Ever get the feeling, looking at your watchlist, that you’re seeing the same thing over and over? That maybe there’s interesting stuff out there you just haven’t heard about yet?

I put a simple question to Twitter today:

Back to business: Give me a ticker symbol you think I should be writing about (limit one per person), three reasons you think it’s great, and one thing you’ll openly admit they need to do better.

— Chris Parry ™ (@ChrisParry) June 3, 2020

It took a while for folks to understand the rules, but once they did, 35 tickers had been put forth as untold stories.

The negative perception put forth for almost all of them was, “needs to tell its story better,” which is good news for my sales team but, going all the way back to my Stockhouse days, whenever we polled investors about what they wish public companies would do better, the overwhelming answer is ‘communicate with investors.’

So I’m about to help those companies out. Here are all 35 of the companies our readers suggested we should give some love to. Some are undiscovered gems. Some are, in the words of Bubbles, ‘decent!’ And some are… well, you guys, I’m not going to say I’m angry, just really disappointed.

Let’s go!

Of the 35 names put forth, only eight did more than a million dollars in trading volume on the day of writing. 19 did $100k of volume or more. Five did less than $10k, and three did zero.

Let’s kick in from the top:

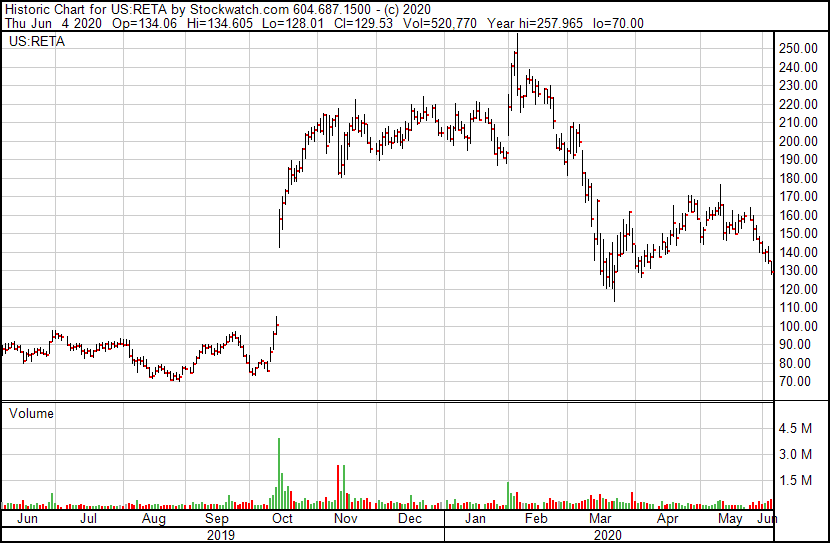

REATA PHARMACEUTICALS (RETA.Q)

- Sector: Pharma

- Market cap: $3.8 billion

One bad thing , $reta how come so little revenues but huge market cap

— Mr. D (@DjDarroo) June 3, 2020

Mr D asks a good question of Reata Pharmaceuticals (RETA.Q); a $3 billion market cap on the back of four drugs making their way to FDA approval is a bit of a premium price tag. If those drugs get approval for use, they’ll be valuable assets, but approval is by no means a given in the pharma world.

The drugs: Omaveloxolone targets the chronic inflammation and mitochondrial dysfunction associated with Friedrich’s Ataxia, Bardoxolone methylis going after Alport Syndrome and Autosomal Dominant Polycystic Kidney Disease (with three other opportunities in the research stage), and RTA901 and RTA 1701 being researched in the autoimmune and neurological indication areas.

Bardoxolene is the one with the most potential, given the seemingly large number of potential uses and the larger patient numbers for an approved product.

This is proper pharmaceutical advancement, not the sort of Hail Mary we often see in one-IP pharma deals that will raise whatever funds they can scrounge and drag out trials for years doing it on the cheap. RETA has around $600m in hand to get to monetization, and will lose around $40m per quarter as it continues its clinical trials. That gives an 18 month runway to gain FDA approval, then build a sales force (or license the ensuing product) for any of the above product options.

