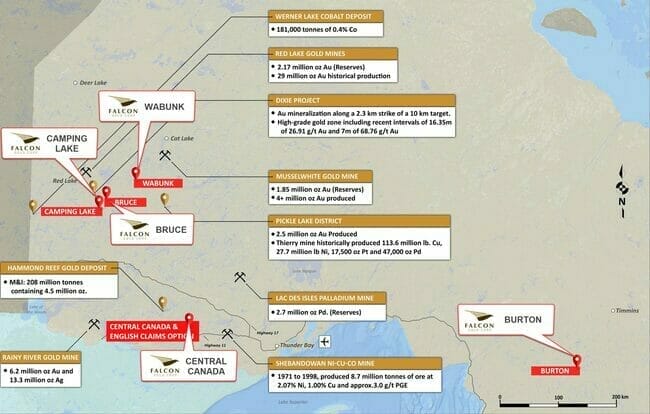

Falcon Gold (FG.V), an ExplorerCo with a modest $2.7 market cap, has its sights set on a quintet of high-grade projects in NW Ontario.

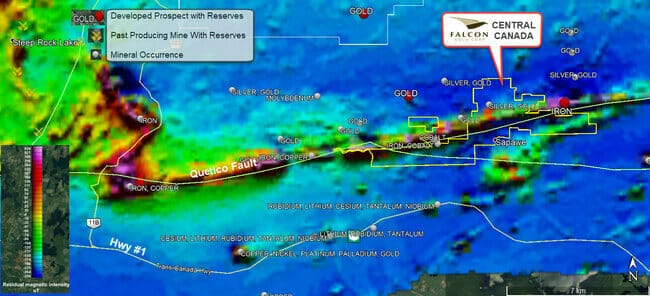

Central Canada Project

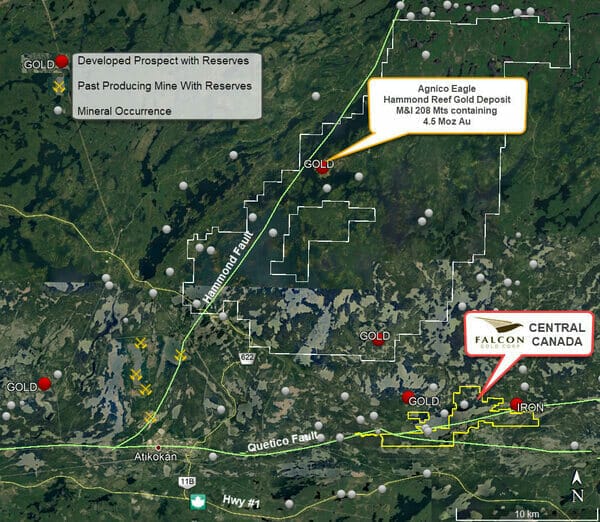

Recently raised flow-through funds will go directly into drilling the company’s flagship Central Canada Gold & Polymetalic Project, some 3,200 hectares of geologically prospective terra firma.

Agnico Eagle’s (AEM.T) Hammond Reef Gold Deposit—4.5 million ounces of gold Measured and Indicated—is located roughly 20 kilometers to the southeast.

Hammond Reef lies on the Hammond fault which is the structural control for those 4.5M ounces. Falcon’s Central Project lies along a similar geological structure—the Quetico Fault. Multiple occurrences of mineralization in a variety of geological settings are known to exist on the property.

Central Canada saw production via a 40-meter shaft and a 75 ton per day mill back in the day.

The property has an interesting history that goes way back:

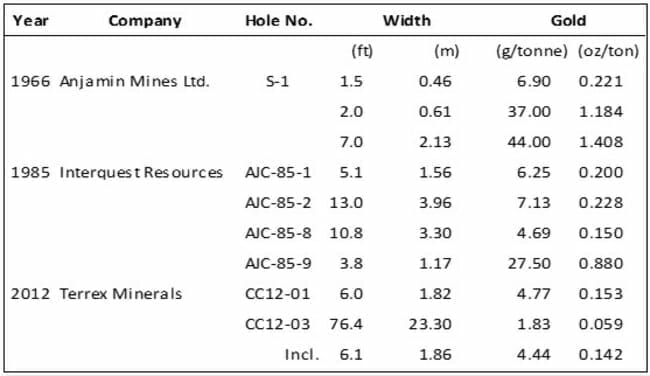

- 1901 to 1907 – Shaft sunk to a depth of 12 meters lead to the extraction of 27 oz of gold from 18 tons using a stamp mill (if my math is correct, that’s 1.5 ounces per ton);

- 1930 to 1935 – Central Canada Mines Ltd. installed a 75 ton per day mill on the property and deepened the shaft to 40 meters with roughly 42 meters of crosscuts;

- 1965 – Anjamin Mines Limited drilled a 0.61-meter intercept of 37.0 g/t Au and 2.13-meters of 44.0 g/t Au (nice hit);

- 1985 – Interquest Resources drilled 13 holes totaling 1,840 meters with a highlight of 1.17 meters grading 30.0 g/t Au;

- 2012 – Terrex Minerals drilled 1.82 meters at 4.77 g/t Au and 23.30 meters at 1.83 g/t Au (including 1.86 meters of 4.44 g/t Au).

