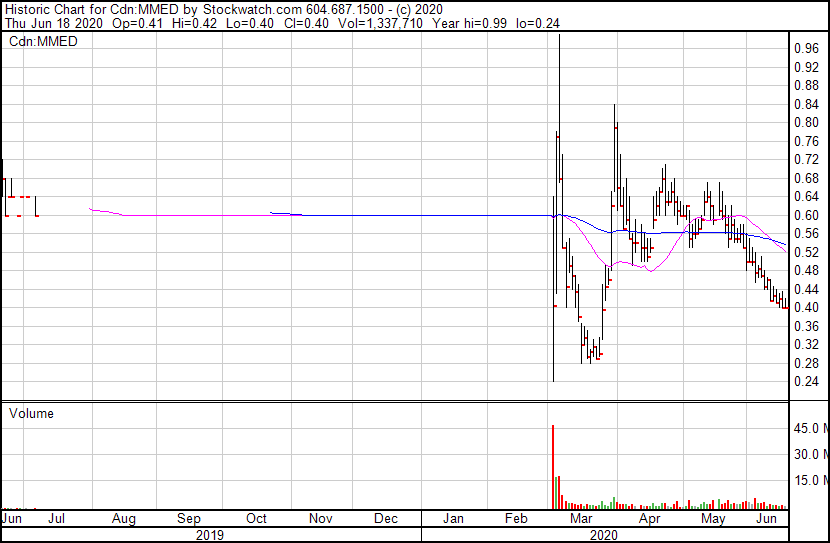

MINDMED (MMED.NEO)

MindMed announced Thursday it’s adding DMT (N,N-dimethyltryptamine), the active ingredient in Ayahuasca, to its research target list, working with the University Hospital of Basel to run phase 1 clinical trials.

DMT is a naturally occurring psychedelic substance and is the active ingredient used in ayahuasca ceremonies by indigenous Amazonian shamanic practitioners. DMT causes a rapid onset and offset of action compared with similar psychedelic substances such as psilocybin or LSD (lysergic acid diethylamide). When https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngistered as an ayahuasca brew, natural substances are mixed with DMT to prolong its experiential effects and slow the metabolism in the human body.

MMED co-boss J.R. Rahn:

“There is a growing trend in Western society to use ayahuasca and DMT to facilitate a healing process for one’s mind. However, there is very limited safety data and clinical trials evaluating DMT as a potential medicine so we are going to double down on understanding the therapeutic opportunity and more effective ways to https://e4njohordzs.exactdn.com/wp-content/uploads/2021/10/tnw8sVO3j-2.pngister DMT in a controlled setting to achieve this healing process.”

MindMed, which opened strongly on the public markets but has seen an ongoing stock slump recently, is primarily focused, at least officially, on addressing the opioid crisis “by developing a non-hallucinogenic version of the psychedelic ibogaine.”

In addition, the company has established a microdosing division to conduct clinical trials of LSD microdosing for adult ADHD.

Last week, MMED announced it was running phase 2 trials on LSD for the treatment of cluster headaches. Two weeks prior, it announced it was adding MDMA to its target list, and closed a $13 million raise at $0.53 per share.

The market hasn’t enjoyed those news pieces as much as the company would have hoped, with the stock now sitting well below the raise price at $0.40.

Not helping MMED’s share price is the fact it’s listed on the largely ignored third-tier NEO exchange.

YIELD GROWTH CORP (BOSS.C)

Also on the DMT train this week is Yield Growth Corp’s NeonMind subsidiary, which has filed a provisional patent covering the use of the substance to treat compulsive eating disorder.

It currently has no approved medical use, though DMT-containing plants are commonly used in indigenous Amazonian shamanic practice, and are sometimes found in the drink ayahuasca. DMT is found naturally in several plants including mimosa tenuiflora, diplopterys cabrerana and psychotria viridis. It is structurally similar to psilocin and its precursor psilocybin, a chemical found in magic mushrooms.

“DMT is a very interesting molecule that acts on the same type of serotonin receptors which are known to regulate appetite,” said Dr. William Panenka, chair of the NeonMind scientific advisory board. “As part of our overall patent strategy, we are establishing defensible intellectual property around multiple compounds that act on these receptors and intend to follow this with rigorous clinical trial work to establish efficacy.”

A week prior, Yield file patents related to using LSD and LSA for weight loss, while the parent company continues to roll out new products in the CBD space.

