(Note: I’m currently touring a silver production/development scenario in Mexico. Internet access is limited. In lieu of fresh content, a few recent articles from my Highballer site will have to suffice over the next few days)

Highballer article – Jan. 26, 2020…

Last week, I elevated three companies from the junior exploration arenas to top-shelf status in my first report under the ‘Highballer’ banner—Highballer’s Top Three Picks for 2020.

I didn’t arrive at this top three list lightly.

I went with Defense Metals (DEFN.V), Cartier Resources (ECR.V), and Coral Gold (CLH.V) because of the quality of the flagship asset, the geological prowess of management, the jurisdiction (all three operate in mining-friendly climes), and the end game potential.

As I mentioned in my introduction letter, my goal here is wealth creation. My role is to present a shortlist of junior exploration companies that will generate positive share price trajectory when the next bull cycle kicks in.

A quick review of a few sector-wide concerns

Every day a Gold Producer digs ore out of the ground—every day they’re open for business—their precious metal inventory shrinks. And these ounces are NOT easy to replace.

The brutal bear market of the past nine years forced many producing companies to dramatically scale back exploration spending. There’s also the nagging possibility that we’ve reached Peak Gold.

To maintain current production levels, Senior Producers require a robust pipeline of Tier-1 (5,000,000-plus ounce) development projects, an increasingly tall order in this day and age.

If WE are successful in finding a company with a Tier-1 asset in the early stages of development, the payoff—the end game—could be substantial.

The company featured below may hold that potential. And we’re here early—it only began trading four months ago.

A new company pursuing high-grade Tier-1 potential in Southcentral Alaska.

Back in June of 2018, Constantine Metal Resources (CEM.V), in a very heads up move, announced an alliance with Cook Inlet Region, Inc., an “Alaskan Native Corporation”.

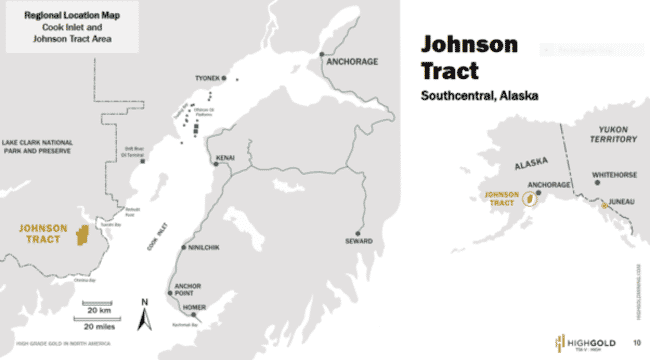

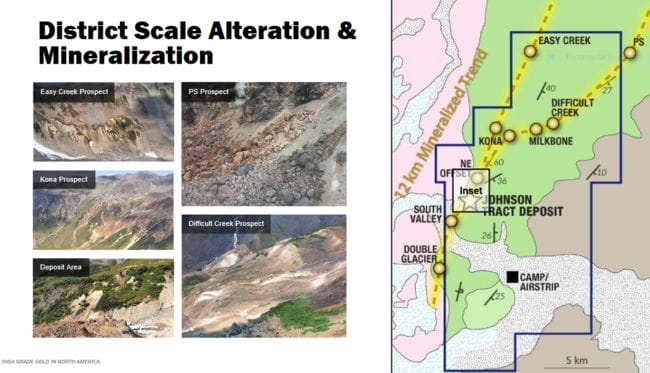

This agreement opened the door to 20,942 acres of highly prospective terra firma called Johnson Tract, a gold-silver-zinc-copper-lead deposit surrounded by 12 km’s of pervasive alteration and mineralization.

Last summer, in a move to unlock value, Constantine spun out all of its gold assets, including the Johnson Tract property, into a new vehicle called Highgold (HIGH.V).

The word ‘high’ is in the name for good reason. High-grade gold and base metal values are what this story is all about.

A bit of background

Johnson Tract was discovered by Anaconda back in 1982.

Anaconda’s discovery hole tagged an incredible 108.6 meters grading 10.39 g/t gold, 7.64% zinc, 0.71% copper, 2.01% lead and 8.1 g/t silver (including 48 meters grading 21.1 g/t gold, 9.93% zinc, 0.88% copper, 2.86% lead and 12.3 g/t silver).

Those are some crazy high-grade values. And it’s not often you find high-grade gold AND base metals together in the same deposit.

