In a recent Highballer offering, we stated the following re Forum Energy Metals (FMC.V)…

“Things are busy at Forum Central, and it’s about to get much busier.”

Last week, on September 1st, the company dropped the following headline:

Rio Tinto Commences Drilling at the Janice Lake Sedimentary Copper/Silver Project, Saskatchewan

Here, Rio Tinto Exploration Canada (Rio for short) is taking aim at Forum’s flagship Janice Lake Sedimentary Copper/Silver Project in north-central Saskatchewan.

Before we dig deeper into this recently launched drilling event, a review of the underlying fundamentals underpinning the quarry of this colossal undertaking.

Copper

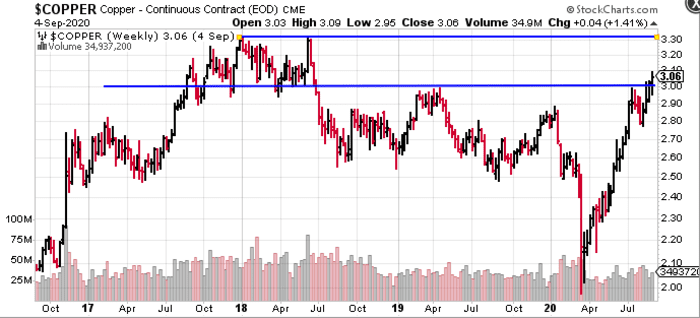

The current price of copper (Cu)—a pic is worth roughly a grand…

After challenging resistance at $3.00, the market is wondering “what’s next?” If copper is to carve out higher ground and trade like there really is a growing problem on the supply front (more below), the $3.30 level, representing the next zone of resistance, will be the first stop among many on copper’s march to higher ground.

After challenging resistance at $3.00, the market is wondering “what’s next?” If copper is to carve out higher ground and trade like there really is a growing problem on the supply front (more below), the $3.30 level, representing the next zone of resistance, will be the first stop among many on copper’s march to higher ground.

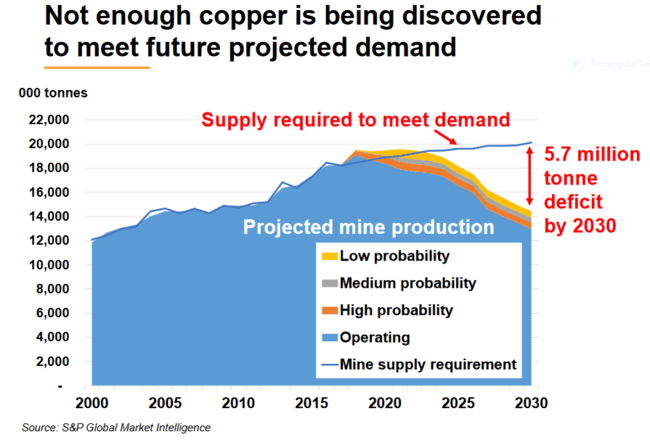

Why should copper be trading higher? Once again, a pic is worth a grand…

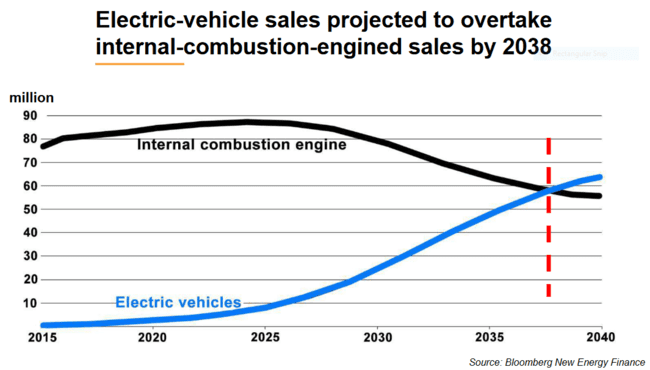

There will come a time when electric vehicles (EVs) overtake the internal combustion engine.