NEW WAVE HOLDINGS (SPOR.C)

This time for sure!

Considering it was a mining company in September of last year, then an e-sports company, New Wave Holdings sure has been busy on the psychedelics front the last few months. In that time, there have been two rollbacks, three ticker symbols, and several acquisitions bought and subsequently sold.

What’s left is a group that REALLY wants to chase the hottest sectors but leaves a lot of questions regarding how serious they are.

They’re trying to see to that over the last few weeks with a new roster of advisors and executives, including Dr. Carolyn Myers, PhD, who will provide ‘business strategy and business development consulting services to the company.’

Dr. Myers is an accomplished senior executive with extensive experience creating, growing and leading health care businesses. She is currently principal of BioEnsemble Ltd., a business strategy consulting firm that advises C-suite executives of small and medium-sized life sciences companies on a comprehensive range of drug development, commercial and business development services.

Dr. Myers will be instrumental in shaping New Wave’s research and development (R&D) focus in the area of psychedelic compounds, including psilocybin, MDMA, LSD and ketamine.

As accomplished as Dr Myers may be, the market yawned at the news, with stock in the company dropping a few cents, so New Wave repeated it the next day.

“Under Dr. Myers’ leadership, New Wave will continue to advance our R&D portfolio with the goal of developing industry partnerships as well as developing and commercializing therapies using psychedelic compounds such as ketamine, psilocybin and MDMA,” said Trumbull Fisher, President of New Wave.

Company stock dropped another cent to $0.25 on the repeated news.

This is not new for SPOR (AKA NWES, AKA TRM), which has had little problem raising money while it’s chased hot sectors this past year, but has had a lot of problems raising awareness – and convincing folks of its legitimacy – while doing so.

The company made substantial purchases in the e-sports arena, including investments in teams, event producers, and more, much of which appears headed for quick flips or writedowns going forward.

There’s a lot of focus now on New Wave’s more recent acquisition, in a 50% stake in Anahit Therapeutics.

- Anahit Therapeutics is developing a wholesale model, which includes psilocybin cultivation in emerging markets (for example, the Caribbean) that enables low-cost high-quality operations (that is, cultivation, extraction, formulation and packaging) for local and export markets;

- Building infrastructure to grow and sell mushrooms locally in Jamaica and exporting products to other legal jurisdictions such as the Netherlands and Brazil;

- Anahit Therapeutics is developing a product portfolio to include health care products that incorporate legal functioning mushrooms, as well as conducting research and development initiatives; Anahit Therapeutics’ product SKUs will include cordyceps, lion’s mane, chaga and reishi mushroom-based liquid cordyceps, concentrated mushroom powder, tea, chocolate, syrups, elixirs, cold beverages, and nasal spray;

That’s all fine as a stake driven into the sector, but legal revenues in psychedelics aren’t really a thing just yet, which means New Wave will need to cover the bills while waiting for lawsuits and regulatory changes to open things up. They can always go back to the market to raise money, but lost $4 million in their most recent quarter, according to financials, which is the same amount they’re trying to raise going into the new sector. At last report, the company had brought in roughly half of the intended amount, after a month of trying.

In addition, New Wave agreed to lend Anahit $350k going into their arrangement, which tells me that company isn’t banging out revenue just yet.

Going by its track record in e-sports, it would appear New Wave’s model isn’t to buy revenue in a sector, but rather involvement in a sector, as a means of convincing investors to buy in. That worked early on in the cannabis sector’s evolution, but today sees most players in that space writing down massive amounts.

My suggestion to New Wave, not that they’re contacting me asking my advice, would be to chill the fuck out for a bit and focus on developing a real business that can sustain in the short term, given the limitations that the psychedelics space currently works within.

Others are buying clinics as placeholders, or doing ‘research’ as placeholders, or announcing their intention to do something mushroom based ‘sometime’ in the future. Frankly, being the first one in isn’t a magic formula to long term success. Capital preservation, real moves that progress the business, and maybe even some public lobbying for regulatory change seem much better options.

