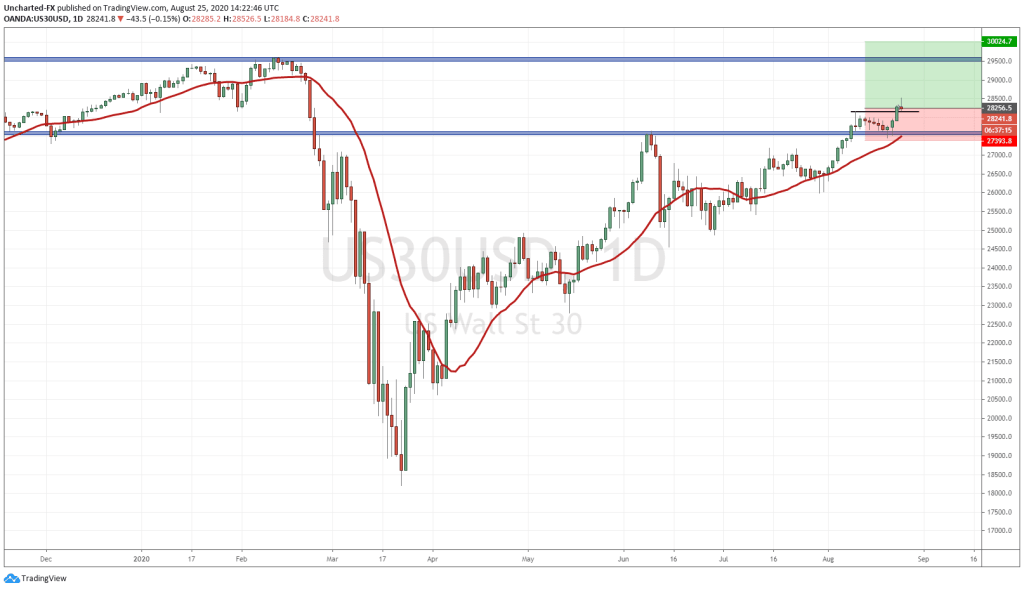

Hey Investors, very green day for small-caps as the large-cap market continues react to the economic information and uncertainty, here is a quick wrap up of what happened during this trading day:

- S&P 600 (USA Small Caps) up 0.69% & S&P 500(USA Large Caps) down by 0.46% for the day

- S&P/TSX 20(CAD Small Cap) up 0.95% as S&P/TSX 60 (CAD Large Cap) drops 1.00% intraday

- Bitcoin up 2.17% ,USD gains 0.21% value ,CAD up 0.19% & Gold up by 0.17%

Market Close, Wednesday, September 16, 2020

|

S&P 600 $ 882 0.69% |

S&P /TSX 20

$ 566 0.95% |

Gold

$ 1,958.00 0.17% |

|

Silver $27.37 0.44% |

Oil WTI

$38.93 2.74% |

Gas Henry Hub $2.74 0.04% |

| BTCUSD

$ 11,013 2.17% |

CAD 20 Y

0.85 0.02% |

USA 10 Y 0.69 0.01% |

Market Movers

Today we have a big winner in:

Snowflake Inc (NYSE: SNOW)

| 52 Week H/L: $ 319 / 240 |

| Open : $120 |

| Close : $319 |

| Intraday Price Change: 120% |

| Day’s Volume: 15 Million |

| Market Cap: CAD 68 Billion |

| Book Value: CAD 763 Million |

| Diluted Shares Outstanding: 62 Million |

| Sales TTM: CAD 402 Million |

Snowflake Inc. provides a cloud-based data platform in the United States and internationally. The company’s platform enables customers to consolidate data into a single source of truth to drive meaningful business insights, build data-driven applications, and share data. Its platform is used by various organizations of various sizes in a range of industries. The company was founded in 2012 and is headquartered in San Mateo, California.

This is a historic IPO that hit the open markets today, backed by the Oracle of Omaha and SalesForce Inc.

Warren Buffett is one to not venture into IPOs because of his disdain with the investment banking and securitization and underwriting process, but this kind of investment is not far from most of his long-lived investing principles he has built over his 50-year career.