Contiguous with the Central Gold Project, the English Claims Option—55 claim units covering an area of approximately 880 hectares—has a historic drill hit of 0.64% Cu, 0.15% Co, 1.1% Zn and 0.35 g/t Au over a true width of 40 meters at the Staines Copper & Cobalt Occurrence. That is another nice hit.

I don’t know if the company plans to twin these historic intercepts, or drill along strike—either way, the flow-through funds noted above will go towards testing these historical high-grade hits.

This upcoming drilling campaign could represent a potent price catalyst for an ExplorerCo with a sub-$3M market cap.

Falcon Applies for Exploration Drill Permits Central Canada Project

Multiple gold, copper, cobalt and other metals occurrences have been discovered, on the approximate 3200-hectare property, in a variety of geological settings – none of which has been sufficiently pursued to determine economic potential for mining.

And this, just a few weeks back:

Falcon is progressing very well on its Central Canada property exploration permit applications and anticipates approval very shortly. The Company is funded and ready to commence exploration and drilling activities this winter on its mineralized prospects. The permit application includes approximately 20 drill pad locations, overburden trenching, and geophysical surveys to test historic prospects and expand the company’s economic geology understanding.

Residual Magnetics

Directly adjoining the Central Canada Project is the historic Sapawe Mine that produced 4,547 ounces of gold and 1,315 ounces of silver from 33,013 tonnes of material.

The Sapawe property has a historic resource of some 528,614 tonnes grading 0.31 oz/t gold (Sapawe Gold Mines calculation, 1995).

“Significant gold mineralization has also been identified in the halo of the original Sapawe Mine of up to 24 g/t. Gold mineralization can be traced across the Central Canada property with more recent drilling by Interquest Resources Corp. intersecting over 1 meter of approximately 30 g/t gold in diamond drill core. Trenching work in 2011 indicated significant gold mineralization to the south of the historic Sapawe Gold Mine, where the operator sampled up to 6.7 g/t gold along a “well” mineralized shear zone.”

Falcon will be targeting potential strike extensions of this high-grade structure.

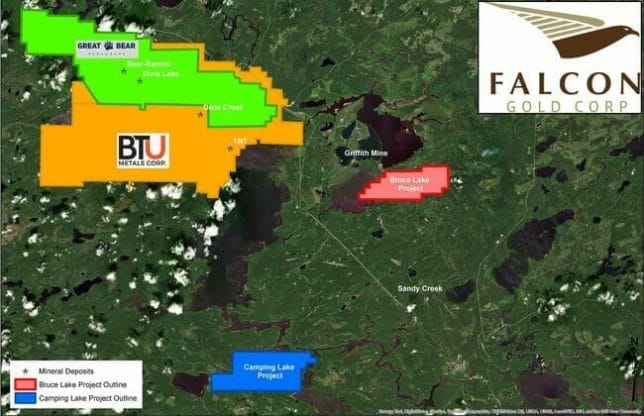

Camping Lake

In Red Lake, aka The High-Grade Gold Capital of the World, the company controls two projects known as Camping Lake and Bruce.

That is Great Bear (GBR.V)—market cap = $400M—and their world-class Dixie Project in the top left of the above map.

Falcon’s Camping Lake Property is located roughly 25 kilometers to the south of Dixie (Bruce is roughly 20 kilometers to the southeast).

Falcon, choosing to focus on its flagship Central Gold Project wisely optioned out a 51% chunk of Camping Lake to International Montoro (IMT.V) for 1.5 million IMT shares and $300k in work commitments. This JV works to minimize shareholder dilution while advancing Camping Lake further along the development curve. Smart move.

From 2010-2013, the Camping Lake property area was subjected to work programs completed by Laurentian Goldfields Ltd., Kinross Gold Corporation and Anglo Gold that included petrographic studies; diamond drilling; rock, soil and sediment samples and IP/Ground Geophysics.

Montoro will be putting boots to the ground at Camping Lake this winter.