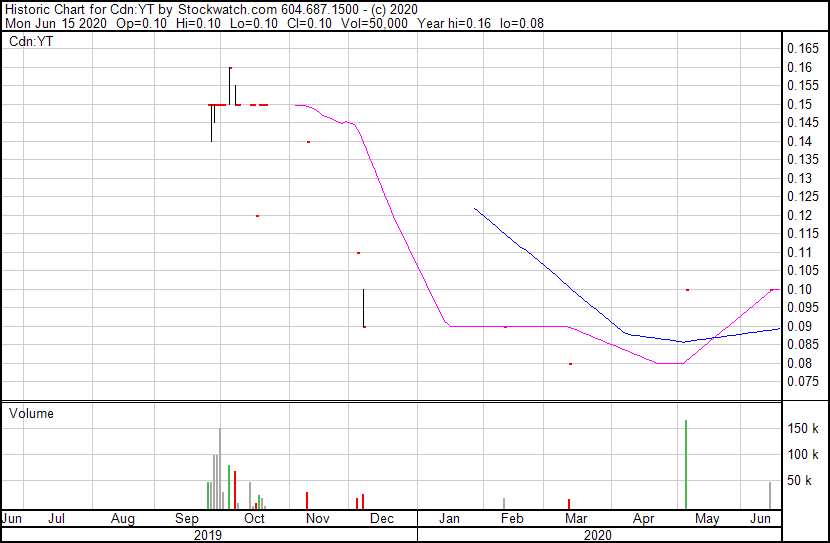

YUKOTERRE HOLDINGS (YT.C) / SILO

If you were one of those who contributed part of the $350k mining explorer Yukoterre Holdings raised in IPO last September, and have been wondering what the hell that company was doing with your money other than rewarding its executives with options – three financial quarters later, your questions have been answered.

No, you won’t be exploring a BC-based coal deposit, as was initially advertised. Now, you’re buying an Oregon-based shrooms outfit.

Silo was founded in Oregon and has been in the psychedelics and functional mushroom space since 2018 and ultimately formulated and announced a patent-pending psilocybin nasal spray in Jamaica in 2019. This metered-dosing delivery modality was created for consumer microdosing to address some of the primary issues that may prevent many from trying natural psychedelics for the first time, including dose reliability, taste, stomach upset and stigma. Its primary benefit is an uptake speed that is faster than nature intended for convenience and to help prevent dosage stacking, a problem that is most well known from cannabis edibles overdosing.

What’s interesting here is, this is interesting.

As a relative newcomer to the psychedelics space, the issue of dosage stacking and stomach upset is really quite the issue that prevents me actively microdosing. I love the effects of shrooms, really enjoy the ego removal, the euphoria without losing one’s mind, the ability to function while enjoying micro-benefits… but geez, does it make my stomach turn.

A fast acting, consistently dosed delivery option that won’t have my stomach fighting the ingredients would be a godsend for me.

In addition to its IP (intellectual property) portfolio, Silo is focusing on consumer product and wellness centre/retreat brand development for psychedelic and functional mushrooms. Its go-to-market revenue strategy includes scaling its U.S. Silo Reboot brand of functional mushrooms and its magic mushroom cultivation and psychedelic retreat operations in Jamaica. Following the proposed transaction, Silo anticipates that it will continue to grow its operations organically and by strategically integrating complementary businesses to its operations.

Translated: There’s really not that much revenue available just yet, but they’ll engage in placeholder business activity selling products here and there, to be prepared for the inevitable law relaxations that are ongoing but a long way from complete.

The products, I must say, appear to be real and not dissimilar to those found in Canada on various online mushroom dispensary sites. The Jamaican retreat site looks indepth, though it’s hard to tell if there’s any profit there or it it’s a lifestyle business at present.

SILO does offer white labeling of products, which could be profitable as the sector ramps up. But the kicker is the nasal spray IP. If it does what they say it does, and its defensible from competitors, that’s a real opportunity.

Whether one might be attracted to this as an investment opportunity, for mine, will come down to whether the folks from the shell SILO is going into are sticking around or exiting, and how quickly the industry moves from the grey market to white.

Certainly the anemic trading of the RTO company over the last nine months points to a need to tell their story loudly and often, and demonstrate legitimacy going forward.