The “Buffett” Way

In my own words his philosophy goes, A good business can be a terrible investment if the auction priced paid for its marketable securities is well above the economic value determined by its ability to produce positive cash flows as going concern.

We must also not forget although Buffett is the CEO and Chairman of Berkshire Hathaway and is the Chief of Investments of their $USD 207 Billion Equity portfolio he is one to only invest in “elephant-sized acquisitions” of entire operating businesses or the partial share of marketable common stock.

Berkshire Hathaway also has two investments Mangers, Tod & Ted, inhouse who manage a combined $20 Billion in AUM for Berkshire, and many of the smaller purchases can be attributed to them relative to the size of the entire portfolio.

Now onto his principles, Buffett believes a business should pass all four of the following principles to be a wonderful business investment :

- Understandable business or better said a business the Investor can understand

- The management should work for the shareholders and not their own self-interests with integrity

- The business should have a competitive economic moat that allows it to stay competitive

- It should have an attractive purchase price that is discounted appropriately.

Let’s put snowflake Inc to the test :

Understandable Business or better said a business the Investor can Understand

- The Snowflakes business model seems fairly simple, essentially, they are a cloud-based warehousing firm that stores information for corporations to use it in real-time. This allows a business to react to data as it comes through the channel as efficiently as possible.

- Today data is like oil, it can be seen as a basic commodity needed by the economies of the world to function properly and the ability to control and process this information in a timely manner gives firms a competitive edge.

The management should work for the shareholders and not their own self-interests with integrity

- Snowflake Inc. was founded in 2012 in San Mateo, California by three data warehousing experts: Benoit Dageville, Thierry Cruanes, and Marcin Zukowski. Dageville and Cruanes previously worked as data architects at Oracle Corporation; Zukowski was a co-founder of the Dutch start-up Vectorwise.

- The company’s first CEO was Mike Speiser, a venture capitalist at Sutter Hill Ventures

- Since it is a recent IPO this needs to be watched over time and more information becomes available about how the Board and the managers treat their corporate objectives and shareholders.

- The only conclusion we can make at the moment is that for this business the team seems well equipped to handle this industry as their experience is vast

The business should have a competitive economic moat that allows it to stay competitive

- A quick way(emphasis on quick) to assess if snowflake has a competitive advantage is to take a look at their margins or profitability.

- Sales Revenue is one of the cleanest numbers in the financial stamens because it is essentially, Price multiplied by Quantity(P×Q). It is free of the majority of the accounting assumptions made by management and their helpers.

- Price Multiplied by quantity translates into the price the snowflakes charges to its customers and multiplied by the volume of business its able to do, and then compared to the cost to produce this business(direct cost)

| Year | 2019 | 2020 | 2020 June |

| Gross Margin |

46% |

56% |

61% |

- This is not fully conclusive but shows that snowflake does have some competitive edge.

- It has grown margins in the last few years from 46% to 61%, meaning as 2020 June 31st they are selling the cloud-based software for $1 and it costs them 39 cents to produce it.

It should have an attractive purchase price that is discounted appropriately.

- Now we know the business is competitive and has able management, what does this mean for the investor buying into the common stock post-IPO

- The reason Mr. Buffet does not like IPOs is because of the costs associated with buying into them. He believes most IPOs are overvalued.

- To avoid going into the intricacies of the securitization and underwriting process we can break down in a simple format of how the price will be issued in the secondary market

IPO Price =

Add: Fair Value of snowflake ( Using a Discounted Cash Flow or similar IPO multiples like EBITDA )

Add: Underwriting Costs ( Fee paid to the investment house to issue the common stock to the public and do the marketing for the new IPO)

Add: Legal Fees ( Fees associated with regulatory registration and processes)

Add: Other costs ( Vested stock options given to management and sometimes given to investment bankers and private investors)

And in Second Place:

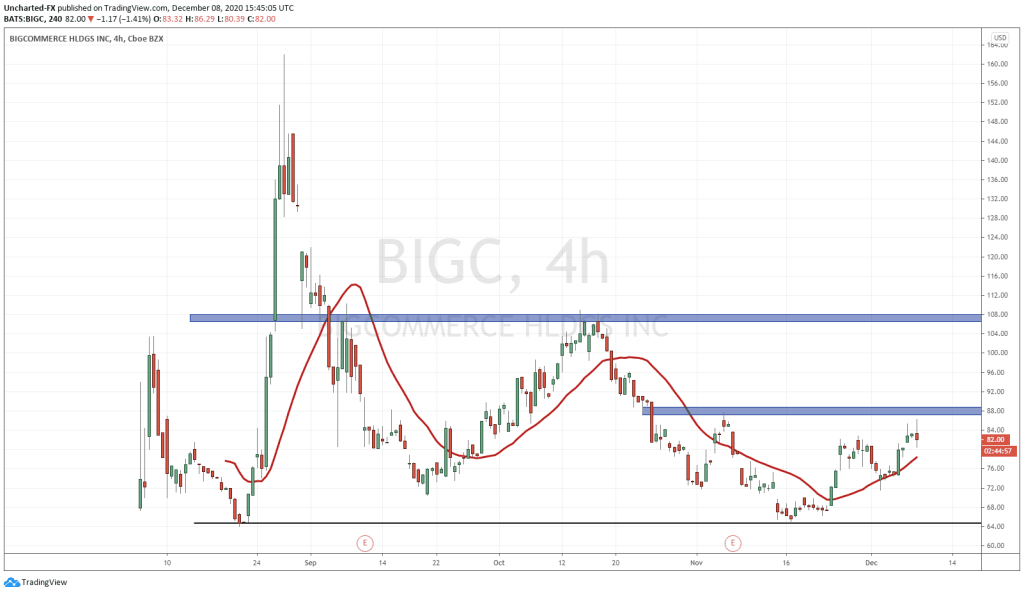

Giyani Metals Corp (CVE: EMM)

