Recent general market disorder and mayhem has wreaked havoc on the junior exploration arena over the past few weeks.

For those holding junior ExplorerCos, the sector has been a world of hurt, assuaged only by the occasional rally… shades of bull markets past.

Investors holding gold and silver stocks just want that hurt to stop, if only for an hour or two.

The headline crossing trader’s screens yesterday: “TSX, Dow 30 slip into Bear Market territory”.

Today, investors are trying to digest headlines relating to a ban on air travel between Europe and the U.S. The broader markets are coming apart at the seams.

Gold is also selling off, shedding its safe-haven status, trading at $1570 as I type.

You gotta know margin clerks are pushing themselves to the brink of exhaustion, selling anything offering a modicum of liquidity.

For now, volatility dominates every conceivable form of trade.

The deep values I see in the junior arena

To minimize risk, we’re focusing only on those companies with a resource (historic or 43-10 compliant) and or a large, well established geological footprint.

Large geological footprints auger well for big price moves in the underlying shares if models are validated, and significant extensions or new zones of mineralization are delineated.

All of the companies featured below have received coverage in these pages. The search function at the top of the screen works like a dandy. Simply enter the ticker (i.e. WGO.V) and you should find what you’re looking for. Also, clicking on the name of the companies will take you to our most recent coverage.

We’re going to feature stocks with richer market caps ($50M and higher) in this first of a two-part roundup.

Tomorrow, we’ll look at deep value stocks sporting market caps below $50M.

I’m updating this piece at the beginning of the March 12 trading day. The prices and charts featured below will reflect early to mid-session trade.

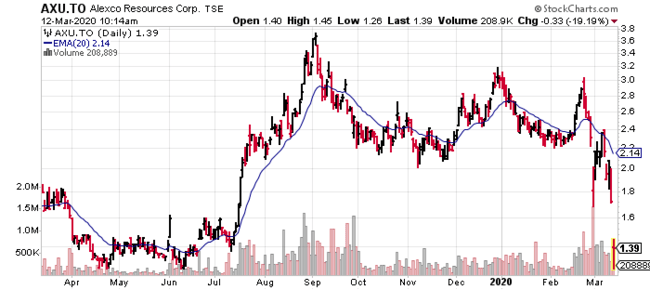

- 119.93 million shares outstanding;

- $166.70M market cap based on its last trade at $1.39

Alexco operates in the Keno Hill Silver District.

The company is on the cusp of making a production decision to become Canada’s primary’ silver producer (primary in the sense that > 50% of production revenue will be derived from silver itself).

It’s 400 tpd mine plan factors in current reserves of 1.2 million tonnes grading 800 g/t silver + a further 7% combined lead (Pb) and zinc (Zn).

Current resources, both Indicated and Inferred, total more than 107 million ounces plus significant zinc and lead credits.

A 2019 Prefeasibility Study (PFS) demonstrates robust economics:

- an after-tax NPV (5%) of $101.2 M;

- an after-tax IRR of 74%;

- all-in sustaining costs (AISC) between $11 to $12.00;

- capital expenditures (CapEx) a very modest $23M.

There’s a lot of meat on these bones. The CapEx is extremely modest. To fund a big chunk of that CapEx, the company recently monetized its reclamation business, taking in $12.1M (another $1.25M is due Feb. 14, 2021).

Today’s gap down, a test of 52-week lows, can only be described as surreal.

Price support at $1.60 was shredded as if it held no sway, proof that technical analysis is meaningless when buyers pull their orders and sellers sell.

If you believe that precious metals stocks are on the verge of a multi-year bull market, as I do, Alexco is a top-shelf stock.

The current session low of $1.26 would be an extremely attractive entry point for those thinking medium to long term (authors humble opinion).

- 113.26 million shares outstanding;

- $61.16M market cap based on its last trade at $0.54

Ely is an emerging royalty company with projects based in Nevada and the Western U.S.

ELY’s current royalty portfolio includes a number of deeded royalties and optioned properties that are currently generating revenue.

The company has been on an acquisition spree.

The spree continues…

Feb. 28 news – Ely Gold Royalties Acquires Key Nevada Royalty Portfolio

The company’s shares traded as high as $1.00 in recent sessions.

Today, they’re trading right back at the lows set only a few sessions back.