There will come a time when electric vehicles (EVs) overtake the internal combustion engine.

And that date with destiny is not too far off.

EVs require heaps of Cu:

- hybrid electric cars require 85 lbs of the soft, malleable metal (a metal with high thermal and electrical conductivity properties);

- EVs require 183 lbs of the metal;

- electric buses need between 500 and 800 lbs.

Even the charging-station infrastructure for EVs require significant quantities of the metal.

As our species continues its unabated push to urbanize our planet—there will be eight billion of us tripping over one another in a few more years—the demand for green metals, like copper, will go through the roof.

As our species continues its unabated push to urbanize our planet—there will be eight billion of us tripping over one another in a few more years—the demand for green metals, like copper, will go through the roof.

More examples of the role copper will play in a greener world:

- Flywheels (pumped hydro) will require .3 to 4 tonnes of Cu per megawatt (MW);

- Wind turbines will require 3.6 tonnes of Cu per MW;

- Solar panels will require 4 to 5 tonnes of Cu per MW.

According to the International Energy Agency, worldwide demand for air conditioning is expected to triple over the next 30 years. And on that front:

- 52 lbs of Cu go into each cool air unit;

- 8 billion cool air units are expected to be in use worldwide by 2050;

- China, India, and Indonesia will account for roughly half of the global increase in electricity demand.

Here’s where it gets dicey

The current supply deficit we’ll be facing in the not-too-distant future is somewhat unsettling:

- The lions share of the worlds primary Cu supply comes from only 20 mines;

- The world has less than 20 years worth of (economic) copper reserves remaining;

- The 14 largest producers show an average reserve grade of .62% (large deposits running grades north of 1% are exceedingly rare);

- Future copper projects—the 19 largest development projects on deck—run grades averaging roughly 0.5%;

- Further down the foodchain, for the next group of large development projects, 0.4% will be the average;

- A lot of money has been spent searching for the metal—very little in the way of large, economic ore bodies have been discovered.

This next chart is definitely worth a grand…

Today, roughly 19% of the world’s energy is electricity. Over the next 30 years, that number is expected to climb to 50%.

Today, roughly 19% of the world’s energy is electricity. Over the next 30 years, that number is expected to climb to 50%.

The last time I dug deep, I discovered that no new significant copper mines are coming online over the next three years. There’s nothing that will save the day should supply disruptions come into play. Major price shocks would be the consequence should anything threaten this flimsy supply balance.

Getting back to Forum’s headline

Rio Tinto Commences Drilling at the Janice Lake Sedimentary Copper/Silver Project, Saskatchewan

