On August 4, 2020 Last Mile Holdings’ (MILE.V) provided an update on certain key performance indicators (KPIs) and new market launches.

Notably, in July 2020 Gotcha officially launched micromobility systems in the following markets

- Galveston, Texas (e-scooters and cruisers)

- South El Monte, California (e-bikes)

- Clair Shores, Michigan. (e-scooters)

Last Mile is focusing on university campuses and small to midsize municipalities in the U.S.

MILE’s subsidiary, Gotcha has secured permits to deploy approximately 20,000 vehicles, 80% of which are exclusive.

With 80 combined locations, MILE is the third largest micro-mobility company by location in North America, after Lime and Bird.

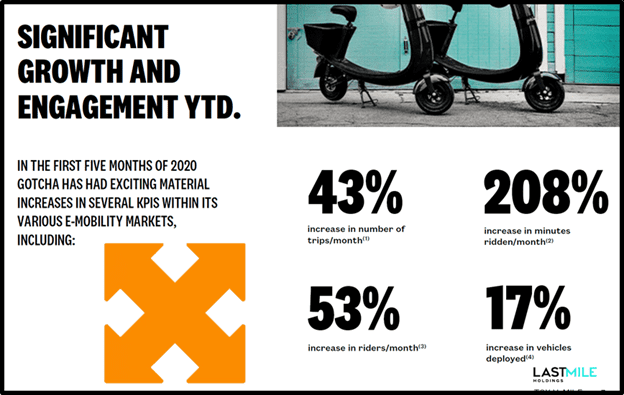

“In the first five months of 2020 Gotcha has driven industry-leading and month-by-month improved single vehicle unit economics,” stated Last Mile a month ago.

With an average profit of $2.45 per trip, Gotcha’s results year-to-date represent a nearly 93% premium when compared to the latest publicly available data for its peers.

Excluding depreciation, cash contribution per ride of $3.70 represents a 39% contribution margin.

On a total revenue per trip basis, Gotcha’s $9.42 average represents a positive differential of 121% according to the same data source.

Gotcha reported increases in profitability across its various end markets, driven by increases of 208% in minutes-ridden-per-month.

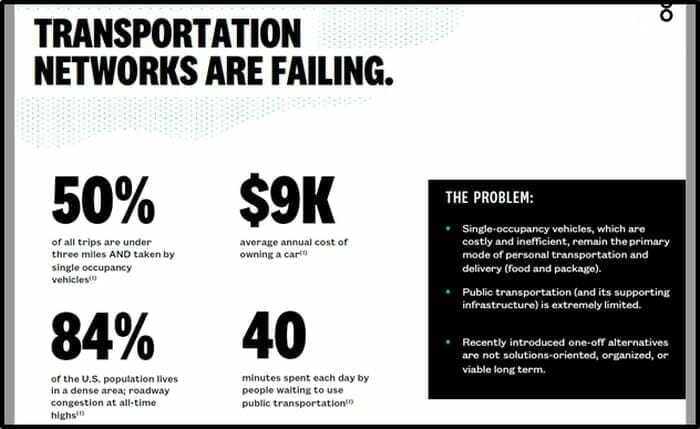

Young companies have the advantage of low baseline revenues to improve upon. That said – Last Mile’s ridership surge is a counter-example to the diminishing returns of other ride share companies.

“Scooter-sharing service Lime is considering further cuts to its workforce in the U.S. as sales and scooter trips plummeted with the coronavirus pandemic,” reported Bloomberg on March 21, 2020.

“As recently as January, Lime had about $50 million of cash,” reported Bloomberg, “But with a monthly burn rate of about $22.5 million, and factoring in revenue generation for the year to date, the person [anonymous Bloomberg source] estimated Lime had about 12 weeks left before running out of money”.

The impact of global self-isolation measures and government bans on travel have decimated Lime’s ability to make money from the hundreds of thousands of scooters it has around the world. – Bloomberg.

To be fair, Lime is not struggling alone.

Unless you are Amazon (AMZN.Q), Moderna (MRNA.Q) or Zoom (ZM.Q) – there is a high likelihood this pandemic has hurt your bottom line. Despite that, in the medium and long-term, ride-share companies are positioned to benefit from demographic and behavioural shifts.

Last Mile’s August 4, 2020 announcement updates press releases originally issued on June 17, 2020, and July 6, 2020.

Last Mile’s August 4, 2020 announcement updates press releases originally issued on June 17, 2020, and July 6, 2020.

August 4, 2020 highlights:

- Launched micromobility systems in Galveston, Texas (e-scooters and cruisers), South El Monte, California (e-bikes), St. Clair Shores, Michigan. (e-scooters)

- Consistent revenue driven by high ridership in key markets, such as: Memphis, Tennessee (cruisers); Baton Rouge, Louisiana. (e-bikes); and Charleston, S.C. (pedal bikes).

- After a contract renewal, Gotcha is relaunching its exclusive e-scooter program at Michigan State University in early August as students return for the fall semester.

- Average ride times have remained at consistent levels since early May and continue to represent significant increases across the board from pre-COVID-19 pandemic averages.

- Outperformance within the higher margin cruiser and scooter products in the summer months contributing to attractive unit economic profile.

- In early August, Gotcha surpassed 86,000 unique riders across its multimodal fleet and has logged more than 260,000 trips year to date.

“Throughout the continuing COVID-19 pandemic, Gotcha has been co-ordinating efforts with university and municipal partners to keep its products on the streets and provide riders a socially distant transportation alternative,” stated Last Mile.

With many universities anticipating various level of student attendance in the fall of this year, Gotcha expects to record increased usage within many of its current 30 university locations, including its upcoming relaunch at Michigan State University.

On July 30, 2020 Last Mile announced amended the terms of a previously announced Private Placement, for proceeds of up to $7 million – priced at CND $0.075 per Unit.

Each Unit comes with a warrant priced at $0.11 for a period of 24 months from the closing of the Offering.

Chairman and significant shareholder Louis Lucido will be participating and has indirectly committed USD $1.0 million in connection with the Offering.

Mr. Lucido was a founding partner of DoubleLine Capital, the USD $148 billion Los Angeles-based investment management firm headed by Jeffrey Gundlach.

Net proceeds from the Offering will be used for general working capital purposes as well as to purchase approximately 4,000 new vehicles,” stated Last Mile, “which will be deployed to meet contractual agreements with 10 municipalities and universities for shared mobility systems.

“This financing enables us to effectively double our outstanding vehicles for deployment from 4,000 to 8,000,” stated MILE CEO Max Smith, “fueling the increased demand we’re seeing in many of our markets.”

“These new deployments will fulfill existing contracts, providing us with a clear expansion plan,” continued Smith, “We are committed to growing responsibly, and the funds provided through this transaction should enable us to reach EBITDA profitability in the foreseeable future.”

“With certain student populations slated to return to some of our larger existing markets this fall, we are conservatively monitoring usage rate and are optimistic that ridership levels have significant room for even further improvement in the months ahead as we can provide our riders with a socially distant and safe way to get around campus,” stated Smith in the August 4 2020 news release.

“With certain student populations slated to return to some of our larger existing markets this fall, we are conservatively monitoring usage rate and are optimistic that ridership levels have significant room for even further improvement in the months ahead as we can provide our riders with a socially distant and safe way to get around campus,” stated Smith in the August 4 2020 news release.

- Lukas Kane

Full Disclosure: Last Mile Holdings is an Equity Guru marketing client.