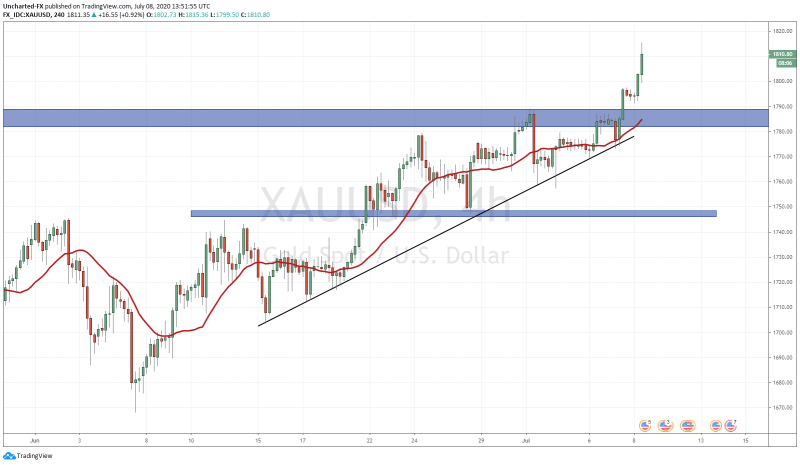

With Gold breaking above my key resistance level (although I want to see it close above on the WEEKLY chart…which now seems to be very likely, although anything can happen in 3 trading days until then) I thought it would be fitting to go back and look at the movement in one of the Gold junior mining stocks I discussed from a technical level. As mentioned, my strategy of looking at market structure (uptrend, range, downtrend) even applies and works for the junior miners because all assets move this way. These are cycles that keep repeating themselves, and our job is just to await for the reversal. This tends to come in the form of a bottoming pattern. In fact, I used this exact same strategy to trade the Gold breakout last year, and the breakout in GDX which is still valid and have been in an uptrend ever since.

I have maintained a bullish stance on Gold, but was expecting a major pullback. This obviously did not happen. What this indicates is that things might be worse than we thought. Gold is generally a confidence crisis asset. People run into it when they begin losing confidence in the government, central banks and the fiat money. All three of these seem to be occurring and will exacerbate. Elections in the US coming up which will be a gong show. Regardless of who wins, the opposition will likely not accept the results and the reaction from the public will be intense. You will see more riots and protests on the streets because the division between the people is at a peak. Central banks and fiat money really need no discussion here. i have spoken about the consequences of this monetary policy and how the Keynesians cannot admit they are wrong. Their argument is they just have not cut rates deep into negative enough nor have they printed enough money. Human history is just cycles of hard money and soft money…and maybe we are near the end of this soft money cycle (although the Keynesians will attempt to keep it alive through digital currency).

I spoke about the argument by Ray Dalio as well. In fact it has seen other Billionaires like Paul Tudor Jones and Stanley Druckenmiller also take a position in Gold. Gold is the best currency. In a period where bond yields are low, fixed income traders are not beating the real rate of inflation. They haven’t been for quite some time. Ray Dalio’s argument is why buy bonds for pretty much a guaranteed loss in yield when you can buy Gold, which has the possibility of moving more than 3% a month? Distortions in the market and exuberance now mean bonds are being held not for yield but for capital appreciation, betting on central banks to cut rates even lower. Into the negative for many western nations.

Another interesting idea here is the Fed’s nuclear option. Many know the Fed and the US want a weaker US Dollar, but in this currency war world, the Dollar would see a bid due to it being a reserve currency and hence, a safe haven currency. If things are going wild, people run into what they think is the best fiat: the US Dollar. Especially at a time when every central bank is trying to devalue their currency at the expense of the US Dollar…which fiat would you hold in this type of environment? The Nuclear Option has been detailed by experts such as James Rickards. It is the Fed buying Gold to weaken the price of the Dollar. Now I am not saying this is happening now, but something to keep in mind with the way money flows are moving these days.