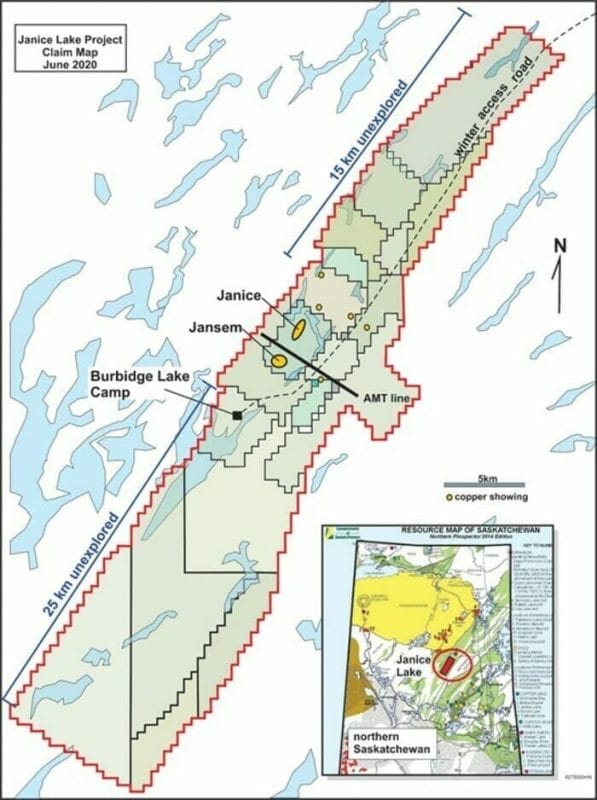

Forum’s flagship Janice Lake asset—some 38,250 hectares located in north-central Saskatchewan within the Wollaston Domain—“is a northeasterly-trending belt of metamorphosed lower Proterozoic supracrustal rocks deposited upon Archean granitoid basement.”

The property boasts over 20 sediment-hosted copper showings that hold the potential for multiple layers of copper mineralization.

Janice Lake has district-scale potential.

It’s this potential, on a district scale, that attracted mining behemoth Rio Tinto in a JV worth $30M.

Forum entered into an agreement granting Rio Tinto Canada a four year option to acquire a 51% interest in the Janice Lake Project by spending $10 million in exploration, making $490,000 in cash payments, and servicing the remaining $200,000 in underlying cash payments to Transition Metals Corp. Rio can earn a further 29% interest (total 80%) by spending a further $20 million in exploration over a three years (total $30 million) and making further cash payments of $150,000 to Forum (total $640,000).

The terms of this JV are aggressive.

Rio has spent over $3M on the project in less than a year. They plan to spend another $7M on a multiple phase drilling campaign, which is now in play.

The following pic shows a road (highway) Rio pushed into the project.

Rio also constructed an 80-person camp this summer. All tents and buildings are up, the kitchen has been assembled, the plumbing is in—they’re now finishing up the electrical.

Rio also constructed an 80-person camp this summer. All tents and buildings are up, the kitchen has been assembled, the plumbing is in—they’re now finishing up the electrical.

As you might imagine, this camp will be a top-shelf facility in every respect. It will also be built to withstand the icy Saskatchewan winter.

As you might imagine, this camp will be a top-shelf facility in every respect. It will also be built to withstand the icy Saskatchewan winter.

I highlight these two additions to recently constructed infrastructure to demonstrate how committed Rio is to the project.

According to this press release, a Rotary Air Blast (RAB) is now on-site and is probing the immediate subsurface layers of Janice Lake’s historic and newly mapped regional copper showings, including numerous recently developed geophysical targets over the 52-kilometer length of the project.

The RAB rig—good for a 30 meter poke through the overburden and into the bedrock—will be used as a scout drill of sorts, setting up and narrowing the field of targets that will come into play when a diamond drill rig enters the fray in the coming months.

“Copper/silver mineralization currently extends for approximately 8km in outcrop and in drillholes along strike of the Janice Lake Basin. RAB drilling is a quick, cost-effective and efficient method of testing the numerous showings on the project that have not had any historic drilling. This will aid in the development of a diamond drill program for the winter of 2021.”

“Copper/silver mineralization currently extends for approximately 8km in outcrop and in drillholes along strike of the Janice Lake Basin. RAB drilling is a quick, cost-effective and efficient method of testing the numerous showings on the project that have not had any historic drilling. This will aid in the development of a diamond drill program for the winter of 2021.”

In chatting with Forum CEO Rick Mazur recently, I learned that ground crews have been busy for the past two months mapping and prospecting. This groundwork will better define the region’s geology, specifically, the meta-conglomerate/psammites/pelites (metamorphosed conglomerate/sandstone/shale) rock that hosts the copper/silver mineralization at the Janice and Jansem targets (map above).

CEO Mazur:

“… it appears that Induce Polarization (IP) surveys are helping delineate mineralization. The results from soil and biogeochemical surveys over Jansem are being reviewed. The idea is to apply these techniques elsewhere to discover new orebodies.”