I can’t see how you can go wrong, long term, buying at current levels. But well-placed stink bids below fifty cents could draw some attention in this schizophrenic market.

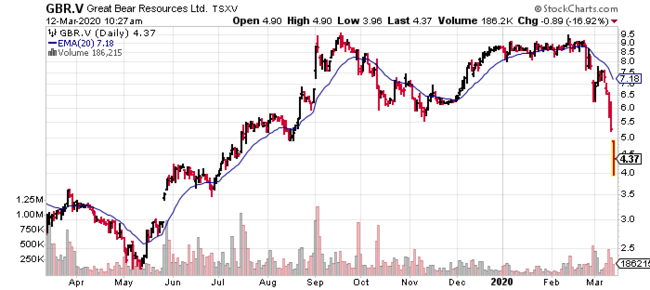

45.81 million shares outstanding;

$196.07M market cap based on its last trade at $4.28

I nearly didn’t include this one, but after today’s carnage, it belongs in the deep discount bin.

We recognized the early potential of Great Bear’s Dixie Project in the Red Lake region of Ontario, shortlisting the stock at $2.00 back in January of 2019.

Since then, the 18-kilometer long LP Fault Zone has received the lions share of attention where the company is targeting broader zones of potentially economic mineralization.

- Feb. 13 news – Great Bear Drills 10.58 g/t Gold Over 21.00 m; Initiates 5 Kilometre Grid Drill Program at LP Fault; Mobilizes Fifth Drill Rig

- Feb. 20 news – Great Bear Defines High-Grade Gold Controls at LP Fault; Regional Drilling Identifies Six New Gold Targets Over 11 Kilometres; Provides LP Fault Drill Data

Some might characterize the company’s chart as a dog’s breakfast. Fair enough, but that isn’t a reflection of the company’s underlying fundamentals…

Great Bear is as A-list as a company gets in this sector. The five-dollar level should have acted as minor support for the stock.

Stink bids below the $4.00 level might get filled. If yours do, consider yourself fortunate—the company’s gold-in-the-ground hasn’t gone anywhere.

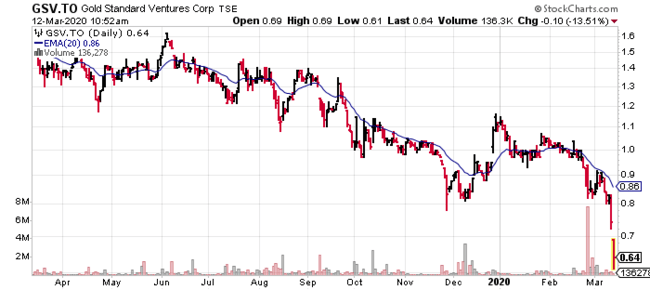

Gold Standard Ventures (GSV.T)

- 277.53 million shares outstanding;

- $174.84M market cap based on its last trade at $0.63

This is another advanced-stage development company that has slipped so far beneath the market’s radar, it’s nearly invisible.

The company’s flagship Railroad Project is located along the Piñon mountain range of the Railroad Mining District of Nevada.

Pinion has an Indicated resource of 31.61 million tonnes grading 0.62 g/t Au for 630,300 ounces of gold and an Inferred resource of 61.08 million tonnes grading 0.55 g/t Au for 1,081,300 ounces of gold.

This resource is due for revision to include recent success with the drill bit.

Dark Star, 2.1 kilometers to the east of Pinion, has an Indicated resource of 15.38 million tonnes grading 0.54 g/t Au for 265,100 ounces of gold and an Inferred resource of 17.05 million tonnes grading 1.31 g/t Au for 715,800 ounces of gold.

This resource is also due for revision to include highly favorable drill results from a 2018 drilling campaign.

The company recently tabled a prefeasibility study (PFS) for its Dark Star and Pinion oxide gold heap leach projects with a reasonable CapEx ($194M) and good leverage to firmer gold prices.

The company’s shares aren’t just visiting 52-week lows, they’re currently touring multi-year lows.

The following is a 4-year weekly chart of the company.

This one might be worth some serious due diligence if you’re seeking deep value development play.

So far, today’s price plunge is accompanied by modest volume.

Looking at a decade-long chart, $0.50 should act as super-solid support.