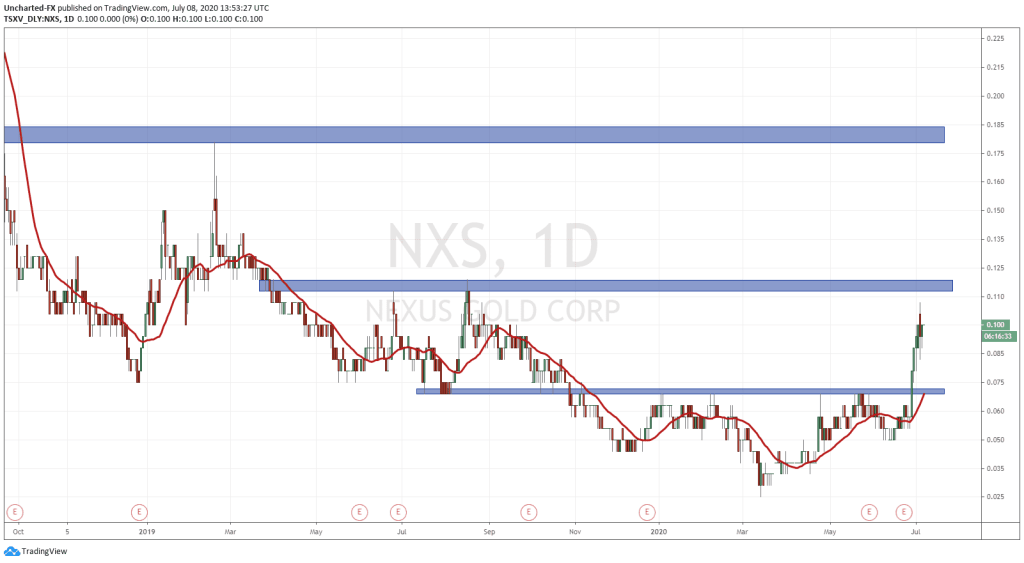

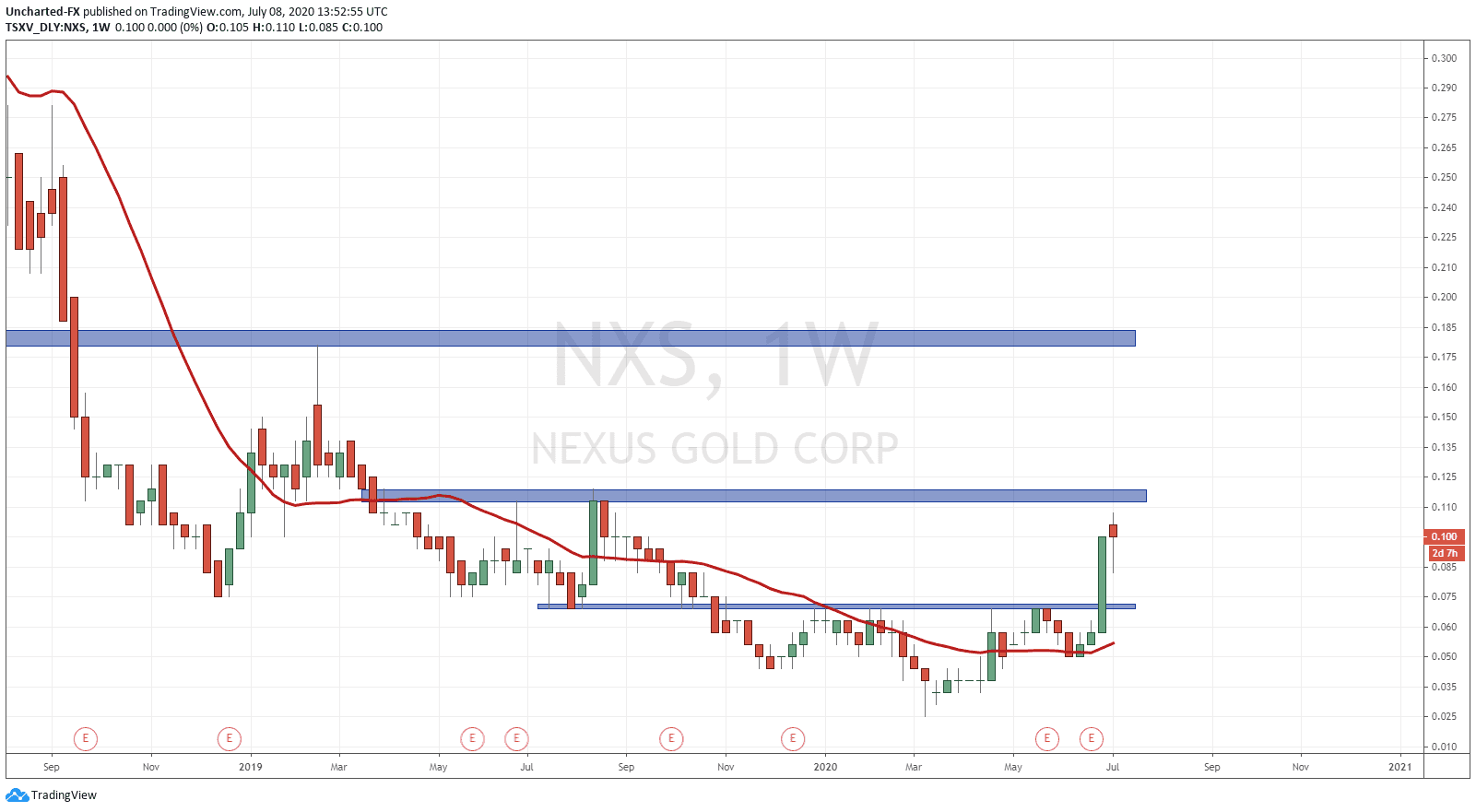

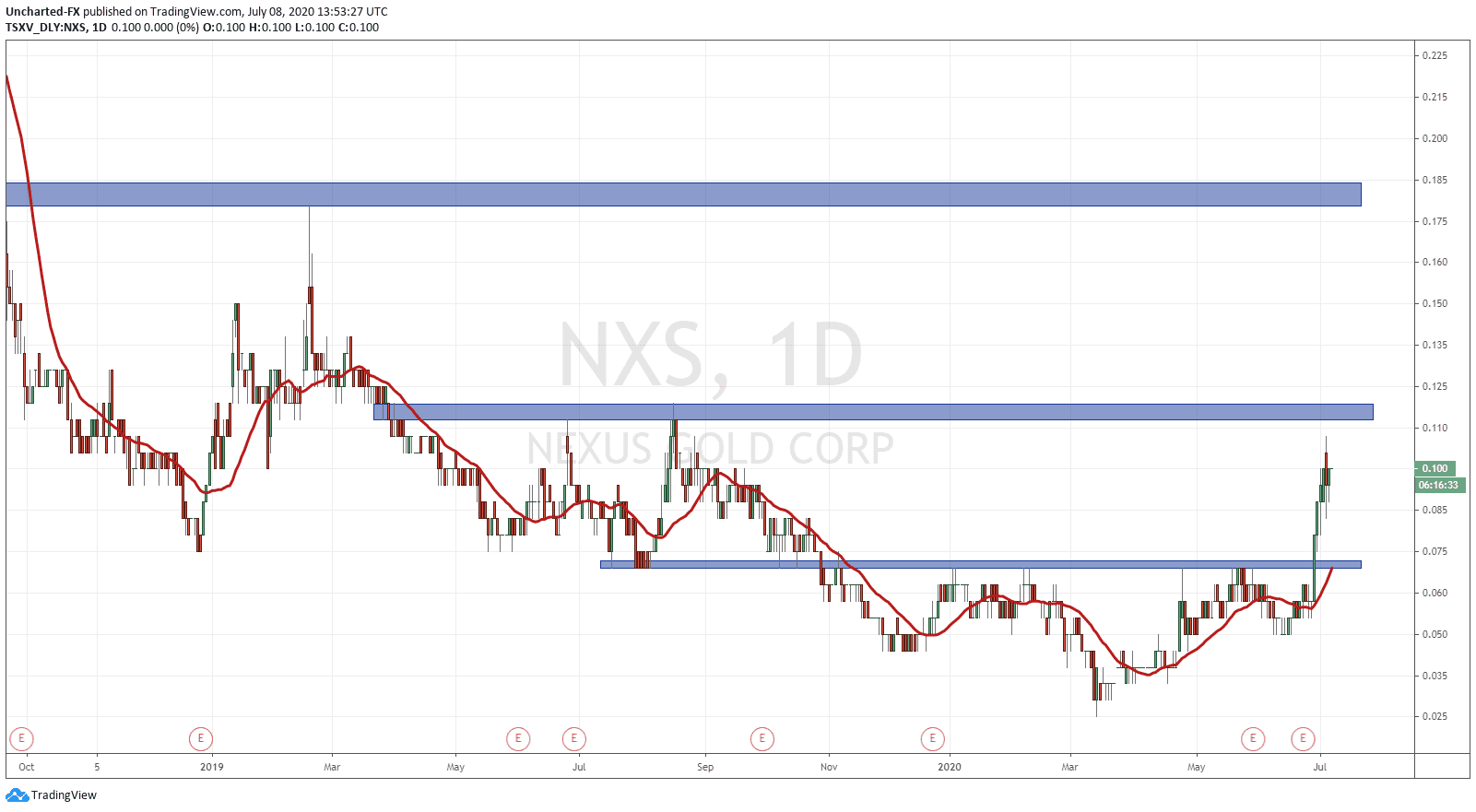

Last week, we looked at Nexus Gold (NXS.V) and the potential head and shoulders pattern forming. For those that are a part of the Equity Guru Discord Channel and trading/investing rooms, you were notified of the breakout and hence, confirmation of the head and shoulders pattern. This breakout occurred both on the weekly and daily chart as discussed per the article.

Nexus had a very strong daily green candle breakout, with the highs being at the closing price. This is the type of strength you want to see in breakouts, and how we can gauge candlesticks for that momentum. As you can seem, the momentum so far has been strong. We followed with a 12% gain and subsequently, days with 5% gains as well as a pullback which is entirely normal. In fact, as long as price remains above the breakout zone of 0.07, we are comfortable holding the trade.