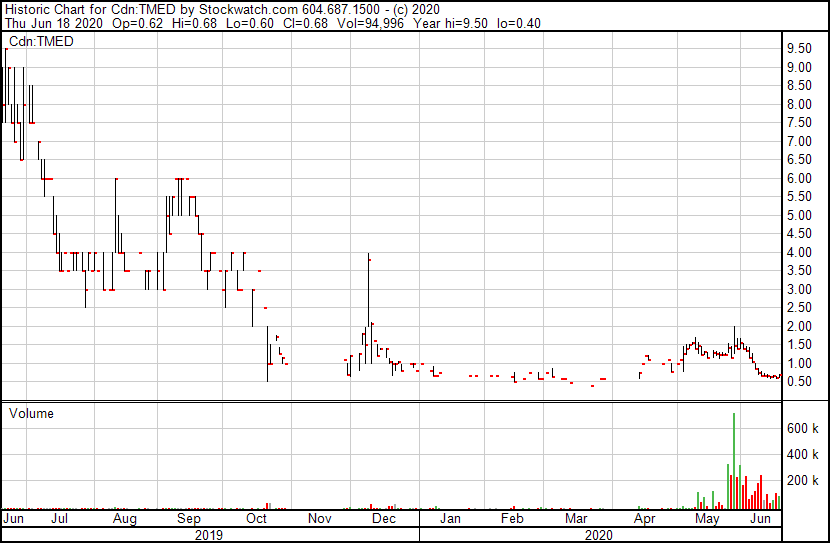

EGF THERAMED (TMED.C)

The big knock on shroom companies in the public markets right now is that most of them are chancers rather than pioneers – markets guys looking to acquire any asset that could convince a psychedelics investor to toss coin at their stock.

The track record of EGF Theramed (aka Theramed, aka Evatrade Health, aka Auxcellence Health) in building shareholder value has been spotty at best over the last few years, with a 100 to 1 rollback in its recent history, a new CEO in April that was gone by May, spin offs and trading suspensions, shifts from biotech to CBD to now psychedelics, court ordered asset disposals a few years back and, more recently, a request from the OTC Markets to explain what was going on with $700,000 worth of recent promo.

The history of this company is oof-worthy, but our focus should be on the now. Does EGF Theramed have actual assets in the psychedelics space that are worth buying into?

That depends on your outlook.

It also depends on whether you bought in on that big promo campaign and got left holding the bag.

EGF announced on May 22 it was going to buy an asset, Green Parrot, a Jamaica-based shroom retreat set-up (Jamaica’s lax outlook on shrooms is giving a lot of early market runners cover), and raise $2 million at $1.10 per share. Shortly after a big promo campaign ran the stock to as high as $2.

But before that raise could be closed, someone starting pounding out EGF paper, driving the stock price down hard, leading the company to amend the terms of the raise three weeks later to $0.75 per share.

Today the stock opened at $0.62 per share. So much for that promo campaign, eh?

Full disclosure: Our own company sells market awareness campaigns to public companies, but the $300k-for-two-weeks deals we see frequently from companies desperate to shift stock right now, and to hell with the subsequent sell-off, make little sense. Our highest price packages cost 1/5 of that, and last six months. Our budget programs run far cheaper still.

Admittedly, we don’t drive 200,000 Google ad clickers to a landing page on a Tuesday morning, convincing daytraders to buy on the pump, only to see them sell off on their 15% profit the following day. Our investors stick around for a while, anticipating their chosen company will build something substantial over the weeks and months ahead. They like that we challenge our clients to deliver, and hold them to a higher standard than FastPennyStocksShootingOutMyAss.com or GermanNutsoPromoDepot.eu.

A sample of the bullshit from Dear Wall Street leads off with “May Be One of the Most Promising Companies to Watch Right Now in the Massive Shroom Boom!” and concludes, “Any Big Pharma company that acquires or licenses [EGF acquisition] Pharmadelic Labs IP would have something equivalent to a magical oven that every chef dreams about having in his restaurant to gain that little extra edge over the competition!”

Good grief.

EGF has effectively shown their hand as a promo dependent paper churn with a heart attack monitor for a stock chart and a management team that struggles to answer to their maneuvers in any way other than to say, “Wasn’t us, someone else wrote that, we only paid the guys who paid them to write it.”

Who’s going to trust them now? How will that financing close when it’s underwater even after a 25% price reduction?

This makes my heart hurt, because there’s a ton of ways for pubcos to stake their claim in the shrooms space and really build a business without resorting to cheap tactics with a non-cheap price tag. That honest efforts keep getting crowded out for dough by miners-cum-CBD hawkers-cum-esports promoters-cum-shroom guys is a drag.

EGF has a $10 million market cap, and that might be about right for what they have. But they won’t enjoy any sort of rise in that valuation until they find Jesus and make legitimacy the focus of their business model.

— Chris Parry

FULL DISCLOSURE: None of the companies above are clients of Equity.Guru, though Yield Growth Corp has been at various points.