Metalla Royalty and Streaming (MTA.V)

- 34.41 million shares outstanding;

- $175.50M market cap based on its last trade at $5.10

Metalla Royalty & Streaming (MTA.V) is one of the more aggressive companies in the space, assembling a portfolio of royalty and streaming deals that could create significant price trajectory as this bull market in precious metals plays out.

Having inked deals with third parties on existing royalties/streams, the company is in business with the likes of Agnico Eagle (AEM.T), Newmont-Goldcorp (NGT.T), Pan American Silver (PAAS.T), St. Barbara (SBM.AX), and Osisko (OR.T).

2019 was a year of tremendous acquisition growth for the company.

If the deal they announced on Feb. 18 is any indication, 2020 could be a repeat.

Metalla Acquires an Existing 2.0% Gold Royalty on Teck / Newmont’s Nuevaunión Project

Like the vast majority of the stocks I follow in this sector, Metalla is trading well below recently registered highs.

The shares are currently retesting their recent lows in the $5.00 range. If the broader markets close at or near session lows, stink bids below these extremes could see a fill.

- 358.68 million shares outstanding;

- $186.52M market cap based on its last trade at $0.52

“Pouring Gold before Christmas” is scrolled out across the company’s Investors page.

Fully funded to production, the first gold pour at the company’s flagship Madsen Project is set for Q4 of this year.

If pressed, if I were forced to pick only a handful of companies for an A-list portfolio, Pure Gold would occupy a spot.

The PureGold Mine Feasibility Study Highlights:

- Probable Mineral Reserves of 3.5 Mt at 9.0 g/t containing 1.0 million ounces of gold;

- Low initial capital requirement of $95 million including a 9% contingency;

- Mine life of 12.2 years with a 13 month pre-production period;

- Peak annual production of approximately 125,000 ounces with average annual gold production in years 3 through 7 of approximately 102,000 ounces;

- Life of mine (“LOM”) direct operating cash cost estimated at US$607 per ounce of gold recovered;

- LOM all in sustaining cash cost (“AISC”) estimated at US$787 per ounce of gold recovered;

- Pre-tax NPV5% and IRR of $353 million and 43% respectively with a 3.0 year payback of initial capital;

- After-tax NPV5% and IRR of $247 million and 36% respectively with a 3.4 year payback of initial capital

The above study is anchored by a very conservative $1,275 gold price (gold is currently trading on both sides of $1600).

Recent exploration on the property continues to intersect high-grade rock.

A few choice drill hole highlights include:

- 24.9 g/t gold over 1.0 meter;

- 34.1 g/t gold over 2.2 meters; including

64.6 g/t gold over 1.0 meter; - 33.1 g/t gold over 3.4 meters; including

79.4 g/t gold over 1.4 meters; - 13.2 g/t gold over 6.3 meters; including

26.3 g/t gold over 2.0 meters.

Pure Gold’s price chart has seen some violent swings in recent sessions.

The $0.55 level should have offered fairly decent support. Current prices might be viewed as an attractive entry point, but when there’s a near-complete absence of buyers, a tradable bottom is difficult to divine.

Stink bids below today’s low could pay off handsomely in the medium to long term.

- 124.45 million shares outstanding;

- $83.38M market cap based on its last trade at $0.67

Skeena is another one of those rare junior’s that deserves top-shelf status.

With four million ounces grading 4.4 g/t AuEq, the company’s Eskay Creek Project ranks as one of the highest grade open pit deposits in the world.

A PEA released late last year turned more than a few heads with its conservative inputs and robust economics:

- High-grade open-pit averaging 3.23 g/t Au, 78 g/t Ag (4.17 g/t AuEq) (diluted);

- After-tax NPV5% of C$638M (US$491M) and 51% IRR at US$1,325/oz Au and US$16/oz Ag;

- After-tax payback period of 1.2 years;

- Pre-production capital expenditures (CAPEX) of C$303M (US$233M);

- After-tax NPV: CAPEX Ratio of 2.1:1;

- Life of Mine (“LOM”) average annual production of 236,000 oz Au, 5,812,000 oz Ag (306,000 oz AuEq);

- LOM all-in sustaining costs (AISC) of C$983/oz (US$757/oz) AuEq recovered;

- LOM cash costs of C$949/oz (US$731/oz) AuEq recovered;

- 6,850 tonne per day (TPD) mill and flotation plant producing saleable concentrate.