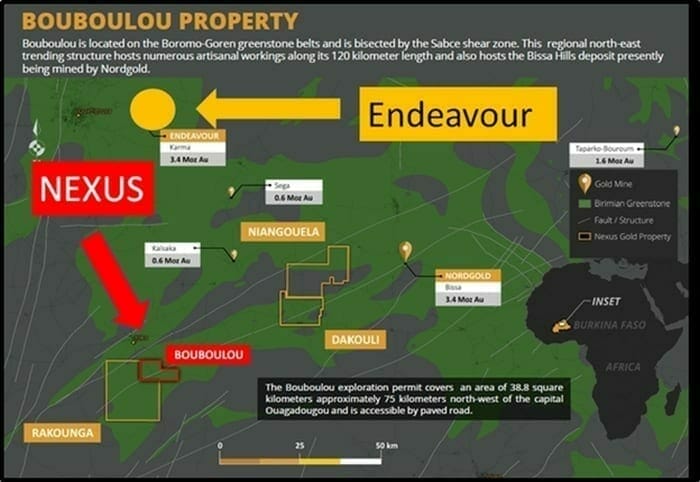

Nexus Gold is a Gold exploration and development company with assets in West Africa (Burkina Faso) and Canada. As well as five West African-based projects, Nexus controls the New Pilot Project in BC, four prospective gold and gold-copper projects in Newfoundland and the McKenzie Gold Project in Red Lake, Ontario. They have commenced drilling at their Mackenzie project in Ontario, and just recently, put out 10.5 g/t samples from Burkina Faso.

Our esteemed writers have covered Nexus Gold and the most recent article can be read here. I will be summarizing some of the points.

On June 19, 2020 Nexus reported that phase one drilling has begun at the company’s 100% owned McKenzie Gold Project, located in Red Lake, Ontario.

“The initial phase one program will consist of a minimum of 1000 meters of diamond drilling,” stated Nexus at the time.Historic drilling conducted in 2005 along this corridor returned significant values, including 7.49 ams-per-tonne gold over 8.2 meters, 15.54 g/t Au over 0.8 meters, 4.47 g/t gold over 1.4 meters, and 2.15 g/t Au over 5.5 meters. The initial drill program at McKenzie is designed to expand on 2005 drilling and to follow up on anomalous rock samples.

On July 2, 2020 Nexus Gold doubled down on that McKenzie drill program, adding an additional 1,000 metres. This is not entirely unexpected. Nexus “should have several holes drilled by now,” reported Equity Guru’s Greg Nolan on June 30, 2020, “It’s possible we could see this first phase expanded”. The added metreage will focus on drill targets previously identified in the southernmost section of the property.

“With the first few holes complete, we’ve decided its in our best interests to execute a larger drill program,” stated Nexus President and CEO Alex Klenman. “The environment is right for a more aggressive allocation of assets, so we’re doubling the initial commitment.”

This drilling program will “test the mineralization potential of several gold targets occurring within an east-west-trending corridor” occurring within volcanic rocks.

“It’s obvious a good drill hole can have a significant impact,” continued Klenman, “Increasing the phase one metreage gives us the opportunity to cover more ground and test more targets. We think it’s the right time to do that”.

Last week, NXS updated shareholders on its exploration program at the 100%-owned Dakouli II Gold Concession, located in Burkina Faso, West Africa. We believe Burkina Faso is in a good position to take over the mantle of Africa’s next hot gold producer. Eight new mines have been commissioned in Burkina Faso over the past six years. Endeavour Mining (EDV.T) – a $3.6 billion gold miner – is operating the Houndé and and Karma gold mines in Burkina Faso. EDV’s 2019 Burkina Faso revenues were about $600 million. The Karma mine is right in the same neighbourhood.

“Warren Robb, Nexus VP of Exploration had his sights set on Dakouli from the get-go,” states Equity Guru’s Greg Nolan, “For those unfamiliar with Robb, he was Roxgold’s chief geologist in 2012 where he supervised exploration on the Bissa West and Yaramoko gold projects. Robb believes Dakouli is ripe for discovery. Artisanal miners on the property are working a strike of roughly 400 meters and going down 80-plus meters.” – end of Nolan.

Back in Canada, on the McKenzie project, NXS anticipates executing additional drilling later in the year to test multiple targets located in the northern portion of the property. In this excellent Market One Minute segment, Klenman gives an overview of the exploration objectives on two continents.

Trade ideas and market discussion can be found on our Public Discord Channel: https://discord.gg/akcgCVP

Check out and subscribe to our Youtube channel where charts and market events are discussed on our Morning Market Moment show: https://www.youtube.com/channel/UCG7ZYDUeNANJiDxH88F9aQA