Equally compelling is the fact that this project has been hidden from the market for decades. No exploration—zip, zero, nada—has been conducted on the property in over 25 years.

Between 1982 and 1995, 88 holes were drilled on the project for a total of 26,840 meters. These historic drilling campaigns tagged multiple 50 to 100-meter intercepts grading 10 g/t Au or better.

Grades and widths this fat are not easy to come by nowadays. It’s the main reason we’re here.

The lay

Johnson Tract (JT) is only eight kilometers from the coast as the crow flies (roughly 20 kilometers by road). Being this close to tidewater, in this part of the world, is a huge advantage.

Though the company has only been around for a few months, it already has a drilling campaign under its belt—a 2,000-meter, 9-hole program—one designed to confirm past (historic) results.

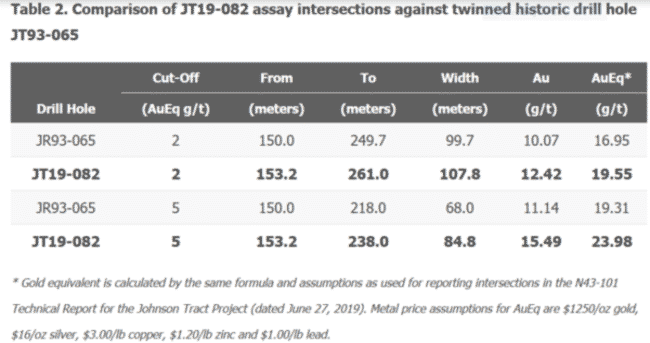

In twinning two of the fatter historic intercepts, the company got its confirmation. Results tabled last November were nothing short of outstanding.

Grade continuity, the extent to which the mineralization is distributed, is good. When you pair these kinds of grades with these kinds of widths, the ounces can pile up in a hurry.

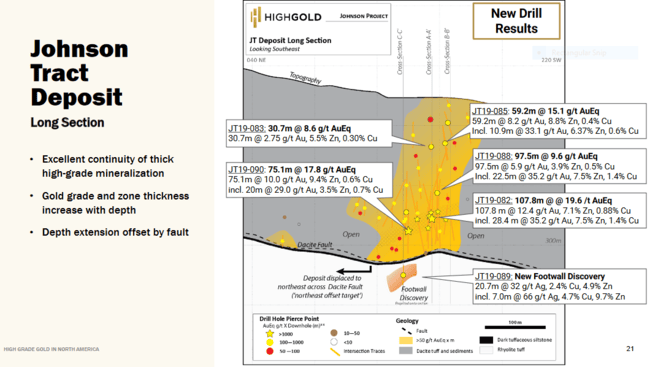

Speaking of grade, it appears to increase the deeper down they go. But if you examine the next slide closely, you’ll see that the deposit was displaced by a fault at depth.

The company believes it knows exactly where the displaced depth extension of the deposit lies—to the northeast.

During a recent Metals Investor Forum presentation, Highgold CEO Darwin Green stated that previous operators found the depth extension, drilled two holes into it, but never followed up on the discovery.

Before leaving the above slide, note the new zone of mineralization encountered at depth—the “New Footwall Zone Discovery” (20.7 meters grading 32 g/t Ag, 2.4% Cu, 4.9% Zn including 7.0 meters grading 66 g/t Ag, 4.7% Cu, 9.7% Zn).

This new zone clearly demonstrates the untapped potential of Johnson Tract.

Geological sleuthing at its finest.

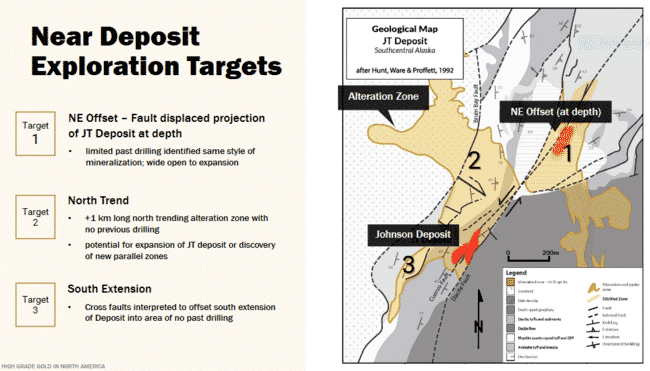

As you can see on the slide above, the projected depth extension portion of the deposit will be the highest priority target during the next round of drilling.

