Ontario-based Supreme Cannabis (FIRE.T) released its Q2 2020 financials today and there were few surprises contained in its pages, bar perhaps the size of the quarterly loss.

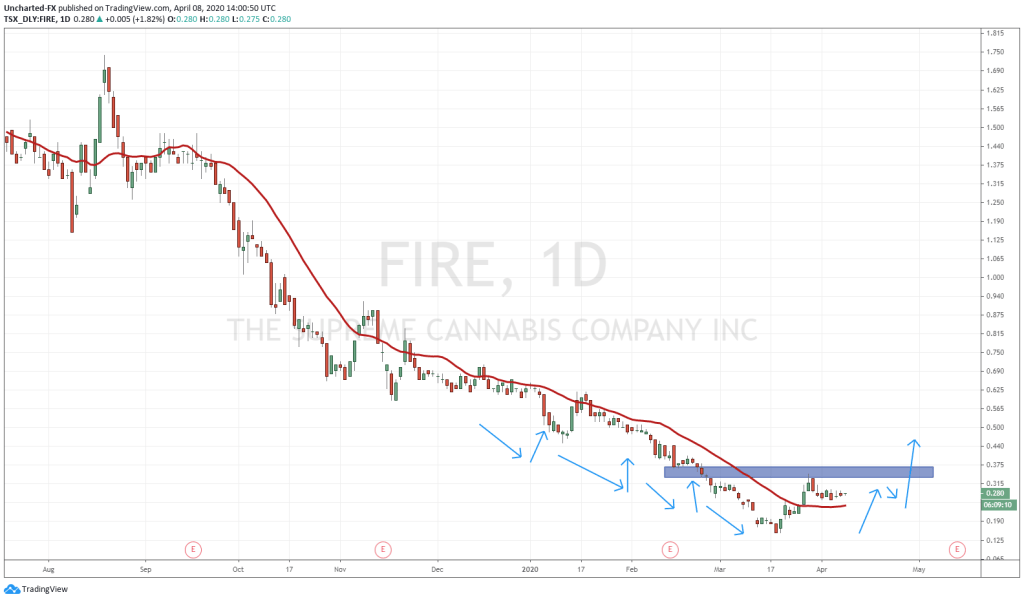

At a $17.3 million net loss after taxes (and a $10.4 million loss in adjusted EBITDA terms), FIRE shares fell in value below the $0.40 mark it’s been hovering around for some time, a 5% drop in real terms.

Previous quarters had seen smaller losses, even come close to break even. But even the rosiest-eyed fanboy would have expected these numbers to be rough, considering the CEO change and staff layoffs announced earlier in the year. We predicted as much a week ago.

…the shift that would allow them to level up while their competitors wallow, is notching a single clearly profitable quarter.

NOTE: It won’t be this quarter.

When you let a CEO go and then dump a bunch of workforce, you’re signaling to the world that what’s coming isn’t what you’re proud of. Both moves are preemptive, and usually announce, ‘We know, we know, but you can see we’re working on it, right?’ So we’ll expect the next FIRE financials to have some stems mixed in.

As announced on February 11, 2020, Supreme Cannabis has implemented a new operating structure, including staff reductions, to drive efficiencies and support long-term, profitable growth. With an optimized cost structure in place, the Company is moving forward with its strategy to transition to a premium cannabis CPG company, driving near-term revenue with new high-quality brands and products at every price segment.

This is Supreme’s new pitch to investors, that they have understood their previously successful wholesale-focused business model worked only for as long as other companies struggled with under supply. Now, with over supply being rampant, the demand for ‘wholesale flower that won’t be sent back for being crappy’ has fallen. Supreme still brings a far higher wholesale price for its product than do others (Aurora’s wholesale prices are far lower, and their revenues in that area are down 45% this quarter), but management have definitely received the memo that the quality advantage is far more lucrative on shelves under their own brand name, than it is delivering buckets of white labeled weed to competitors.

As such, the company has had to rejig. Less money spent on capital outlays related to facility growth and quantity, and more focus on squeezing the most they can out of the quality they have – including 250k sq ft of paid for, built out, largely licensed cannabis grow.

Interim CEO Colin Moore:

“As one of the few licensed producers with completed cultivation infrastructure and in-house value-added processing capabilities, as well as proven premium brands in the recreational market, we are well positioned to accelerate our CPG-focused transition. Our strong liquidity position, including the Credit Facility arranged by a tier one bank, further ensures we have the capital necessary to execute going forward.”

He’s not wrong: Supreme does have access to significant cash in hand, and borrowing facilities. And the shift to consumer packaged goods and building their own brands is the smart move.

But there’s going to be questions about whether this shift has come a quarter too late.

Supreme has put a decent amount of capital into Blissco, which is ready to crack on with its extraction business in Langley BC after the parent made big equipment investments, but currently contributes a negligible $700k to the Supreme bottom line.

The African adventure to Lesotho continues, but the amount of value attributed to it has been reduced, which has contributed a big chunk of that loss the company has registered this quarter.

During Q2 2020, the Company completed its standard evaluation of investments which resulted in a reduction in the carrying value of MG Health Lesotho. This reduction is reflective of general cannabis market conditions and recognized as a loss in Other Comprehensive Income.

To be honest, it appears that loss, and others, have been hauled in and laid out this quarter so the company can register one big painful financial period now, while their competitors are also suffering, with the plan being for the next one to be free and clear of writedowns. Aurora’s big loss yesterday, with $1 billion in writedowns, would appear to be part of a similar plan, if only based on their decision to book next quarter’s projected product returns now, rather than when they actually show up.

If this is to be ‘the quarter of confession and pain,’ investors will want to keep their powder dry accordingly.

One of Supreme’s big selling points for me has always been their free cash in hand, a war chest that sat around $40 million to $50 million for some time.

They still have that cash available but now it’s accruing interest.

In the quarter, Supreme Cannabis entered into a credit agreement with Bank of Montreal as Lead Arranger and Agent on behalf of a group of lenders for $90.0 million of senior secured credit facilities (the “Credit Facility”), consisting of a term loan of $70.0 million and a revolving credit facility of $20.0 million. The Company initially drew $55.0 million of the term loan under the Credit Facility, ending the quarter with a total cash and restricted cash balance of $55.0 million and $35.0 million of undrawn capacity.

This shift from money raised selling shares to money raised paying BMO doesn’t come without concern. The company has made the decision through 2019 to be a grower, not a shower, and that’s meant paying for facility expansion, putting legitimate capital into their acquisitions, and trusting that the market will mature in a way that pays those decisions back. They’re clearly not as free-spending and cray cray as groups like Aurora, but to remain competitive and get the 7 Acres brand out there properly in competition with the Aurora’s of the world, they’ve had to pay for some catch up, and that’s not cheap right now.

At present, at a $140 million market cap, I don’t see Supreme’s value as outlandish at all. If anything, its defensible to have that sort of valuation attached to a group that is rightly famous for its quality product, even if the cost of building that reputation is being borne out now. As a take out target, they rank highly, even at a 100% premium, because a lot of competitors would die for a facility that cranks out actually enjoyable weed.

Staff cuts may be a factor in whether they can maintain that reputation for quality. Former CEO John Fowler has been active on Twitter, looking for new homes for many of the people he brought into Supreme, folks who were major factors in the building of that quality rep. That competitors can now access that sophisticated and reputable workforce is a danger to Supreme. That few have the capital to do so may be their saving grace.

This too shall pass. But not this quarter.

— Chris Parry

FULL DISCLOSURE: Supreme Cannabis is an Equity.Guru marketing client