brands in the industry.

An initial batch of Oryx’s best performing slots has initially been certified for the U.K. market, including games developed by Oryx’s in-house studio and exclusive titles from Gamomat.

The total addressable market for the online casino sector in the United Kingdom in 2021 is approximately $US5.5 billion according to H2 Gambling Capital, making it the largest regulated iGaming market in the world.

The license represents an important step in Bragg’s growth strategy as it continues to further grow its market share in regulated jurisdictions and secure entry into new markets including large established markets such as the United Kingdom.

CLOUD VILLAGE INC (9899. SEHK) Launches Hong Kong Initial Public Offering

Cloud Village is a leading interactive music streaming service provider in China that recently announced the launch of its Hong Kong Public Offering, which forms part of the Global Offering of 16,000,000 new ordinary shares and listing of its ordinary shares on the Main Board of The Stock Exchange of Hong Kong Limited (the “SEHK”) under the stock code “9899.HK.”

The offering comprises 1,600,000 Shares under the Hong Kong Public Offering and 14,400,000 offer Shares for the International Offering, representing approximately 10.0% and 90.0% of the total number of shares in the Offering, respectively, subject to re-allocation and over-allotment.

The offer price for the Hong Kong Public Offering will be not more than HK$220.00 per share The Company will set the International Offer Price by December 1, 2021, Hong Kong time. Shares will be traded on board lots of 50 shares.

The Company plans to use the net proceeds from the Offering to continue cultivating its community, innovating, and improving technological capabilities, selected mergers, acquisitions and strategic investments, and general corporate purposes.

ePlay Digital (EPY.C) talks about customer data tracking for apps

ePlay Digital Inc. has released new 2021 data tracking customer acquisition cost (CAC) for Google, App Store Search, Facebook, and TikTok platforms across the company’s 12-plus apps on Google Play and Apple App Store. The data help the company decide how to maintain growth and target revenue for existing and new apps, including Klocked and Fan Freak.

For more details on why this affects you, I would suggest watching this great video on the topic done by Shelby Holliday.

- Customer acquisition costs (CAC) range from a low of 11 cents per app install from Google Ads to a high of $24.11 per app install from Facebook Ads.

- ePlay’s Android apps enjoy the lowest CAC overall. Of ePlay’s 13 active apps, eight have a CAC of less than $1 for each download (between 11 cents and 86 cents).

- These include Howie Go Viral, Swish AR, Outbreak Android, Big Swish Android, Swish AR ES, and Klocked.

- Google accounts for five of the least expensive app CACs, TikTok for three, Apple Search Ads for two. Facebook is, across the board, the most expensive source of downloads for ePlay and further efforts are necessary to drive CAC on Facebook down.

Fan Freak: “ePlay has been working hard to minimize customer acquisition costs and deliver transparency without giving away competitive advantages,” says Trevor Doerksen, chief executive officer of ePlay Digital. “We are thrilled with the results indicating future focus across the app portfolio, including with Klocked ranging from 56 cents per app install from Apple Search, $1.23 from TikTok, and as low as $1.66 from Google.”

Enthusiast Gaming (EGLX.T) acquires League fan community U.GG

EGLX has acquired Outplayed Inc., owner of U.GG, one of the largest League of Legends fan communities in the world. The total consideration is approximately $US45-million in cash and stock paid at closing and to be paid through a schedule of deferred anniversary payments, plus earnouts of potentially up to $US12-million, subject to certain performance milestones being achieved within a two-year period from the date of closing.

Founded in 2017 by Shinggo Lu and Alan Liang and based in Austin, Tex., U.GG was incubated at Harris Blitzer Sports & Entertainment’s Sixers Innovation Lab. U.GG has grown into one of the largest global services for the world’s most popular e-sport, League of Legends, by turning better data into smarter insights for fans and gamers. By combining a rigorous data science approach with a proprietary user-centric experience, U.GG provides actionable, data-driven insights supporting, educating, connecting, and engaging its current monthly active user base of approximately eight million players. U.GG is featured on the official League of Legends website as a resource for players.

Enthusiast Gaming to Participate in Canaccord Genuity Digital Gaming Summit

On Thursday afternoon EGLX announced that its Chief Financial Officer, Alex Macdonald, will present at the Canaccord Genuity Digital Gaming Summit on November 30, 2021.

Macdonald will participate in a fireside chat with Canaccord Genuity Managing Director, Research – Technology, Robert Young, on November 30, 2021, from 12:30 pm – 12:55 pm ET.

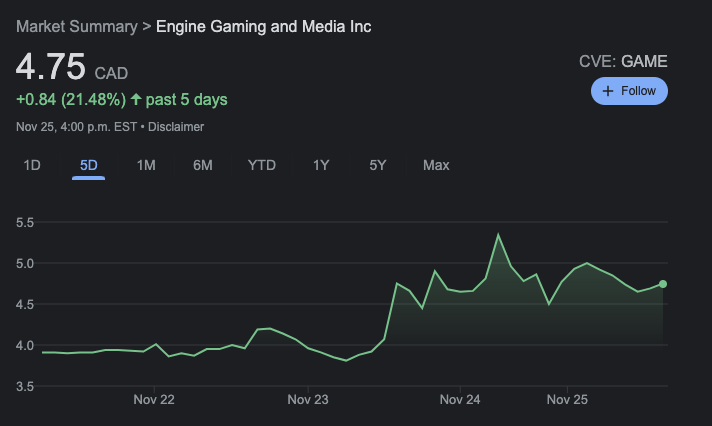

Engine Gaming (GAME.V) loses $40.7 million (U.S.) in fiscal 2021

Key Financial Highlights

For the year ended Aug. 31, 2021, total revenue was $37.2 million, up from $10.5 million in FY 2020, an increase of 253 percent year over year. Total revenue for Q4 FY 2021 was $11.8 million, up from $7.0 million in Q4 FY 2020, an increase of 67 percent YoY and 22 percent higher than sequential Q3 FY 2021 of $9.6 million.

For the year ended Aug. 31, 2021, net loss was $40.7 million, an increase in a net loss of $8.4 million from FY 2020 net loss of $32.3 million. Net loss for Q4 FY 2021 was $13.5 million, an increase in a net loss of $3.4 million from $10.1 million in Q4 FY 2020. For the year ended Aug. 31, 2021, net loss included $18.5 million in non-cash expense (income) and $8.1 million in Q4 FY 2021.

The company had cash of $15.3-million and $8.6 million in receivables as of Aug. 31, 2021. In addition, the company had a working capital surplus of $10.4 million after excluding non-cash warrant liability and legal proceedings provision.

Key segment revenue growth that contributed to the strong revenue performance:

- Software as a service: SaaS revenue for FY 2021 was $6.4 million, up from $2.6 million in FY 2020, an increase of 147 percent YoY. Revenue for Q4 FY 2021 was $2.0-million, 28 percent higher than sequential Q3 FY 2021 of $1.5 million.

- Advertising: Advertising revenue for FY 2021 was $26.7 million. Advertising revenues grew 37 percent quarter over quarter, with Q4 FY 2021 revenues of $8.8 million, compared with Q3 FY 2021 revenues of $6.4-million.

- Games development: Games development revenue for FY 2021 was $3.4 million, excluding $1.3-millions of deferred revenues as of Aug. 31, 2021, which has been billed and collected, and is being deferred due to a client acceptance provision. Adjusting FY 2021 and FY 2020 revenue to include deferred revenue outstanding at each year-end, adjusted game development revenue for FY 2021 was $4.7 million, a 72-per-cent growth over FY 2020 revenue of $2.7 million.