If one lands in that time, that market cap makes sense. If there are delays (and the company says COVID-19 hasn’t caused too much trouble on that front), that money may get chewed through quicker than hoped. The company is running at half the market cap it boasted in February, which you’d hope would mean it’s a value buy, but I’m not convinced it’s value at this level either.

The bottom line, for me: At best, if everything got approved, would it double from here?

That’d be a massive result, and I don’t know that it’s a gimme. The company FOR SURE does a lot of trading ($69m worth on the day of writing), so if you’re the in and out type, go hog wild.

My take: Watchlist, buy on big dips. 18 months of runway gives a lot of room to build in new IP.

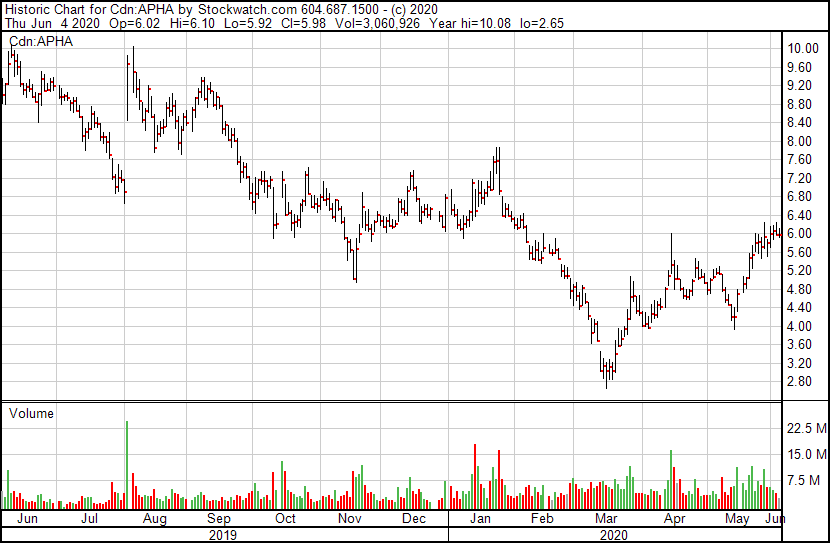

Next up: Aphria (APHA.T)

- Sector: Cannabis

- Market Cap: $1.2 billion

APHA. Only CDN cannabis company that is ebitda positive, showing growth in market share, yet is trading under book value. One thing they could do better is tell their story to help promote the business

— kbrodie (@kbrodie1974) June 4, 2020

I appreciate this suggestion because, though I watch the weed sector closely, I really don’t look at Aphria at all. The old Vic Neufeld days, where the company would buy shit assets from guys (sometimes the CEO himself) at inflated prices, looking for an even more inflated market cap valuation bump, sit heavily in my mind.

Also, unless you’re coming in at a really nice low valuation that I can get a multiple out of down the road, (think GTEC Holdings (GTEC.C) at $21m for three licensed properties), I struggle with seeing growing cannabis as a profit-maker.

Aphria, to their credit, do pull a profit, but it hasn’t always been a clean one. Mystery figures tossed in from others out of failed takeover bids were behind the first Aphria profit, which has subsequently evolved to a $5 million EBITDA quarterly win in the most recent filings.

That’s still *weak* considering it’s a $1.7 billion company, but impressive when compared to comparable large Canadian weed players that write down assets every three months. Honestly, I can’t see why anyone would hold Canopy Growth (WEED.T), considering its going to, by management’s own admission, not earn a profit for three to five years, when Aphria is, at the least, profitable now, experiencing sales growth now, and buying product from other suppliers to make up the demand.

Also, with $500m+ cash in hand, they’re not going down any time soon and should be actively seeking undervalued assets to buy or finance out of trouble.

My take: If you’re looking to ‘buy and forget it’ on the weed sector, this is probably your better bet from the top 5, but I don’t expect to see triple-digit returns until the international scene really lights up.