Ken Wheatley, Forum’s VP of Exploration, was on the project two weeks back and noted visible chalcocite in outcrop along the Rafuse showing, a target located three kilometers northeast of the Janice showing (a 1969 drilling program at Rafuse tagged a highlight interval of 0.9% Cu over 11 meters).

The following image shows the RAB rig probing the immediate subsurface layers at the Roberts showing, one of over a dozen potential diamond drill targets on the property.

According to CEO Mazur, Rio Tinto has Jansem, Janice, and Rafuse in its crosshairs for an initial probe with the diamond drill bit next January. Data from the current (ongoing) summer program will be used to set the stage for additional drill targets that may come into play as ground crews get a better read of the lay.

According to CEO Mazur, Rio Tinto has Jansem, Janice, and Rafuse in its crosshairs for an initial probe with the diamond drill bit next January. Data from the current (ongoing) summer program will be used to set the stage for additional drill targets that may come into play as ground crews get a better read of the lay.

Don’t be surprised if one or more ‘additional drill targets’ rises in the (priority) ranks to take on greater meaning. Such is the nature of a campaign designed to scope out the regional potential of 52-kilometers of prospective, largely untested geology.

A bit of recent Janice Lake history

Janice Lake had been sitting idle, it’s district-scale copper potential largely ignored, until CEO Mazur entered the fray only a few years back.

Janice Lake is not without a history though.

- A 1993 drilling campaign by Noranda tagged an interval of 0.77% Cu over 33.0 meters (including 1.6% Cu over 6 meters) within 35 meters of surface.

- Shortly after, a modest drilling program by Phelps Dodge cut 0.72% Cu over 26.0 meters (including 1.33% Cu over 5.83 meters) in a separate zone.

- More recently, a surface sampling campaign by Transition Metals (XTM.V) produced grab sample values in the range of 0.34 to 9.35% copper, and 0.7 to 61.7 g/t silver.

A first pass, four-hole drilling campaign conducted by Forum in the summer of 2018 tagged a highlight interval of 18.5 meters grading 0.94% Cu and 6.7 g/t Ag (including 5.2 meters grading 2.22% Cu and 16.5 g/t Ag).

Building on the momentum from that 2018 campaign, CEO Mazur brought in Rio Tinto.

It’s worth repeating that Rio is a mining behemoth. It’s currently ranked the 2nd largest mining entity on the planet. And their #1 target commodity is Cu.

Rio never gets involved in a project unless it offers world-class, Tier One potential.

Rio’s first pass with the drill bit tagged the following values last summer:

- 0.41% Cu and 4.2 g/t Ag over 57.1 meters (from 78.9 meters to 136 meters), including 0.95% Cu and 9.7 g/t Ag over 13 meters (from 89 meters to 102 meters);

- 0.57% Cu and 1.50 g/t Ag over 51.8 meters (from 116.2 meters to 168 meters), including 1.09% Cu and 1.39 g/t Ag over 9.1 meters (from 118.9 meters to 128 meters) and 1.32% Cu and 3.42 g/t Ag over 5.0 meters (139.0 meters to 144.0 meters).

These are solid near-surface hits.

Rio appreciated these early-stage results, spurring them to take a 51% interest in the project (assuming they reach the $10M expenditure mark in 2021) within two years, not four years as originally contemplated in the May 9, 2019 option Agreement.

In my opinion, Rio’s interest and financial commitment to Janice Lake add heaps of credibility/validity to the project.

Forum has a market cap of $17.76M based on its 118.43 million shares outstanding and recent close at $0.15.

With Rio Tinto’s ($30M) commitment, an aggressive push on the drilling front, and the district-scale discovery potential of a largely untested project located in a mining-friendly jurisdiction, FMC.V appears nicely set-up for positive share price trajectory.

END

—Greg Nolan

Postscript: Stay tuned for an update on Forum’s Love Lake project in the not-too-distant future.

Full disclosure: Forum Energy Metals is a Highballer marketing client. Forum is not currently an Equity Guru marketing client. The author owns shares.