On March 5, 2020 Heritage Cannabis (CANN.C) announced a development in its previously announced Joint Venture Partnership (JV) with Empower Clinics (CSE: CBDT.C) based in Sandy, Oregon, USA.

Sandy, Oregon (pop. 9,560) was founded in 1845 by pioneers using the Oregon Trail. Early homesteaders survived by eating fish, deer, elk, berries and roots. Currently local republican Senator Chuck Thomsen is facing a recall petition because of his rigid opposition to “cap and trade” (buying & selling carbon credits).

The Heritage/Empower JV was first announced on September 19, 2019. The Joint Venture was to begin producing proprietary branded products for Empower’s physician staffed health clinics in Washington State, Oregon, Nevada and Arizona, including Sun Valley Health, which has direct marketing access to 165,000 patients.

Another part of the plan was to manufacture white label products for other distributors throughout the USA, including “tinctures, topicals, gel caps and formulated bulk CBD oil”.

In December, 2018 the U.S. Congress and Senate approved the $867 billion Farm Bill blowing the door open for hemp and CBD companies.

CBD – a non-psychoactive cannabis compound in marijuana plants and hemp is gaining traction in the health and wellness sector.

In September 2019, Heritage announced it had entered into a L.O.I. to form a 50/50 ownership JV with Empower for the extraction of hemp for CBD oil production, and formulated CBD products. The JV is equally funded by both parties and since formation CDN$250,000 has been provided to the JV.

Heritage is now installing extraction and post-production equipment units at Empower’s existing licenced hemp processing facility in Sandy, Oregon, to begin performing “hemp-based product manufacturing for proprietary formulations, tolling services, and third-party white labelling services for other distributors throughout the United States”.

The proprietary branded products will be distributed through Empower’s physician-staffed health clinics in Oregon and Arizona, online at www.sunvalleyhealth.com and in upcoming new franchise locations.

The downstream equipment now being installed in Sandy, Oregon will perform the following functions:

- gel cap processing

- tincture bottle filling

- vape cartridge filling

- labeling

- packaging

- storage and shipping services

While Empower has the distribution, relationships in the medical community and brick & mortar presence, Heritage is using expertise gained in Canada’s market to provide training and supervision “related to the proprietary methods of extraction and oil production.”

“Having the backing of an experienced partner with the financial strength of Heritage Cannabis is proving to be so beneficial for the development of our first extraction facility”, stated Steven McAuley, CEO of Empower. “Together, we have already identified numerous opportunities to bring new orders to the JV facility ensuring we leverage the capacity we are building.”

CBD demand – and wellness products in general – are led by the medical needs of aging baby boomers – and that is the mother of all of demographic waves.

Between 2016 and 2021, worldwide life expectancy is expected to rise from 73 years to 74.1 years. By 2021, the number of people older than 65 years will jump to 656 million (about 11% of the total population).

These feisty oldsters are still playing rugby at 70 and they’ve got money to burn.

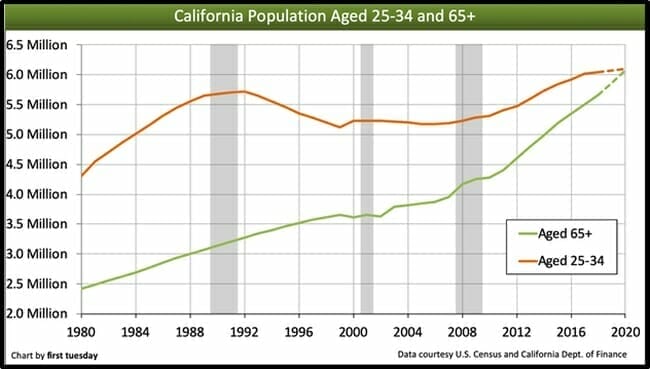

In California, the over-65 population is increasing at twice the speed of millennials.

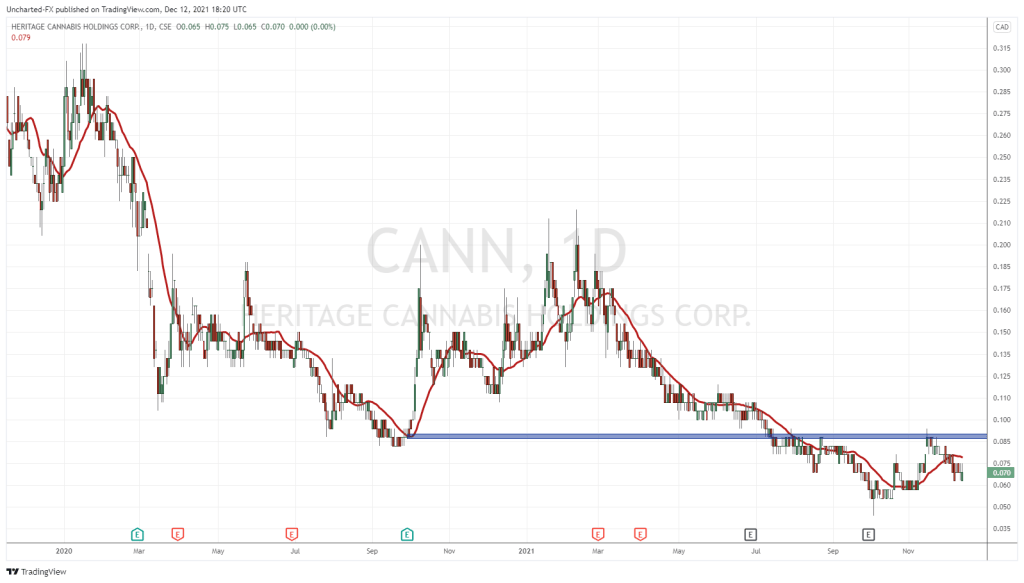

“Heritage has done a host of deals with partners, suppliers, vendors, and acquisitions, that have brought them licenses and steady product supply and got them on shelves fast,” stated Equity Guru’s Chris Parry on February 28, 2020, “This quarter is the quarter all that comes together, so the expectation will be for their losses to shrink, and sales to grow”.

“Heritage’s first revenues EVER came through in this past quarter at $3.56 million,” continued Parry, “We’re used to small cannabis outfits coming out of the blocks with a digit less than that, maybe even two (what’s up, Cannmart), and with quarterly losses far larger than the $2.3 million Heritage lost in the same time frame. You ideally don’t want to be losing anything, but I’ll take a $2.3m ding in your first quarter ever selling product. That’s reasonable and fair and shows progress.

Latest Financial Highlights:

- Revenue of $3.6-million in fiscal 2019, compared with nil in the 12-month period ended Oct. 31, 2018

- Net loss of $13.2-million, or three cents per common share, in fiscal 2019, compared with a net loss of $6.4-million, or four cents per common share, in fiscal 2018

- Although the company is not yet producing positive cash flows from operations, management expects to achieve positive cash flows from operations by Q3 2020.

- In the interim, management believes it has sufficient capital resources on hand to execute its business strategy

- At the end of fiscal 2019, the company had a cash position of $11.5-million, including GICs totalling $9.1-million and working capital of $11.7-million, compared with $1.2-million cash at the end of fiscal 2018 and working capital of $900,000.

In the last year, as the sector-wide cannabis bubble popped, Heritage’s stock price took a beating.

“We are very pleased to be advancing our U.S. strategy through this mutually beneficial partnership with Empower, which provides Heritage ease of access to the world’s largest cannabis market“, stated Clint Sharples, CEO of Heritage. “The installation of extraction units is the next phase of the JV.”

Full Disclosure: Heritage Cannabis is an Equity Guru marketing client