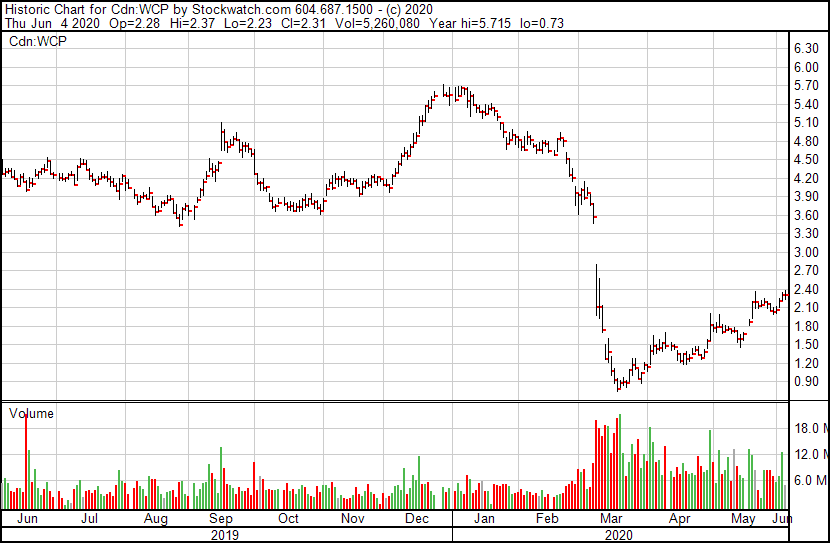

WHITECAP RESOURCES (WCP.T)

- Sector: Oil and gas

- Market Cap: $940 million

WCP pays divy, modest debt levels, great management….buy back shares while cheap

— fumoney (@fumoney2016) June 3, 2020

There’s something I really like about Whitecap Resources, but it might not be immediately obvious to most. Yes, they’re an oil company, producing across central and western Canada. That may make some potential investors nervous, or even put off, for environmental reasons. I’m down with those reasons myself.

But the thing with Whitecap is, it’s carbon neutral, due to the fact it purchases 1.8 million tonnes of carbon dioxide from a Saskatchewan coal gasification plant, and sequesters it for injecting 1500 metres down into oil wells to bring unconventional oil resources to the surface.

I’m not going to tell you that I see oil and gas as a monster growth sector, nor that offsetting oil and gas production with carbon capture makes the world a better place (maybe a bit less worse), but if we’re going to pull oil out of the ground for things we need, and we do, this is the way to do it right.

Add to that, Whitecap pays actual dividends (kids, ask your grandparents what they are), and it’s an interesting way to play the sector.

Now the negative: They got crrrrrrushed last quarter, as the cost of gas was hammered by Saudi/Russian bickering, and COVID-19 lockdowns saw gas usage crater. It was ugly.

Net income, however, for the first quarter was negatively impacted by the severe economic dislocation that has led to a significant decrease to current and forecasted crude oil prices. This resulted in a non-cash accounting charge of $2.9-billion to the company’s net book value. Revisions to forecasted crude oil prices could result in reversals or additional impairment charges impacting net income.

Whitecap entered this economic crisis in a position of strength with total credit capacity of $1.77-billion. The company exited the quarter with net debt at $1.27-billion with $500-million of unused credit capacity available. The company’s credit facilities have two financial covenants, being debt to earnings before interest, taxes, depreciation and amortization (EBITDA) not exceeding 4.0 times and EBITDA to interest not less than 3.5 times. Whitecap’s first quarter debt to EBITDA ratio was 1.7 times and EBITDA to interest ratio was 14.0 times.

That caused this.

A recovery is afoot, with some serious streamlining taking place. Assuming folks start driving again, and the gas prices hold, they should be able to rebuild. Whitecap is STILL paying a dividend, albeit a halved one from previously, so that tells you there’s no panic at the helm.

My take: I’m not an oil and gas guy these days, but recognize it’s going to be around for a while, and if that’s going to be the case, going after it in a way that doesn’t leave the world Brett Wilson’ed is okay by me. Whitecap is slowly building value right now and if they can show a quick turnaround, it should run.