This is only speculation on my part, but with the grades increasing at depth, the next round of drilling could produce some stellar headline numbers from this deep target.

Without a doubt, this deep target adds an element of intrigue to this play, one that sets it apart from most others.

District scale potential

As we noted further up the page, the company has 12 kilometers of strike to explore. Extensive alteration across the property sets up the potential for multiple new discoveries.

Johnson Tract is one helluva an exploration asset, especially considering its jurisdiction.

If the company is successful in proving up a significant high-grade deposit, it’s bound to produce one or more takeover offers. But it won’t go cheap.

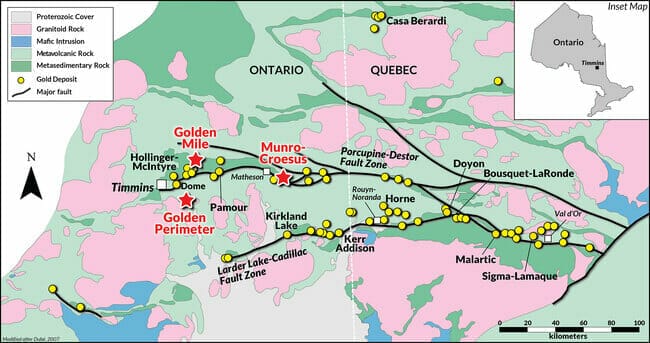

Abitibi Greenstone Belt Projects

The company also controls three highly prospective projects in the world-class Timmins Gold Camp of Ontario—Munro-Croesus, Golden Mile, and Golden Perimeter.

According to the company website, the Munro-Croesus land package includes a past-producing mine that yielded some of the highest-grade gold ever mined in Ontario.

Potential catalysts

Newsflow promises to be steady this year.

A 43-101 compliant resource for the JT deposit is scheduled for Q1.

Drilling off the projected (displaced) depth extension of the deposit will be a priority during the upcoming exploration season. There’ll be a lot of eyes on this one when a drill rig is mobilized in Q2.

Though the company is not quite clear what kind of system they’re dealing with exactly—is it VMS? is it epithermal? is it a combination of the two?—clearly, the exploration upside is wide open.

The company is also planning to mobilize a drill rig to its Munro-Croesus and Golden Perimeter projects in the coming weeks.

The team

This crew has a strong technical background with a lot of experience in Alaska, and multiple discoveries under their collective belts.

I like a crew with a track record of successfully monetizing assets and creating shareholder value—end game expertise. Here, I see the name Ian Cunningham-Dunlop. Aside from leading surface exploration at the fabled Eskay Creek of BC’s Golden Triangle, his resume includes Frontier Gold, a company whose Long Canyon project was taken out by Newmont for $2.3B.

Cap structure

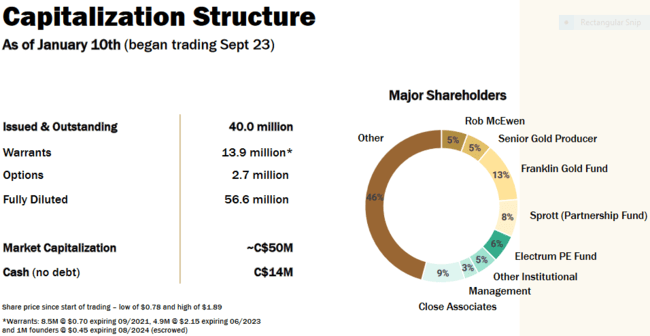

There are 40 million shares outstanding (56.6 million fully diluted). At current prices, the company has a market cap of roughly $46M.

The company closed a $7.65M financing when it listed. Major participants from that first round included:

- Mr. Rob McEwen taking down 10.1% of the company for $1M;

- A senior North American gold producer taking down 9.9% for $990k;

- A partnership managed by an affiliate of the Sprott Group taking down 14.4% for $1.4M.

These are strong hands. Smart money.

More recently, the company raised an additional $9.3M—1,280,000 common shares on a flow-through basis at $1.80, and 5,600,000 common shares at $1.25.

The company is currently sitting on roughly $14M—that’ll buy a lot of drilling.

As you can probably guess, I like this company.

END

Greg Nolan

Full disclosure: I do not own shares in Highgold, though I may initiate purchases in the coming weeks.