| 52 Week H/L: $ 0.31/0.04 |

| Open : $0.15 |

| Close : $0.28 |

| Intraday Price Change: 58% |

| Day’s Volume: 1 Million |

| 10 Day Average Volume: 39 Thousand |

| Market Cap: CAD 23 Million |

| Book Value: CAD 1 Billion |

| Diluted Shares Outstanding: 102 Million |

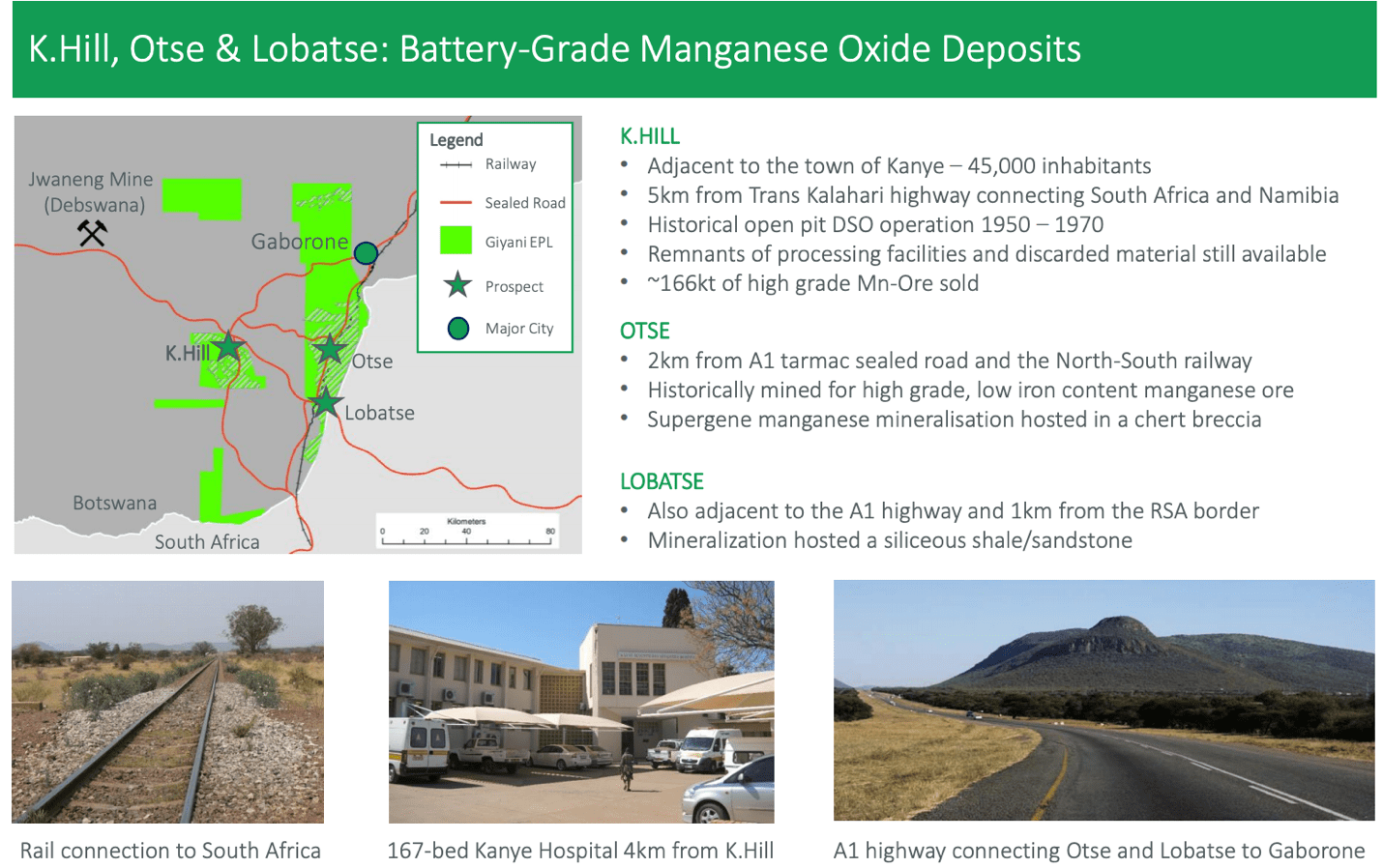

Giyani Metals Corp. is a Canadian explorer and developer focused on the development of its K.Hill, Lobatse & Otse manganese projects in the Kanye Basin, Botswana, Africa.

The company is coming of the back of a successful capital raising, it generated $CAD 1.2 Million in cash. In their press release Robin Birchall, CEO of Giyani Metals Corp. commented:

“We are delighted with the additional demand in this placing. We are very appreciative of the support from our existing shareholders, especially RAB Capital. This will enable us to expand some of our upcoming workstreams, for which we will update the market in due course.”

And early today they addressed the rise in trading volume :

OAKVILLE, Ontario, September 16, 2020 — Giyani Metals Corp. (TSXV: EMM, GR: A2DUU8) (“Giyani” or the “Company“), at the request of the Investment Industry Regulatory Organization of Canada (IIROC) and in response to recent market activity, announces that it is not aware of any undisclosed material information related to the Company or its business that may be affecting the trading price and volume of the Company’s common shares.

So, the big question is what is the market reacting to?

Key Asset is K.Hill Manganese Project

To start we need to understand what the business actually does with the minerals that they mine.

- A very large portion of the manganese that is mined is used in steelmaking, about 86% of it. The rest of the distribution is shared between battery cathodes and other chemical specialty products.

- The main project is in Botswana which is a relatively stable African economy Central Bank of Botswana benchmark interest rate 4.25% & the headline inflation rate of 2.2%

- Botswana has a well-established mining industry with investor-friendly laws and processes for exploration, development, and operations

- From their main project, they expect it to have a high return of 89% for the money invested in it over a 10-year period as demand in the global economy for steel and manufacturing starts to improve.

- For now, these prospects are enough to keep the mine afloat and as more investors notice this potential, they will flood into the stock

- It should be noted that this is merely speculation and many market participants can appraise the business very differently but the potential sales from this high in demand mineral cannot be ignored and the market has given the current shareholders a 58% higher valuation.

Happy hunting!