CAPRICOR THERAPEUTICS (CAPR.Q)

- Sector: Biotech

- Market Cap: $63 million

Capricor.. CAPR

1) They have pushed regenerative medicine for a decade, through the ups and downs of Stem Cell hype and never wavered in there mission.

2) They are focused on compassionate care both in boys with Duchenne Muscular Dystrophy and now in Covid patients with ARDS…— Asher77 (@Asher3334) June 4, 2020

CAPR cont..

3) They are a small biotech using the intellectual backing of US research facilities such as Cedar-Sinai and John Hopkins..not selling out to Big PharmaAnd a neg. Need to expand pipeline and deepen the understanding behind the mechanisms of action for there drugs

— Asher77 (@Asher3334) June 4, 2020

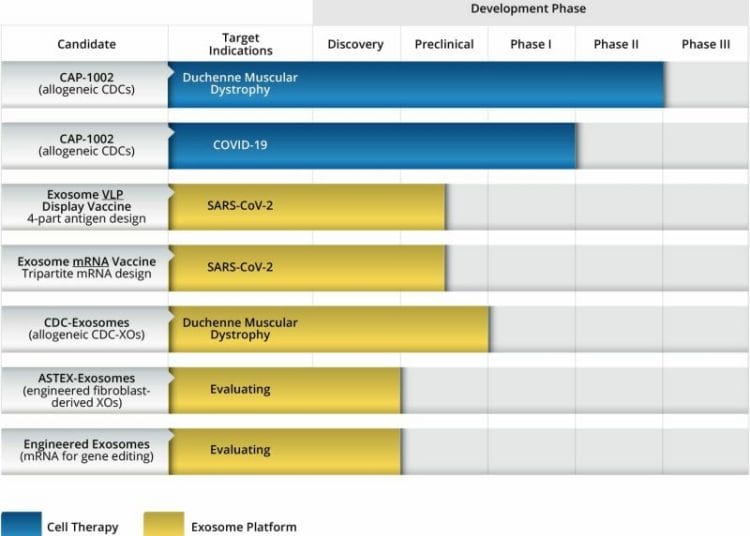

This Twitter user is pretty much on point for Capricor. They’ve got a decent enough pipeline for a small player, mostly in early stage IP that will take some time to prove out.

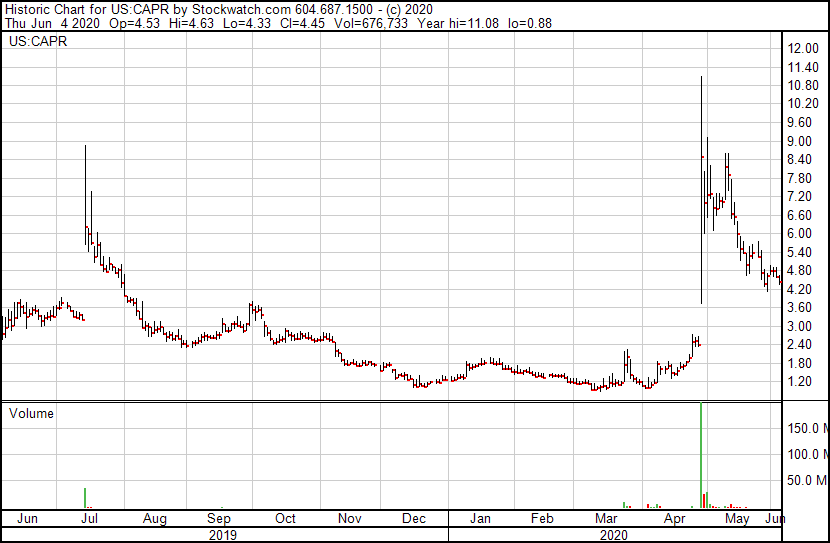

COVID-19 brought them a potential jump start, when they joined in the race for a vaccine and, by virtue of the FDA’s desire to ram things through quickly, instantly jumped through phase I trials.