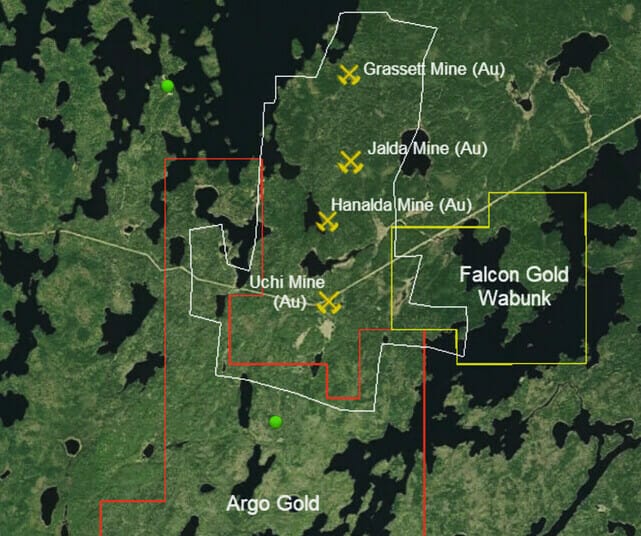

Wabunk Bay

In news released just last week (Feb. 11), Falcon announced having expanded its Wabunk Bay Project land holdings in the Red Lake region to 1,192 hectares.

Wabunk Bay highlights:

- Claims adjoin the Uchi gold mine;

- Historic 7-meter chip sample returned 1.08% Cu and 0.40% Ni;

- Historic drill results assayed 0.62% Cu with Co values of up to 0.33% Co;

- Surface trench samples ran 0.33% Co over 1.5 meters and 0.15% Co over 7.6 meters;

- Separate historic 7-meter chip sample returned 1.08% Cu and 0.40% Ni;

- Occurs within the same greenstone belt as the Red Lake mining camp;

- Gabbroic host rocks have been traced for a strike length of approximately 900 meters

- Main copper, cobalt showings composed of massive and disseminated sulphides in zones roughly 200 meters long by 7-meters wide.

“The acquisition of the land is a strategic move to include a large mafic intrusion which boasts massive sulphide mineralization discovered by Selco Exploration Co. Ltd. in 1970 including a 45-meter interval of varying semi-massive to massive sulphide mineralization. Campbell Island Mines also noted a large magnetic anomaly over this area in 1956 but little work has been done to assess the economic potential. The company plans to explore for Ni, Cu, Pt, Pd as the mafic intrusion immediately west (optioned by Falcon) historically hosts base and precious metals. Highlights of this include 2.66% Cu and 0.39% Ni over 6.9 m from diamond drilling by Campbell Island Mines. Falcon ‘s 2019 brief field program resulted in grab samples assaying up to 760 ppb Au, 2720 ppm Ni, 4780 ppm Cu, 171 ppb Pd, and 221 ppb Pt.”

This recent acquisition in the region captures part of a large regional structure—the Uchi Lake Deformation Zone.

Argo Gold’s (ARQ:C) Woco Gold project—6 kilometers to the southwest—has Eric Sprott wanting exposure to this highly prospective play.

Argo news release dated Feb. 7:

“Mr. Eric Sprott, through 2176423 Ontario Ltd., a corporation which is beneficially owned by him, acquired 11,200,000 Units for a total consideration of $1,008,000. Following the completion of the private placement, Mr. Sprott beneficially owns and controls 11,800,000 Common Shares and 121,008,000 Warrants of the Company representing approximately 22.2% of the issued and outstanding Common Shares of the Company on a non-diluted basis and approximately 36.4% of the issued and outstanding Common Shares on a partially diluted basis.”

Woco is a vein-hosted gold discovery with historic intersections of up to 51.9 g/t Au over 1.31 meters.

Recent drilling by Argo tagged an impressive 132 g/t Au over 1.8 meters.

“This zone also exhibits vein-style similarities with the Uchi Mine, 1.3km north, which reportedly produced a total of 114,467 oz Au and 14,345 oz Ag from 757,074 tons (milled). The ULDZ is a significant regional structure along the southern boundary of the Uchi subprovince with highly prospective splays. This area is presently undergoing gold exploration.”

Skin the game

It’s safe to say Falcon’s CEO Karim Rayani’s values are aligned right alongside those of his shareholder base.

According to an Oct. 21, 2019, press release, Mr. Rayani now owns or has control of over 8,899,000 common shares representing approximately 14.6 percent of the issued and outstanding common shares of the company (assuming exercise of all warrants and options held by Mr. Rayani).

These numbers are a moving target—Rayani continues buying Falcon common, adding another 410k shares to his holdings in recent weeks.

Further, this CEO demonstrates this ‘value alignment’ the same way he conducts business—no outrageously dilutive financings. Only modest raises… just enough to move a project forward.

CEO Rayani talking to Chris Parry last Dec:

“We’re different. We’re determined to do the work, protect our cash, raise only when there’s a need, and where that need will result in drills turning.”

That’s what you want to hear from your CEO.

In a move to strengthen and add depth to his team, CEO Rayani recently announced two new appointments—financing wizard R. Stuart “Tookie” Angus and Ian Graham, a top-shelf X Rio Tinto geologist.

Final thought

The company has multiple irons in the fire. Success on the exploration front should move these shares out of their sub-nickel trading range. Drilling at the company’s Central Gold project could be that catalyst.

We stand to watch.

END

Greg Nolan

Full disclosure: Falcon Gold is not an Equity Guru marketing client.