As we were eager to point out in a recent Guru offering:

“The price assumptions applied here were conservative—$1325 gold. If we use a $1500 gold price, which might be more realistic (gold is currently trading at $1600 as I type), the IRR jumps to 63% and the after-tax payback period is measured in months, not years.”

Like everything else, Skeena has lost ground, and market cap, in recent sessions.

It’s difficult to imagine how you can go wrong putting on a position at current prices. $0.65 should offer solid support.

- 144.22 million shares outstanding;

- $59.13M market cap based on its last trade at $0.41

- 339.67 million shares outstanding;

- $18.68M market cap based on its last trade at $0.055

- 43.42 million shares outstanding;

- $14.76M market cap based on its last trade at $0.34

Though all three companies highlighted above boast multiple project portfolios in British Columbia’s prolific Golden Triangle, Treaty Creek is the main draw, and at this stage in time, it’s taking on the dimensions of a genuine monster.

This 17,913-hectare property borders Seabridge Gold’s (SEA.T) KSM property to the southwest and Pretium Resources’ (PVG.T) Brucejack property to the southeast. Skeena’s Eskay Creek project lies only 12 kilometers to the west. This is a very exclusive neighborhood.

Tudor News – December 18:

The shares in all three companies have dipped in recent sessions—no surprise there. Homing in on Tudor specifically, it’s traded as low as $0.37 (it was pushing $0.90 not too long ago).

The Gldn-Tri field season is only a few months off. A retest of recent lows would be a favorable entry point (for all three of these companies).

Note that Tudor holds a 60% interest in Treaty Creek. American Creek and Teuton each hold 20%.

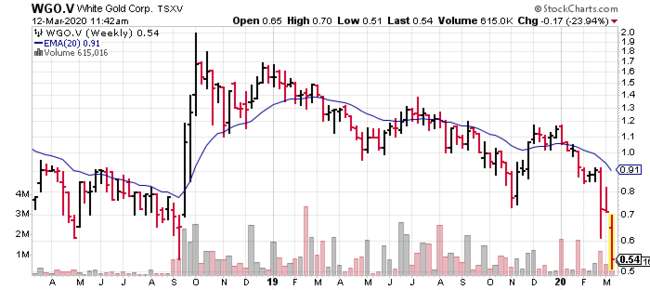

- 124.68 million shares outstanding;

- $67.33M market cap based on its last trade at $0.54

White Gold is a company we featured here in recent weeks…

White Gold (WGO.V) – unparalleled discovery potential in Canada’s Yukon

This is another A-list ExplorerCo… top-shelf all the way.

The company has resources in two main areas:

The Golden Saddle and Arc deposits hold the bulk of the resource ounces.

- 1,039,600 gold ounces within 14,330,000 tonnes at 2.26 g/t Au in the Indicated category;

- 508,700 gold ounces within 10,696,000 tonnes at 1.48 g/t Au in the Inferred category.

There’s good potential to grow these resource numbers.

An updated resource estimate for these two deposits could drop at any time.

The company’s VG Zone, located across the river from Golden Saddle, has an Inferred resource of 230,000 ounces of gold within 4.4 million tonnes at 1.65 g/t Au.

The company sunk 10 RC holes into the VG Zone in 2019. Assays were released on Feb. 20:

The resources highlighted above serve as a solid foundation for the company, but it’s the discovery potential across its 422k hectare land position in the White Gold District that really has my attention.

Two examples:

The company’s Vertigo discovery returned an impressive 22.47 g/t Au over 30.46 meters from surface (inc 3.05 meters @ 59.30 g/t Au).

The very recent Titan discovery returned 72.81 g/t Au over 6.09 meters from 10.67 meters depth, including 136.36 g/t Au over 3.05 meters, all within a 32-meter zone of mineralization which remains open in all directions.

The 2020 exploration season promises to produce substantial newsflow as the company follows up, systematically, on multiple new discoveries in the region.

Looking at the company’s price chart, you’d never guess that this was an A-list entity (the following chart is a 2-year weekly):

Today’s last trade at $0.54 represents a 2-year low. The downside risk from these levels has to be considered minimal. But then again, all bets are off in this helter-skelter market.

That’s it for part one.

Part two is on deck.

END

—Greg Nolan

Full disclosure: of the companies highlighted above, only Metalla Royalty and Streaming is an Equity Guru marketing client.