Capricor’s lead candidate, CAP-1002, is an “off-the-shelf” cardiac cell therapy that is currently in clinical development for the treatment of Duchenne muscular dystrophy (DMD) and COVID-19.

This is where they’re at:

“The first quarter of 2020 has been incredibly productive on so many levels and I am pleased that we have been able to advance our pipeline during these challenging times. As we have described, CAP-1002, our lead product candidate, has strong immunomodulatory characteristics and has been shown preclinically to address some of the same pathology caused by COVID-19. We were very quick to institute a compassionate use program where CAP-1002 was used to treat six patients with COVID-19 which led to the publication of a peer-reviewed paper. Based on that encouraging data, we filed and now have an approved IND for an expanded access program to treat up to 20 additional patients,” said Linda Marbán, Ph.D., Capricor’s president and chief executive officer.

If the COVID push doesn’t bear fruit, that’s going to be problematic because, dough-wise, Capricor lost a net of $2.1 million last quarter, which isn’t far off the last quarter’s loss. With approximately $13.2 million in the bank, they’re looking at a runway of six quarters before things get real dry, but that should be enough to see some progress.

My take: Some of the glisten has come off the rose since the massive jump on the back of news CAPR was headed into COVID land. That might be a good opportunity to take a position before the rubber really begins to hit the road.

SONA NANOTECH (SONA.C)

- Sector: Biotech

- Market Cap: $141 million

$SONA.c 1. New potential industry disrupting COVID-19 gold nanorod testing technology: antigen tests. 2. Massive international demand ($11b US alone for testing). 3. 0 revenue company could hit 1 billion in revenues within a year. Do better: don’t overpromise: “sales in April”.

— Aegis (@Aegis_Trade) June 3, 2020

Nice summary from Aegis here. Nobody paid much attention to this deal a year ago when it was acquired for $1, or six months ago when it was tossing out a mining property, but in early February the Sona guys hit a home run when they were one of the first to jump on what was then called by them the Wuhan Coronavirus.

Sona is developing a quick-response lateral flow test to screen patients for the nCoV19 virus. When completed, the test is expected to produce results in five to 15 minutes and is anticipated to cost less than $50. There is currently no lateral flow test specific to the nCoV19 strain of the coronavirus, which was first detected in Wuhan, Hubei province, China, and continues to spread across the globe.

Sona immediately jumped from $0.14 to $0.21, and ran hard from there, touching $3.80 a week ago.

Just saying you’re going to have a COVID-19 test is easy – showing you might actually be taken seriously by the folks who might like to buy a few billion of them off you is another thing, and that’s been where Sona has hit way above its weight class.

Development work on Sona’s new test to measure the Covid-19 virus is under way in three separate labs in Canada, the United Kingdom and Germany. The company has a continuing, open dialogue with regulators to ensure Sona’s test is being developed within the parameters regulators have outlined. This approach will allow Sona to be eligible for FDA review through its emergency use authorization (EUA) pathway and a fast-track to market. [..]

In support of Sona’s commitment to develop a proprietary rapid-response screening test for Covid-19, the company has chosen the following partners:

- GE Healthcare Life Sciences — the latest membrane technology, offering sensitive and timely test results;

- Bond Digital — the ability to ensure test data are captured and interpreted correctly and can also be collated and analyzed by health care providers and government organizations to help track the spread of the virus;

Not bad.

But over-promising has been an issue.

From a test development perspective, Sona expects to have a working prototype for the Covid-19 rapid response test within the next few weeks.

The company has also entered into a letter of intent agreement with an international distributor representing the health authority of a G20 country for the purchase of two million test kits. The company cautions that its test is still in development, but expects to complete a functional prototype and confirm third party validation tests in the near future.

“Development work on our test is largely complete and we have moved to an optimization stage utilizing a third party for the optimization process.”

The company cautions that its test is still an unvalidated prototype and will update the market as appropriate.

Sona has got plenty of potential partners and buyers lined up, and would have likely experienced much of the same value growth if it kept its head down and did the work instead of promising things it couldn’t deliver, but instead it’s now coming off an unsustainable peak and having to explain why that ‘few weeks’ they talked about several months ago hasn’t played out.

The Canadian tech supercluster did drop $4m on the company as a grant to help on its mission, which is outstanding non-dilutionary dough, and there’s no disputing there’ll be a massive market for a successful product, but it likely has months more testing and trialing and approvals and manufacturing to get through before a product will get to market, all things that will put a strain on the stock price.

My take: If you got in around February, you’ve made a killing and should think about taking your profits. If you got in this week, you might be clenching your teeth. Short of a validated product, this ride might take a while and be mostly headed downwards for a bit.

PYXUS INTERNATIONAL (PYX.NYSE)

- Sector: Cannabis/Agriculture

- Market Cap: $33 million

$pyx good history, waiting for legalization USA, new products

Bad – it never seems to stay stable. It giveth and then takes away the next day— Ray (@Rayzor1971RR) June 3, 2020

Legit, this deal is one that nearly scooted away unnoticed, due to a few years of class action lawsuit threats, over-exposure to vapes at the entirely wrong time, a depressed tobacco market due to trade wars and long term consumer shifts, and a general sense that Canadian weed is impossible to sell for a profit.

A long time legacy agricultural company that grabbed (through a subsidiary of a subsidiary) Canada’s Island Garden, a PEI-based licensed producer, and GoldLeaf, a small Ontario grow with a cultivation license, along with other bits and pieces, the story for me here is a $33 million valuation on a company that has 250k sq ft of licensed cannabis grow in Canada, and around $360 million in tobacco and other crop revenue per quarter.

The bottom line is tight – not break even but not far from it in percentage terms – but it should be noted there’s a nice wedge of debt tossed in as well, much of which comes due at the end of 2021. The company has spent considerable time and effort trying to address its overexposure to tobacco as the consumer markets evolve, but the timing of outside factors has been rough on them.

“As we look toward our capital structure, we continue to evaluate and develop the plans for a potential partial monetization of interests in subsidiaries in the Other Products and Services segment and to address the Company’s long-term debt, maturing in calendar 2021. Our target is to achieve run rate positive Adjusted EBITDA across our Global Specialty Products division during fiscal 2021.”

Translated: They’re going to sell off some assets, and look to weed as the thing that, over time, replaces the last hundred years of tobacco revenue.

Sales were down some 30% last quarter, for a host of reasons, and the company took a net quarterly loss of $22m. All of that saw the stock drop hard for several quarters.

BUT:

The last few days have seen PYX take off like it stole your bike.

What’s that lift about?

Well, the company got GMP accreditation for its Criticality subsidiary:

Criticality, the makers of Korent and Korent Select hemp-based CBD products, opened its 55,000 square foot, state-of-the-art hemp extraction and purification facility in Wilson, North Carolina, in March 2019. The Company’s brands offer a wide-array of CBD products including oil drops, roll-on liniments, topical balms and e-liquids.

That’s nice, but it’s not 41% price spike nice. In fact, it happened two weeks ago.

Simple fact of the matter is, PYX is dirt cheap and was over-shorted on bankruptcy gossip. 36% of the float was shorted going into today, and those shorts got wiped out.

For mine, there’s enough meat on these bones that, even if it did get into chapter 11 discussions, the downside would be small – even at today’s now up 41% price.

A month ago, this was a $20 million company. Yes, it’s up now, but to assume it has no more run left would be a stretch – at the current price, it still sits in my undervalued column.

You may see some sell-offs tomorrow, after such a big jump in one hit, and that may present an opportunity to accumulate.

There will be tough times ahead as Pyxus seeks to turn its ship around, but with $500 million in available borrowings, I can’t see this being an implosion going forward.

Also, FIGR is a damn fine brand with damn fine branding. That’s going to count for something.

My take: A little wager on PYX digging out from under it’s debt seems to me to be a good one, even if you missed the pop.

We’ll be writing about the other 30 tickers in this series every day this week. Come back tomorrow for more!

— Chris Parry

FULL DISCLOSURE: None of these companies have paid Equity.Guru for this coverage.